Dear [Customer's Name], We regret to inform you that your recent application for an individual charge account has been denied by our organization. We understand that you were excited about the potential benefits and convenience this account would offer you, but unfortunately, we are unable to proceed with your request at this time. When reviewing your application, we carefully assessed several factors including your credit history, income verification, and other pertinent information. We always strive to make fair and informed decisions to ensure the financial stability of our organization and protect our valued customers. Although we cannot disclose specific details of your application evaluation, we would like to suggest a few possible reasons for the denial: 1. Insufficient Credit History: Your credit history may not provide us with sufficient data to gauge your creditworthiness. Without substantial credit information, we are unable to assess the potential risk associated with granting you a charge account. 2. Low Credit Score: Your credit score might fall below the minimum threshold required by our organization to qualify for a charge account. This measure is taken to mitigate potential financial losses and protect our existing account holders. 3. Previous Delinquencies: If you have a history of late payments, defaults, or other delinquencies on previous credit obligations, it may impact our decision to offer you a charge account. 4. Inadequate Income: Your stated income may not meet the minimum requirements needed to qualify for a charge account. We have strict guidelines to ensure our customers can responsibly manage their credit obligations and prevent potential financial distress. We understand that receiving a denial can be disappointing, especially when you were hoping to benefit from the advantages of having an individual charge account. However, we encourage you to explore other financial options that may better suit your current circumstances. Should you wish to obtain more clarity regarding the denial or discuss any potential alternatives, please do not hesitate to contact our customer service team. Our knowledgeable representatives are available to provide additional guidance and answer any questions you may have. We appreciate your understanding, and thank you for considering our organization for your financial needs. We value your interest and hope to have the opportunity to serve you in the future should your circumstances change. Sincerely, [Your Name] [Position] [Company/Organization Name] [Contact Information]

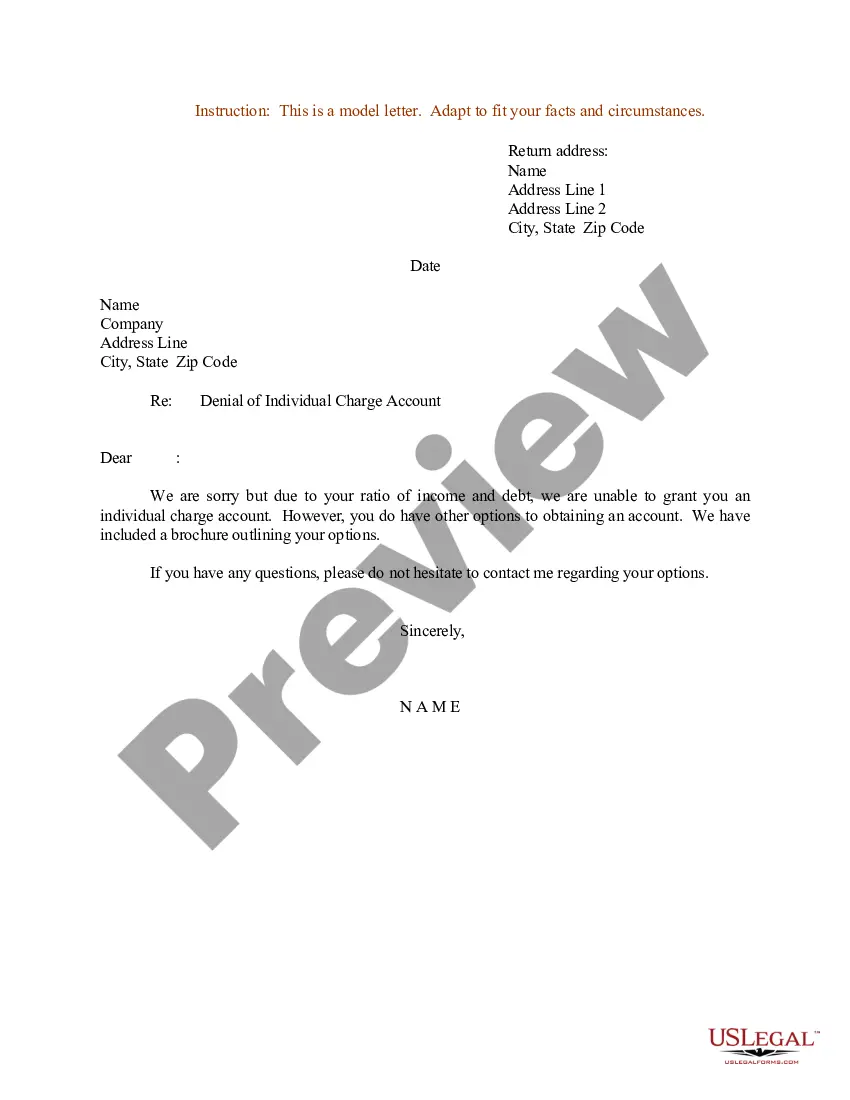

Chicago Illinois Sample Letter for Denial of Individual Charge Account

Description

How to fill out Chicago Illinois Sample Letter For Denial Of Individual Charge Account?

How much time does it usually take you to draft a legal document? Because every state has its laws and regulations for every life sphere, locating a Chicago Sample Letter for Denial of Individual Charge Account meeting all local requirements can be stressful, and ordering it from a professional attorney is often pricey. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, collected by states and areas of use. Apart from the Chicago Sample Letter for Denial of Individual Charge Account, here you can get any specific form to run your business or individual deeds, complying with your regional requirements. Experts check all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can retain the document in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your Chicago Sample Letter for Denial of Individual Charge Account:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Chicago Sample Letter for Denial of Individual Charge Account.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!