A Maricopa Arizona Triple Net Lease for Residential Property is a contractual agreement between a landlord and a tenant, commonly used in the real estate market. This type of lease structure places financial responsibilities primarily on the tenant, requiring them to pay for property taxes, insurance fees, and maintenance costs, in addition to the monthly rent. The term "triple net" refers to the three net expenses that the tenant is responsible for. In Maricopa, Arizona, there are various types of Triple Net Leases for Residential Property available to cater to different preferences and needs of both landlords and tenants. These lease types include: 1. Single Net Lease: In this type of lease, the tenant is responsible for paying property taxes only. This arrangement shifts the financial burden of property taxes to the tenant while the landlord remains responsible for insurance and maintenance costs. However, it is not as common as a triple net lease. 2. Double Net Lease: A double net lease requires the tenant to pay property taxes and insurance fees, while the landlord retains responsibility for maintenance costs. The tenant benefits from reduced financial obligations compared to a triple net lease but still assumes a considerable portion of the property expenses. 3. Absolute Triple Net Lease: This lease type grants the tenant the highest level of financial responsibility. The tenant is responsible for paying property taxes, insurance, and all maintenance expenses. The landlord has little to no expenses associated with the property, apart from collecting rent. This arrangement provides the landlord with a predictable income stream while transferring all property-related risks to the tenant. Maricopa, Arizona's real estate market offers a range of residential properties suitable for triple net leasing. These properties include single-family homes, townhouses, condominiums, and apartment complexes. Each type of property has its unique characteristics, amenities, and rental prices, allowing tenants to choose a property that meets their specific needs or preferences. In conclusion, a Maricopa Arizona Triple Net Lease for Residential Property is a lease structure that places financial responsibilities on the tenant, including property taxes, insurance fees, and maintenance costs. Different types of triple net leases exist, such as single net lease, double net lease, and absolute triple net lease, with varying degrees of financial obligations for the tenant. Maricopa offers a variety of residential properties suitable for triple net leasing, allowing tenants to find their ideal living space while fulfilling their financial obligations.

