Title: Harris Texas Sample Letter for Compromise on a Debt — Everything You Need to Know Introduction: A Harris Texas Sample Letter for Compromise on a Debt is a powerful tool that can help individuals and businesses negotiate with their creditors, seeking a resolution for outstanding debts. This detailed guide aims to provide you with a comprehensive understanding of what Harris Texas Sample Letters for Compromise on a Debt entail, how they can be beneficial, and the different types available to address various debt-related scenarios. Key Points: 1. Importance of a Harris Texas Sample Letter for Compromise on a Debt: — Enables negotiation: A well-crafted compromise letter serves as a starting point to renegotiate debt terms with creditors. — Avoids legal actions: By showing a genuine intention to resolve the debt, the letter can prevent potential lawsuits or collection attempts. — Preserves credit scores: Engaging in debt negotiation rather than defaulting helps minimize the impact on creditworthiness. 2. Main Components of a Harris Texas Sample Letter for Compromise on a Debt: — Contact information: Include full name, address, phone number, and email. — Creditor details: Mention the creditor's name, address, and account number. — Introduction and explanation: Provide a brief overview of the financial challenges faced, leading to the need for negotiation. — Debt settlement proposal: Detail a proposed compromise amount or percentage of the outstanding debt. — Financial hardship proof: Attach supporting documents like pay stubs, bank statements, and medical bills to substantiate financial hardship claims. — Payment terms: Suggest a reasonable repayment plan that aligns with your financial situation. — Request for written acknowledgement: Ask the creditor to confirm the agreement in writing once settled. 3. Types of Harris Texas Sample Letters for Compromise on a Debt: a. Personal Debt Compromise: Designed for individuals struggling with credit card debts, medical bills, personal loans, or other consumer debts. b. Business Debt Compromise: Tailored for small business owners or self-employed individuals encountering difficulties with business-related debts. c. Mortgage Debt Compromise: Geared towards homeowners facing foreclosure or struggling to make mortgage payments. d. Tax Debt Compromise: Aimed at taxpayers seeking to negotiate and settle outstanding tax obligations with state or federal tax authorities. Conclusion: Writing a Harris Texas Sample Letter for Compromise on a Debt is an essential step towards resolving outstanding debts by negotiating with creditors in Harris County, Texas. By understanding the importance of such letters, knowing their key components, and the different types available, individuals and businesses can take proactive measures to find a middle ground with creditors and work towards a debt settlement agreement that suits their financial capabilities. Remember to consult with a professional, such as an attorney or debt settlement expert, to receive personalized guidance throughout the negotiation process.

