San Jose California Seller's Real Estate Disclosure Statement

Description

How to fill out Seller's Real Estate Disclosure Statement?

Regardless of whether you intend to launch your company, engage in a contract, request your ID renewal, or address family-related legal matters, you must prepare particular documentation that complies with your local laws and regulations.

Locating the appropriate forms can require considerable time and effort unless you utilize the US Legal Forms library.

This service offers users access to over 85,000 professionally crafted and validated legal templates for any personal or commercial situation. All documents are categorized by state and usage area, making it quick and easy to select a document like the San Jose Seller's Real Estate Disclosure Statement.

Retrieve the San Jose Seller's Real Estate Disclosure Statement in the format you require. You can print it, or finalize it and sign it electronically through an online editor to save time. The forms available on our website are reusable. With an active subscription, you can access all of your previously obtained documents at any time in the My documents section of your profile. Stop wasting time searching for up-to-date official papers. Become a member of the US Legal Forms platform and maintain your documentation in order with the most extensive online form collection!

- To access the necessary form, the users of the US Legal Forms website merely need to Log In to their account and click the Download button adjacent to the desired form.

- If you are new to this service, it will require a few additional steps to acquire the San Jose Seller's Real Estate Disclosure Statement. Follow the guidelines below.

- Ensure the template satisfies your personal requirements and state law stipulations.

- Browse the form description and verify the Preview if available on the page.

- Utilize the search bar provided for your state above to find another template.

- Click Buy Now to purchase the file after identifying the correct one.

- Choose the subscription plan that best accommodates you to proceed.

- Log in to your account and pay for the service using a credit card or PayPal.

Form popularity

FAQ

Transfers from one co-owner to one or more other co-owners. Transfer made to a spouse or to a child, grandchild, parent, grandparent or other direct ancestor or descendant. Transfers between spouses in connection with a dissolution of marriage or similar proceeding.

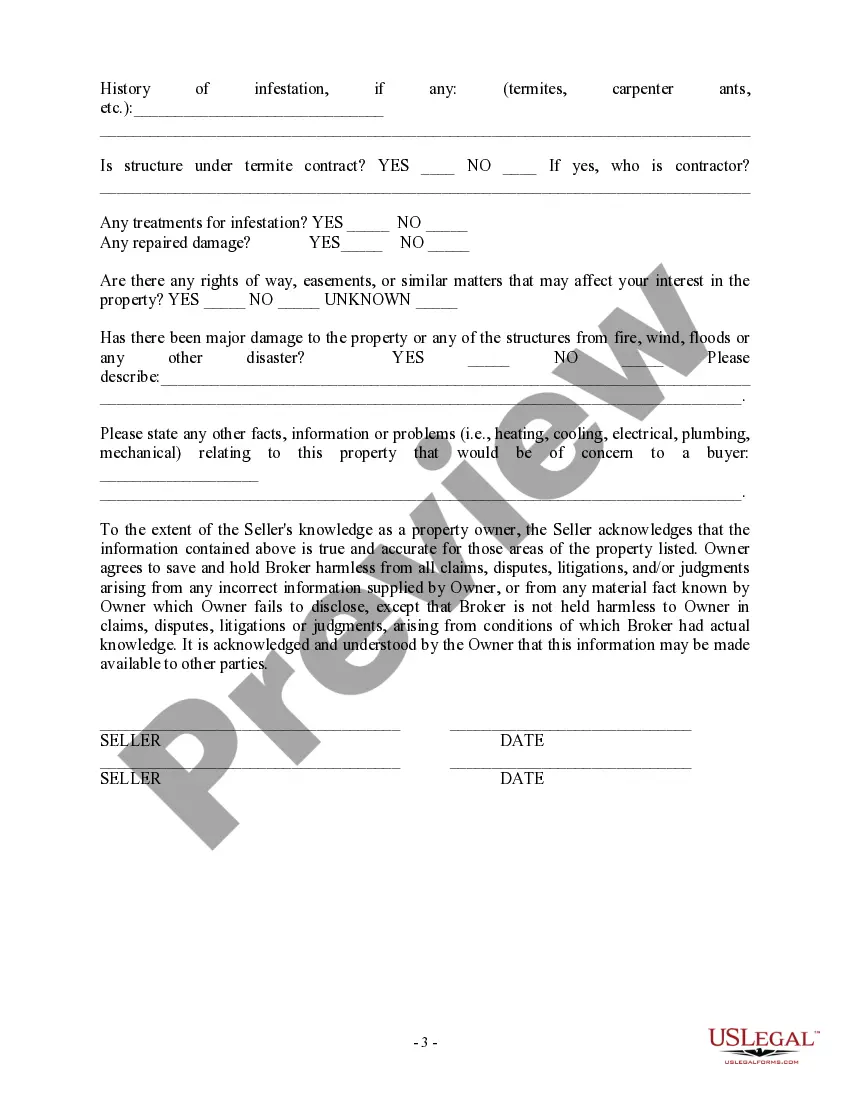

Flooding issues and plumbing leaks are the most common disclosures top real estate agents say they encounter. The biggest issue is always the plumbing leaks and the roof issues because of the recent hurricane we had last year, Fonseca said.

