Subject: Maricopa, Arizona — A Thriving City in the Southwest Dear [Name], We hope this letter finds you in good health and high spirits. We appreciate your interest in obtaining an individual charge account with our institution, and we understand the significance of financial resources for fulfilling your personal needs and aspirations. However, after careful consideration, we regretfully inform you that your application for an individual charge account has been denied. Maricopa, Arizona, nestled in the Sonoran Desert and spanning over 43 square miles, is a dynamic city that has witnessed remarkable growth and transformation over the years. As one of the fastest-growing cities in the state, Maricopa offers a unique blend of suburban charm and urban amenities, making it an ideal place to live, work, and explore. Despite our decision, we understand that financial matters can be crucial and want to provide you with further insight into the reasons for your application denial. In analyzing your application, our team found a few factors that influenced our decision. Firstly, our evaluation revealed that your credit history does not meet the predetermined criteria established by our institution. Maintaining a good credit score is essential for managing financial responsibilities and demonstrating a consistent history of meeting obligations. Additionally, your current debt-to-income ratio exceeds the acceptable limits set by our organization. This ratio displays the proportion of your monthly income dedicated to servicing existing debts, and a higher ratio may indicate an increased risk of financial strain, potentially affecting your ability to make future payments. We acknowledge that receiving news of a denied application can be disheartening, but we believe in offering guidance and support during this process. We encourage you to take the following steps to improve your financial standing for future credit applications: 1. Review and improve your credit history: Regularly checking your credit report enables you to identify any errors or discrepancies that may be negatively impacting your credit score. Timely rectification of these issues positively affects your creditworthiness. 2. Manage your outstanding debts responsibly: Prioritize the settlement of your existing debts to improve your debt-to-income ratio gradually. This demonstrates your commitment to fiscal responsibility and reassures potential lenders. 3. Establish a savings plan: Building a solid savings plan helps create a financial cushion and establishes a positive track record regarding your ability to manage and save money. 4. Consider seeking professional advice: Consulting a financial advisor or credit counselor can provide valuable insights and strategies to improve your financial management skills and overall creditworthiness. Although we cannot approve your individual charge account at this time, we encourage you not to be discouraged. By responsibly addressing the aforementioned factors, you can elevate your financial standing and increase your chances of approval in the future. Maricopa, Arizona, with its panoramic vistas, vibrant community events, and commitment to education, offers an exceptional quality of life for its residents. Even if you are disappointed with the outcome of this application, we hope that you will continue to explore the myriad opportunities available in our flourishing city. Please feel free to reach out if you require further clarification or assistance with your financial journey. We remain committed to supporting you in every way we can. We wish you the best of luck in your endeavors and hope to serve you in the future. Sincerely, [Your Name] [Your Title/Position] [Your Institution/Organization]

