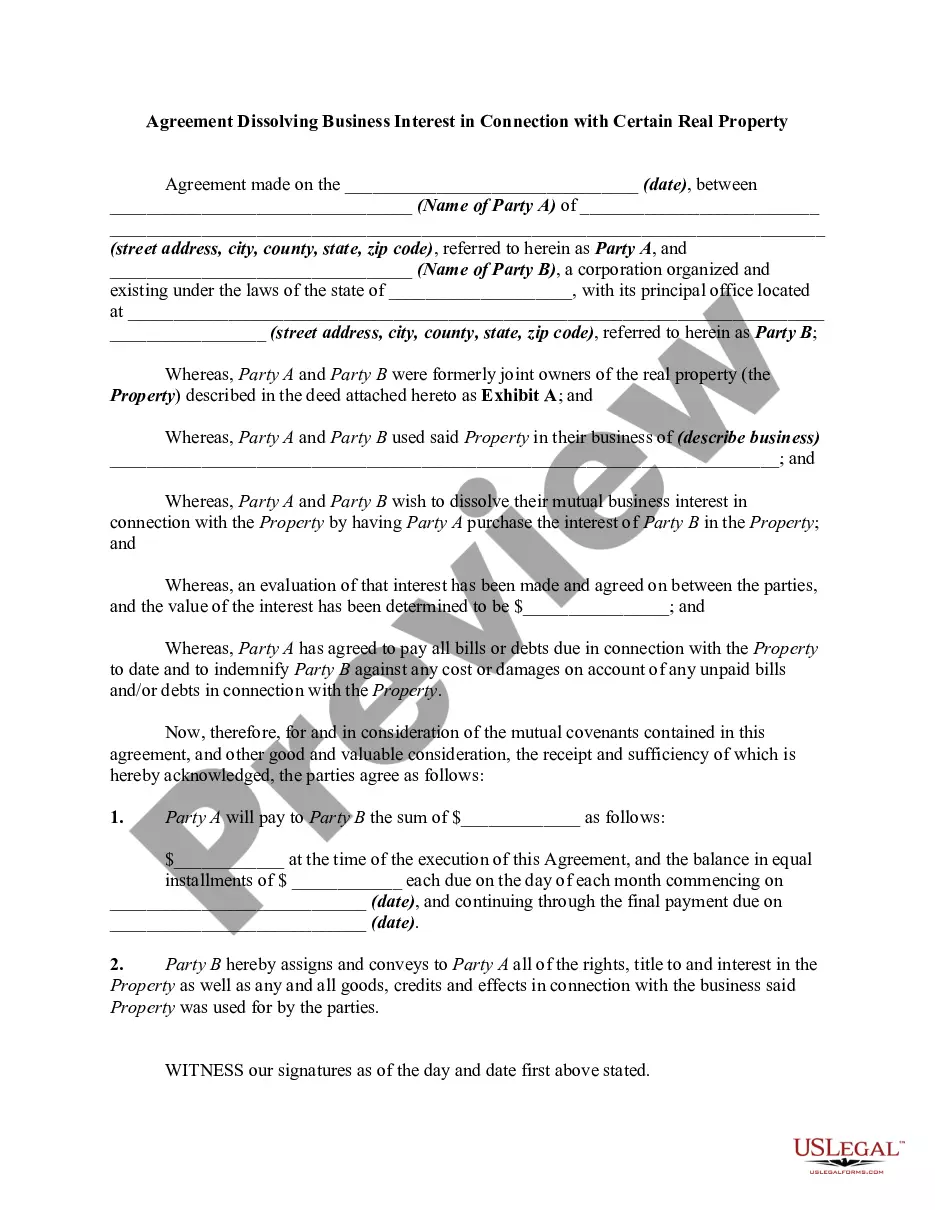

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Understanding the Phoenix Arizona Agreement Dissolving Business Interest in Connection with Certain Real Property Introduction: In Phoenix, Arizona, an Agreement Dissolving Business Interest in Connection with Certain Real Property refers to a legally binding document that outlines the dissolution of a business entity's interest in a specific real property. This agreement enables the smooth transfer or termination of ownership, ensuring all parties involved understand their rights, responsibilities, and obligations. This article will provide an in-depth description of the Phoenix Arizona Agreement Dissolving Business Interest in Connection with Certain Real Property, its provisions, and variations. Key Elements of a Phoenix Arizona Agreement Dissolving Business Interest: 1. Property Details: — The agreement must include a comprehensive description of the real property involved in the dissolution, including the address and legal description. 2. Parties Involved: — Identification of all parties entering the agreement, including the business entity whose interest is being dissolved, and any co-owners or partners. — Clearly stated roles and responsibilities of each party during and after the dissolution process. 3. Terms and Conditions: — Specify the effective date of the dissolution, providing a clear timeline for the transfer of ownership rights. — Outline any conditions or contingencies that must be met for the dissolution to be considered valid. 4. Distribution of Assets and Liabilities: — Define how the business entity's assets and liabilities related to the real property will be distributed among the involved parties. — Address the allocation of profits, losses, debts, taxes, and any other financial obligations connected to the property. 5. Dispute Resolution: — Include provisions detailing the process for resolving disputes that may arise during or after the dissolution process, such as mediation or arbitration. — Specify the governing law for interpretation and enforcement of the agreement. Types of Phoenix Arizona Agreement Dissolving Business Interest: 1. Partnership Dissolution Agreement: — Focuses on dissolving the interest of partners in a partnership business that owns and operates real property. — Outlines the distribution of assets, liabilities, profits, and losses among the partners involved. 2. LLC Dissolution Agreement: — Pertains to Limited Liability Companies (LCS) involved in real property ownership. — Outlines the distribution of membership interest, assets, and transactions associated with the real property. 3. Corporation Dissolution Agreement: — Addresses the dissolution of a corporation's interest in real property. — Includes provisions for the redistribution of shares, satisfying debts, and sale or transfer of assets. Conclusion: A Phoenix Arizona Agreement Dissolving Business Interest in Connection with Certain Real Property is a crucial legal document that ensures a smooth and lawful termination of a business entity's interest in specific real estate. Whether it involves partnerships, LCS, or corporations, this agreement carefully outlines the distribution of assets, liabilities, and determines the rights and responsibilities of each party involved. By understanding the key elements and variations of such agreements, stakeholders can navigate the dissolution process