A Kings New York Triple Net Lease for Residential Property is a legal agreement that outlines the terms and conditions regarding the leasing of a residential property in Kings County, New York. This type of lease shifts some ongoing expenses associated with the property from the landlord to the tenant. A Triple Net Lease, commonly referred to as NNN lease, is a specific type of lease where the tenant pays for property taxes, insurance, and maintenance expenses in addition to the monthly rent. It is the most commonly used lease structure in commercial real estate, but it is also applicable to residential properties in some cases. The Kings New York Triple Net Lease for Residential Property provides a detailed breakdown of the financial responsibilities to ensure transparency and clarity between the landlord and tenant. It specifies that the tenant will bear the financial burden of property taxes, insurance premiums, and maintenance costs along with their regular rental payment. This type of lease can vary depending on different factors such as the property type, location, and landlord preferences. Some variations that may exist include modified triple net lease, absolute triple net lease, and bendable leases. A modified triple net lease, also known as modified NNN lease, allows for a degree of cost-sharing between the landlord and tenant. While the tenant is still responsible for some expenses, the landlord may agree to bear certain costs such as structural repairs or roof replacement. An absolute triple net lease, also known as absolute NNN lease, places the entire financial responsibility on the tenant, including property taxes, insurance, maintenance, and repairs. In this arrangement, the landlord generally has minimal involvement in the property's ongoing financial obligations. Bendable leases, on the other hand, include an additional bond that the tenant is required to procure. This bond acts as a security, ensuring that the tenant fulfills all their financial responsibilities and covers any potential defaults or damages to the property. Overall, a Kings New York Triple Net Lease for Residential Property offers a structured framework that defines the financial obligations and responsibilities of both the landlord and tenant. It provides a clear understanding of who will be responsible for property expenses, allowing for a smooth and efficient leasing process.

Kings New York Triple Net Lease for Residential Property

Description

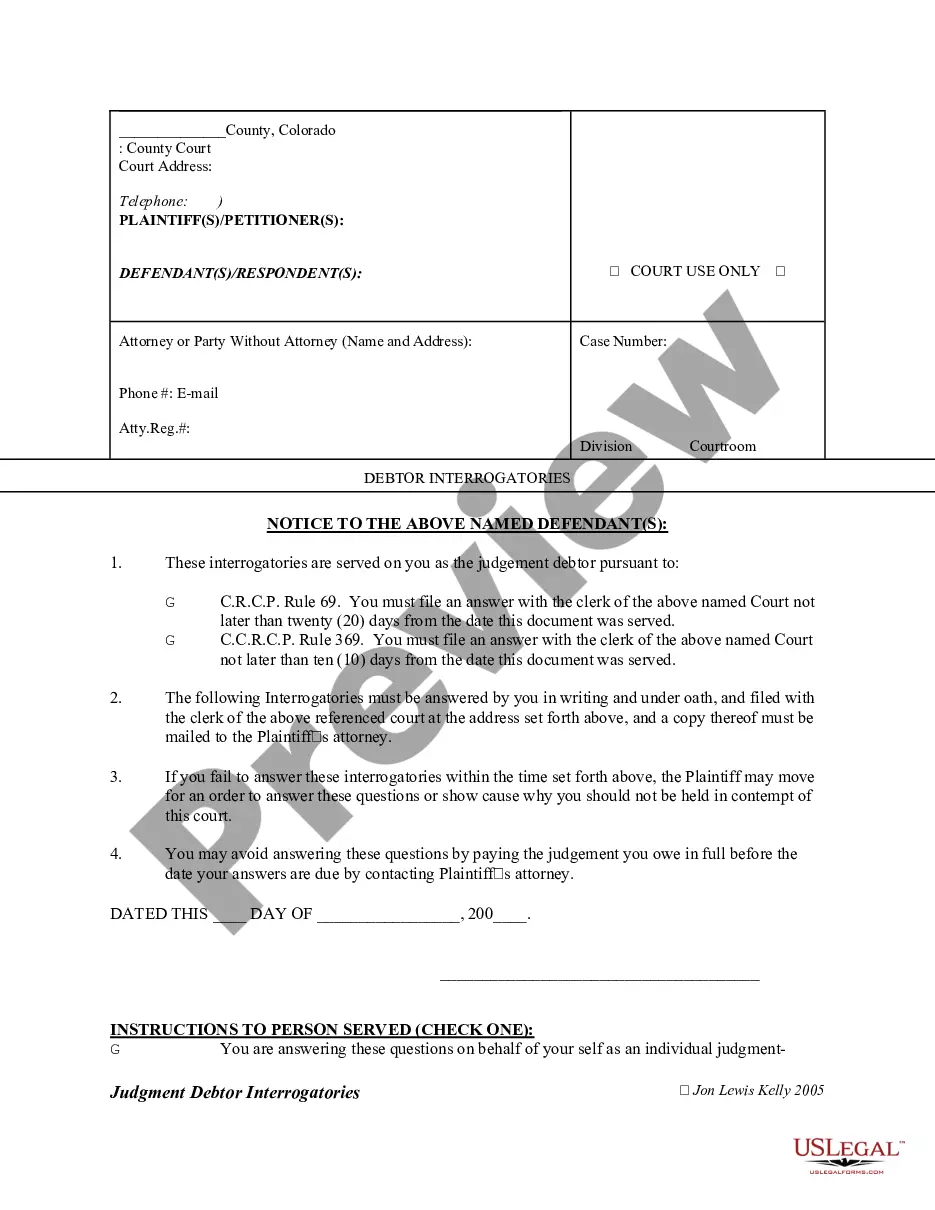

How to fill out Kings New York Triple Net Lease For Residential Property?

Whether you plan to open your business, enter into a deal, apply for your ID update, or resolve family-related legal issues, you need to prepare specific documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal documents for any personal or business occurrence. All files are grouped by state and area of use, so opting for a copy like Kings Triple Net Lease for Residential Property is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few additional steps to obtain the Kings Triple Net Lease for Residential Property. Follow the guide below:

- Make sure the sample fulfills your individual needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample once you find the correct one.

- Choose the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Kings Triple Net Lease for Residential Property in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!