Chicago Illinois Gift Affidavit Form

Description

How to fill out Gift Affidavit Form?

How long does it typically take you to create a legal document.

Considering that every state has its laws and regulations for every life situation, locating a Chicago Gift Affidavit Form that satisfies all local criteria can be tiring, and obtaining it from a qualified attorney is frequently expensive.

Numerous online services provide the most common state-specific templates for download, but utilizing the US Legal Forms library is most advantageous.

Regardless of how often you need to utilize the purchased template, you can locate all the files you’ve ever downloaded in your profile by navigating to the My documents tab. Give it a shot!

- US Legal Forms is the most comprehensive online compilation of templates, categorized by states and areas of application.

- In addition to the Chicago Gift Affidavit Form, you can acquire any particular form to manage your business or personal tasks, adhering to your local regulations.

- Experts validate all samples for their relevance, allowing you to be confident in preparing your documentation accurately.

- Utilizing the service is quite straightforward.

- If you possess an account on the platform and your subscription is active, you simply need to Log In, select the desired sample, and download it.

- You can access the file in your profile at any time in the future.

- On the other hand, if you are new to the platform, there will be additional steps to complete before obtaining your Chicago Gift Affidavit Form.

- Review the content of the page you’re currently viewing.

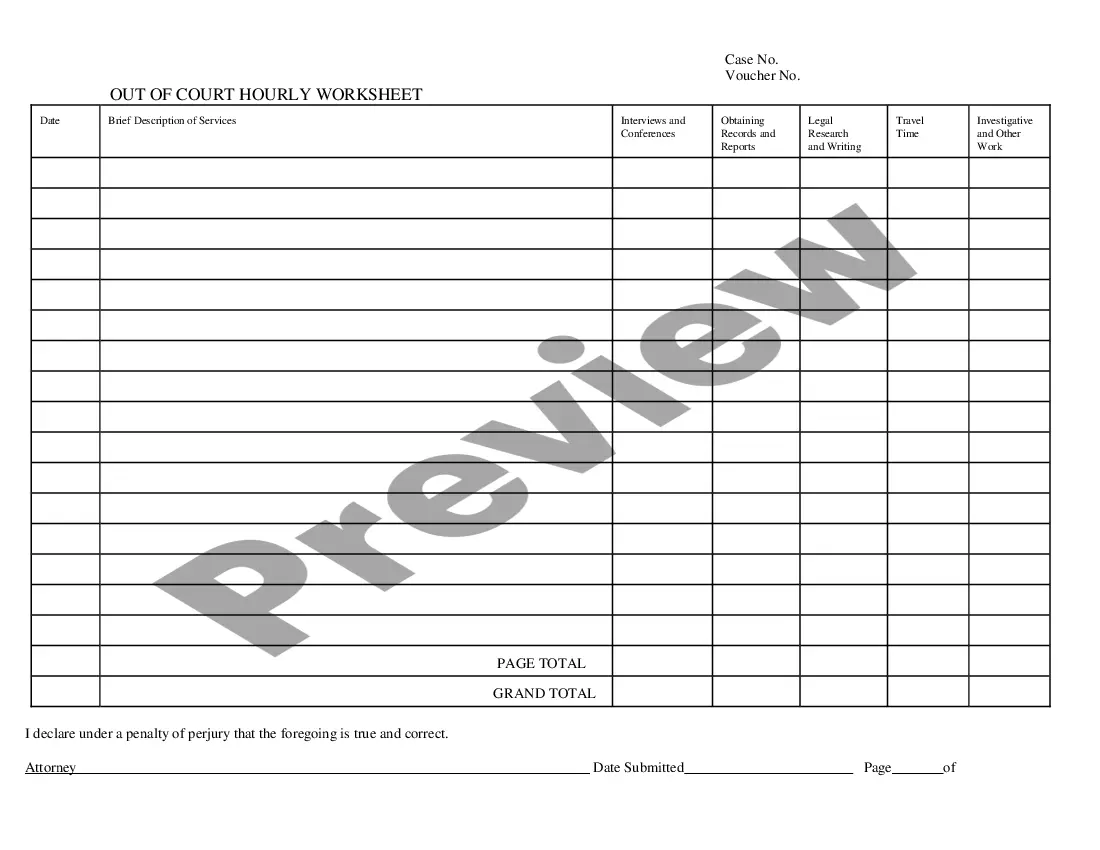

- Examine the description of the template or Preview it (if available).