efficiently while safeguarding their interests.Title: Understanding the Phoenix Arizona Agreement Dissolving Business Interest in Connection with Certain Real Property Introduction: In Phoenix, Arizona, an Agreement Dissolving Business Interest in Connection with Certain Real Property refers to a legally binding document that outlines the dissolution of a business entity's interest in a specific real property. This agreement enables the smooth transfer or termination of ownership, ensuring all parties involved understand their rights, responsibilities, and obligations. This article will provide an in-depth description of the Phoenix Arizona Agreement Dissolving Business Interest in Connection with Certain Real Property, its provisions, and variations. Key Elements of a Phoenix Arizona Agreement Dissolving Business Interest: 1. Property Details: — The agreement must include a comprehensive description of the real property involved in the dissolution, including the address and legal description. 2. Parties Involved: — Identification of all parties entering the agreement, including the business entity whose interest is being dissolved, and any co-owners or partners. — Clearly stated roles and responsibilities of each party during and after the dissolution process. 3. Terms and Conditions: — Specify the effective date of the dissolution, providing a clear timeline for the transfer of ownership rights. — Outline any conditions or contingencies that must be met for the dissolution to be considered valid. 4. Distribution of Assets and Liabilities: — Define how the business entity's assets and liabilities related to the real property will be distributed among the involved parties. — Address the allocation of profits, losses, debts, taxes, and any other financial obligations connected to the property. 5. Dispute Resolution: — Include provisions detailing the process for resolving disputes that may arise during or after the dissolution process, such as mediation or arbitration. — Specify the governing law for interpretation and enforcement of the agreement. Types of Phoenix Arizona Agreement Dissolving Business Interest: 1. Partnership Dissolution Agreement: — Focuses on dissolving the interest of partners in a partnership business that owns and operates real property. — Outlines the distribution of assets, liabilities, profits, and losses among the partners involved. 2. LLC Dissolution Agreement: — Pertains to Limited Liability Companies (LCS) involved in real property ownership. — Outlines the distribution of membership interest, assets, and transactions associated with the real property. 3. Corporation Dissolution Agreement: — Addresses the dissolution of a corporation's interest in real property. — Includes provisions for the redistribution of shares, satisfying debts, and sale or transfer of assets. Conclusion: A Phoenix Arizona Agreement Dissolving Business Interest in Connection with Certain Real Property is a crucial legal document that ensures a smooth and lawful termination of a business entity's interest in specific real estate. Whether it involves partnerships, LCS, or corporations, this agreement carefully outlines the distribution of assets, liabilities, and determines the rights and responsibilities of each party involved. By understanding the key elements and variations of such agreements, stakeholders can navigate the dissolution process efficiently while safeguarding their interests.