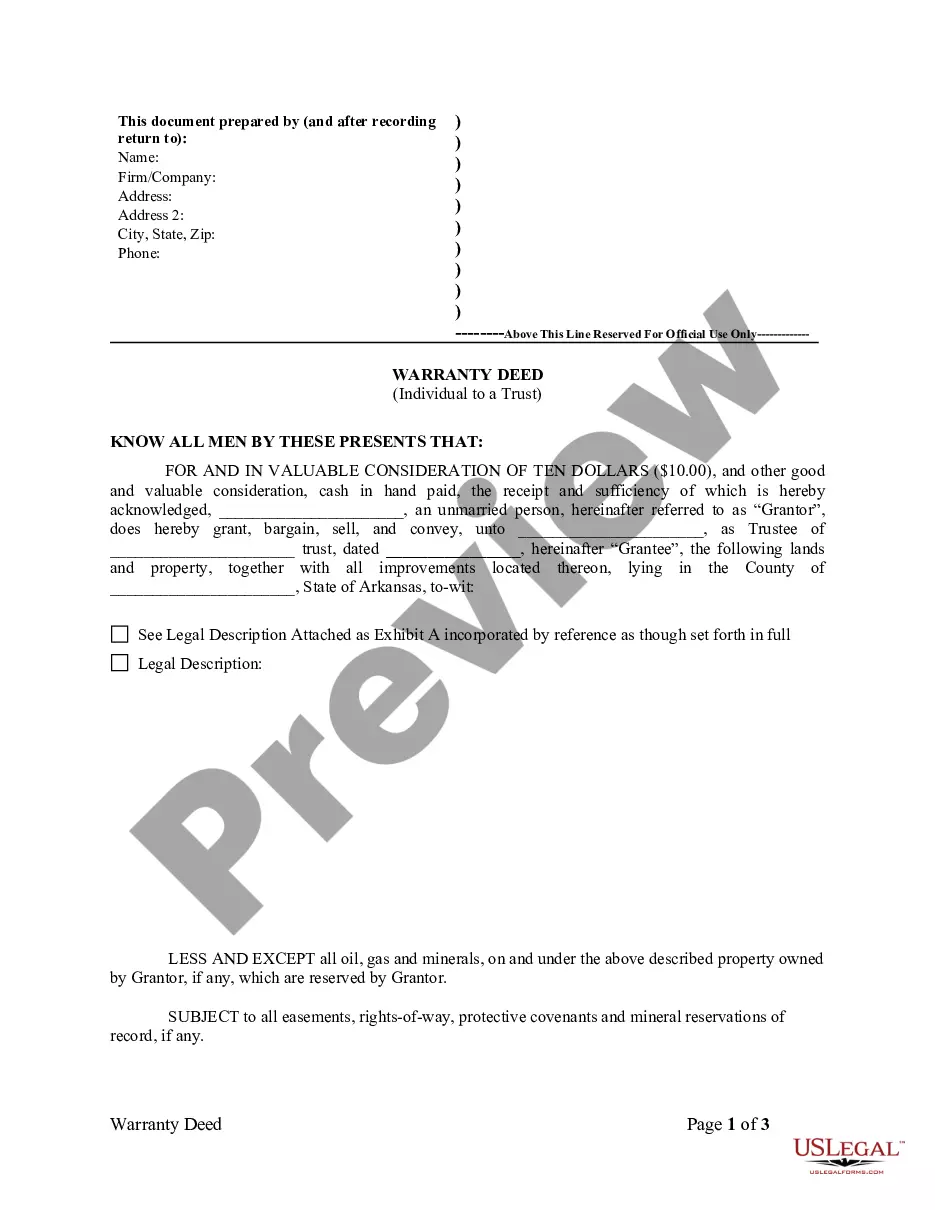

Wayne Michigan is a city located in Wayne County, Michigan, United States. It is a vibrant community known for its rich history, diverse culture, and strong sense of community. This article aims to provide a detailed description of Wayne Michigan Letter regarding trust money, highlighting its significance and shedding light on different types associated with it. A Wayne Michigan Letter regarding trust money refers to a document typically issued by a legal entity or financial institution in Wayne Michigan. This letter contains pertinent information and instructions regarding the handling and distribution of trust funds. It serves as a crucial tool in managing and ensuring the proper administration of trust assets to beneficiaries in accordance with the terms outlined in the trust agreement. 1. Wayne Michigan Letter of Instruction: This type of letter provides a set of detailed instructions from the granter of the trust to the trustee on how to manage and distribute the trust funds. It may include guidance on investment strategies, tax considerations, and specific provisions for the beneficiaries. The Letter of Instruction helps the trustee navigate complex legal and financial matters while adhering to the granter's wishes. 2. Wayne Michigan Letter of Distribution: This specific type of letter is sent by the trustee to the beneficiaries of the trust, informing them about the impending distribution of funds or assets. The letter outlines the amount or nature of the distribution, any applicable tax consequences, and any conditions or restrictions that may apply. It serves as an official notice to the beneficiaries regarding their entitlements as stipulated in the trust agreement. 3. Wayne Michigan Letter of Termination: In the event that a trust's purpose has been fulfilled, or certain conditions outlined in the trust agreement have been met, the trustee may issue a Letter of Termination. This letter formally declares the trust's conclusion, ensuring proper closure. It typically includes instructions for the distribution of the remaining assets, updates on tax obligations, and final accounting statements. 4. Wayne Michigan Letter of Amendment: Trust agreements can be modified or updated due to changing circumstances or the granter's wishes. A Letter of Amendment is sent by the granter to the trustee, outlining the specific changes to be made to the trust's provisions. This letter ensures proper documentation of any alterations made, safeguarding the integrity and validity of the trust. In Wayne Michigan, these various types of letters regarding trust money hold great importance, upholding the principles of transparency, accountability, and legality in managing trust assets. They serve as crucial tools for granters, trustees, and beneficiaries alike, ensuring the responsible and efficient administration of trust funds while honoring the granter's intentions.

Wayne Michigan Letter regarding trust money

Description

How to fill out Wayne Michigan Letter Regarding Trust Money?

Are you looking to quickly draft a legally-binding Wayne Letter regarding trust money or maybe any other document to take control of your own or business affairs? You can go with two options: contact a legal advisor to draft a legal document for you or draft it entirely on your own. The good news is, there's a third solution - US Legal Forms. It will help you receive professionally written legal documents without having to pay sky-high fees for legal services.

US Legal Forms offers a rich collection of more than 85,000 state-specific document templates, including Wayne Letter regarding trust money and form packages. We provide templates for an array of use cases: from divorce papers to real estate documents. We've been out there for over 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and obtain the necessary document without extra hassles.

- To start with, double-check if the Wayne Letter regarding trust money is adapted to your state's or county's regulations.

- In case the form has a desciption, make sure to check what it's suitable for.

- Start the searching process over if the document isn’t what you were hoping to find by using the search box in the header.

- Select the subscription that best suits your needs and proceed to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Wayne Letter regarding trust money template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Moreover, the templates we offer are updated by industry experts, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!