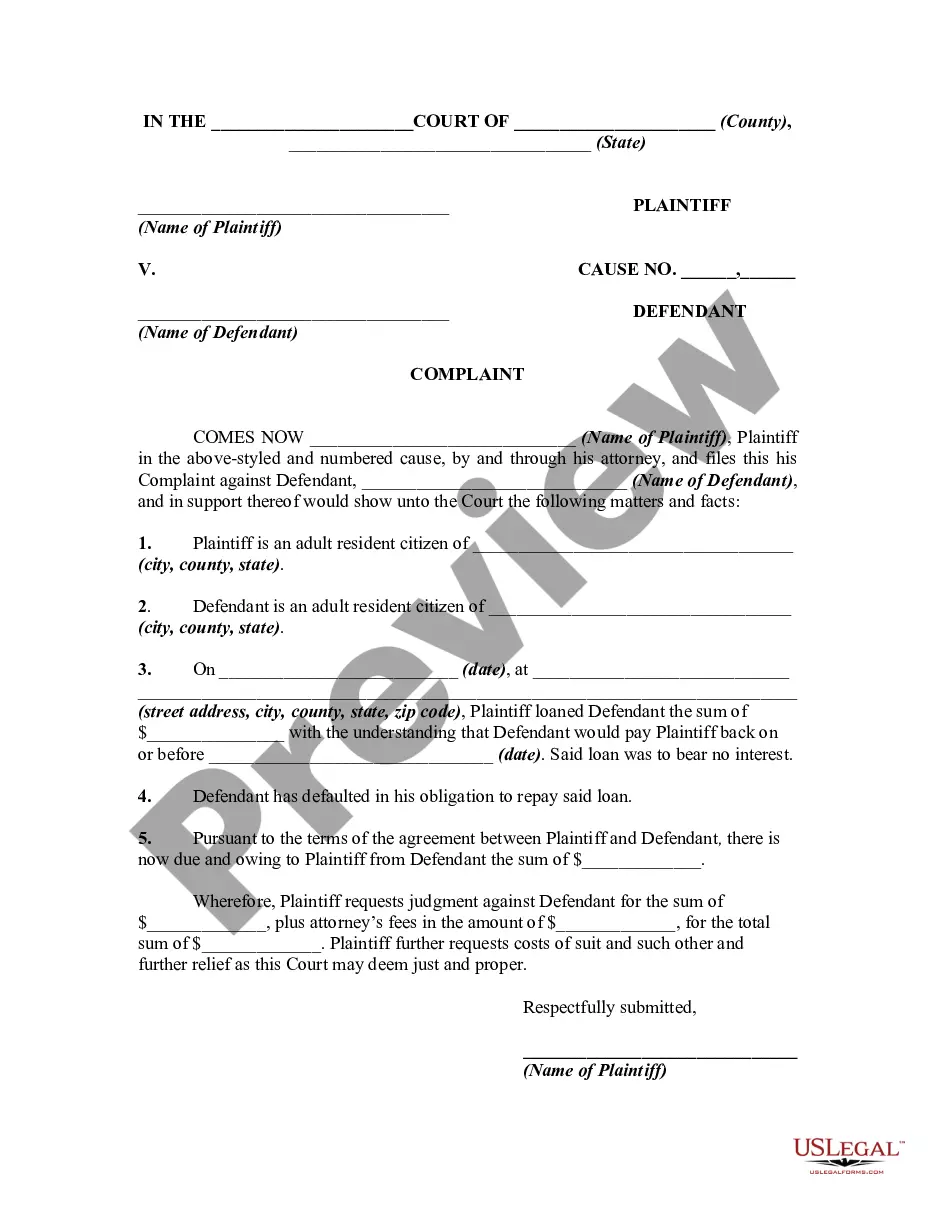

This form is a generic complaint and adopts the "notice pleadings" format of the Federal Rules of Civil Procedure, which have been adopted by most states in one form or another. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Understanding Harris Texas Complaint for Refusal to Pay Debt — Breach of Oral or Implied Contracts Keywords: Harris Texas, complaint, refusal to pay debt, breach, Oral or Implied Contracts Introduction: The Harris Texas Complaint for Refusal to Pay Debt — Breach of Oral or Implied Contracts is a legal recourse available to individuals or businesses when faced with unpaid debts due to the violation of oral or implied contracts. By pursuing this complaint, plaintiffs seek to recover the money owed to them and hold the debtor accountable for breaching their contractual obligations. This article aims to provide a detailed description of such a complaint, its key elements, and potential variations. Key Elements of a Harris Texas Complaint for Refusal to Pay Debt — Breach of Oral or Implied Contracts: 1. Identification of Parties: The complaint should clearly identify the plaintiff (the individual or business owed money) and the defendant (the debtor who has failed to pay). 2. Statement of Facts: A detailed account of the oral or implied agreement terms and conditions, specifying the date, time, location, and context under which the agreement was entered into. 3. Breach of Contract: This section outlines how the defendant has violated the terms of the oral or implied contract by failing to fulfill their payment obligations within the stipulated timeframe. 4. Damages Incurred: The complaint should present a comprehensive list of the specific monetary damages suffered by the plaintiff due to the refusal to pay the debt, including the outstanding amount, any late fees, interest, or other related expenses. 5. Legal Basis: Plaintiffs must cite applicable Harris Texas laws, regulations, or precedent cases that support their claim for breach of oral or implied contracts. 6. Relief Sought: Specify the requested remedy, typically the payment of the outstanding debt, including any additional damages or legal expenses incurred as a result of the breach. Types of Harris Texas Complaint for Refusal to Pay Debt — Breach of Oral or Implied Contracts: 1. Individual vs. Individual: A complaint where one private individual sues another individual for unpaid debts resulting from a breach of oral or implied contracts. 2. Business vs. Individual: In cases where a business entity seeks legal action against an individual debtor for non-payment, recovering debts related to services provided or products sold. 3. Business vs. Business: Complaints filed by businesses against other businesses that have failed to fulfill their contractual obligations, such as non-payment for goods, services, or breach of partnership agreements. Conclusion: When faced with unpaid debts due to the violation of oral or implied contracts, the Harris Texas Complaint for Refusal to Pay Debt — Breach of Oral or Implied Contracts offers an avenue for seeking legal recourse. By adhering to key elements of the complaint and accurately outlining the