Kings New York Sample Letter for Denial of Individual Charge Account

Description

How to fill out Kings New York Sample Letter For Denial Of Individual Charge Account?

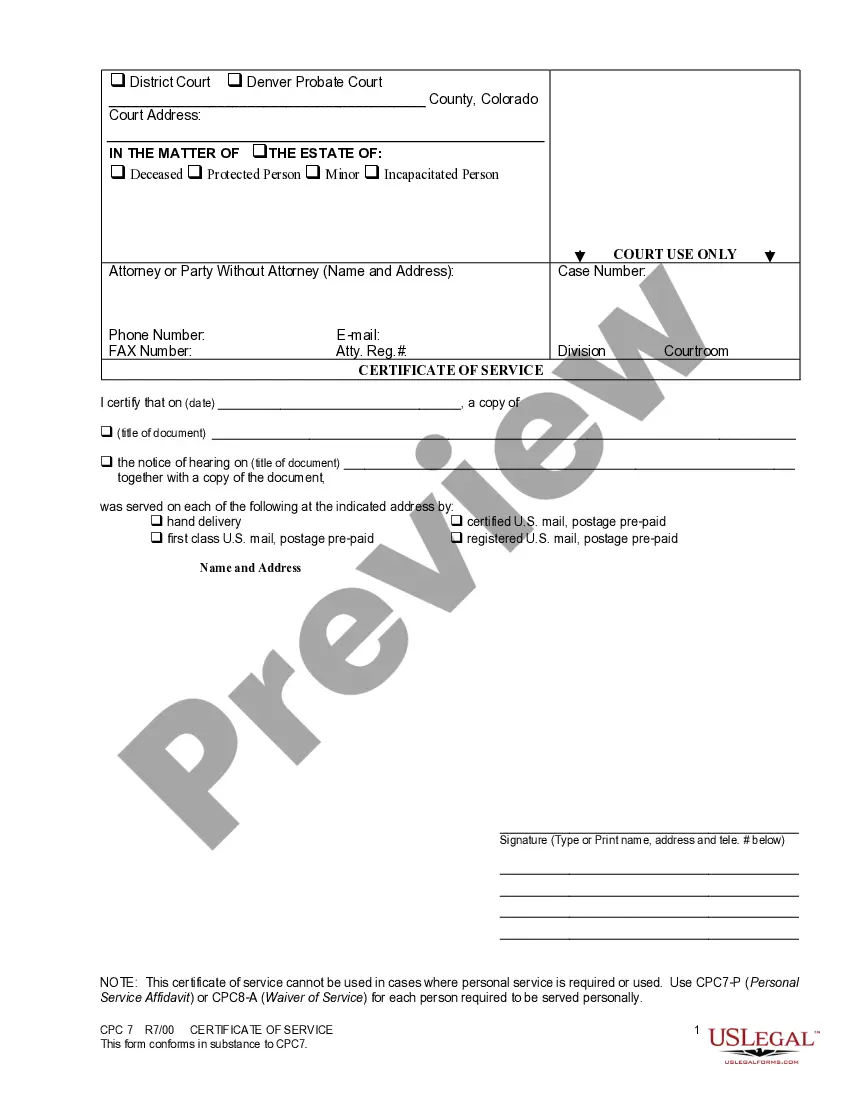

Whether you plan to open your company, enter into a contract, apply for your ID update, or resolve family-related legal issues, you need to prepare certain documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business case. All files are grouped by state and area of use, so picking a copy like Kings Sample Letter for Denial of Individual Charge Account is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of more steps to obtain the Kings Sample Letter for Denial of Individual Charge Account. Adhere to the instructions below:

- Make certain the sample meets your individual needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to obtain the file when you find the proper one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Kings Sample Letter for Denial of Individual Charge Account in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

Valid Reasons to Dispute a Credit Card Charge Legitimate reasons to dispute a credit card charge include being charged twice for the same transaction, being charged for something you returned or something that was never received. Sometimes the credit card issuer fails to credit a payment.

Dear Sir, Subject: Current Bank a/c no: 123456789: Request for rectification of a wrong debit. While verifying the monthly statement of my above account for month of November 2016, I find a debit of Rupees 2500. I have not made any transactions where in such charges is due.

This letter is to dispute an incorrectly charged amount on my credit card. My credit card number is XCXCXXC and it has a constant record of all bills cleared at the appropriate time. I want to inform you that the statement issued to me from bank includes an erroneous charge of Rs.

Yes. If the cardholder doesn't make a compelling enough case to their bank, or doesn't have a valid reason for filing a chargeback, the bank may refuse to open a dispute.

I am writing to dispute a charge of $ to my credit or debit card account on date of the charge. The charge is in error because explain the problem briefly. For example, the items weren't delivered, I was overcharged, I returned the items, I did not buy the items, etc..

I am writing to dispute a billing error in the amount of $ on my account. The amount is inaccurate because describe the problem. I am requesting that the error be corrected, that any finance and other charges related to the disputed amount be credited as well, and that I receive an accurate statement.

Disputing a debit card charge involves contacting your bank and asking it to cancel the error, which restores your balance to its previous level. The bank's final decision can take up to 10 business days. Call your bank's customer service hotline, which you can usually find online or on the back of your debit card.

You can dispute a fraudulent credit card charge by contacting your credit card issuer directly and informing them of the problem. By law, you cannot be held liable for more than $50 in fraudulent charges. However, a charge of even this amount is unlikely.

Ask the company if it will reverse the charge. If you're not satisfied with the merchant's response, you may be able to dispute the charge with your credit card company and have the charge reversed. This is sometimes called a chargeback. Contact your credit card company to see whether you can dispute a charge.