A limited partnership is a modified partnership and is a creature of State statutes. Most States have either adopted the Uniform Limited Partnership Act (ULPA) or the Revised Uniform Limited Partnership Act (RULPA). In a limited partnership, certain members contribute capital, but do not have liability for the debts of the partnership beyond the amount of their investment. These members are known as limited partners. The partners who manage the business and who are personally liable for the debts of the business are the general partners. A limited partnership can have one or more general partners and one or more limited partners.

The general partners manage the business of the partnership and are personally liable for its debts. Limited partners have the right to share in the profits of the business and, if the partnership is dissolved, will be entitled to a percentage of the assets of the partnership. A limited partner may lose his limited liability status if he participates in the control of the business.

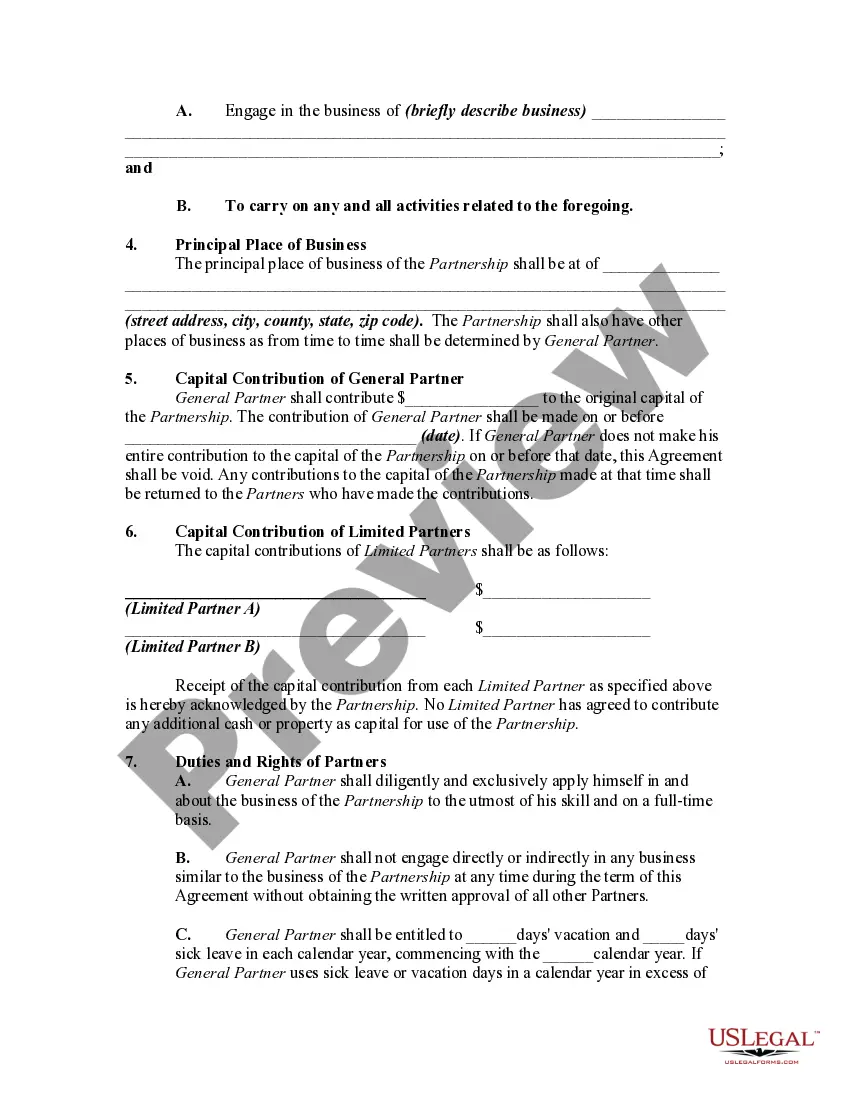

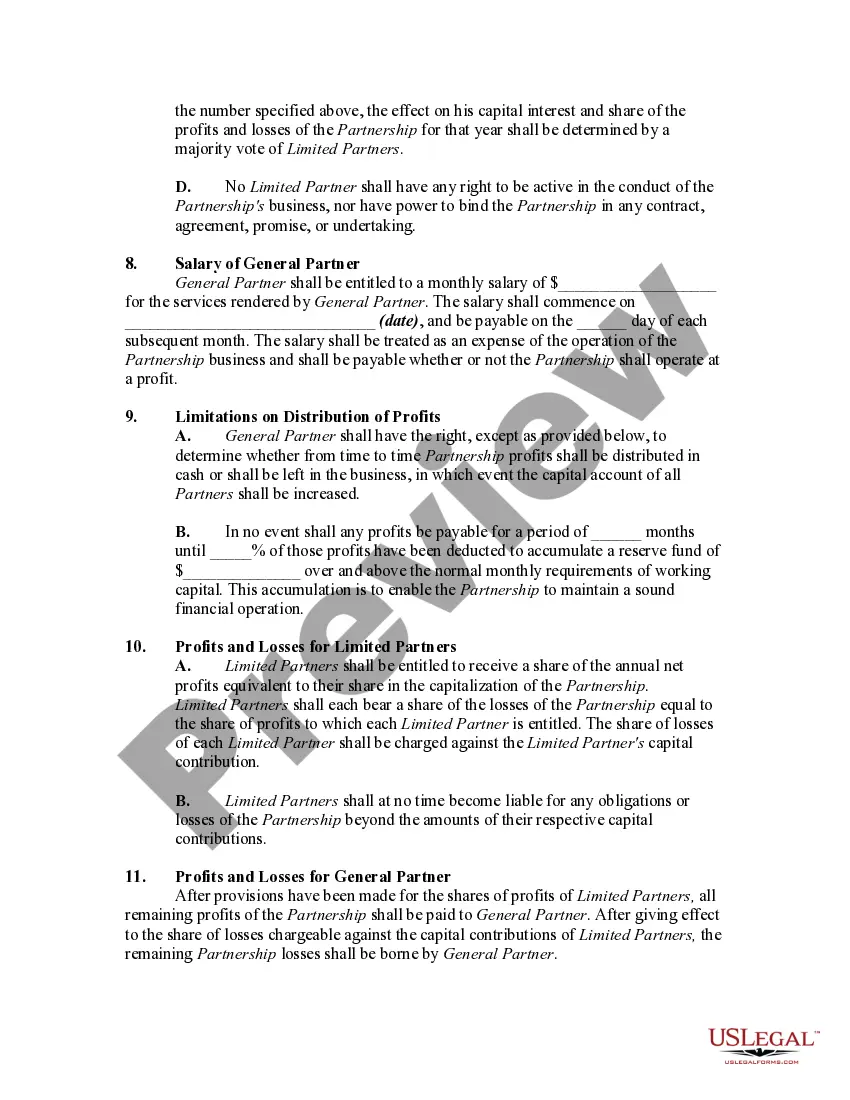

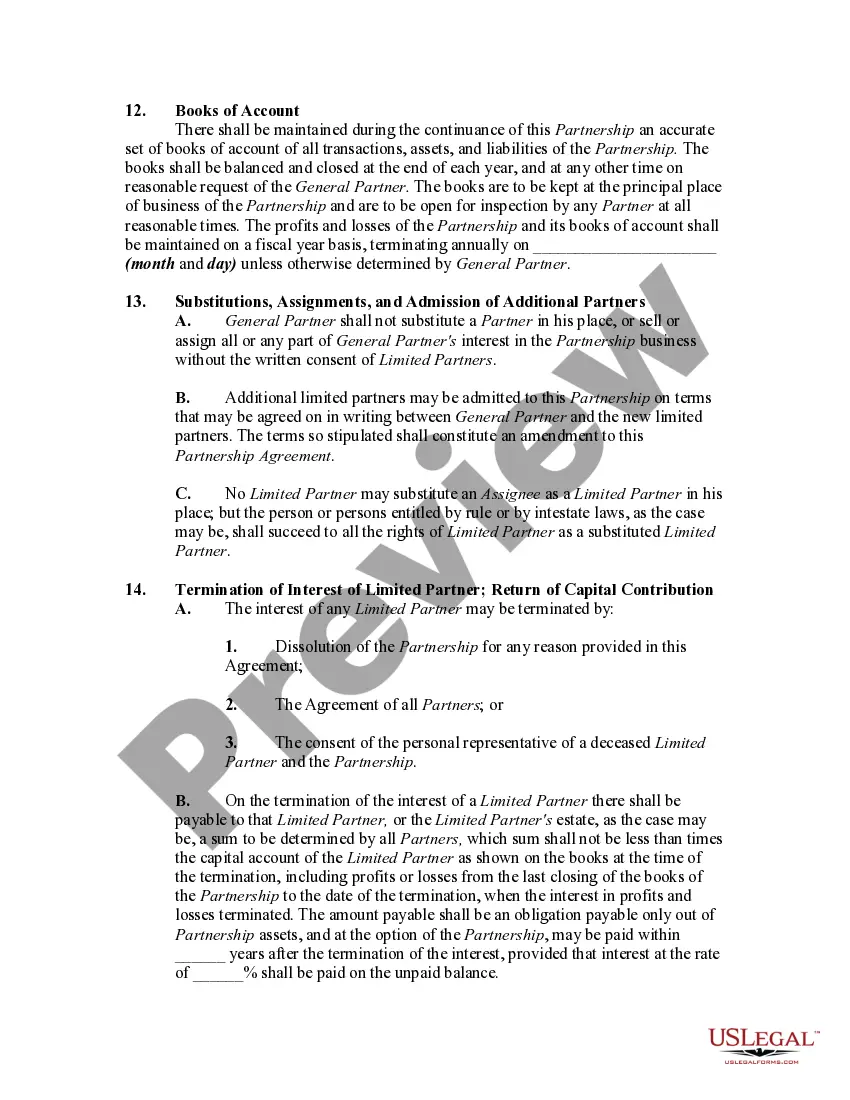

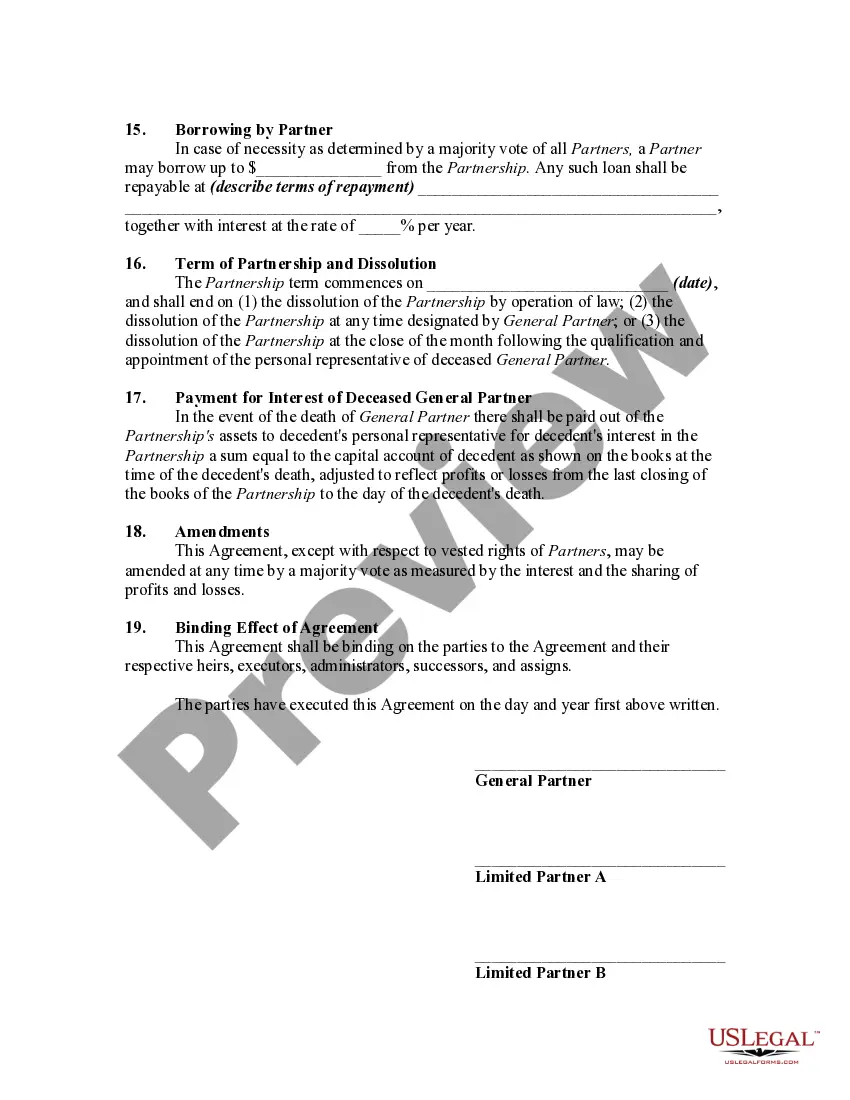

Kings New York General Form of Limited Partnership Agreement is a legally binding document that outlines the terms and conditions for a limited partnership in the state of New York. This agreement governs the relationship between the general partner(s) and limited partner(s) involved in the partnership. It serves as a crucial framework for defining the rights, responsibilities, and obligations of each party. The Kings New York General Form of Limited Partnership Agreement typically consists of various sections, including: 1. Formation and Name of Partnership: This section specifies the name and purpose of the limited partnership, as well as the duration of its existence. 