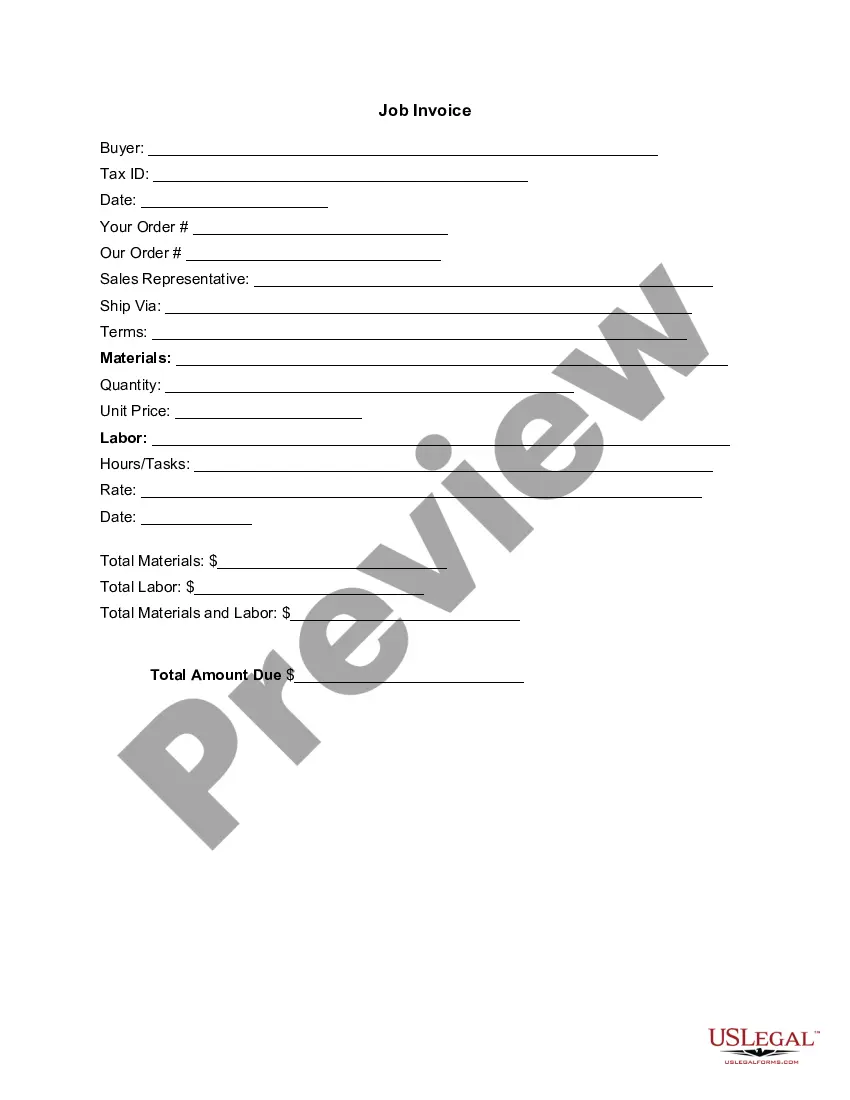

This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Phoenix Arizona Privacy and Confidentiality Policy for Credit Counseling Services In Phoenix, Arizona, credit counseling services prioritize the privacy and confidentiality of their clients. These policies aim to safeguard customer information and ensure that it remains strictly confidential. By adhering to robust privacy practices, credit counseling agencies in Phoenix maintain the trust and confidence of their clients. Key Keywords: Phoenix Arizona, Privacy and Confidentiality Policy, Credit Counseling Services 1. Overview of Phoenix Arizona Privacy and Confidentiality Policy for Credit Counseling Services: Credit counseling services in Phoenix, Arizona, have implemented comprehensive privacy and confidentiality policies to protect clients' sensitive information. These policies outline the procedures and safeguards that are in place to maintain the privacy and confidentiality of customer data. 2. Importance of Privacy and Confidentiality in Credit Counseling Services: Recognizing the sensitive nature of financial information and the trust placed by clients in credit counseling services, Phoenix agencies prioritize privacy and confidentiality. They understand the significance of safeguarding personal data, including social security numbers, credit card information, income details, and other financial records. 3. Collection and Use of Personal Information: Phoenix credit counseling services clearly define the types of personal information collected from clients. This may include names, contact details, financial data, and social security numbers. The policy also explains how this information is used, such as providing counseling, creating customized financial plans, and coordinating with creditors on behalf of clients. 4. Data Security Measures: Phoenix credit counseling agencies implement strong data security measures to ensure the confidentiality of client information. These measures may include secure data storage, encrypted communication channels, limited access to customer data, and firewall protection. 5. Restrictions on Sharing Personal Information: The privacy and confidentiality policy establishes strict guidelines on sharing client information. It ensures that personal data is not disclosed to external parties, except in cases required by law or explicit client consent. 6. Employee Confidentiality: Phoenix credit counseling services have policies that emphasize employee confidentiality. These policies outline the responsibility of employees to handle customer information confidentially, maintain privacy while interacting with clients, and the consequences of breaching confidentiality obligations. 7. Third-Party Service Providers: If credit counseling agencies in Phoenix utilize third-party service providers, their policies may outline the measures taken to ensure that these providers adhere to privacy and confidentiality standards. This may include signing confidentiality agreements, maintaining data security protocols, and conducting periodic audits. 8. Website and Online Privacy: As many credit counseling services have online presence, their privacy and confidentiality policies may also cover website usage. This section may discuss the collection of non-personally identifiable information through cookies and analytics tools and the steps taken to protect online user data. 9. Retention and Disposal of Client Information: Phoenix credit counseling services establish guidelines for the retention and disposal of client information. These policies define the duration for which customer data is retained and the methods used for its secure disposal to prevent unauthorized access or data breaches. Different types of Phoenix Arizona Privacy and Confidentiality Policies for Credit Counseling Services may include variations in specific procedures or terminologies, but they all share the common goal of protecting