The federal benefits that are exempt from garnishment include:

" Social Security Benefits

" Supplemental Security Income (SSI) Benefits

" Veterans' Benefits

" Civil Service and Federal Retirement and Disability Benefits

" Military Annuities and Survivors' Benefits

" Student Assistance

" Railroad Retirement Benefits

" Merchant Seamen Wages

" Longshoremen's and Harbor Workers' Death and Disability Benefits

" Foreign Service Retirement and Disability Benefits

" Compensation for Injury, Death, or Detention of Employees of U.S. Contractors Outside the U.S.

" Federal Emergency Management Agency Federal Disaster Assistance.

Other exempt funds include:

" unemployment income,

" some social security disability income payments,

" some workman's compensation payments, and

" some joint account funds if the account is held by spouses as tenants by the entirety and the judgment is against only one spouse.

Even if the bank account is in just your name, there are some types of funds that are considered "exempt" from debt collection under state or federal law. The rationale behind these laws is to allow people to preserve the basic necessities for living. Exempt funds remain exempt when deposited in checking, savings or CD accounts so long as they are readily available for the day to day needs of the recipient and have not been converted into a "permanent investment."

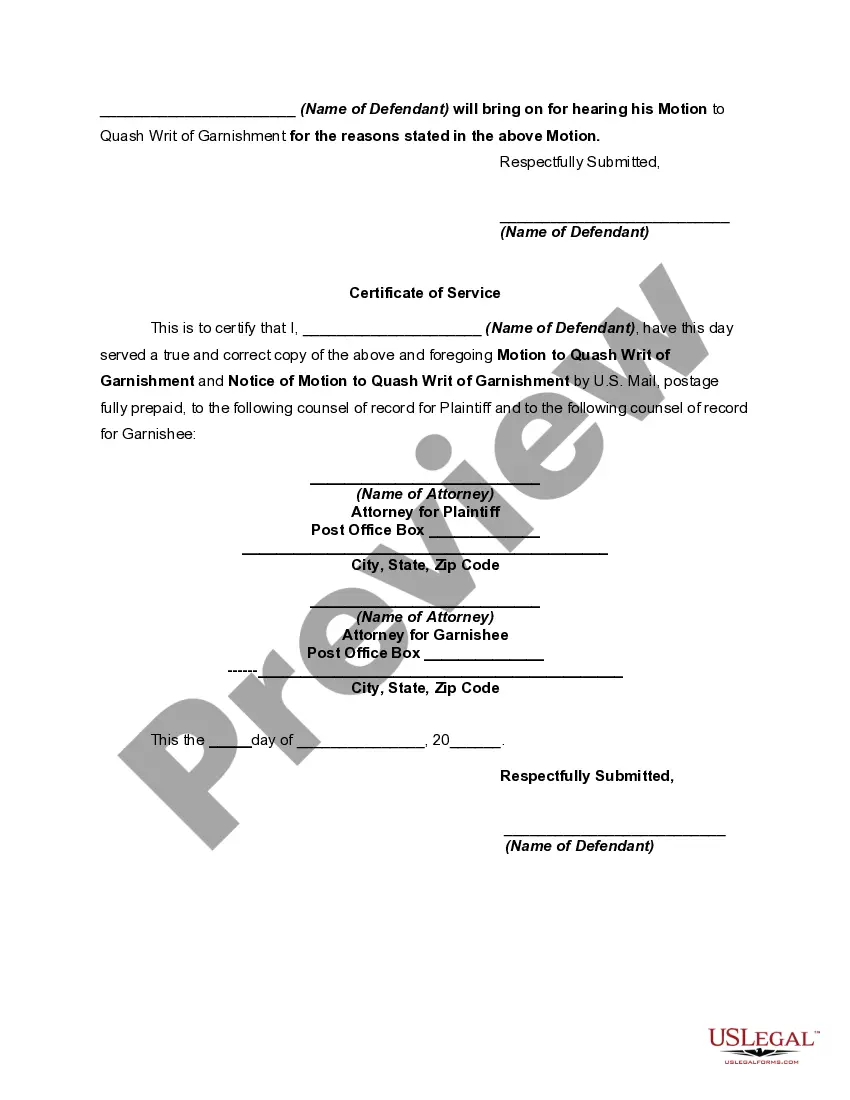

Collin Texas Motion of Defendant to Discharge or Quash Writ of Garnishment and Notice of Motion — Funds Exempt by Law from Garnishment is a legal process in Collin County, Texas, that allows a defendant to contest a writ of garnishment and seek protection for certain funds that are legally exempt from garnishment. A motion to discharge or quash a writ of garnishment is typically filed by a defendant who believes that the writ was issued improperly or unfairly. This motion serves as a request to the court to dismiss or cancel the garnishment order. The defendant must provide compelling evidence and argumentation to support their claim. In Collin County, Texas, if the defendant can establish that certain funds are exempt by state or federal law, they can also file a Notice of Motion — Funds Exempt by Law from Garnishment. This notice alerts the court and the garnishing party that specific funds or assets are protected from garnishment under applicable exemption laws. Some common types of Collin Texas Motion of Defendant to Discharge or Quash Writ of Garnishment and Notice of Motion — Funds Exempt by Law from Garnishment include: 1. Exemption based on income: The defendant may argue that certain income sources, such as Social Security benefits, veteran's benefits, or workers' compensation, are exempt from garnishment under state or federal law. 2. Exemption based on property: The defendant may claim that specific property, like a primary residence, necessary household goods, or a vehicle, is protected from garnishment as per exemption statutes. 3. Exemption based on public assistance: A defendant receiving public assistance, such as welfare or food stamps, may argue that these funds are exempt from garnishment to ensure their ability to meet basic needs. 