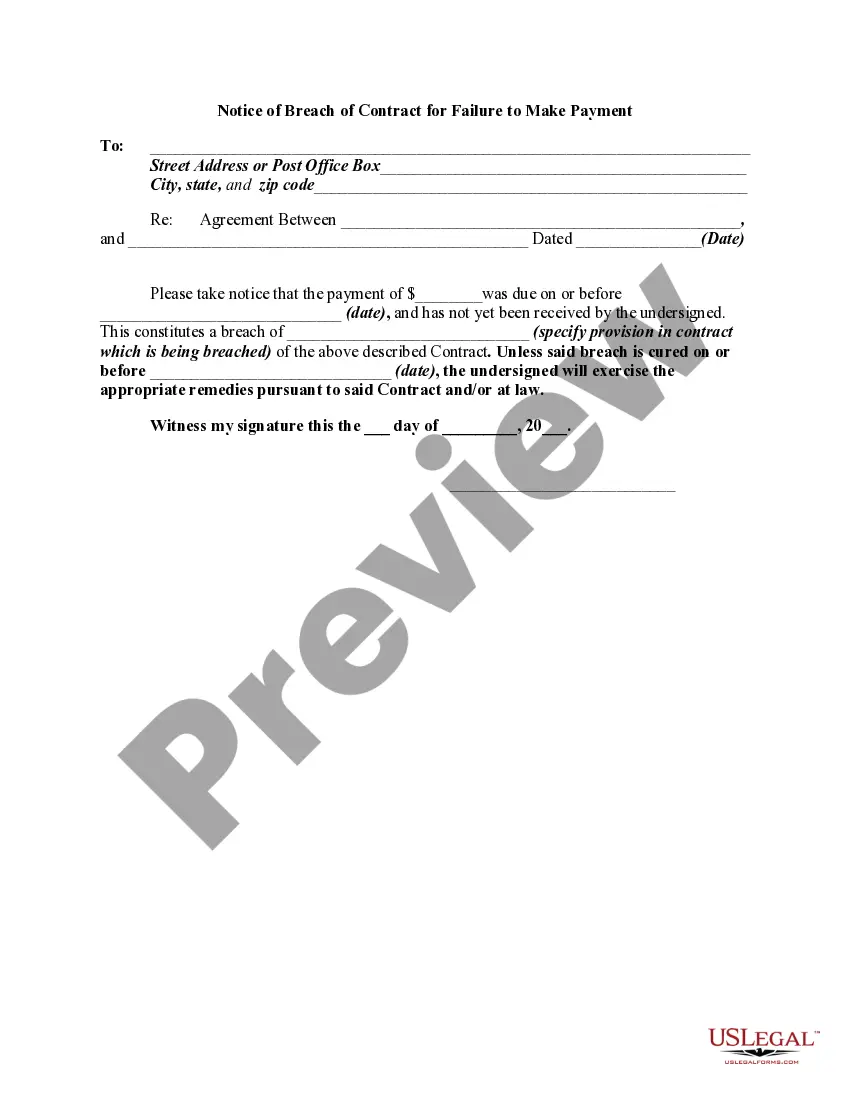

This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

Oakland Michigan Notice of Default in Payment Due on Promissory Note is a legal document issued to notify a borrower that they have failed to make the required payment on their promissory note in Oakland County, Michigan. This notice is an important step in the foreclosure process and serves as a warning to the borrower that legal action may be taken if the payment is not made promptly. The Notice of Default in Payment Due on Promissory Note in Oakland Michigan typically includes the following details: 1. Identification of Parties: The notice will begin by identifying the lender, also known as the note holder, and the borrower, who is in default. 2. Description of the Promissory Note: The document will outline the terms of the original promissory note, including the date of execution, loan amount, interest rate, and repayment terms. 3. Outstanding Payment Details: The notice will specify the payment amount that is past due, including any late fees or interest that has accumulated as a result of the missed payment(s). 4. Deadline and Cure Period: The borrower will be given a specific deadline to bring the payments up to date or cure the default. This period is usually stated in terms of days or weeks, offering the borrower an opportunity to rectify the situation. 5. Consequences of Non-Payment: The notice may outline the potential consequences of continued non-payment on the promissory note. This may include foreclosure proceedings, additional fees, or potentially damaging the borrower's credit score. 6. Contact Information: The notice will provide the lender's contact information or the contact information of a designated representative to whom the borrower can reach out regarding the default or to seek assistance in resolving the issue. It is important for borrowers to carefully review the Notice of Default in Payment Due on Promissory Note and take immediate action to resolve the default. Failure to respond or rectify the situation within the specified cure period can lead to further legal action by the lender, potentially resulting in foreclosure or other financial consequences. Note: While there may not be specific types of Oakland Michigan Notice of Default in Payment Due on Promissory Note, the content may vary depending on the lender's policies and the individual circumstances of the borrower.Oakland Michigan Notice of Default in Payment Due on Promissory Note is a legal document issued to notify a borrower that they have failed to make the required payment on their promissory note in Oakland County, Michigan. This notice is an important step in the foreclosure process and serves as a warning to the borrower that legal action may be taken if the payment is not made promptly. The Notice of Default in Payment Due on Promissory Note in Oakland Michigan typically includes the following details: 1. Identification of Parties: The notice will begin by identifying the lender, also known as the note holder, and the borrower, who is in default. 2. Description of the Promissory Note: The document will outline the terms of the original promissory note, including the date of execution, loan amount, interest rate, and repayment terms. 3. Outstanding Payment Details: The notice will specify the payment amount that is past due, including any late fees or interest that has accumulated as a result of the missed payment(s). 4. Deadline and Cure Period: The borrower will be given a specific deadline to bring the payments up to date or cure the default. This period is usually stated in terms of days or weeks, offering the borrower an opportunity to rectify the situation. 5. Consequences of Non-Payment: The notice may outline the potential consequences of continued non-payment on the promissory note. This may include foreclosure proceedings, additional fees, or potentially damaging the borrower's credit score. 6. Contact Information: The notice will provide the lender's contact information or the contact information of a designated representative to whom the borrower can reach out regarding the default or to seek assistance in resolving the issue. It is important for borrowers to carefully review the Notice of Default in Payment Due on Promissory Note and take immediate action to resolve the default. Failure to respond or rectify the situation within the specified cure period can lead to further legal action by the lender, potentially resulting in foreclosure or other financial consequences. Note: While there may not be specific types of Oakland Michigan Notice of Default in Payment Due on Promissory Note, the content may vary depending on the lender's policies and the individual circumstances of the borrower.