Maricopa, Arizona, is a vibrant city located in the southern part of the state. Known for its remarkable growth and prime location, it has become a popular destination for commercial real estate investors. One prevalent type of lease that investors often consider is the Maricopa Arizona Triple Net Lease for Commercial Real Estate. A Triple Net Lease, commonly referred to as NNN lease, is a contractual agreement between a landlord and a tenant, where the tenant agrees to pay not only the base rent but also their share of the property's operating expenses, including real estate taxes, property insurance, and maintenance costs. This type of lease transfers the responsibility of these expenses from the landlord to the tenant, making it favorable for property owners. In Maricopa, Arizona, there are different variations of the Triple Net Lease for Commercial Real Estate, each with its own set of advantages and considerations. Some of these variations include: 1. Single-Tenant Triple Net Lease: This type of lease is typically used when there is only one tenant occupying the property. It offers simplicity and stability for both the landlord and tenant, as there is a single lease agreement governing the entire property. 2. Multi-Tenant Triple Net Lease: In this scenario, multiple tenants occupy different units within a commercial property. Each tenant is responsible for their share of operating expenses, based on their proportionate square footage. This lease type offers diversification of risk for landlords and is often found in shopping centers, office buildings, or industrial complexes. 3. Ground Lease: A ground lease is a longer-term lease typically used for land or development purposes. In this arrangement, the tenant constructs and maintains the building on the property while still paying rent and other expenses to the landlord. Ground leases can be structured as triple net leases, with the tenant responsible for operating expenses. Maricopa, Arizona's Triple Net Lease for Commercial Real Estate provides many advantages for both landlords and tenants. For landlords, it offers a steady income stream, predictable expenses, and minimal management responsibilities. Tenants benefit from having more control over their space, the ability to customize the property to suit their needs, and potentially lower rental rates compared to full-service leases. In conclusion, the Maricopa Arizona Triple Net Lease for Commercial Real Estate is a popular option in the city's thriving real estate market. It offers flexibility, stability, and attractive investment opportunities for both landlords and tenants. Whether opting for a single-tenant, multi-tenant, or ground lease, individuals interested in commercial real estate in Maricopa, Arizona should carefully consider the advantages and considerations associated with each lease type to make informed decisions that align with their investment goals.

Maricopa Arizona Triple Net Lease for Commercial Real Estate

Description

How to fill out Maricopa Arizona Triple Net Lease For Commercial Real Estate?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to create some of them from scratch, including Maricopa Triple Net Lease for Commercial Real Estate, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in various categories ranging from living wills to real estate paperwork to divorce documents. All forms are organized according to their valid state, making the searching process less overwhelming. You can also find detailed materials and tutorials on the website to make any activities associated with document execution simple.

Here's how you can purchase and download Maricopa Triple Net Lease for Commercial Real Estate.

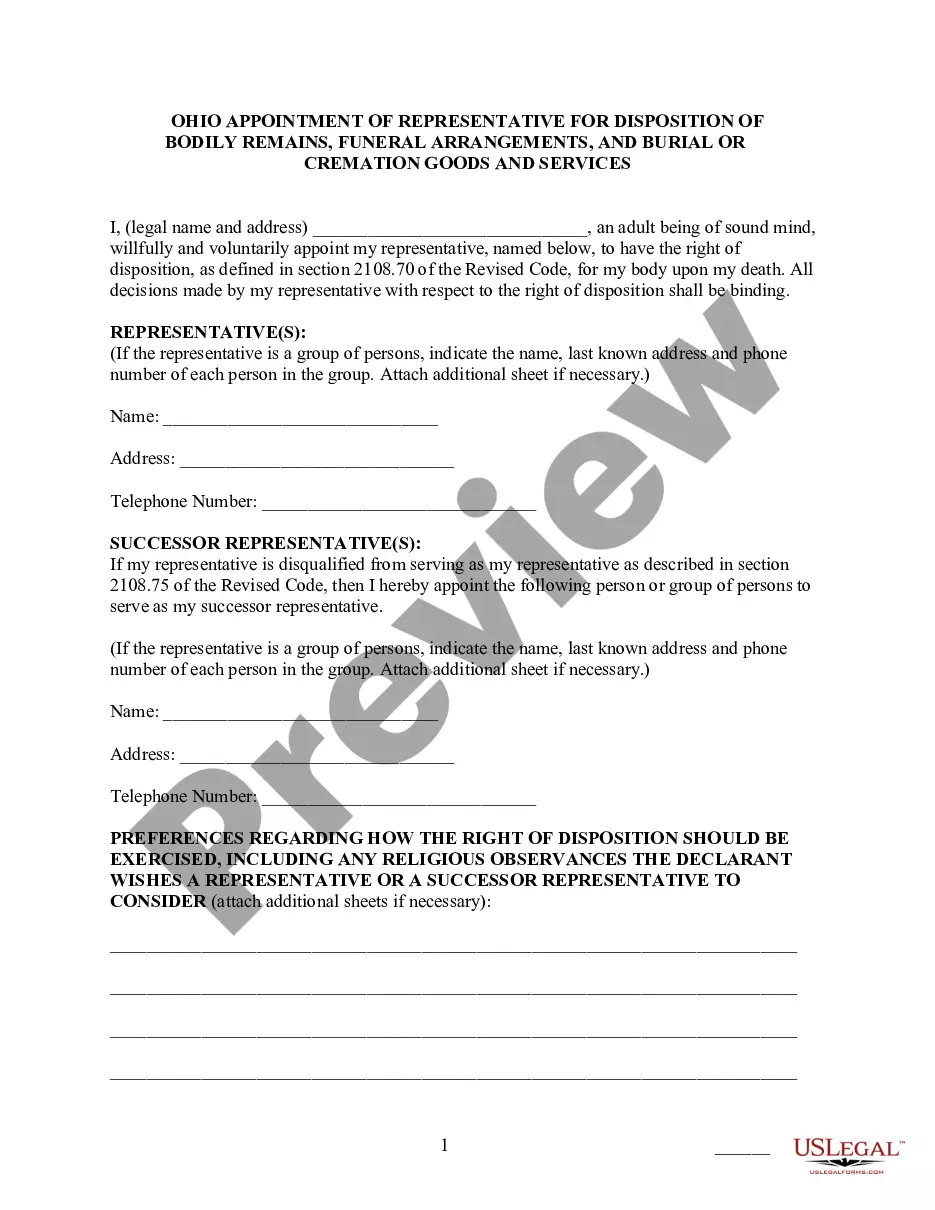

- Go over the document's preview and outline (if provided) to get a general idea of what you’ll get after downloading the document.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can impact the validity of some documents.

- Examine the similar forms or start the search over to locate the correct file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment gateway, and buy Maricopa Triple Net Lease for Commercial Real Estate.

- Select to save the form template in any available file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Maricopa Triple Net Lease for Commercial Real Estate, log in to your account, and download it. Of course, our website can’t replace an attorney entirely. If you need to deal with an extremely difficult situation, we advise getting a lawyer to review your document before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Become one of them today and purchase your state-specific paperwork effortlessly!