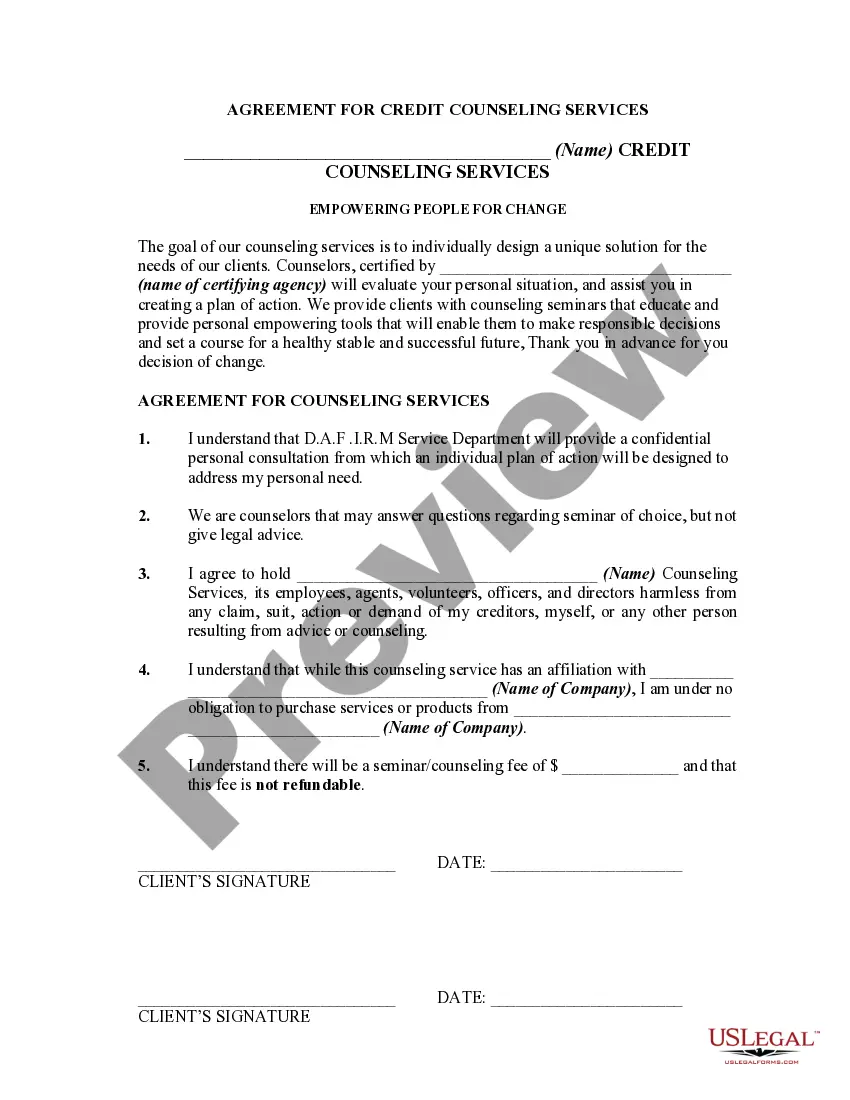

This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Kings New York Agreement for Credit Counseling Services is a comprehensive program designed to assist individuals in managing their personal finances and improving their credit. This agreement is tailored to residents of Kings County, New York, and offers a range of services aimed at helping individuals overcome financial challenges and achieve long-term financial stability. Under the Kings New York Agreement for Credit Counseling Services, individuals can expect to receive personalized budgeting assistance and guidance on debt management. This program aims to educate individuals on effective money management techniques, including proper budgeting and saving strategies. One key aspect of the Kings New York Agreement for Credit Counseling Services is debt counseling. Certified credit counselors work closely with individuals to assess their financial situation, understand their debt obligations, and create a customized plan to address and reduce outstanding debts. These counselors can negotiate with creditors on behalf of clients to possibly secure lower interest rates, reduced monthly payments, or even debt consolidation options. In addition to debt counseling, credit education is an important component of the Kings New York Agreement for Credit Counseling Services. Clients receive guidance on understanding credit reports, improving credit scores, and developing healthy credit habits. This includes strategies for responsible credit card usage, managing loans, and addressing any inaccuracies or errors in credit reports. Another type of service offered under the Kings New York Agreement for Credit Counseling Services is housing counseling. This includes assistance for individuals seeking to buy a home, avoid foreclosure, or manage rental expenses. Housing counselors provide guidance on budgeting for housing costs, understanding mortgage options, and navigating the home buying process. Furthermore, the Kings New York Agreement for Credit Counseling Services may offer financial education workshops and seminars to help individuals develop a stronger understanding of personal finance. These sessions may cover a range of topics, such as basic money management, building emergency funds, and long-term financial planning. Overall, the Kings New York Agreement for Credit Counseling Services is a comprehensive program that provides residents of Kings County, New York, with the necessary tools and guidance to overcome financial challenges, manage debt, and improve credit health. Whether individuals are struggling with overwhelming debts, want to improve their credit scores, or seek assistance in purchasing a home, this program offers a variety of specialized services to address their needs.The Kings New York Agreement for Credit Counseling Services is a comprehensive program designed to assist individuals in managing their personal finances and improving their credit. This agreement is tailored to residents of Kings County, New York, and offers a range of services aimed at helping individuals overcome financial challenges and achieve long-term financial stability. Under the Kings New York Agreement for Credit Counseling Services, individuals can expect to receive personalized budgeting assistance and guidance on debt management. This program aims to educate individuals on effective money management techniques, including proper budgeting and saving strategies. One key aspect of the Kings New York Agreement for Credit Counseling Services is debt counseling. Certified credit counselors work closely with individuals to assess their financial situation, understand their debt obligations, and create a customized plan to address and reduce outstanding debts. These counselors can negotiate with creditors on behalf of clients to possibly secure lower interest rates, reduced monthly payments, or even debt consolidation options. In addition to debt counseling, credit education is an important component of the Kings New York Agreement for Credit Counseling Services. Clients receive guidance on understanding credit reports, improving credit scores, and developing healthy credit habits. This includes strategies for responsible credit card usage, managing loans, and addressing any inaccuracies or errors in credit reports. Another type of service offered under the Kings New York Agreement for Credit Counseling Services is housing counseling. This includes assistance for individuals seeking to buy a home, avoid foreclosure, or manage rental expenses. Housing counselors provide guidance on budgeting for housing costs, understanding mortgage options, and navigating the home buying process. Furthermore, the Kings New York Agreement for Credit Counseling Services may offer financial education workshops and seminars to help individuals develop a stronger understanding of personal finance. These sessions may cover a range of topics, such as basic money management, building emergency funds, and long-term financial planning. Overall, the Kings New York Agreement for Credit Counseling Services is a comprehensive program that provides residents of Kings County, New York, with the necessary tools and guidance to overcome financial challenges, manage debt, and improve credit health. Whether individuals are struggling with overwhelming debts, want to improve their credit scores, or seek assistance in purchasing a home, this program offers a variety of specialized services to address their needs.