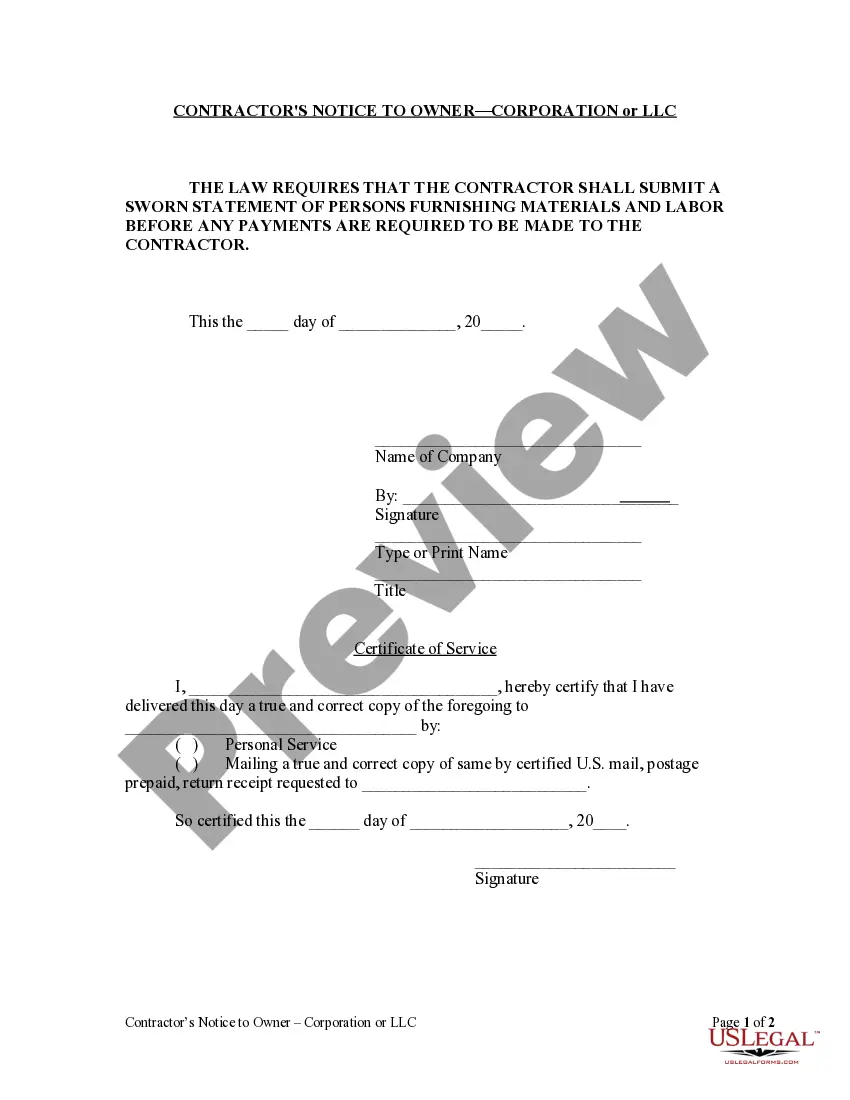

This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

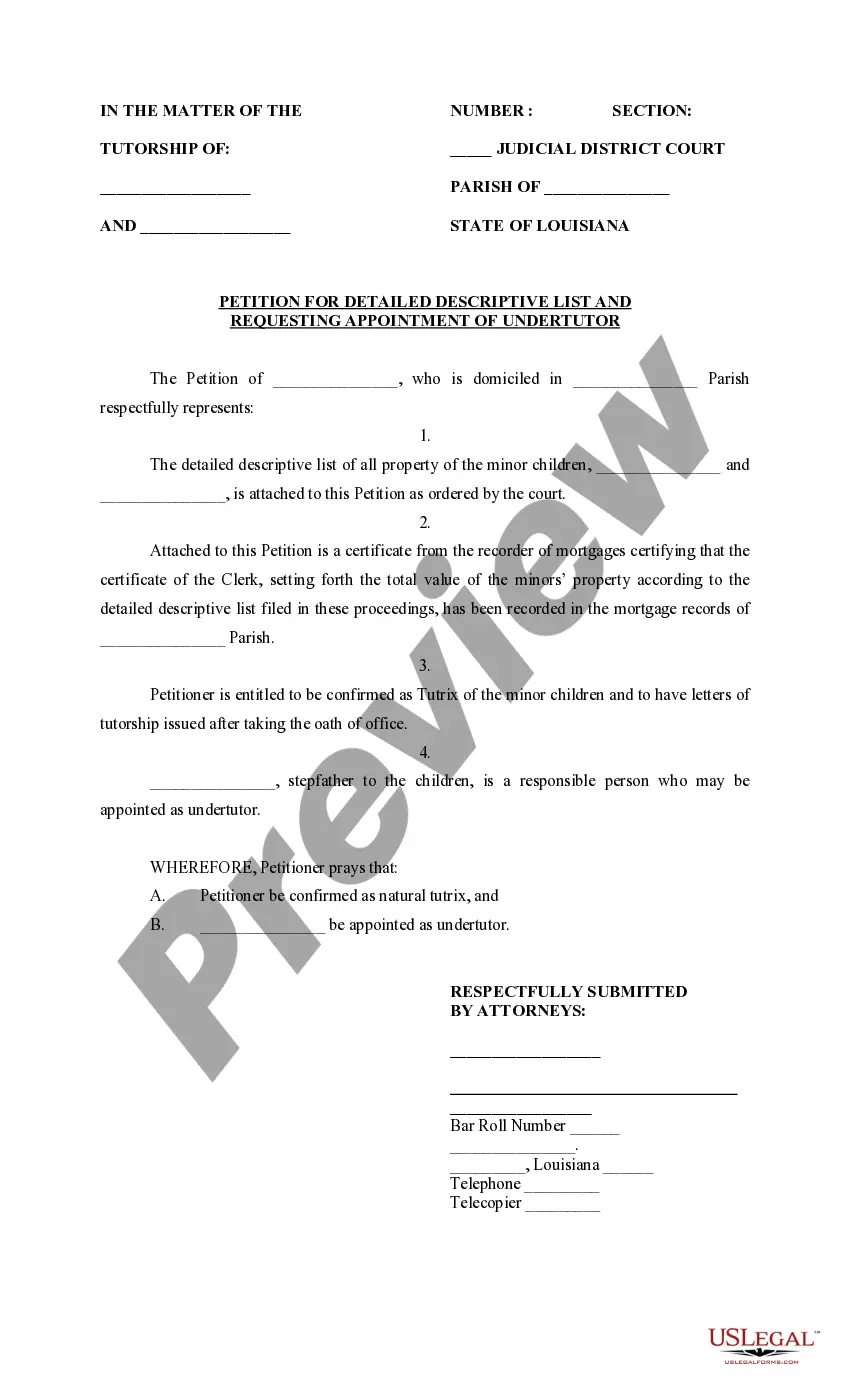

Cuyahoga Ohio Notice of Default in Payment Due on Promissory Note is a legal document that notifies the borrower of their failure to make payments on a promissory note. This notice serves as a formal warning indicating that the borrower's payments on the loan have reached a state of default. In Cuyahoga County, Ohio, there are several types of notices of default in payment due on promissory notes, categorized based on the stage of the default and the subsequent actions that may be taken. These different types of notices aim to provide clarity and transparency throughout the debt collection process. Some commonly recognized types include: 1. Preliminary Notice of Default: This notice is typically issued by the lender when the borrower first misses a payment or fails to meet the agreed-upon terms of the promissory note. It serves as an initial warning and may include details such as the outstanding amount, due dates, and any penalties or interest accruing. 2. Notice of Default: If the borrower does not rectify the default or fails to respond to the preliminary notice, the lender may issue a formal Notice of Default. This document specifically informs the borrower that they have a certain period (usually provided by law) to cure the default or face further legal proceedings. 3. Notice of Intent to Accelerate: If the borrower fails to cure the default within the given timeframe mentioned in the Notice of Default, the lender may issue a Notice of Intent to Accelerate. This notice states the intention to accelerate the entire loan amount, making it due immediately, subject to potential legal action if the default is not remedied promptly. 4. Notice of Acceleration: In the event that the borrower does not resolve the default as per the Notice of Intent to Accelerate, the lender may issue a Notice of Acceleration. This notice declares that the entire outstanding balance on the promissory note is now due and demandable and must be paid immediately. It is important to note that the specific terms and requirements for Cuyahoga Ohio Notice of Default in Payment Due on Promissory Note may vary based on applicable state laws, the nature of the loan, and the specific clauses mentioned in the promissory note itself. Seeking legal advice or consulting with a professional can provide borrowers with a better understanding of their rights and options when faced with such notices.