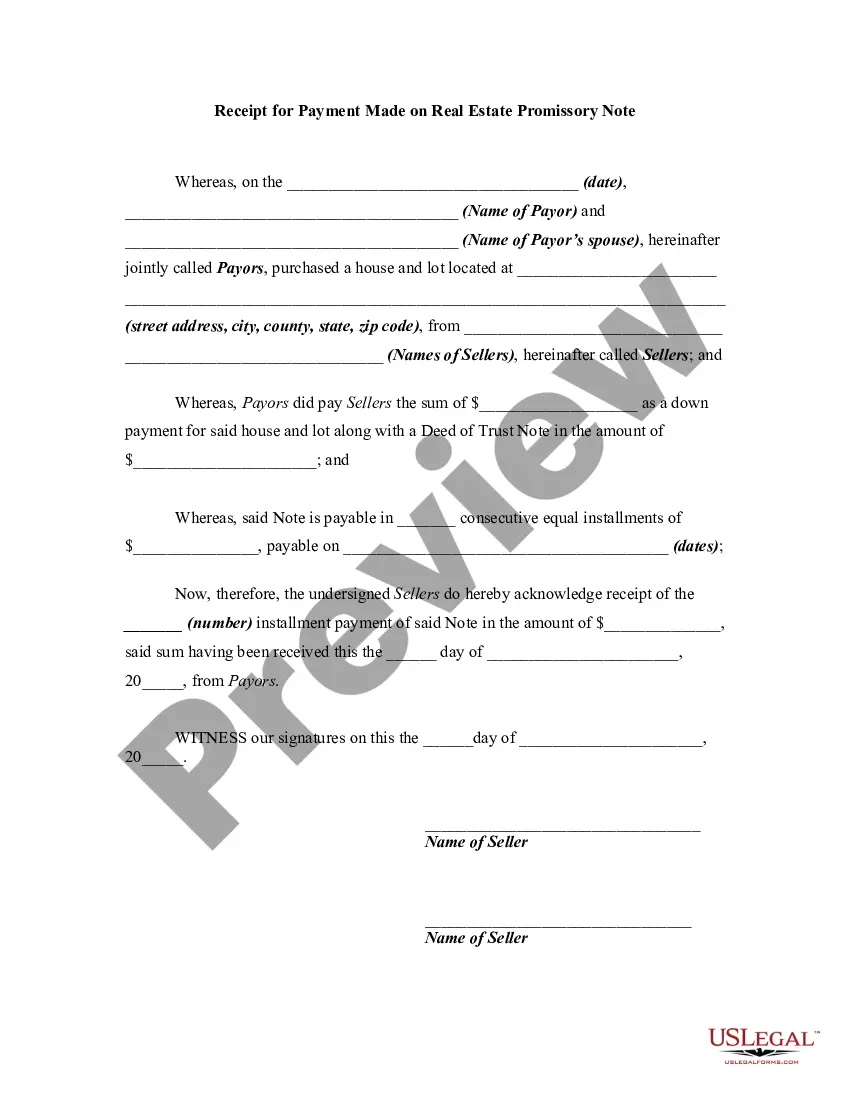

This form is a generic sample of a receipt for an installment payment for an owner financed real estate sale/purchase.

A Lima Arizona Receipt for Payment Made on Real Estate Promissory Note is a legal document used to acknowledge and record the receipt of a payment towards a real estate promissory note in the town of Lima, Arizona. This receipt serves as proof that a payment has been made by the borrower in accordance with the terms outlined in the promissory note. In Lima, Arizona, there are different types of receipts for payment made on real estate promissory notes, depending on the specific transaction or situation. Some of these variations may include: 1. Simple Receipt for Payment: This is a basic receipt that outlines the amount paid, date of payment, the name of the payer, and any additional details related to the transaction. It is a straightforward acknowledgment of the payment made on the real estate promissory note. 2. Partial Payment Receipt: A partial payment receipt is issued when the borrower makes a payment that does not cover the full amount due according to the terms of the promissory note. This receipt states the partial amount paid and may provide information on the remaining balance, due date, and any applicable penalties or interest charges. 3. Lump Sum Payment Receipt: This type of receipt is used when the borrower makes a single, substantial payment towards the real estate promissory note, typically paying off a significant portion of the outstanding balance. The receipt will detail the lump sum amount received, relevant dates, and confirm that the payment reduces the total amount owed. 4. Late or Delayed Payment Receipt: If a payment on the real estate promissory note is received after the agreed-upon due date, a late payment receipt is issued. It acknowledges the late payment made by the borrower and may include any penalties or additional charges incurred. 5. Final Payment Receipt: When a borrower fully repays the real estate promissory note, a final payment receipt is issued. This receipt signifies the completion of the loan obligation and should state that the debt has been fully settled. It typically includes the total amount paid, the final payment date, and any discharge or release of the promissory note. 6. Installment Payment Receipt: For promissory notes with installment payment plans, each payment made by the borrower towards the real estate loan is acknowledged through an installment payment receipt. It details the amount paid, date of payment, and remaining balance for each installment. Remember that specific terms and conditions may vary for Lima Arizona Receipts for Payment Made on Real Estate Promissory Notes, as they depend on the agreements made between the lender and borrower.A Lima Arizona Receipt for Payment Made on Real Estate Promissory Note is a legal document used to acknowledge and record the receipt of a payment towards a real estate promissory note in the town of Lima, Arizona. This receipt serves as proof that a payment has been made by the borrower in accordance with the terms outlined in the promissory note. In Lima, Arizona, there are different types of receipts for payment made on real estate promissory notes, depending on the specific transaction or situation. Some of these variations may include: 1. Simple Receipt for Payment: This is a basic receipt that outlines the amount paid, date of payment, the name of the payer, and any additional details related to the transaction. It is a straightforward acknowledgment of the payment made on the real estate promissory note. 2. Partial Payment Receipt: A partial payment receipt is issued when the borrower makes a payment that does not cover the full amount due according to the terms of the promissory note. This receipt states the partial amount paid and may provide information on the remaining balance, due date, and any applicable penalties or interest charges. 3. Lump Sum Payment Receipt: This type of receipt is used when the borrower makes a single, substantial payment towards the real estate promissory note, typically paying off a significant portion of the outstanding balance. The receipt will detail the lump sum amount received, relevant dates, and confirm that the payment reduces the total amount owed. 4. Late or Delayed Payment Receipt: If a payment on the real estate promissory note is received after the agreed-upon due date, a late payment receipt is issued. It acknowledges the late payment made by the borrower and may include any penalties or additional charges incurred. 5. Final Payment Receipt: When a borrower fully repays the real estate promissory note, a final payment receipt is issued. This receipt signifies the completion of the loan obligation and should state that the debt has been fully settled. It typically includes the total amount paid, the final payment date, and any discharge or release of the promissory note. 6. Installment Payment Receipt: For promissory notes with installment payment plans, each payment made by the borrower towards the real estate loan is acknowledged through an installment payment receipt. It details the amount paid, date of payment, and remaining balance for each installment. Remember that specific terms and conditions may vary for Lima Arizona Receipts for Payment Made on Real Estate Promissory Notes, as they depend on the agreements made between the lender and borrower.