4. Exemption based on self-employment income: If the defendant is self-employed, they may assert that certain portions of their income are exempt from garnishment under applicable laws. It's important to note that the specific laws and regulations governing exemptions and motions to discharge or quash writs of garnishment may vary depending on the jurisdiction and nature of the debt. Therefore, it's crucial for the defendant or their legal counsel to thoroughly research and understand the applicable laws in Collin County, Texas. Consulting with a knowledgeable attorney can help ensure an accurate and effective filing of the motion to protect exempt funds from garnishment.Collin Texas Motion of Defendant to Discharge or Quash Writ of Garnishment and Notice of Motion — Funds Exempt by Law from Garnishment is a legal process in Collin County, Texas, that allows a defendant to contest a writ of garnishment and seek protection for certain funds that are legally exempt from garnishment. A motion to discharge or quash a writ of garnishment is typically filed by a defendant who believes that the writ was issued improperly or unfairly. This motion serves as a request to the court to dismiss or cancel the garnishment order. The defendant must provide compelling evidence and argumentation to support their claim. In Collin County, Texas, if the defendant can establish that certain funds are exempt by state or federal law, they can also file a Notice of Motion — Funds Exempt by Law from Garnishment. This notice alerts the court and the garnishing party that specific funds or assets are protected from garnishment under applicable exemption laws. Some common types of Collin Texas Motion of Defendant to Discharge or Quash Writ of Garnishment and Notice of Motion — Funds Exempt by Law from Garnishment include: 1. Exemption based on income: The defendant may argue that certain income sources, such as Social Security benefits, veteran's benefits, or workers' compensation, are exempt from garnishment under state or federal law. 2. Exemption based on property: The defendant may claim that specific property, like a primary residence, necessary household goods, or a vehicle, is protected from garnishment as per exemption statutes. 3. Exemption based on public assistance: A defendant receiving public assistance, such as welfare or food stamps, may argue that these funds are exempt from garnishment to ensure their ability to meet basic needs. 4. Exemption based on self-employment income: If the defendant is self-employed, they may assert that certain portions of their income are exempt from garnishment under applicable laws. It's important to note that the specific laws and regulations governing exemptions and motions to discharge or quash writs of garnishment may vary depending on the jurisdiction and nature of the debt. Therefore, it's crucial for the defendant or their legal counsel to thoroughly research and understand the applicable laws in Collin County, Texas. Consulting with a knowledgeable attorney can help ensure an accurate and effective filing of the motion to protect exempt funds from garnishment.