Often, an attempted waiver of the TDS by the buyer or the seller, such as the use of an as is clause in the purchase agreement, makes an agent's standard due diligence and disclosures seem unnecessary. However, the buyer cannot waive the seller's delivery of the statutorily-mandated TDS.

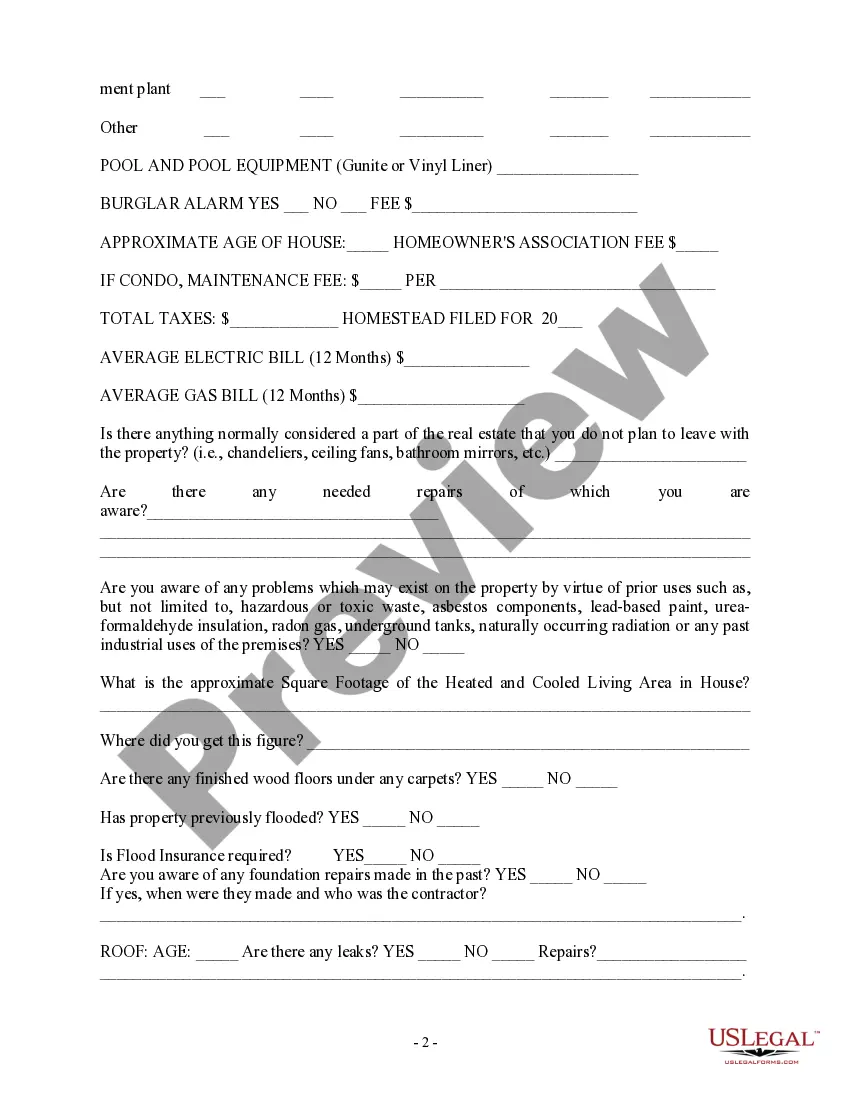

The seller of a one-to-four unit residential property completes and delivers to a prospective buyer a statutory form called a Transfer Disclosure Statement (TDS), more generically called a Condition of Property Disclosure Statement.

As a broad rule, all sellers of residential real estate property containing one to four units in California must complete and provide written disclosures to the prospective buyers.

The current list of non-disclosure states includes Alaska, Idaho, Kansas, Louisiana, Mississippi, Missouri (some counties), Montana, New Mexico, North Dakota, Texas, Utah, and Wyoming.

When you make an offer on a home, one of the first pieces of paperwork you'll get is a seller's property disclosure. Also known as a property disclosure statement, home disclosure and real estate disclosure form, this document contains a list of known problems with the home.

What Are the Mandatory Real Estate Disclosures in California? California Transfer Disclosure Statement (TDS) Declaring Material Facts. What Happens If You Don't Disclose Material Facts?

Here are eight common real estate seller disclosures to be aware of, whether you're on the buyer's side or the seller's side. Death in the Home.Neighborhood Nuisances.Hazards.Homeowners' Association Information.Repairs.Water Damage.Missing Items.Other Possible Disclosures.