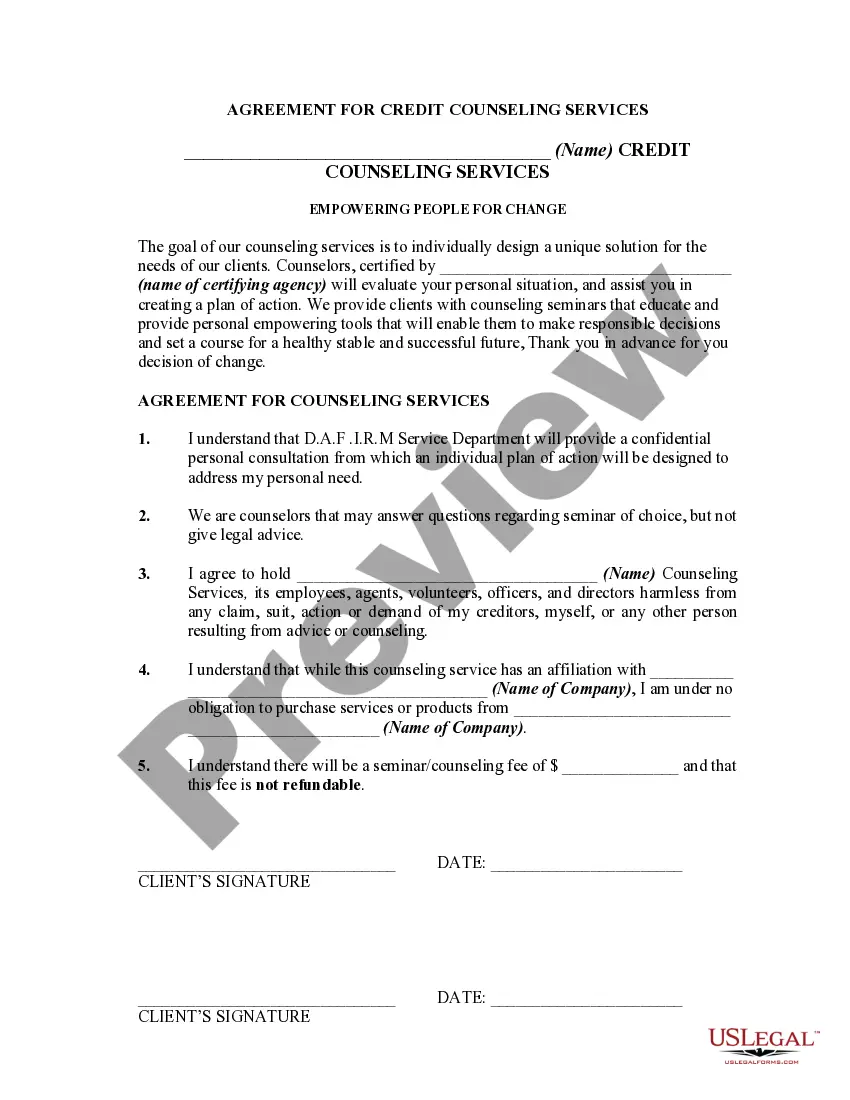

This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Los Angeles California Agreement for Credit Counseling Services is a legal document that outlines the terms and conditions agreed upon between a credit counseling agency and an individual seeking financial assistance in Los Angeles, California. This agreement sets forth the rights and responsibilities of both parties involved in the credit counseling process. The primary aim of the Los Angeles California Agreement for Credit Counseling Services is to help individuals manage their debts, improve their credit scores, and achieve financial stability. The agreement typically includes relevant keywords such as: 1. Debt management: This refers to the process of creating a personalized plan to help individuals repay their debts and regain control over their finances. The agreement will detail the strategies and techniques used to effectively manage debt. 2. Budgeting: Proper budgeting is crucial for successful financial management. The agreement will outline how the credit counseling agency assists individuals in creating and maintaining a realistic budget to meet their financial obligations. 3. Credit education: The agreement may specify that the credit counseling agency provides educational resources and workshops to guide individuals on credit-related matters. This may include educating individuals on credit scores, credit reports, and debt management strategies. 4. Counseling services: The agreement may address the counseling sessions provided by the agency, which may be conducted in-person, over the phone, or online. These sessions aim to review an individual's financial situation, provide personalized advice, and offer potential solutions. 5. Creditor negotiations: In some cases, the credit counseling agency may negotiate with creditors on behalf of the individual seeking assistance. The agreement may outline the parameters of these negotiations, including how the agency aims to lower interest rates or negotiate reduced payments. 6. Client responsibilities: The agreement will specify the responsibilities of the individual receiving credit counseling services. This may include the obligation to provide accurate financial information, make timely payments, attend counseling sessions, and follow the proposed debt management plan. 7. Data privacy: Privacy and protection of personal information are essential. The agreement should include provisions that ensure confidentiality and maintain the privacy of the client's financial details. Different types of Los Angeles California Agreements for Credit Counseling Services may be available based on the specific needs of individuals. Some variations can include focused debt management plans, debt consolidation agreements, or agreements targeted towards specific financial challenges such as student loans or mortgage debts. These specialized agreements may address the unique circumstances specific to each type of credit counseling service. In conclusion, the Los Angeles California Agreement for Credit Counseling Services is a comprehensive document that outlines the specifics of the credit counseling process and the relationship between the individual seeking assistance and the credit counseling agency. It aims to help individuals regain control over their finances, reduce debt, and achieve financial stability by providing