- Look for another form using the relevant option in the header.

- Click Buy Now once you’re confident in your chosen file.

- Choose the subscription plan that best fits your needs.

- Register for an account on the platform or Log In to advance to payment options.

- Complete the payment using PayPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Chicago Gift Affidavit Form.

- Print the sample or utilize any favored online editor to fill it out electronically.

Form popularity

FAQ

To get a gift affidavit, start by locating and completing the Chicago Illinois Gift Affidavit Form. You can find this form on various legal websites, including uslegalforms, where you can also access instructions. Once completed, make sure to gather any necessary evidence and have the affidavit notarized. Following this process will help you submit your gift affidavit accurately.

To complete an affidavit in Illinois, you need a valid photo ID, the Chicago Illinois Gift Affidavit Form, and any necessary documentation that supports your claims. Additionally, having a notary public present may be required to attest to your signature. Compiling these pieces ensures the affidavit is legally sufficient and credible. Uslegalforms can simplify the collection and presentation of these requirements.

Illinois law requires that affidavits, including the Chicago Illinois Gift Affidavit Form, contain a declaration of truth and be signed under penalty of perjury. The signatory must also be of legal age and mentally competent. It's important to comply with these legal standards to avoid challenges. You can review detailed guidelines on affidavit requirements through resources like uslegalforms.

You can obtain an Illinois Rut 50 form through the official Illinois Department of Revenue website or local tax offices. Additionally, many online platforms, like uslegalforms, offer downloadable templates for the Rut 50 form. Using these resources can ease the process of acquiring the necessary documentation for your Chicago Illinois Gift Affidavit Form.

When preparing a Chicago Illinois Gift Affidavit Form, you must include clear evidence to support your claims. This evidence may consist of receipts, gift letters, or statements from witnesses who can validate the gift transaction. It's crucial to present evidence that upholds the validity of your affidavit. Using uslegalforms can help you understand what specific evidence you should gather.

To file an affidavit in Chicago, Illinois, you typically need a completed Chicago Illinois Gift Affidavit Form, along with identification and any supporting documentation. It's essential to ensure that all information is accurate and truthful. In some cases, you may also need a notarization to validate the affidavit. You can find templates and detailed guidance on sites like uslegalforms.

Yes, an affidavit generally needs to be notarized in Illinois. Notarization helps verify the identity of the affiant and ensures the document is officially recognized. When you use our Chicago Illinois Gift Affidavit Form, it often includes a section for notarization, making compliance simple and efficient.

Writing an affidavit in Illinois involves providing a clear statement of facts relevant to your situation. Start with an introductory paragraph stating your name and intent, followed by numbered sections detailing each fact. Finish with your signature and, in many cases, notarization. You can find a user-friendly Chicago Illinois Gift Affidavit Form on our site to ease this process.

To write a simple affidavit, begin with a title and include the affiant's information. Clearly state the facts pertaining to the subject matter you are affirming in numbered paragraphs. Be sure to include a closing statement and signature line. If you're looking for guidance, our Chicago Illinois Gift Affidavit Form can serve as a helpful template.

Gifting a car may be advantageous because it often simplifies the transfer process and may avoid sales tax. When selling a car for $1, you might still need to handle tax implications and paperwork more complexly. Using a Chicago Illinois Gift Affidavit Form can clarify the transaction, making gifting a smoother option compared to selling.