Maricopa Arizona Triple Net Lease for Residential Property

Description

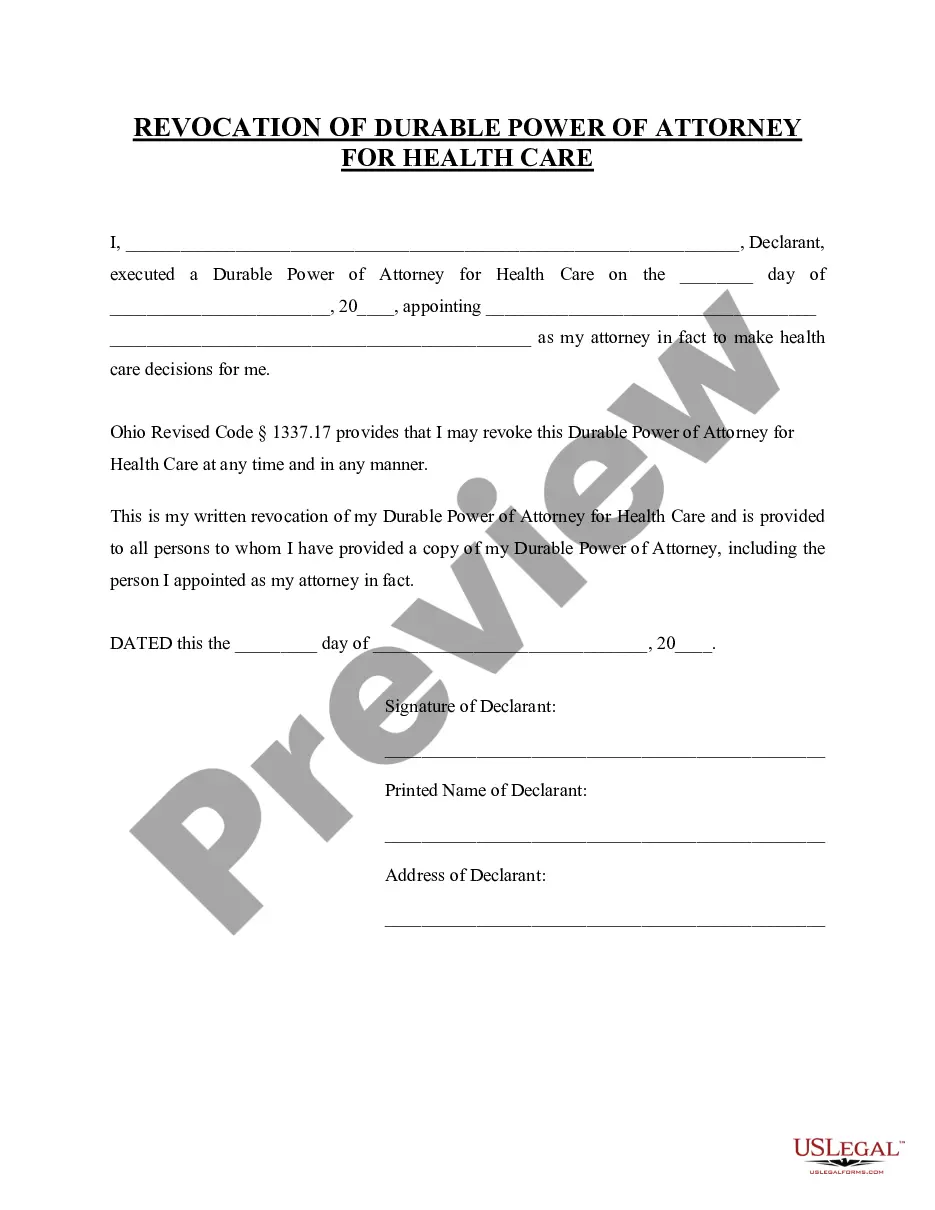

How to fill out Maricopa Arizona Triple Net Lease For Residential Property?

How much time does it normally take you to draw up a legal document? Since every state has its laws and regulations for every life situation, finding a Maricopa Triple Net Lease for Residential Property meeting all regional requirements can be stressful, and ordering it from a professional lawyer is often costly. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, grouped by states and areas of use. Aside from the Maricopa Triple Net Lease for Residential Property, here you can get any specific document to run your business or personal affairs, complying with your regional requirements. Specialists check all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can retain the file in your profile anytime later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Maricopa Triple Net Lease for Residential Property:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Maricopa Triple Net Lease for Residential Property.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

NNN is a good investment vehicle because it's a source of passive income with minimal responsibilities for the landlord. Tenants also benefit from a lower base rental rate than a gross lease agreement.

The Maricopa County property tax rate is 0.610% of the assessed home value.

Since 1980, Arizona has calculated two separate values for each parcel of property: Full Cash Value (FCV), and Limited Property Value (LPV). "Full cash value" for property tax purposes is that value determined as prescribed by statute.

7. Triple net lease (NNN) A type of commercial real estate lease under which you typically pay the base rent, plus property taxes, building insurance and utilities, as well as other operating and maintenance costs. The landlord assumes no costs, other than those for structural repairs.

Ideal triple net lease tenants are those with the experience managing their own properties and the financial resources to pay rent and operating expenses. For real estate investors who prioritize stability and consistency over capital growth, triple net properties can be a very good real estate investment.

In a nutshell, the definition of triple net leases or NNN leases are net leases where a building tenant agrees to pay all property tax, property insurance, and maintenance costs (the three netshence the NNN) in addition to a monthly lump sum base rent.

Yes. The relief comes in several forms. First, there is an exemption for widows, widowers and totally disabled persons. For qualified people, the exemption has the effect of reducing the assessed value of the real property by up to $3,000 with a corresponding reduction in property tax.

Valuation notices are mailed to property owners annually. The notification outlines the value the county assessor has established for your property for the current tax year and the future tax year.

Current year LPV is a single calculation of the preceding valuation year LPV of the property plus five percent of that value ARS §42-13301(A). As in the old methodology, in the new Rule A, the LPV cannot exceed the property's current FCV ARS §42-13301(B).

The formulas for calculating Full Cash Value and Assessed Value are: Full Cash Value = Original Cost multiplied by Valuation Factor (AZDOR Personal Property Manual, Chapter 10) Assessed Value = Full Cash Value multiplied by Assessment Ratio (varies per Legal Class of property per ARS Title 42, Chapter 15, Article 1.