The federal benefits that are exempt from garnishment include:

" Social Security Benefits

" Supplemental Security Income (SSI) Benefits

" Veterans' Benefits

" Civil Service and Federal Retirement and Disability Benefits

" Military Annuities and Survivors' Benefits

" Student Assistance

" Railroad Retirement Benefits

" Merchant Seamen Wages

" Longshoremen's and Harbor Workers' Death and Disability Benefits

" Foreign Service Retirement and Disability Benefits

" Compensation for Injury, Death, or Detention of Employees of U.S. Contractors Outside the U.S.

" Federal Emergency Management Agency Federal Disaster Assistance.

Other exempt funds include:

" unemployment income,

" some social security disability income payments,

" some workman's compensation payments, and

" some joint account funds if the account is held by spouses as tenants by the entirety and the judgment is against only one spouse.

Even if the bank account is in just your name, there are some types of funds that are considered "exempt" from debt collection under state or federal law. The rationale behind these laws is to allow people to preserve the basic necessities for living. Exempt funds remain exempt when deposited in checking, savings or CD accounts so long as they are readily available for the day to day needs of the recipient and have not been converted into a "permanent investment."

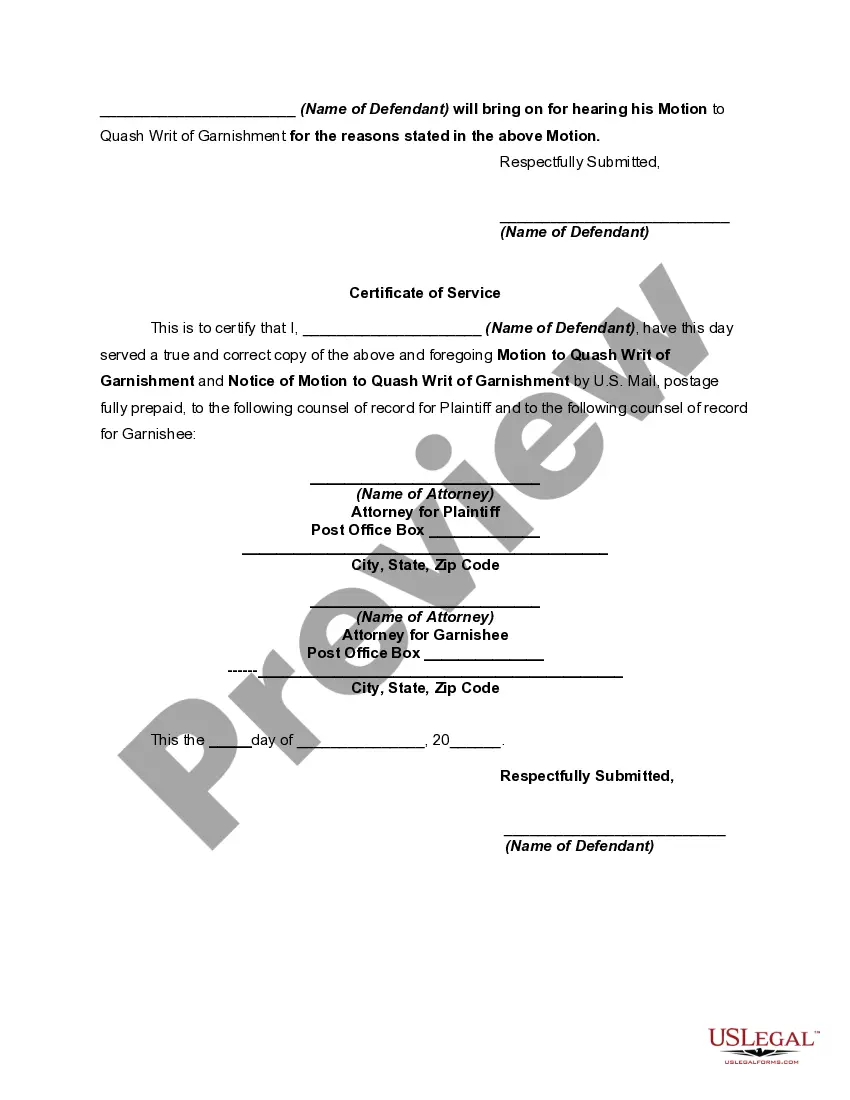

A Motion of Defendant to Discharge or Quash Writ of Garnishment and Notice of Motion — Funds Exempt by Law from Garnishment is an important legal document filed in Sacramento, California to protect individuals from having their funds garnished unlawfully. This motion allows defendants to challenge the garnishment order issued by the court or creditor, asserting that their funds are exempt from garnishment under California law. It is vital to understand the different types of motions one can file under this umbrella, ensuring the appropriate one is used for the specific circumstances. 1. Motion to Discharge Writ of Garnishment: This motion requests the court to discharge the writ of garnishment served on the defendant, arguing that the garnishment order was improperly filed or lacks legal merit. It aims to stop the enforcement of the garnishment and free the defendant's funds. 2. Motion to Quash Writ of Garnishment: Similar to the previous motion, a motion to quash seeks to nullify the writ of garnishment, claiming that it is defective in some way. The primary focus is to challenge the legal validity of the garnishment order and halt any further action taken by the garnishing party. 3. Motion to Exempt Funds from Garnishment: This motion addresses the exemption status of the defendant's funds, primarily asserting that they are protected by law and should not be subject to garnishment. It highlights specific exemptions granted under California law to shield the funds from being seized, such as certain sources of income, public benefits, or assets considered necessary for basic living expenses. 