specific damages suffered, individuals and businesses can pursue full recovery of the outstanding debt, ensuring justice is served.Title: Understanding Harris Texas Complaint for Refusal to Pay Debt — Breach of Oral or Implied Contracts Keywords: Harris Texas, complaint, refusal to pay debt, breach, Oral or Implied Contracts Introduction: The Harris Texas Complaint for Refusal to Pay Debt — Breach of Oral or Implied Contracts is a legal recourse available to individuals or businesses when faced with unpaid debts due to the violation of oral or implied contracts. By pursuing this complaint, plaintiffs seek to recover the money owed to them and hold the debtor accountable for breaching their contractual obligations. This article aims to provide a detailed description of such a complaint, its key elements, and potential variations. Key Elements of a Harris Texas Complaint for Refusal to Pay Debt — Breach of Oral or Implied Contracts: 1. Identification of Parties: The complaint should clearly identify the plaintiff (the individual or business owed money) and the defendant (the debtor who has failed to pay). 2. Statement of Facts: A detailed account of the oral or implied agreement terms and conditions, specifying the date, time, location, and context under which the agreement was entered into. 3. Breach of Contract: This section outlines how the defendant has violated the terms of the oral or implied contract by failing to fulfill their payment obligations within the stipulated timeframe. 4. Damages Incurred: The complaint should present a comprehensive list of the specific monetary damages suffered by the plaintiff due to the refusal to pay the debt, including the outstanding amount, any late fees, interest, or other related expenses. 5. Legal Basis: Plaintiffs must cite applicable Harris Texas laws, regulations, or precedent cases that support their claim for breach of oral or implied contracts. 6. Relief Sought: Specify the requested remedy, typically the payment of the outstanding debt, including any additional damages or legal expenses incurred as a result of the breach. Types of Harris Texas Complaint for Refusal to Pay Debt — Breach of Oral or Implied Contracts: 1. Individual vs. Individual: A complaint where one private individual sues another individual for unpaid debts resulting from a breach of oral or implied contracts. 2. Business vs. Individual: In cases where a business entity seeks legal action against an individual debtor for non-payment, recovering debts related to services provided or products sold. 3. Business vs. Business: Complaints filed by businesses against other businesses that have failed to fulfill their contractual obligations, such as non-payment for goods, services, or breach of partnership agreements. Conclusion: When faced with unpaid debts due to the violation of oral or implied contracts, the Harris Texas Complaint for Refusal to Pay Debt — Breach of Oral or Implied Contracts offers an avenue for seeking legal recourse. By adhering to key elements of the complaint and accurately outlining the specific damages suffered, individuals and businesses can pursue full recovery of the outstanding debt, ensuring justice is served.