The Travis Texas General and Continuing Guaranty and Indemnification Agreement is a legally binding contract designed to provide protection to a lender by ensuring the repayment of a loan or debt. This agreement is commonly used in the state of Texas and functions as a guarantee and indemnification for the lender against any potential losses. Keywords: Travis Texas General and Continuing Guaranty, Indemnification Agreement, lender, repayment, loan, debt, Texas, guarantee, indemnification, losses. There are several types of Travis Texas General and Continuing Guaranty and Indemnification Agreements, each serving specific purposes. Let's explore a few variations: 1. Commercial Loan Guaranty: This type of agreement is used when a business entity seeks a loan, and one or more individual or corporate guarantors provide a guarantee for the repayment of the loan in case the business defaults on the payment. 2. Real Estate Loan Guaranty: When acquiring a property, individuals or entities may require financing through a real estate loan. A real estate loan guaranty agreement ensures that the guarantor(s) will be responsible for the loan repayment if the borrower defaults. 3. Equipment Financing Guaranty: In situations where businesses need to finance the purchase or lease of equipment, this type of guaranty agreement provides the lender with assurance that the guarantor(s) will be liable for any outstanding debt if the borrower fails to fulfill their obligations. 4. Construction Guaranty and Indemnification Agreement: This agreement is specifically used in the construction industry where project financing is involved. It guarantees that the guarantor(s) will indemnify the lender against any losses or damages incurred during the construction process. 5. Subsidiary or Affiliate Guaranty: When a subsidiary or affiliate company requires financing, a guarantor (typically the parent company) may sign this type of agreement to guarantee the repayment of the loan if the borrower defaults. Regardless of the specific type, all Travis Texas General and Continuing Guaranty and Indemnification Agreements are intended to protect the lender's interests by holding the guarantor(s) accountable for any default or loss suffered by the lender due to the borrower's actions.

Travis Texas General and Continuing Guaranty and Indemnification Agreement

Description

How to fill out Travis Texas General And Continuing Guaranty And Indemnification Agreement?

Drafting paperwork for the business or individual needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to create Travis General and Continuing Guaranty and Indemnification Agreement without expert assistance.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Travis General and Continuing Guaranty and Indemnification Agreement on your own, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

In case you still don't have a subscription, adhere to the step-by-step instruction below to get the Travis General and Continuing Guaranty and Indemnification Agreement:

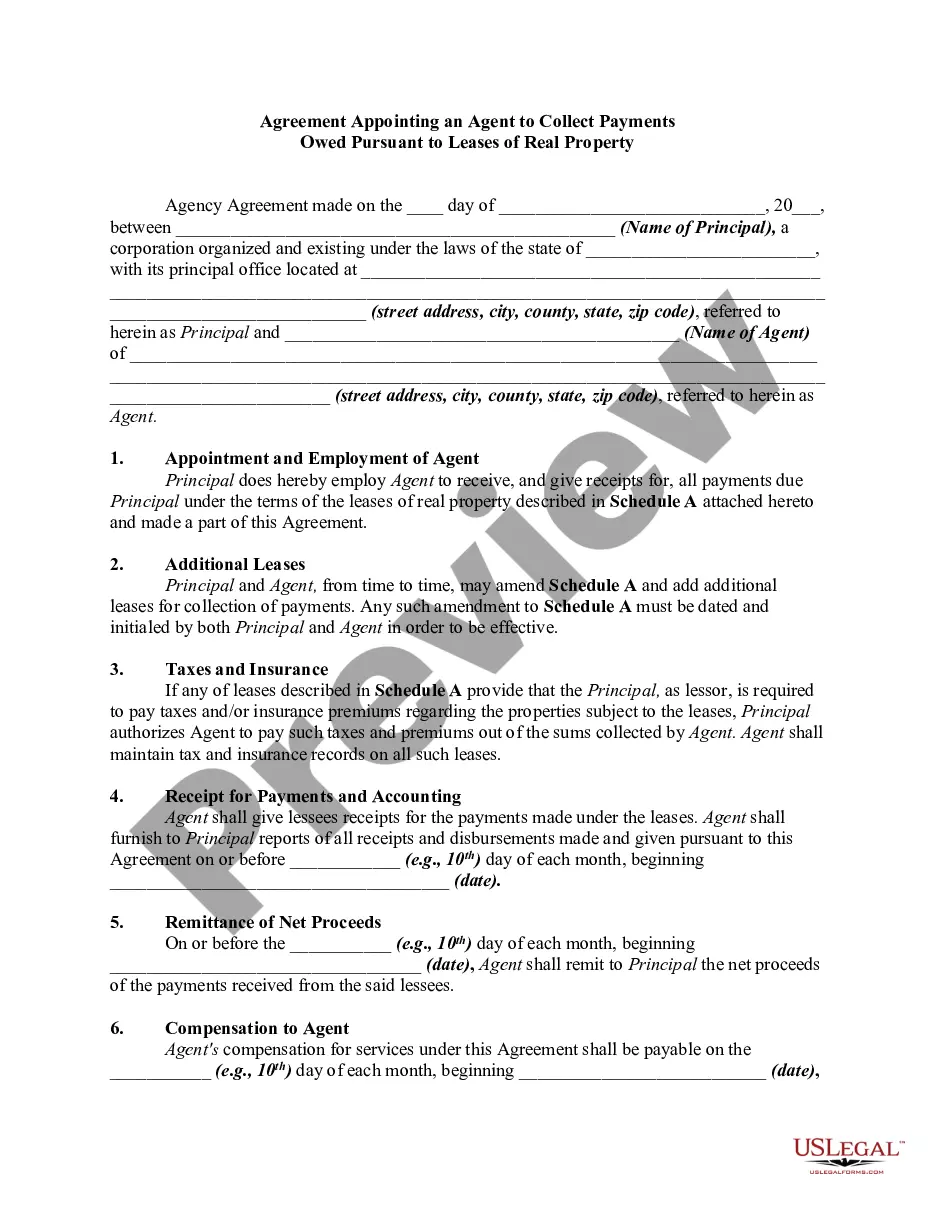

- Look through the page you've opened and verify if it has the sample you need.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that satisfies your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any scenario with just a couple of clicks!