Harris Texas Triple Net Lease for Residential Property

Description

How to fill out Triple Net Lease For Residential Property?

A document procedure consistently accompanies any legal action you undertake.

Initiating a business, applying for or accepting a job proposition, transferring ownership, and numerous other life circumstances require you to prepare formal paperwork that varies from state to state.

That’s why having everything consolidated in a single location is so advantageous.

US Legal Forms is the largest online repository of current federal and state-specific legal documents.

Click Buy Now once you find the necessary template.

- On this platform, you can effortlessly discover and obtain a document for any personal or business purpose used in your area, including the Harris Triple Net Lease for Residential Property.

- Searching for templates on the site is extremely straightforward.

- If you already possess a subscription to our service, Log In to your account, find the sample using the search bar, and click Download to store it on your device.

- After that, the Harris Triple Net Lease for Residential Property will be accessible for further use in the My documents section of your account.

- If you are engaging with US Legal Forms for the first time, follow this simple instruction to acquire the Harris Triple Net Lease for Residential Property.

- Ensure you have opened the correct page with your local document.

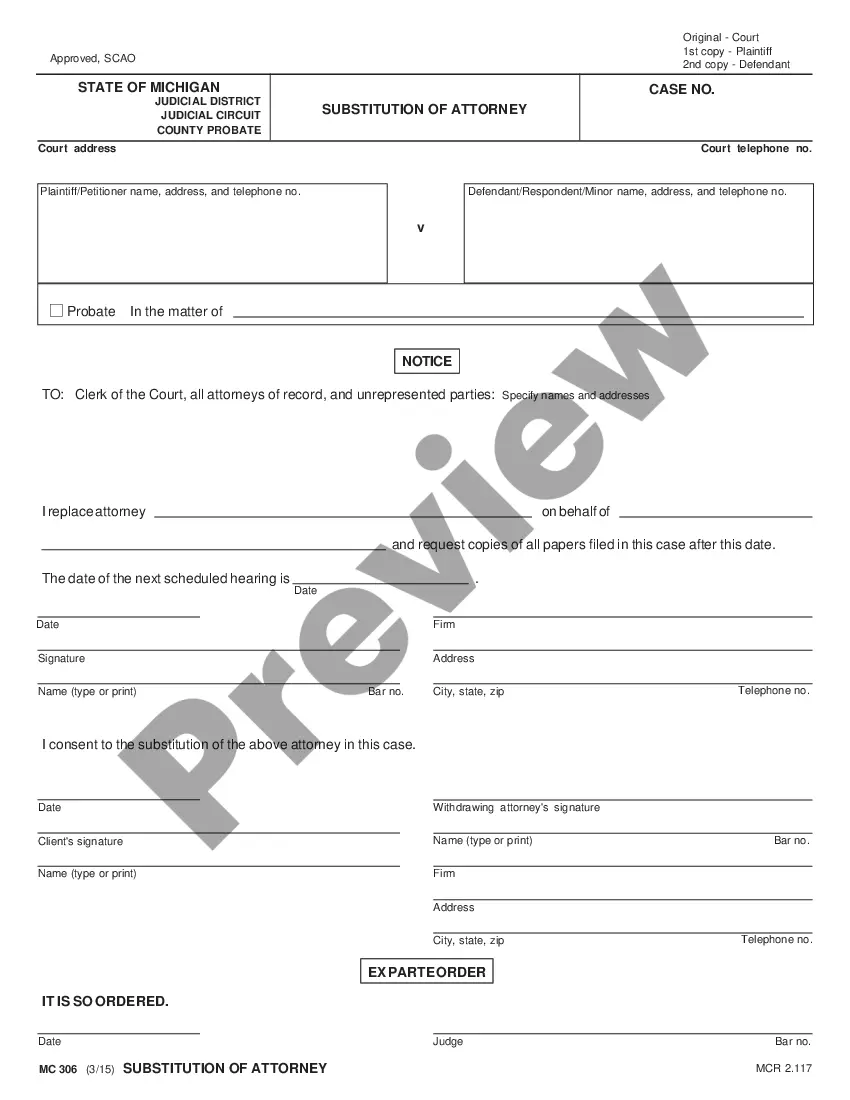

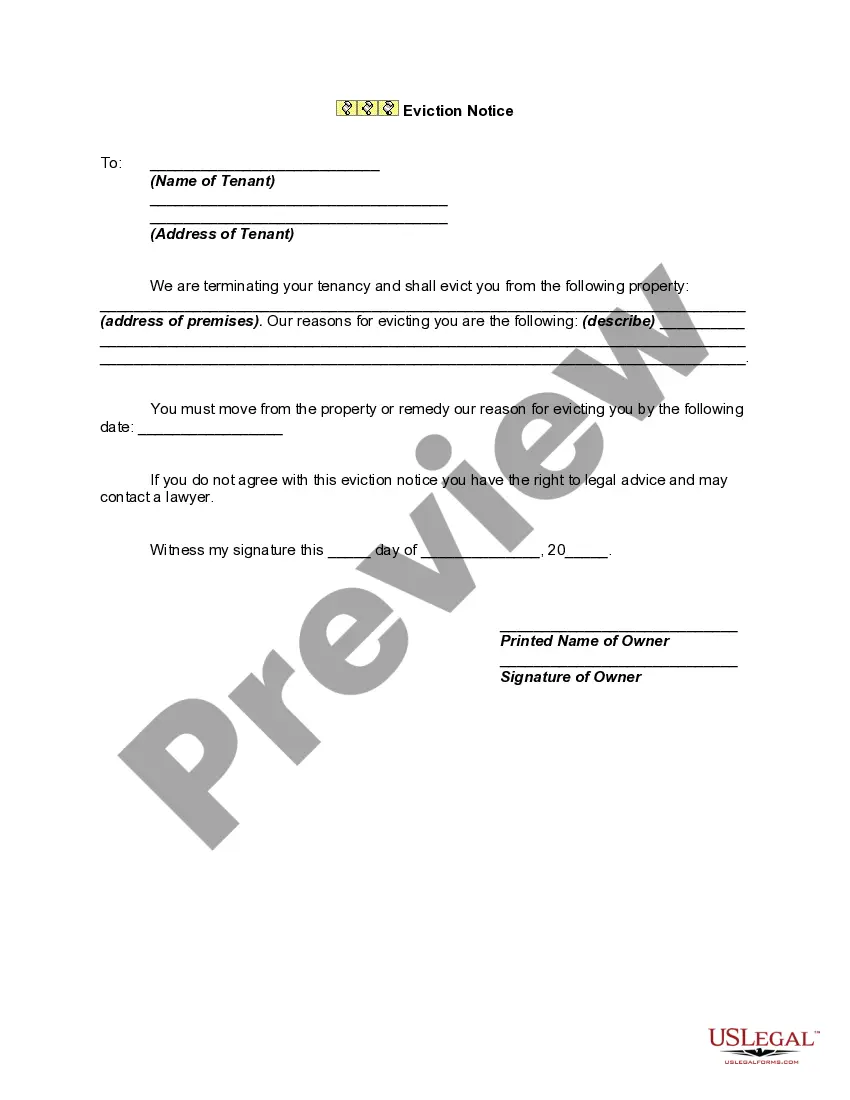

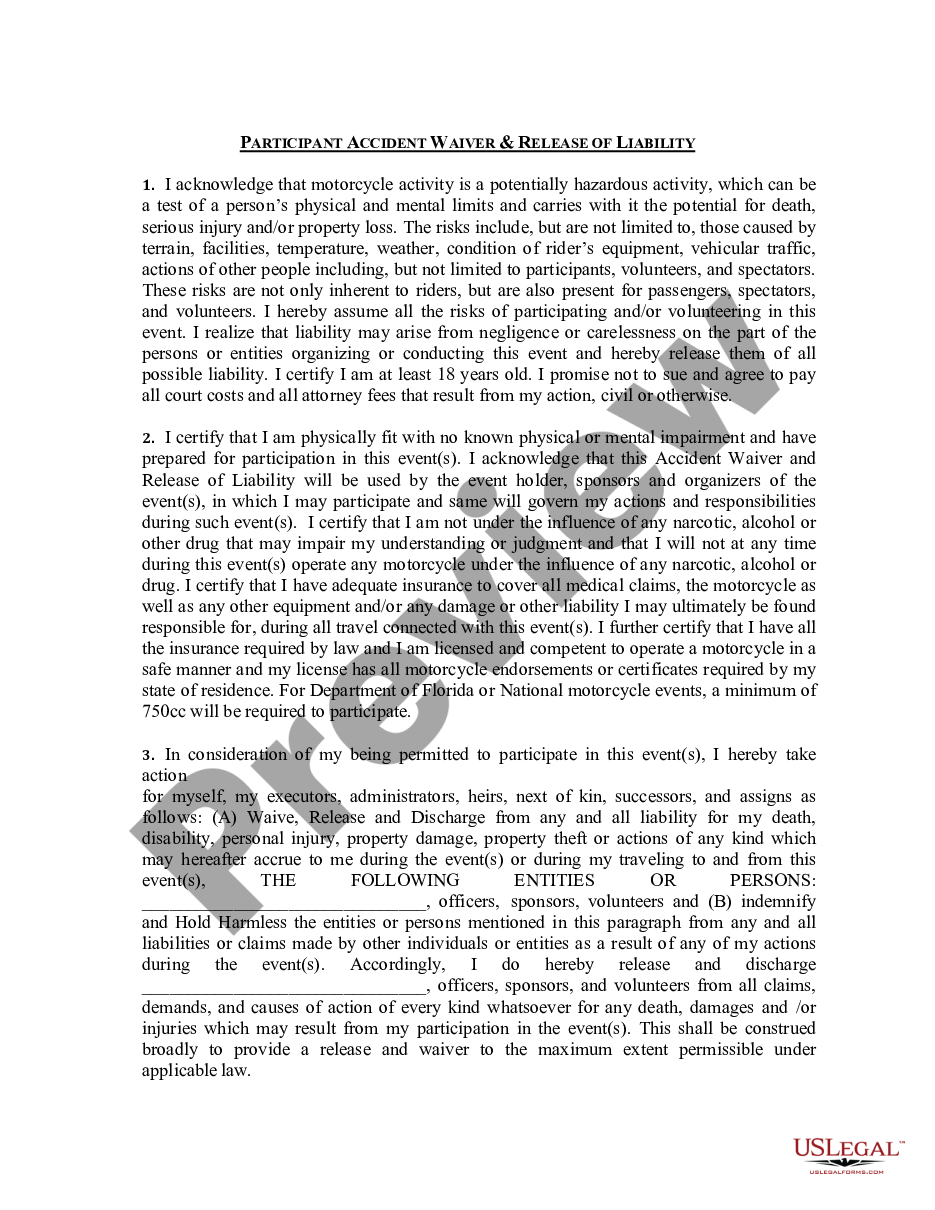

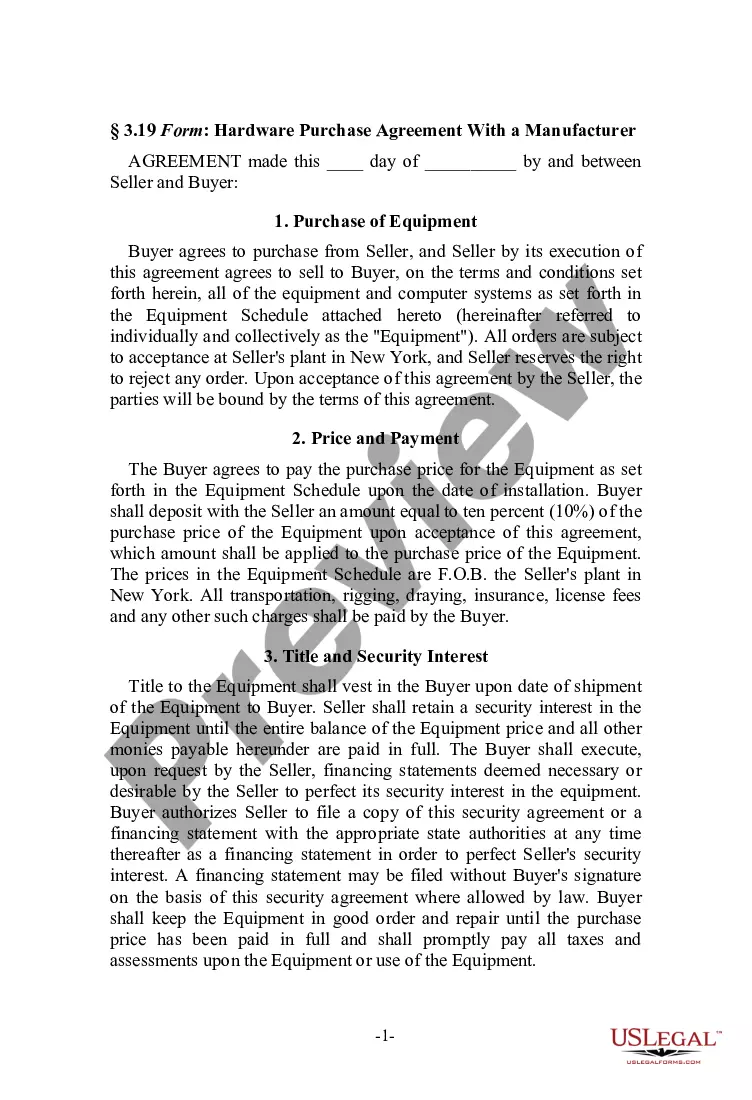

- Utilize the Preview mode (if available) and look through the template.

- Examine the description (if present) to confirm that the form meets your needs.

- Search for another document using the search tab in case the example does not suit you.

Form popularity

FAQ

NNN leases are considered to be one of the most secure investment opportunities. This is because, similar to bonds, single-tenant net-leased properties provide steady and predictable returns over time.

