The federal benefits that are exempt from garnishment include:

" Social Security Benefits

" Supplemental Security Income (SSI) Benefits

" Veterans' Benefits

" Civil Service and Federal Retirement and Disability Benefits

" Military Annuities and Survivors' Benefits

" Student Assistance

" Railroad Retirement Benefits

" Merchant Seamen Wages

" Longshoremen's and Harbor Workers' Death and Disability Benefits

" Foreign Service Retirement and Disability Benefits

" Compensation for Injury, Death, or Detention of Employees of U.S. Contractors Outside the U.S.

" Federal Emergency Management Agency Federal Disaster Assistance.

Other exempt funds include:

" unemployment income,

" some social security disability income payments,

" some workman's compensation payments, and

" some joint account funds if the account is held by spouses as tenants by the entirety and the judgment is against only one spouse.

Even if the bank account is in just your name, there are some types of funds that are considered "exempt" from debt collection under state or federal law. The rationale behind these laws is to allow people to preserve the basic necessities for living. Exempt funds remain exempt when deposited in checking, savings or CD accounts so long as they are readily available for the day to day needs of the recipient and have not been converted into a "permanent investment."

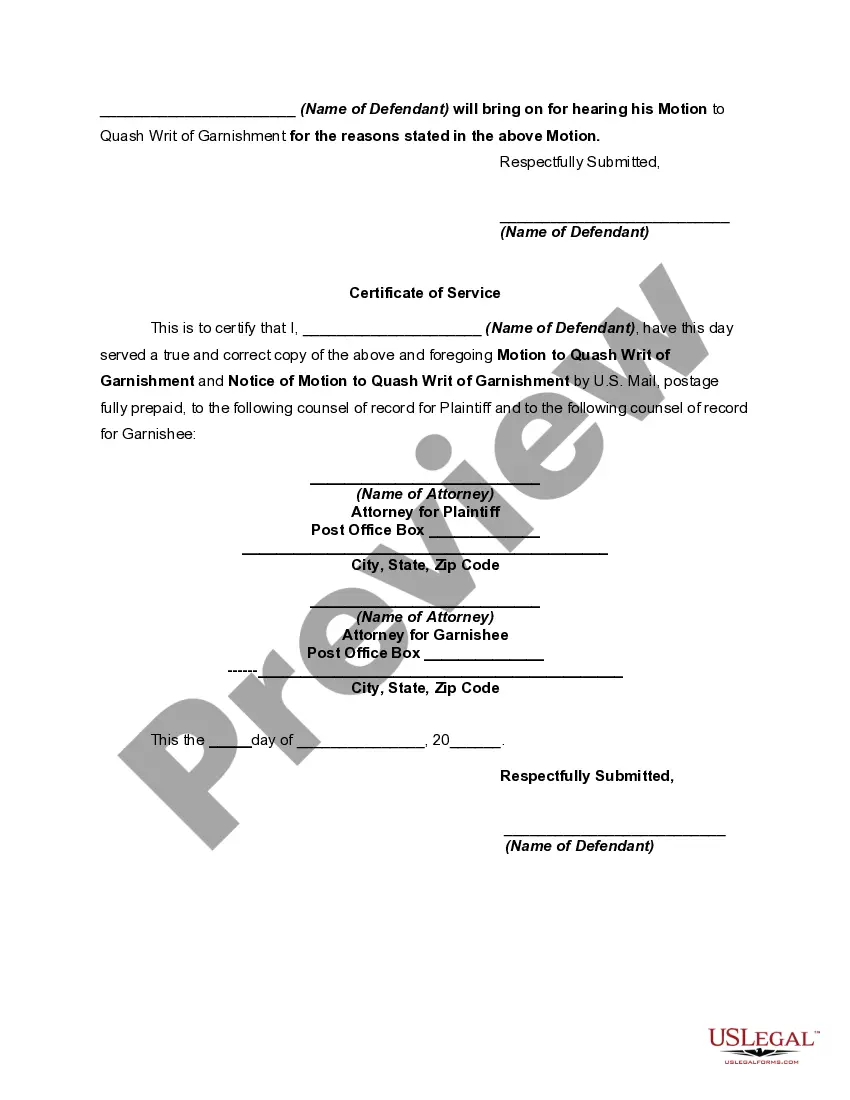

The San Bernardino County Superior Court allows defendants to file a Motion to Discharge or Quash a Writ of Garnishment and Notice of Motion regarding funds exempt by law from garnishment. In such cases, defendants can seek to protect specific types of funds that are legally exempt from being withheld through garnishment. It is important to understand the process and available options for this motion in San Bernardino, California. When a debtor faces a garnishment order, typically issued by a creditor, they may file a Motion to Discharge or Quash the garnishment writ. This motion serves as a legal remedy to protect funds that are protected under state and federal laws from being subject to garnishment. By filing this motion, defendants can challenge the validity of the garnishment or assert that certain funds should be exempted due to their specific nature. In San Bernardino, California, there are several types of funds that can be considered exempt from garnishment, including: 1. Wages: Under California law, a portion of an individual's wages is protected from garnishment. The specific amount that can be exempted depends on the debtor's disposable income and the number of dependents they have. 2. Public benefits: Certain benefits, such as Social Security, Disability, and Unemployment Insurance, are generally protected from garnishment. 3. Retirement accounts: Funds held in qualified retirement plans, such as 401(k) or IRA accounts, are usually exempt from garnishment. 4. Child support or spousal support: In most cases, funds received for child support or spousal support are exempt from garnishment. 5. Life insurance policy proceeds: Proceeds from a life insurance policy may be exempt if they are needed for the support of the debtor's dependents. When filing a Motion to Discharge or Quash a Writ of Garnishment and Notice of Motion, it is essential to provide detailed documentation, such as bank statements, pay stubs, retirement account statements, or any other evidence supporting the exemption claim. This will help establish the legitimacy and necessity of protecting the funds from garnishment. Defendants in San Bernardino, California, should consult with an attorney who specializes in debt and garnishment issues to