Alameda California Contract for the Lease of Aircraft

Description

How to fill out Alameda California Contract For The Lease Of Aircraft?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from scratch, including Alameda Contract for the Lease of Aircraft, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in different categories varying from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching experience less frustrating. You can also find detailed materials and tutorials on the website to make any activities associated with document execution straightforward.

Here's how to find and download Alameda Contract for the Lease of Aircraft.

- Go over the document's preview and outline (if available) to get a basic information on what you’ll get after downloading the document.

- Ensure that the document of your choosing is specific to your state/county/area since state laws can affect the validity of some documents.

- Check the similar forms or start the search over to locate the correct document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment gateway, and purchase Alameda Contract for the Lease of Aircraft.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Alameda Contract for the Lease of Aircraft, log in to your account, and download it. Needless to say, our platform can’t replace an attorney completely. If you need to cope with an extremely challenging situation, we advise using the services of an attorney to check your document before executing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Become one of them today and purchase your state-specific paperwork effortlessly!

Form popularity

FAQ

With a lease, you don't pay the sales tax up front. You pay sales tax monthly based on the amount of your payment. You may also have to pay an acquisition fee to the bank and a down payment called a cap reduction fee.

California generally does charge sales tax on the rental or lease of tangible personal property unless a specific exemption applies. As a lessor, you may have the option to pay sales tax up-front on the asset purchase, rather than charge your lessees sales tax.

Airlines lease aircraft from other airlines or leasing companies for two main reasons: to operate aircraft without the financial burden of buying them, and to provide temporary increase in capacity.