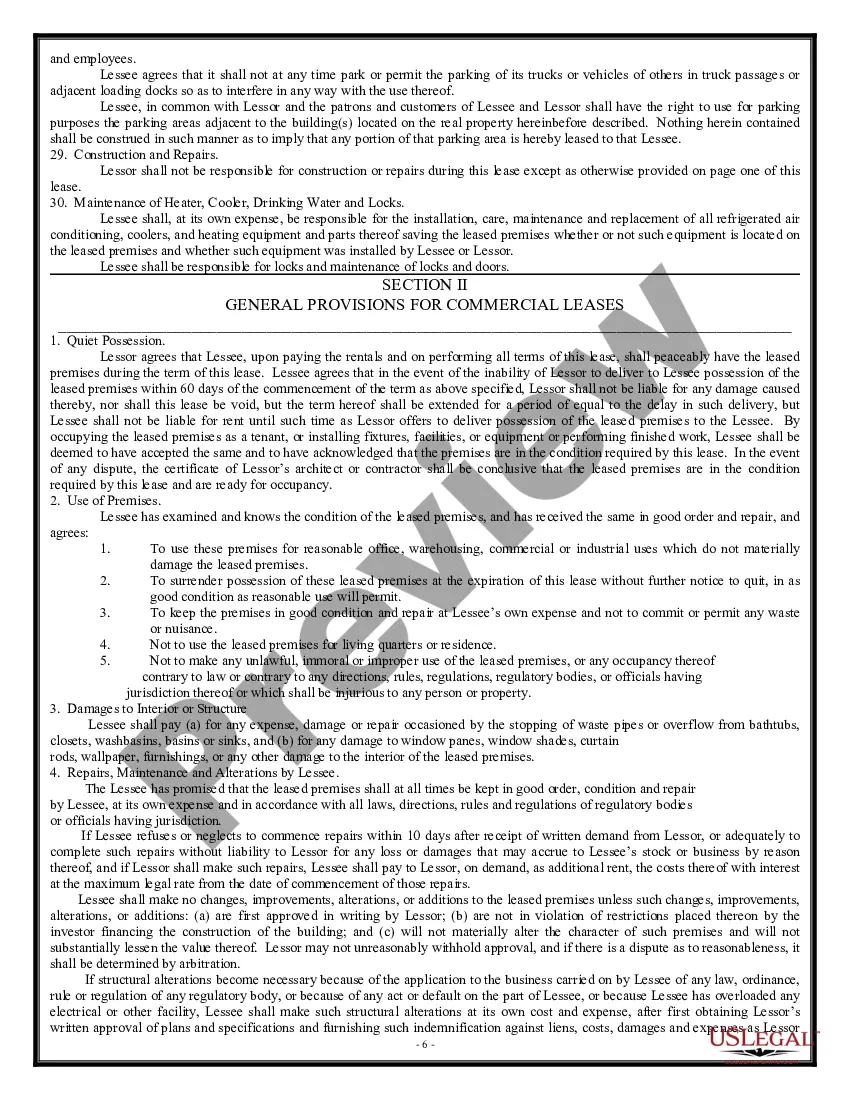

With a triple net lease, the tenant promises to pay all the expenses of the property, including real estate taxes, building insurance, and maintenance. These payments are in addition to the fees for rent and utilities.

Calculating a Triple Net Lease Triple net leases are calculated by adding the yearly taxes on the property and the insurance for the space together and dividing that amount by the building total rental square footage.

With a triple net lease, the tenant promises to pay all the expenses of the property, including real estate taxes, building insurance, and maintenance. These payments are in addition to the fees for rent and utilities.

Cons of a Triple Net Lease-Tenants Tax Liabilities: Because the tenant is responsible for annual property taxes in a triple net lease, this also means that they will be prone to all the liabilities of taxes as well, including fines and penalties for late or incorrect tax remittance.

Ideal triple net lease tenants are those with the experience managing their own properties and the financial resources to pay rent and operating expenses. For real estate investors who prioritize stability and consistency over capital growth, triple net properties can be a very good real estate investment.

A triple net lease (triple-net or NNN) is a lease agreement on a property whereby the tenant or lessee promises to pay all the expenses of the property, including real estate taxes, building insurance, and maintenance. These expenses are in addition to the cost of rent and utilities.

Lease Rate: $20.00 /SF NNN (Estimated NNN = $3.25/SF), meaning the base rental rate is $20.00 per square foot per year and the property expenses, which include property taxes and insurance, are estimated to be $3.25 per square foot per year, though they can fluctuate from year to year.

Benefits of a Triple Net Lease The most obvious benefit of using a triple net lease for a tenant is a lower price point for the base lease. Since the tenant is absorbing at least some of the taxes, insurance, and maintenance expenses, a triple net lease features a lower monthly rent than a gross lease agreement.