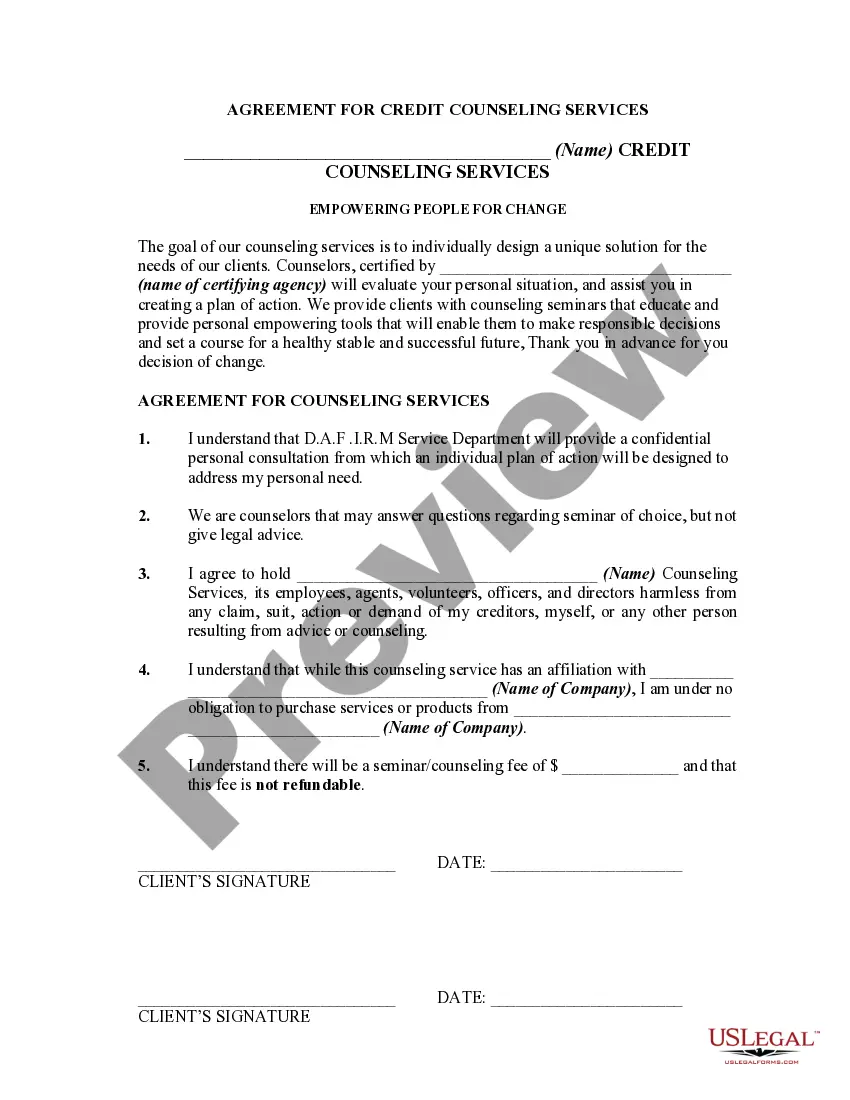

This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Collin Texas Agreement for Credit Counseling Services is a legally binding document that outlines the terms and conditions between a credit counseling agency and the residents of Collin County, Texas, who seek their services to manage their finances and credit. This agreement aims to provide clarity and transparency in the relationship between the credit counseling agency and the individuals seeking assistance. The key objective of the Collin Texas Agreement for Credit Counseling Services is to establish the roles, responsibilities, and expectations of both the credit counseling agency and the client. It ensures that the credit counseling agency will provide professional guidance and support to the individuals, helping them address their financial challenges and improve their overall financial health. This agreement encompasses various aspects, including the scope of services provided by the credit counseling agency. It may cover services such as budgeting assistance, debt management plans, credit report analysis, financial education, and counseling sessions. By agreeing to this document, the client acknowledges their willingness to participate actively in the credit counseling process and follow the agency's recommendations. Furthermore, the Collin Texas Agreement for Credit Counseling Services may outline the fees associated with the services provided. It may specify the payment structure, including one-time enrollment fees or monthly maintenance charges, if any. Additionally, it may define the refund policy, cancellation procedure, and the responsibility of the client for any outstanding payments. Different types of Collin Texas Agreements for Credit Counseling Services can exist depending on the specific needs of the clients. Some common variations include agreements for debt management plans, credit report analysis and consultation, financial education workshops or seminars, and foreclosure prevention counseling. Each type of agreement may have its own terms and conditions tailored to the nature of the service being provided. In summary, the Collin Texas Agreement for Credit Counseling Services is a crucial tool that sets the framework for the partnership between credit counseling agencies and individuals seeking financial assistance. It ensures that both parties understand their roles and responsibilities, promoting a mutual commitment towards achieving the goal of financial stability and well-being.Collin Texas Agreement for Credit Counseling Services is a legally binding document that outlines the terms and conditions between a credit counseling agency and the residents of Collin County, Texas, who seek their services to manage their finances and credit. This agreement aims to provide clarity and transparency in the relationship between the credit counseling agency and the individuals seeking assistance. The key objective of the Collin Texas Agreement for Credit Counseling Services is to establish the roles, responsibilities, and expectations of both the credit counseling agency and the client. It ensures that the credit counseling agency will provide professional guidance and support to the individuals, helping them address their financial challenges and improve their overall financial health. This agreement encompasses various aspects, including the scope of services provided by the credit counseling agency. It may cover services such as budgeting assistance, debt management plans, credit report analysis, financial education, and counseling sessions. By agreeing to this document, the client acknowledges their willingness to participate actively in the credit counseling process and follow the agency's recommendations. Furthermore, the Collin Texas Agreement for Credit Counseling Services may outline the fees associated with the services provided. It may specify the payment structure, including one-time enrollment fees or monthly maintenance charges, if any. Additionally, it may define the refund policy, cancellation procedure, and the responsibility of the client for any outstanding payments. Different types of Collin Texas Agreements for Credit Counseling Services can exist depending on the specific needs of the clients. Some common variations include agreements for debt management plans, credit report analysis and consultation, financial education workshops or seminars, and foreclosure prevention counseling. Each type of agreement may have its own terms and conditions tailored to the nature of the service being provided. In summary, the Collin Texas Agreement for Credit Counseling Services is a crucial tool that sets the framework for the partnership between credit counseling agencies and individuals seeking financial assistance. It ensures that both parties understand their roles and responsibilities, promoting a mutual commitment towards achieving the goal of financial stability and well-being.