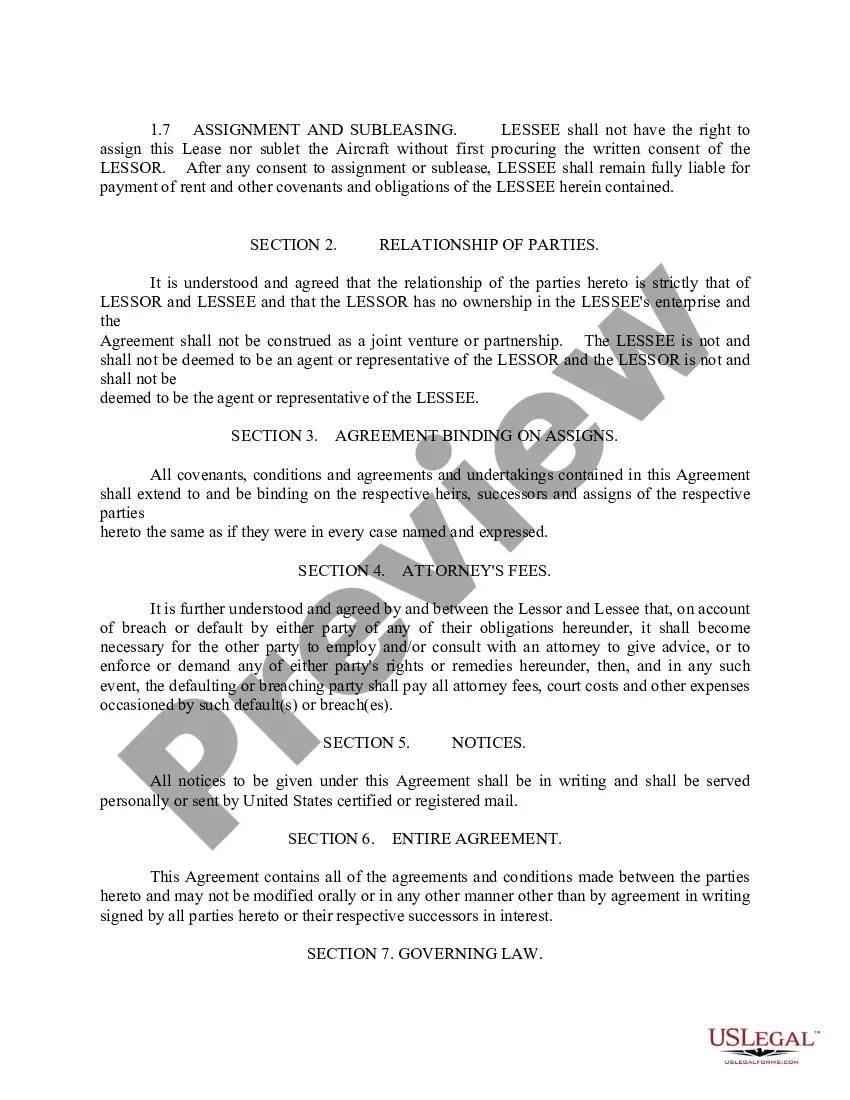

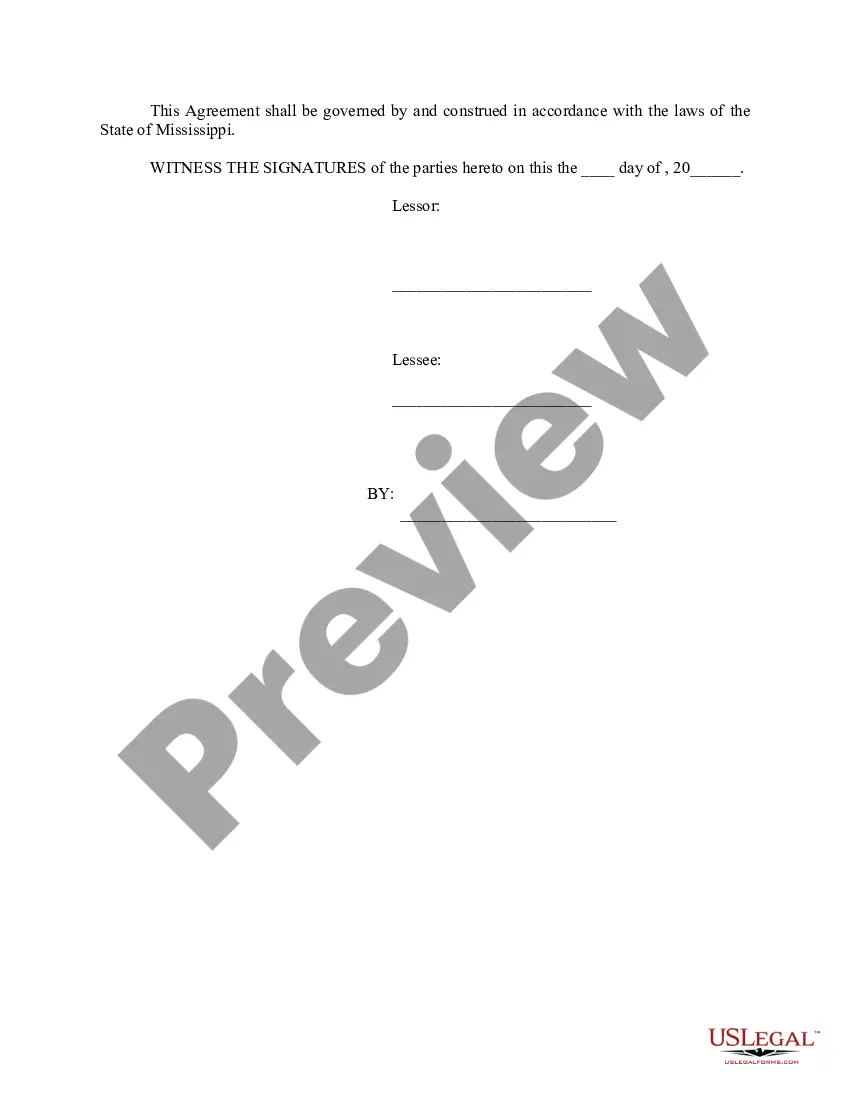

In layman's terms, leasing simply means transferring an aircraft without transferring its title. The owner (aka the lessor) keeps the legal title but possession transfers to the lessee.

In general terms, a lease is a transfer of an aircraft without transfer of title. The owner of the aircraft, or lessor, retains legal title to the aircraft, but transfers possession of the aircraft to the lessee.

California's top marginal tax rate is 13.3%. The new proposal would add three new surcharges on seven-figure earners. It would add a 1% surcharge to gross income of more than $1 million, 3% on income over $2 million and 3.5% on income above $5 million.

With a dry lease, an aircraft owner/lessor leases an aircraft to a lessee/operator without a crew. Neither the lessor nor the lessee is required to hold a charter certificate. In a dry lease situation, the lessee provides its own crew and exercises operational control of its flights.

Leasing is structured differently than a purchase, and you are in effect paying for the use of the car rather than paying for the car. As a result, most states charge sales tax on each lease payment.

An aircraft lease agreement is a contract between the aircraft owner and the lessee. The leasing company, typically airlines, provides payments for the use of airplanes.

There are four main benefits to leasing aircraft instead of buying. They are financial liquidity, capacity flexibility, rapid expansion, fleet consistency and reduced maintenance costs. Financial liquidity has been critical for low cost carriers, but this benefit can accrue to any firm in the industry.