Maricopa Arizona Sample Letter for Denial of Individual Charge Account

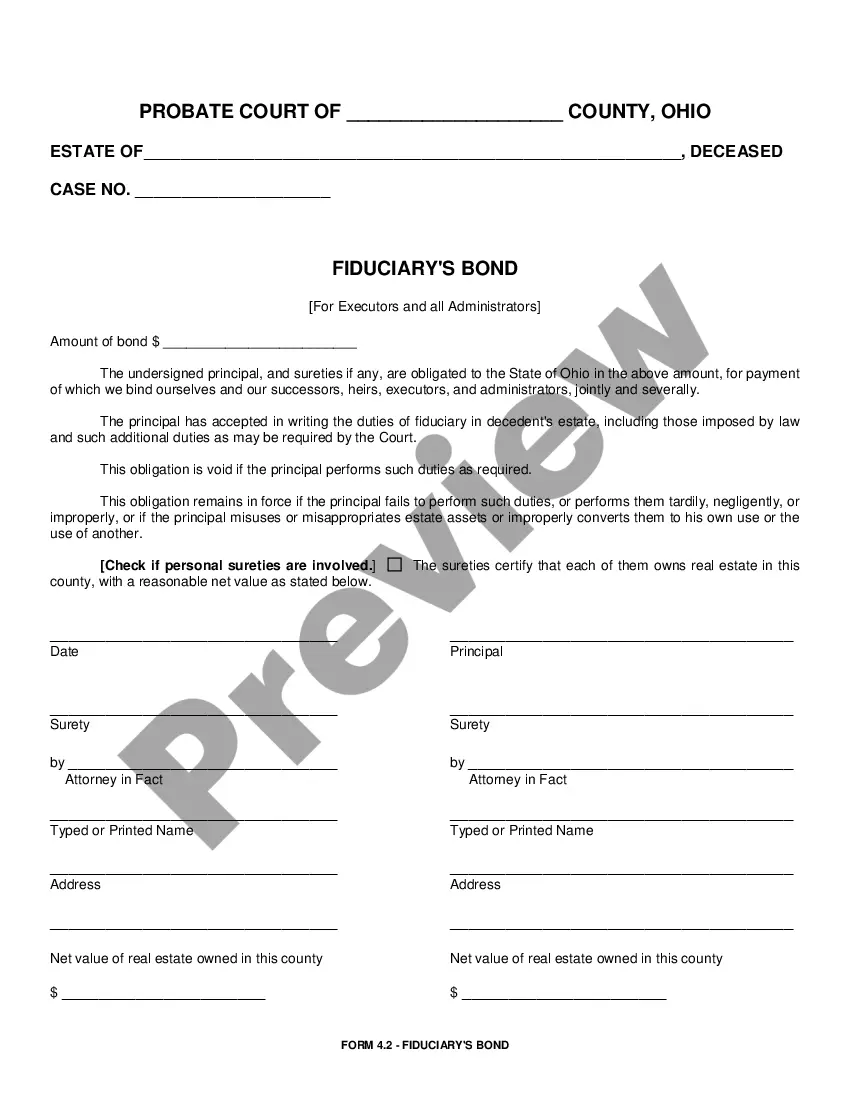

Description

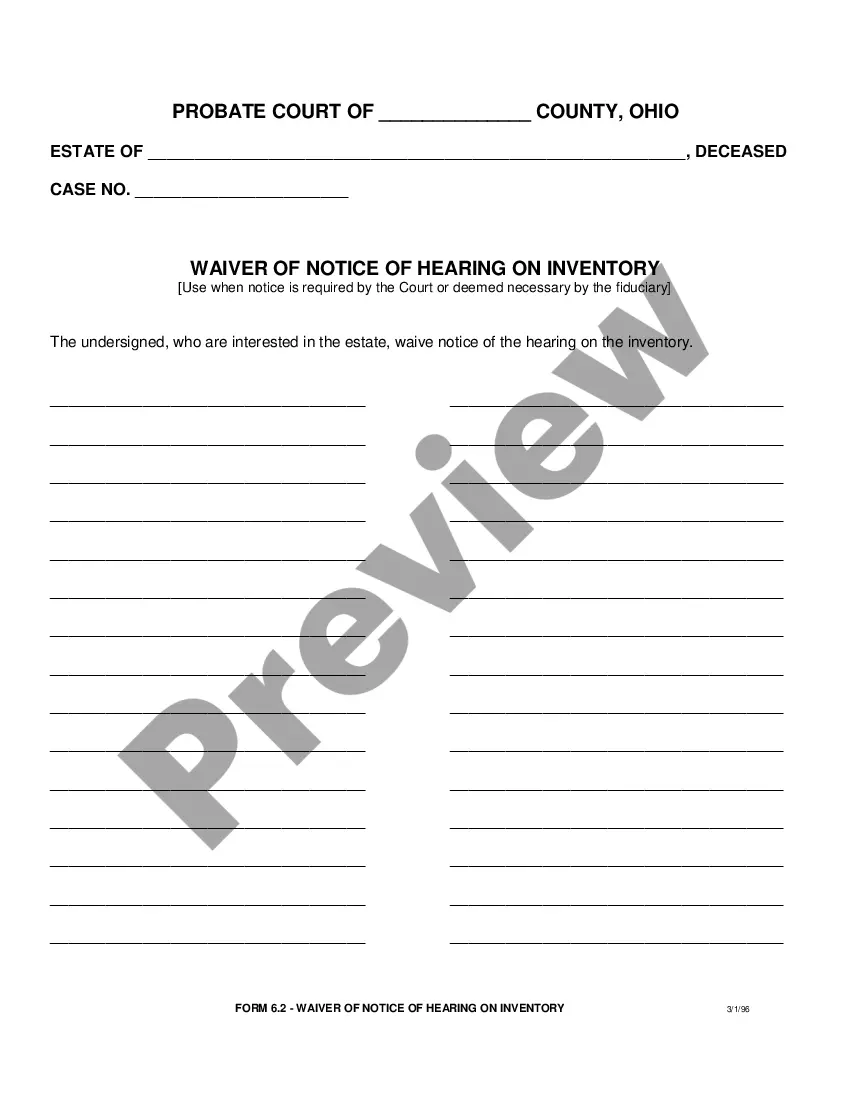

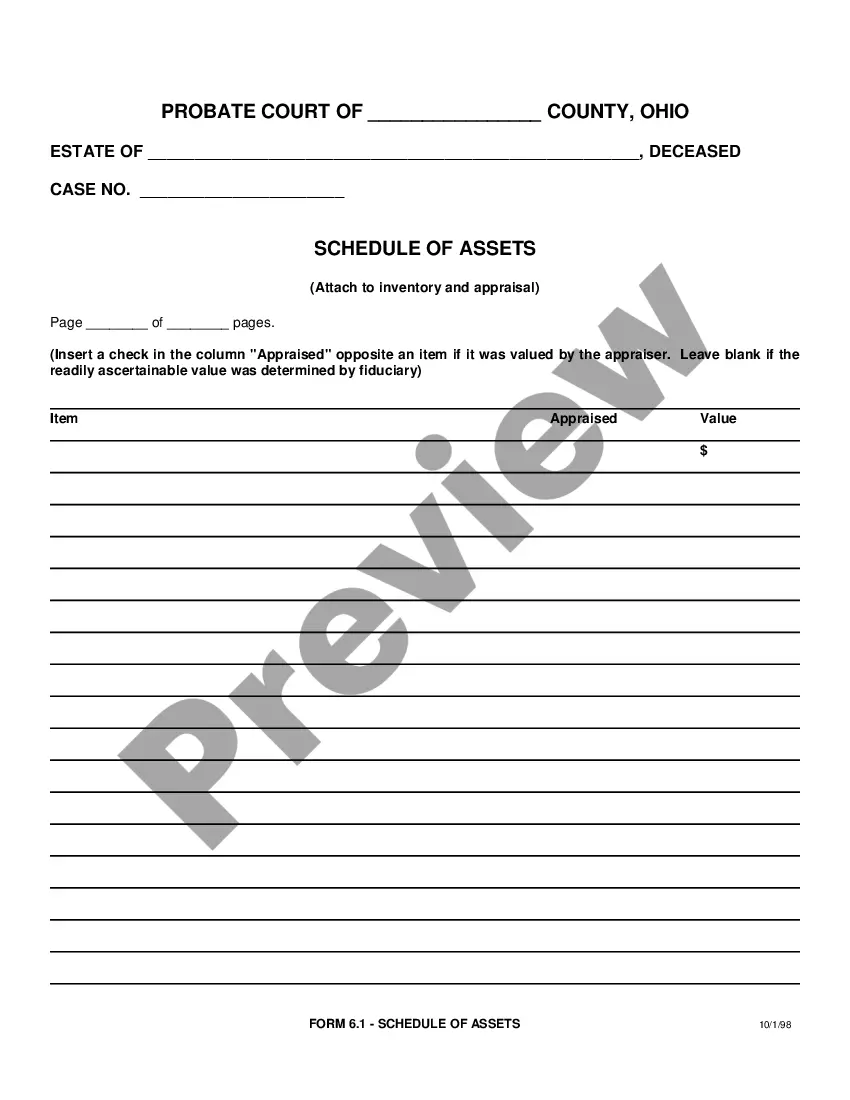

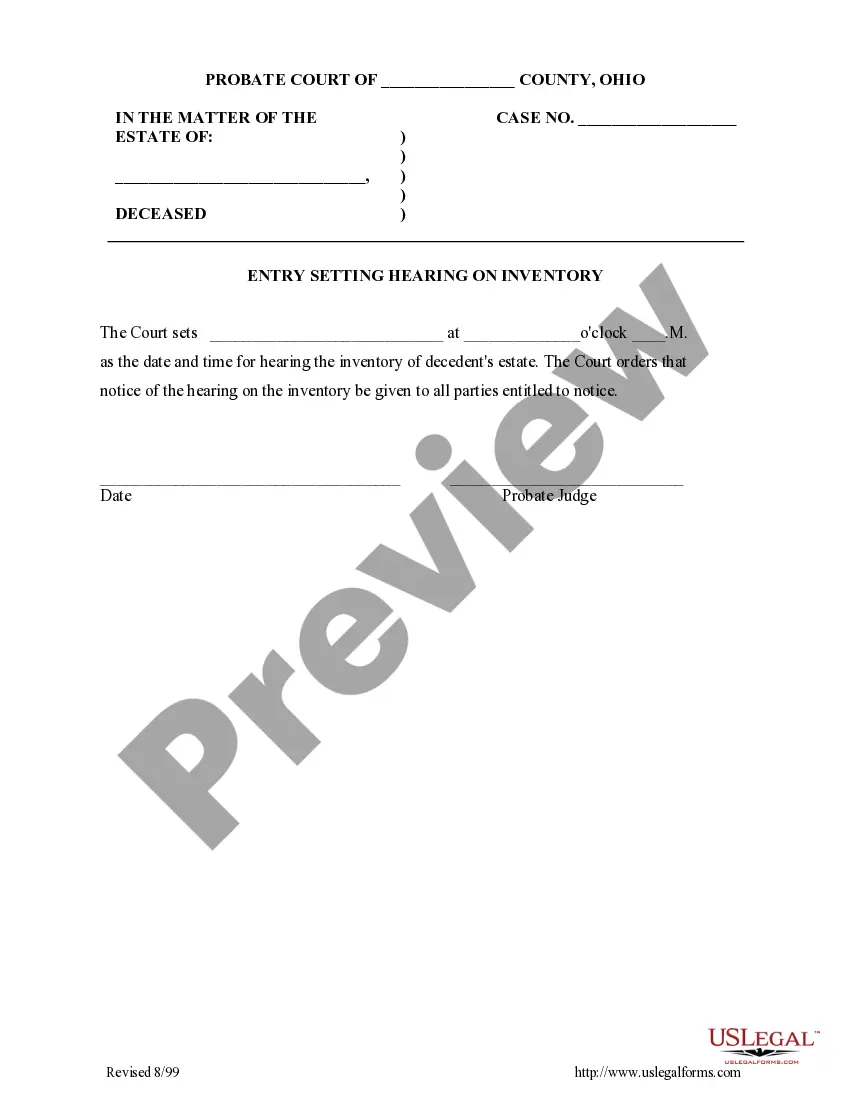

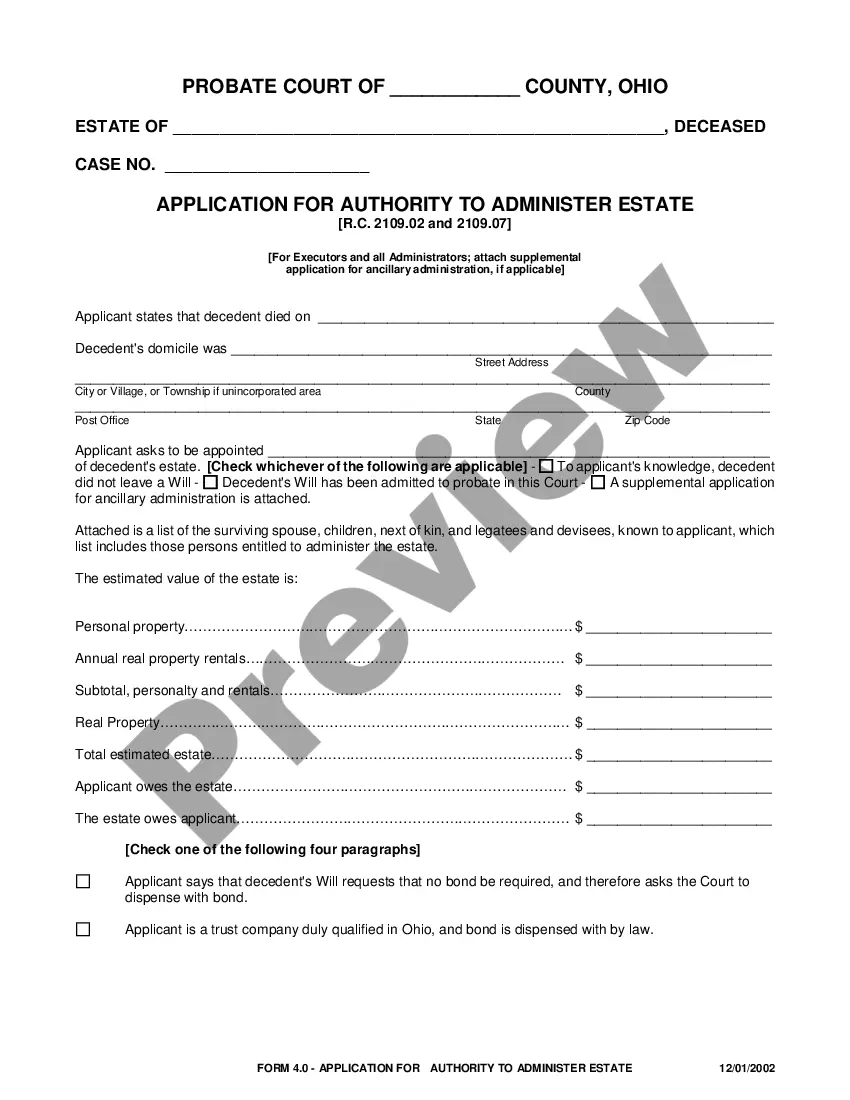

How to fill out Maricopa Arizona Sample Letter For Denial Of Individual Charge Account?

Whether you intend to start your company, enter into an agreement, apply for your ID update, or resolve family-related legal concerns, you need to prepare certain paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal templates for any individual or business occasion. All files are collected by state and area of use, so opting for a copy like Maricopa Sample Letter for Denial of Individual Charge Account is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of more steps to obtain the Maricopa Sample Letter for Denial of Individual Charge Account. Follow the instructions below:

- Make sure the sample fulfills your personal needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample when you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa Sample Letter for Denial of Individual Charge Account in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!