navigate the process effectively. Legal professionals can provide guidance on the applicable laws and assist in preparing a strong motion to protect exempt funds from garnishment. In conclusion, the San Bernardino County Superior Court allows defendants to file a Motion to Discharge or Quash a Writ of Garnishment and Notice of Motion to safeguard funds protected by law from garnishment. Various types of funds, such as wages, public benefits, retirement accounts, child support, and life insurance policy proceeds, may be exempt from garnishment. Seeking legal advice and providing substantial documentation are crucial elements for successfully defending against a garnishment order in San Bernardino, California.The San Bernardino County Superior Court allows defendants to file a Motion to Discharge or Quash a Writ of Garnishment and Notice of Motion regarding funds exempt by law from garnishment. In such cases, defendants can seek to protect specific types of funds that are legally exempt from being withheld through garnishment. It is important to understand the process and available options for this motion in San Bernardino, California. When a debtor faces a garnishment order, typically issued by a creditor, they may file a Motion to Discharge or Quash the garnishment writ. This motion serves as a legal remedy to protect funds that are protected under state and federal laws from being subject to garnishment. By filing this motion, defendants can challenge the validity of the garnishment or assert that certain funds should be exempted due to their specific nature. In San Bernardino, California, there are several types of funds that can be considered exempt from garnishment, including: 1. Wages: Under California law, a portion of an individual's wages is protected from garnishment. The specific amount that can be exempted depends on the debtor's disposable income and the number of dependents they have. 2. Public benefits: Certain benefits, such as Social Security, Disability, and Unemployment Insurance, are generally protected from garnishment. 3. Retirement accounts: Funds held in qualified retirement plans, such as 401(k) or IRA accounts, are usually exempt from garnishment. 4. Child support or spousal support: In most cases, funds received for child support or spousal support are exempt from garnishment. 5. Life insurance policy proceeds: Proceeds from a life insurance policy may be exempt if they are needed for the support of the debtor's dependents. When filing a Motion to Discharge or Quash a Writ of Garnishment and Notice of Motion, it is essential to provide detailed documentation, such as bank statements, pay stubs, retirement account statements, or any other evidence supporting the exemption claim. This will help establish the legitimacy and necessity of protecting the funds from garnishment. Defendants in San Bernardino, California, should consult with an attorney who specializes in debt and garnishment issues to navigate the process effectively. Legal professionals can provide guidance on the applicable laws and assist in preparing a strong motion to protect exempt funds from garnishment. In conclusion, the San Bernardino County Superior Court allows defendants to file a Motion to Discharge or Quash a Writ of Garnishment and Notice of Motion to safeguard funds protected by law from garnishment. Various types of funds, such as wages, public benefits, retirement accounts, child support, and life insurance policy proceeds, may be exempt from garnishment. Seeking legal advice and providing substantial documentation are crucial elements for successfully defending against a garnishment order in San Bernardino, California.