4. Notice of Motion — Funds Exempt by Law from Garnishment: Alongside the motion, a notice of motion is typically filed to inform all relevant parties involved, including the garnishing party, the court, and the defendant, that a motion to discharge or quash the writ of garnishment will be heard. This notice ensures that all parties have an opportunity to contest or support the motion in a timely manner. When preparing these motions, it is essential to include keywords relevant to Sacramento, California, and the legal context such as "California Code of Civil Procedure," "Sacramento Superior Court," "Writ of Execution," "judgment debtor," "wages garnishment," "bank account garnishment," and "exempt property." Adequate research and familiarity with the specific laws and regulations governing garnishment in California are crucial to effectively draft and argue these motions.A Motion of Defendant to Discharge or Quash Writ of Garnishment and Notice of Motion — Funds Exempt by Law from Garnishment is an important legal document filed in Sacramento, California to protect individuals from having their funds garnished unlawfully. This motion allows defendants to challenge the garnishment order issued by the court or creditor, asserting that their funds are exempt from garnishment under California law. It is vital to understand the different types of motions one can file under this umbrella, ensuring the appropriate one is used for the specific circumstances. 1. Motion to Discharge Writ of Garnishment: This motion requests the court to discharge the writ of garnishment served on the defendant, arguing that the garnishment order was improperly filed or lacks legal merit. It aims to stop the enforcement of the garnishment and free the defendant's funds. 2. Motion to Quash Writ of Garnishment: Similar to the previous motion, a motion to quash seeks to nullify the writ of garnishment, claiming that it is defective in some way. The primary focus is to challenge the legal validity of the garnishment order and halt any further action taken by the garnishing party. 3. Motion to Exempt Funds from Garnishment: This motion addresses the exemption status of the defendant's funds, primarily asserting that they are protected by law and should not be subject to garnishment. It highlights specific exemptions granted under California law to shield the funds from being seized, such as certain sources of income, public benefits, or assets considered necessary for basic living expenses. 4. Notice of Motion — Funds Exempt by Law from Garnishment: Alongside the motion, a notice of motion is typically filed to inform all relevant parties involved, including the garnishing party, the court, and the defendant, that a motion to discharge or quash the writ of garnishment will be heard. This notice ensures that all parties have an opportunity to contest or support the motion in a timely manner. When preparing these motions, it is essential to include keywords relevant to Sacramento, California, and the legal context such as "California Code of Civil Procedure," "Sacramento Superior Court," "Writ of Execution," "judgment debtor," "wages garnishment," "bank account garnishment," and "exempt property." Adequate research and familiarity with the specific laws and regulations governing garnishment in California are crucial to effectively draft and argue these motions.