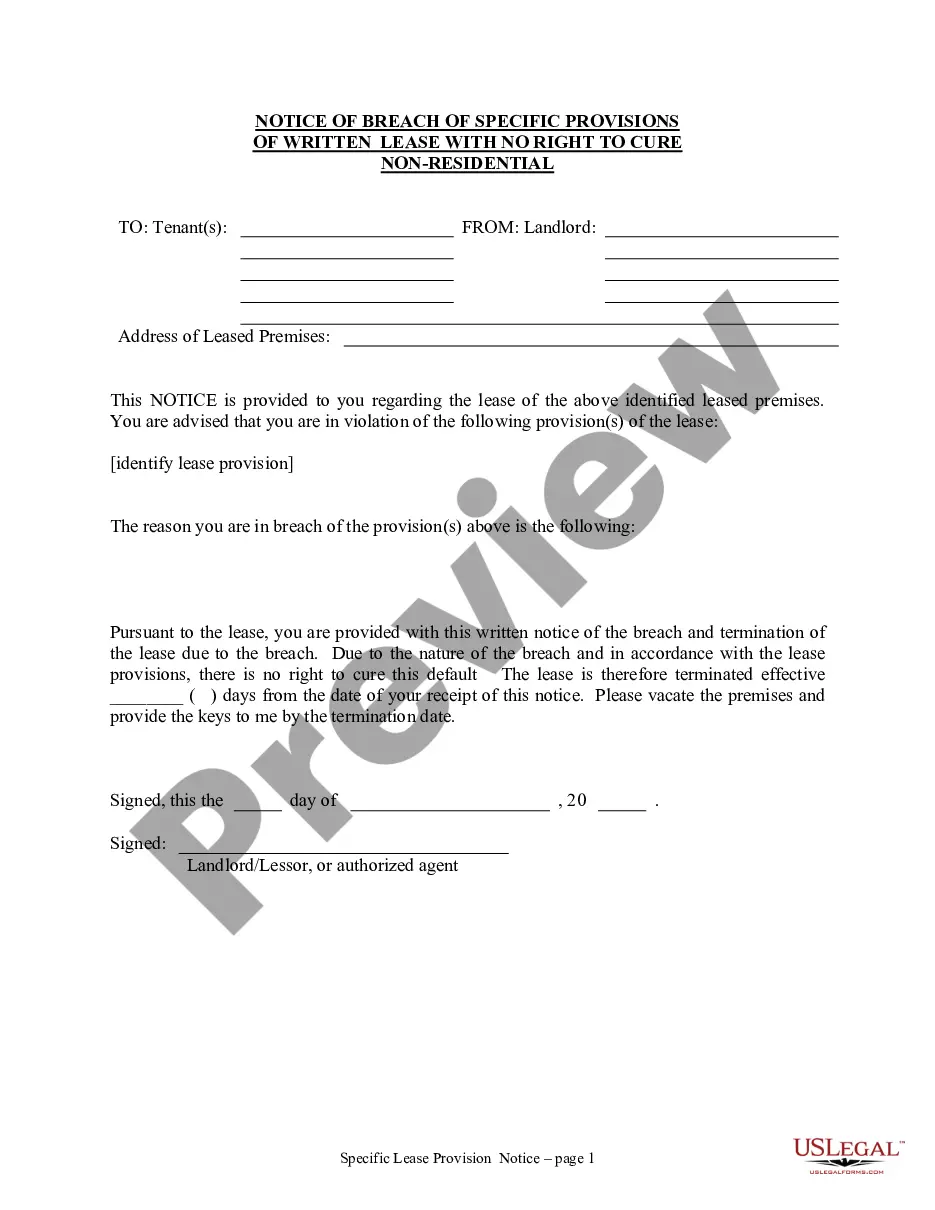

This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

A Hillsborough Florida Notice of Default in Payment Due on Promissory Note is a legally binding document that serves as a notification to a borrower in Hillsborough County, Florida, informing them that they are in default of their payment obligations outlined in a promissory note. This notice is typically sent by the lender or creditor when the borrower fails to make the required payment(s) by the agreed-upon due date(s). The purpose of the Hillsborough Florida Notice of Default is to formally inform the borrower of their default status and provide them with an opportunity to rectify the situation and bring their payments up to date. It serves as a preliminary step prior to initiating legal action such as foreclosure on the property securing the loan. Keywords: Hillsborough Florida, Notice of Default, Payment Due, Promissory Note, borrower, lender, creditor, default status, payment obligations, due date, rectify, foreclosure, property. Different types of Hillsborough Florida Notice of Default in Payment Due on Promissory Note: 1. Residential Mortgage Notice of Default: This type of notice pertains to default in payment on a residential mortgage loan, typically associated with a single-family home, townhouse, or condominium. It outlines the specific terms of the loan agreement and the consequences of default, such as foreclosure. 2. Commercial Loan Notice of Default: This notice is specific to default in payment on a commercial loan, typically used for financing commercial real estate properties or business ventures. The notice will highlight the terms of the loan and the potential actions the lender may take if the borrower fails to correct the default. 3. Auto Loan Notice of Default: This notice is applicable when a borrower defaults on their auto loan payment(s). The notice will detail the loan terms, the specific vehicle securing the loan, and the consequences of non-payment, usually leading to repossession of the vehicle. 4. Personal Loan Notice of Default: This type of notice is used for default in payment on a personal loan, which can cover various purposes such as debt consolidation, education, or medical expenses. The notice will outline the loan terms and provide options for the borrower to rectify the default, possibly through a payment plan or loan modification. These different types of Hillsborough Florida Notice of Default in Payment Due on Promissory Note aim to inform borrowers of their defaulted payment status and encourage them to take immediate action to remedy