client privacy and maintaining confidentiality.Phoenix Arizona Privacy and Confidentiality Policy for Credit Counseling Services In Phoenix, Arizona, credit counseling services prioritize the privacy and confidentiality of their clients. These policies aim to safeguard customer information and ensure that it remains strictly confidential. By adhering to robust privacy practices, credit counseling agencies in Phoenix maintain the trust and confidence of their clients. Key Keywords: Phoenix Arizona, Privacy and Confidentiality Policy, Credit Counseling Services 1. Overview of Phoenix Arizona Privacy and Confidentiality Policy for Credit Counseling Services: Credit counseling services in Phoenix, Arizona, have implemented comprehensive privacy and confidentiality policies to protect clients' sensitive information. These policies outline the procedures and safeguards that are in place to maintain the privacy and confidentiality of customer data. 2. Importance of Privacy and Confidentiality in Credit Counseling Services: Recognizing the sensitive nature of financial information and the trust placed by clients in credit counseling services, Phoenix agencies prioritize privacy and confidentiality. They understand the significance of safeguarding personal data, including social security numbers, credit card information, income details, and other financial records. 3. Collection and Use of Personal Information: Phoenix credit counseling services clearly define the types of personal information collected from clients. This may include names, contact details, financial data, and social security numbers. The policy also explains how this information is used, such as providing counseling, creating customized financial plans, and coordinating with creditors on behalf of clients. 4. Data Security Measures: Phoenix credit counseling agencies implement strong data security measures to ensure the confidentiality of client information. These measures may include secure data storage, encrypted communication channels, limited access to customer data, and firewall protection. 5. Restrictions on Sharing Personal Information: The privacy and confidentiality policy establishes strict guidelines on sharing client information. It ensures that personal data is not disclosed to external parties, except in cases required by law or explicit client consent. 6. Employee Confidentiality: Phoenix credit counseling services have policies that emphasize employee confidentiality. These policies outline the responsibility of employees to handle customer information confidentially, maintain privacy while interacting with clients, and the consequences of breaching confidentiality obligations. 7. Third-Party Service Providers: If credit counseling agencies in Phoenix utilize third-party service providers, their policies may outline the measures taken to ensure that these providers adhere to privacy and confidentiality standards. This may include signing confidentiality agreements, maintaining data security protocols, and conducting periodic audits. 8. Website and Online Privacy: As many credit counseling services have online presence, their privacy and confidentiality policies may also cover website usage. This section may discuss the collection of non-personally identifiable information through cookies and analytics tools and the steps taken to protect online user data. 9. Retention and Disposal of Client Information: Phoenix credit counseling services establish guidelines for the retention and disposal of client information. These policies define the duration for which customer data is retained and the methods used for its secure disposal to prevent unauthorized access or data breaches. Different types of Phoenix Arizona Privacy and Confidentiality Policies for Credit Counseling Services may include variations in specific procedures or terminologies, but they all share the common goal of protecting client privacy and maintaining confidentiality.