Harris Texas Sample Letter for Compromise on a Debt

Description

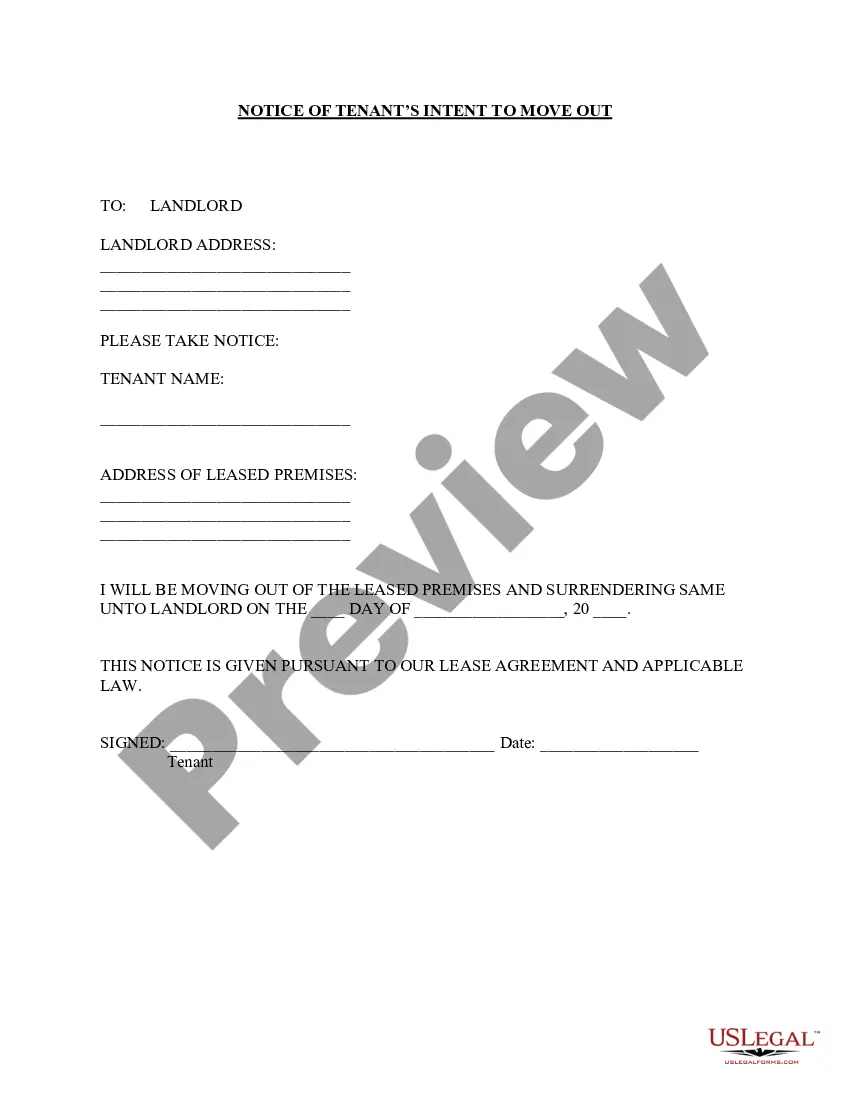

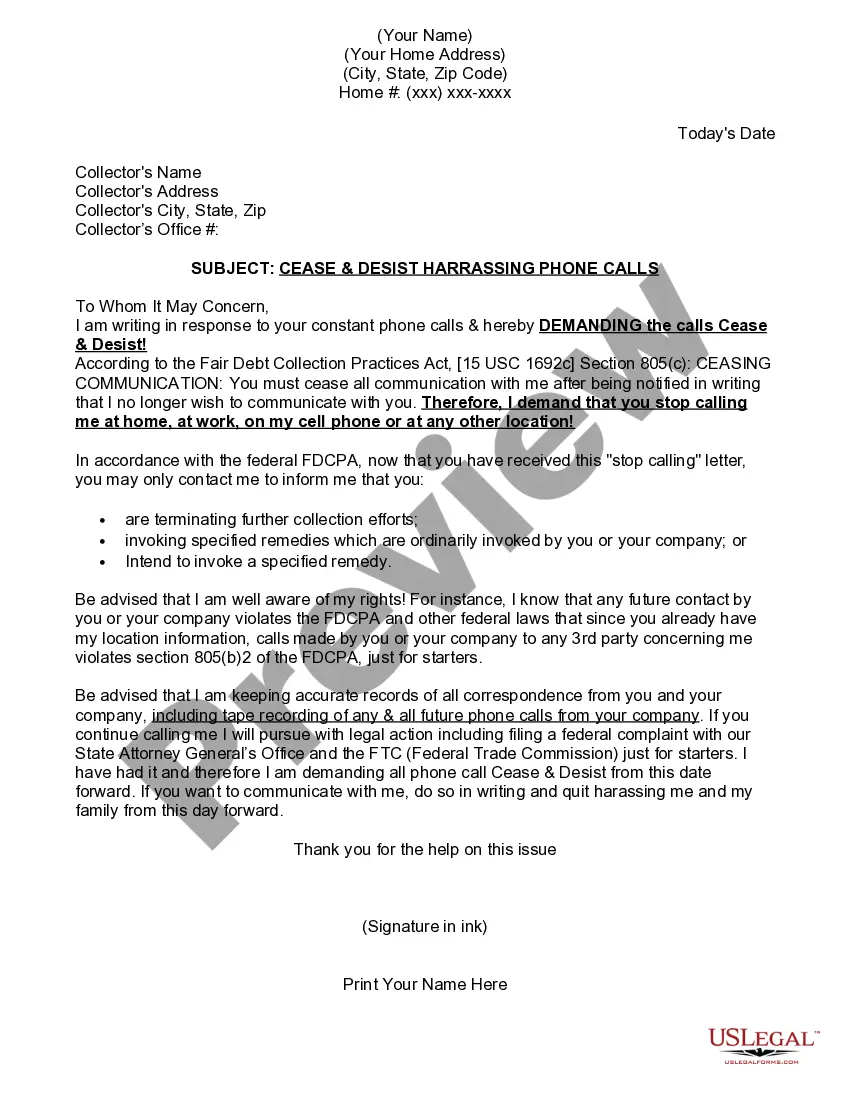

How to fill out Harris Texas Sample Letter For Compromise On A Debt?

Are you looking to quickly create a legally-binding Harris Sample Letter for Compromise on a Debt or maybe any other form to handle your own or corporate affairs? You can go with two options: hire a professional to write a legal document for you or draft it completely on your own. The good news is, there's an alternative solution - US Legal Forms. It will help you get professionally written legal documents without having to pay unreasonable prices for legal services.

US Legal Forms offers a huge collection of more than 85,000 state-compliant form templates, including Harris Sample Letter for Compromise on a Debt and form packages. We provide templates for a myriad of use cases: from divorce paperwork to real estate documents. We've been out there for more than 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the necessary template without extra hassles.

- First and foremost, double-check if the Harris Sample Letter for Compromise on a Debt is adapted to your state's or county's regulations.

- If the form has a desciption, make sure to verify what it's intended for.

- Start the searching process again if the form isn’t what you were seeking by utilizing the search bar in the header.

- Select the plan that is best suited for your needs and proceed to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Harris Sample Letter for Compromise on a Debt template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to buy and download legal forms if you use our catalog. In addition, the templates we provide are updated by industry experts, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!