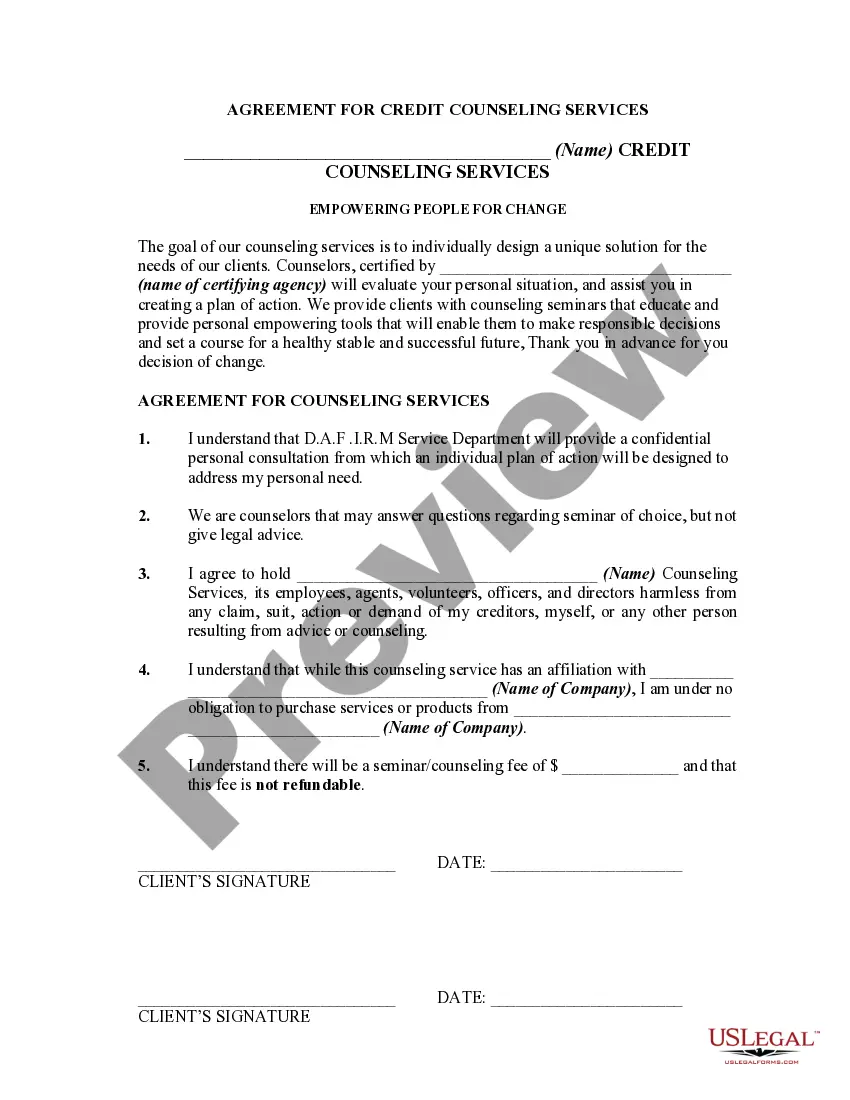

This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Mecklenburg North Carolina Agreement for Credit Counseling Services is a legal document that outlines the terms and conditions for individuals seeking credit counseling services in the Mecklenburg County area of North Carolina. This agreement is designed to protect both the consumer and the credit counseling agency by clearly defining the responsibilities and rights of each party involved. One type of Mecklenburg North Carolina Agreement for Credit Counseling Services is the Individual Credit Counseling Agreement. This agreement is typically used when an individual seeks personalized credit counseling services. It outlines the specific services to be provided, such as budgeting assistance, debt management plans, and financial education. The agreement also specifies the cost of services, any applicable fees, and the duration of the counseling program. Another type of Mecklenburg North Carolina Agreement for Credit Counseling Services is the Group Credit Counseling Agreement. This agreement is commonly used for group counseling sessions, workshops, or seminars. It outlines the topics to be covered, the duration of the sessions, and any fees associated with attending the group counseling program. The Mecklenburg North Carolina Agreement for Credit Counseling Services typically covers key points such as confidentiality, dispute resolution procedures, termination clauses, and client obligations. The agreement emphasizes the importance of maintaining client privacy and confidentiality throughout the counseling process. It also outlines how any disputes or conflicts will be resolved between the parties involved, ensuring a fair and impartial process for all. Additionally, the agreement sets forth the conditions under which either party can terminate the agreement. This includes situations where the client fails to fulfill their financial commitments or breaches the terms of the agreement. The termination clause also outlines any applicable penalties or fees that may be incurred by the client in such cases. Under the Mecklenburg North Carolina Agreement for Credit Counseling Services, clients are typically obligated to provide accurate and complete financial information. This information helps the credit counseling agency assess the client's financial situation and develop appropriate strategies to address their debt or credit issues. The agreement also emphasizes the client's responsibility to actively participate in the counseling process and follow the recommendations provided by the credit counselor. In conclusion, the Mecklenburg North Carolina Agreement for Credit Counseling Services is a comprehensive legal document that outlines the rights and responsibilities of both the client and the credit counseling agency. It ensures transparency, confidentiality, and fair treatment throughout the credit counseling process. By adhering to this agreement, individuals in Mecklenburg County can receive quality credit counseling services that cater to their unique financial needs while protecting their rights and interests.The Mecklenburg North Carolina Agreement for Credit Counseling Services is a legal document that outlines the terms and conditions for individuals seeking credit counseling services in the Mecklenburg County area of North Carolina. This agreement is designed to protect both the consumer and the credit counseling agency by clearly defining the responsibilities and rights of each party involved. One type of Mecklenburg North Carolina Agreement for Credit Counseling Services is the Individual Credit Counseling Agreement. This agreement is typically used when an individual seeks personalized credit counseling services. It outlines the specific services to be provided, such as budgeting assistance, debt management plans, and financial education. The agreement also specifies the cost of services, any applicable fees, and the duration of the counseling program. Another type of Mecklenburg North Carolina Agreement for Credit Counseling Services is the Group Credit Counseling Agreement. This agreement is commonly used for group counseling sessions, workshops, or seminars. It outlines the topics to be covered, the duration of the sessions, and any fees associated with attending the group counseling program. The Mecklenburg North Carolina Agreement for Credit Counseling Services typically covers key points such as confidentiality, dispute resolution procedures, termination clauses, and client obligations. The agreement emphasizes the importance of maintaining client privacy and confidentiality throughout the counseling process. It also outlines how any disputes or conflicts will be resolved between the parties involved, ensuring a fair and impartial process for all. Additionally, the agreement sets forth the conditions under which either party can terminate the agreement. This includes situations where the client fails to fulfill their financial commitments or breaches the terms of the agreement. The termination clause also outlines any applicable penalties or fees that may be incurred by the client in such cases. Under the Mecklenburg North Carolina Agreement for Credit Counseling Services, clients are typically obligated to provide accurate and complete financial information. This information helps the credit counseling agency assess the client's financial situation and develop appropriate strategies to address their debt or credit issues. The agreement also emphasizes the client's responsibility to actively participate in the counseling process and follow the recommendations provided by the credit counselor. In conclusion, the Mecklenburg North Carolina Agreement for Credit Counseling Services is a comprehensive legal document that outlines the rights and responsibilities of both the client and the credit counseling agency. It ensures transparency, confidentiality, and fair treatment throughout the credit counseling process. By adhering to this agreement, individuals in Mecklenburg County can receive quality credit counseling services that cater to their unique financial needs while protecting their rights and interests.