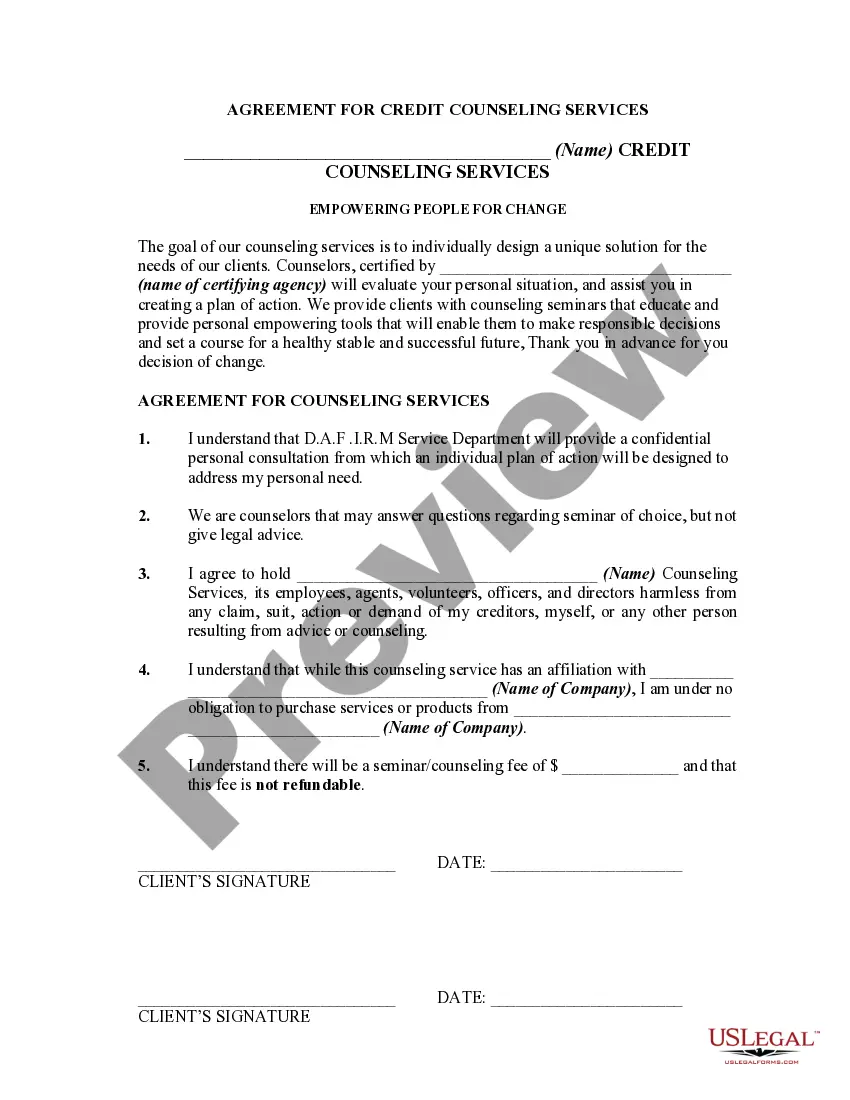

This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Wake North Carolina Agreement for Credit Counseling Services is a comprehensive and legally binding document that outlines the terms and conditions between a consumer and a credit counseling agency in Wake, North Carolina. This agreement is designed to assist individuals who are facing financial challenges and need assistance in managing their debts and improving their financial situation. Keywords: Wake North Carolina Agreement, credit counseling services, detailed description, terms and conditions, consumer, credit counseling agency, financial challenges, managing debts, improving financial situation. There may be different types of Wake North Carolina Agreement for Credit Counseling Services, and some of them include: 1. Debt Management Agreement: This type of agreement specifies the terms of a debt management plan offered by a credit counseling agency. It outlines the details of monthly payments, interest rates, and the agency's role in negotiating with creditors to lower interest rates or waive fees. 2. Financial Education Agreement: This agreement focuses on providing financial education and counseling services to individuals who need assistance in managing their finances better. It may cover topics such as budgeting, saving, credit management, and financial goal-setting. 3. Bankruptcy Counseling Agreement: This agreement is specifically designed for individuals considering bankruptcy as a last resort. It outlines the counseling services provided by the agency to assess the financial situation and explore alternatives to bankruptcy, such as debt consolidation or negotiation with creditors. 4. Housing Counseling Agreement: Wake North Carolina Agreement for Housing Counseling Services offers guidance and assistance to individuals who need help with housing-related financial issues. This includes mortgage counseling, foreclosure prevention, rental assistance, and budgeting for housing expenses. 5. Student Loan Counseling Agreement: This type of agreement provides counseling and guidance specifically tailored to individuals struggling with student loan debt. It covers topics such as loan consolidation, loan forgiveness programs, and repayment options based on individual circumstances. In summary, the Wake North Carolina Agreement for Credit Counseling Services serves as a vital tool to establish a clear understanding and roadmap for individuals seeking professional assistance in managing their financial obligations.The Wake North Carolina Agreement for Credit Counseling Services is a comprehensive and legally binding document that outlines the terms and conditions between a consumer and a credit counseling agency in Wake, North Carolina. This agreement is designed to assist individuals who are facing financial challenges and need assistance in managing their debts and improving their financial situation. Keywords: Wake North Carolina Agreement, credit counseling services, detailed description, terms and conditions, consumer, credit counseling agency, financial challenges, managing debts, improving financial situation. There may be different types of Wake North Carolina Agreement for Credit Counseling Services, and some of them include: 1. Debt Management Agreement: This type of agreement specifies the terms of a debt management plan offered by a credit counseling agency. It outlines the details of monthly payments, interest rates, and the agency's role in negotiating with creditors to lower interest rates or waive fees. 2. Financial Education Agreement: This agreement focuses on providing financial education and counseling services to individuals who need assistance in managing their finances better. It may cover topics such as budgeting, saving, credit management, and financial goal-setting. 3. Bankruptcy Counseling Agreement: This agreement is specifically designed for individuals considering bankruptcy as a last resort. It outlines the counseling services provided by the agency to assess the financial situation and explore alternatives to bankruptcy, such as debt consolidation or negotiation with creditors. 4. Housing Counseling Agreement: Wake North Carolina Agreement for Housing Counseling Services offers guidance and assistance to individuals who need help with housing-related financial issues. This includes mortgage counseling, foreclosure prevention, rental assistance, and budgeting for housing expenses. 5. Student Loan Counseling Agreement: This type of agreement provides counseling and guidance specifically tailored to individuals struggling with student loan debt. It covers topics such as loan consolidation, loan forgiveness programs, and repayment options based on individual circumstances. In summary, the Wake North Carolina Agreement for Credit Counseling Services serves as a vital tool to establish a clear understanding and roadmap for individuals seeking professional assistance in managing their financial obligations.