the situation to avoid further legal repercussions.A Hillsborough Florida Notice of Default in Payment Due on Promissory Note is a legally binding document that serves as a notification to a borrower in Hillsborough County, Florida, informing them that they are in default of their payment obligations outlined in a promissory note. This notice is typically sent by the lender or creditor when the borrower fails to make the required payment(s) by the agreed-upon due date(s). The purpose of the Hillsborough Florida Notice of Default is to formally inform the borrower of their default status and provide them with an opportunity to rectify the situation and bring their payments up to date. It serves as a preliminary step prior to initiating legal action such as foreclosure on the property securing the loan. Keywords: Hillsborough Florida, Notice of Default, Payment Due, Promissory Note, borrower, lender, creditor, default status, payment obligations, due date, rectify, foreclosure, property. Different types of Hillsborough Florida Notice of Default in Payment Due on Promissory Note: 1. Residential Mortgage Notice of Default: This type of notice pertains to default in payment on a residential mortgage loan, typically associated with a single-family home, townhouse, or condominium. It outlines the specific terms of the loan agreement and the consequences of default, such as foreclosure. 2. Commercial Loan Notice of Default: This notice is specific to default in payment on a commercial loan, typically used for financing commercial real estate properties or business ventures. The notice will highlight the terms of the loan and the potential actions the lender may take if the borrower fails to correct the default. 3. Auto Loan Notice of Default: This notice is applicable when a borrower defaults on their auto loan payment(s). The notice will detail the loan terms, the specific vehicle securing the loan, and the consequences of non-payment, usually leading to repossession of the vehicle. 4. Personal Loan Notice of Default: This type of notice is used for default in payment on a personal loan, which can cover various purposes such as debt consolidation, education, or medical expenses. The notice will outline the loan terms and provide options for the borrower to rectify the default, possibly through a payment plan or loan modification. These different types of Hillsborough Florida Notice of Default in Payment Due on Promissory Note aim to inform borrowers of their defaulted payment status and encourage them to take immediate action to remedy the situation to avoid further legal repercussions.