2. Contributions: It details the capital contributions made by each partner, whether in cash, property, or any other form. The agreement also outlines whether additional contributions can be requested in the future. 3. Allocations and Distributions: This section deals with how profits, losses, and distributions will be allocated among partners. It may include provisions for special allocations based on agreed-upon criteria. 4. Management and Authority: The agreement defines the role and powers of the general partner(s) and outlines the decision-making process within the partnership. It may specify voting rights, control over operations, and limitations on certain actions. 5. Limited Partner Liability: This portion clarifies the limited liability of the limited partners, ensuring they are not personally responsible for partnership debts or liabilities beyond their initial contributions. 6. Withdrawals and Termination: It stipulates the conditions and procedures for a partner's withdrawal or termination from the partnership, including any associated consequences or buyout mechanisms. 7. Dispute Resolution: This section establishes the process for resolving disputes that may arise between partners, often through arbitration or mediation rather than going to court. 8. Taxation: The agreement may touch on tax-related matters, such as the partnership's treatment for federal and state tax purposes and the allocation of tax attributes. It is essential to note that while the Kings New York General Form of Limited Partnership Agreement serves as a standardized template for partnerships, it can be customized to suit the specific needs and preferences of the partners involved. Different types or variations of the agreement may arise based on the nature of the partnership or industry-specific requirements. For instance, there could be specialized versions of the Kings New York General Form of Limited Partnership Agreement for real estate partnerships, private equity funds, or investment ventures. These variations would incorporate additional clauses and provisions specifically tailored to those industries. However, the core principles of the general form agreement remain consistent across different editions.Kings New York General Form of Limited Partnership Agreement is a legally binding document that outlines the terms and conditions for a limited partnership in the state of New York. This agreement governs the relationship between the general partner(s) and limited partner(s) involved in the partnership. It serves as a crucial framework for defining the rights, responsibilities, and obligations of each party. The Kings New York General Form of Limited Partnership Agreement typically consists of various sections, including: 1. Formation and Name of Partnership: This section specifies the name and purpose of the limited partnership, as well as the duration of its existence. 2. Contributions: It details the capital contributions made by each partner, whether in cash, property, or any other form. The agreement also outlines whether additional contributions can be requested in the future. 3. Allocations and Distributions: This section deals with how profits, losses, and distributions will be allocated among partners. It may include provisions for special allocations based on agreed-upon criteria. 4. Management and Authority: The agreement defines the role and powers of the general partner(s) and outlines the decision-making process within the partnership. It may specify voting rights, control over operations, and limitations on certain actions. 5. Limited Partner Liability: This portion clarifies the limited liability of the limited partners, ensuring they are not personally responsible for partnership debts or liabilities beyond their initial contributions. 6. Withdrawals and Termination: It stipulates the conditions and procedures for a partner's withdrawal or termination from the partnership, including any associated consequences or buyout mechanisms. 7. Dispute Resolution: This section establishes the process for resolving disputes that may arise between partners, often through arbitration or mediation rather than going to court. 8. Taxation: The agreement may touch on tax-related matters, such as the partnership's treatment for federal and state tax purposes and the allocation of tax attributes. It is essential to note that while the Kings New York General Form of Limited Partnership Agreement serves as a standardized template for partnerships, it can be customized to suit the specific needs and preferences of the partners involved. Different types or variations of the agreement may arise based on the nature of the partnership or industry-specific requirements. For instance, there could be specialized versions of the Kings New York General Form of Limited Partnership Agreement for real estate partnerships, private equity funds, or investment ventures. These variations would incorporate additional clauses and provisions specifically tailored to those industries. However, the core principles of the general form agreement remain consistent across different editions.