tailored guidance, education, and counseling services.Los Angeles California Agreement for Credit Counseling Services is a legal document that outlines the terms and conditions agreed upon between a credit counseling agency and an individual seeking financial assistance in Los Angeles, California. This agreement sets forth the rights and responsibilities of both parties involved in the credit counseling process. The primary aim of the Los Angeles California Agreement for Credit Counseling Services is to help individuals manage their debts, improve their credit scores, and achieve financial stability. The agreement typically includes relevant keywords such as: 1. Debt management: This refers to the process of creating a personalized plan to help individuals repay their debts and regain control over their finances. The agreement will detail the strategies and techniques used to effectively manage debt. 2. Budgeting: Proper budgeting is crucial for successful financial management. The agreement will outline how the credit counseling agency assists individuals in creating and maintaining a realistic budget to meet their financial obligations. 3. Credit education: The agreement may specify that the credit counseling agency provides educational resources and workshops to guide individuals on credit-related matters. This may include educating individuals on credit scores, credit reports, and debt management strategies. 4. Counseling services: The agreement may address the counseling sessions provided by the agency, which may be conducted in-person, over the phone, or online. These sessions aim to review an individual's financial situation, provide personalized advice, and offer potential solutions. 5. Creditor negotiations: In some cases, the credit counseling agency may negotiate with creditors on behalf of the individual seeking assistance. The agreement may outline the parameters of these negotiations, including how the agency aims to lower interest rates or negotiate reduced payments. 6. Client responsibilities: The agreement will specify the responsibilities of the individual receiving credit counseling services. This may include the obligation to provide accurate financial information, make timely payments, attend counseling sessions, and follow the proposed debt management plan. 7. Data privacy: Privacy and protection of personal information are essential. The agreement should include provisions that ensure confidentiality and maintain the privacy of the client's financial details. Different types of Los Angeles California Agreements for Credit Counseling Services may be available based on the specific needs of individuals. Some variations can include focused debt management plans, debt consolidation agreements, or agreements targeted towards specific financial challenges such as student loans or mortgage debts. These specialized agreements may address the unique circumstances specific to each type of credit counseling service. In conclusion, the Los Angeles California Agreement for Credit Counseling Services is a comprehensive document that outlines the specifics of the credit counseling process and the relationship between the individual seeking assistance and the credit counseling agency. It aims to help individuals regain control over their finances, reduce debt, and achieve financial stability by providing tailored guidance, education, and counseling services.