The federal benefits that are exempt from garnishment include:

" Social Security Benefits

" Supplemental Security Income (SSI) Benefits

" Veterans' Benefits

" Civil Service and Federal Retirement and Disability Benefits

" Military Annuities and Survivors' Benefits

" Student Assistance

" Railroad Retirement Benefits

" Merchant Seamen Wages

" Longshoremen's and Harbor Workers' Death and Disability Benefits

" Foreign Service Retirement and Disability Benefits

" Compensation for Injury, Death, or Detention of Employees of U.S. Contractors Outside the U.S.

" Federal Emergency Management Agency Federal Disaster Assistance.

Other exempt funds include:

" unemployment income,

" some social security disability income payments,

" some workman's compensation payments, and

" some joint account funds if the account is held by spouses as tenants by the entirety and the judgment is against only one spouse.

Even if the bank account is in just your name, there are some types of funds that are considered "exempt" from debt collection under state or federal law. The rationale behind these laws is to allow people to preserve the basic necessities for living. Exempt funds remain exempt when deposited in checking, savings or CD accounts so long as they are readily available for the day to day needs of the recipient and have not been converted into a "permanent investment."

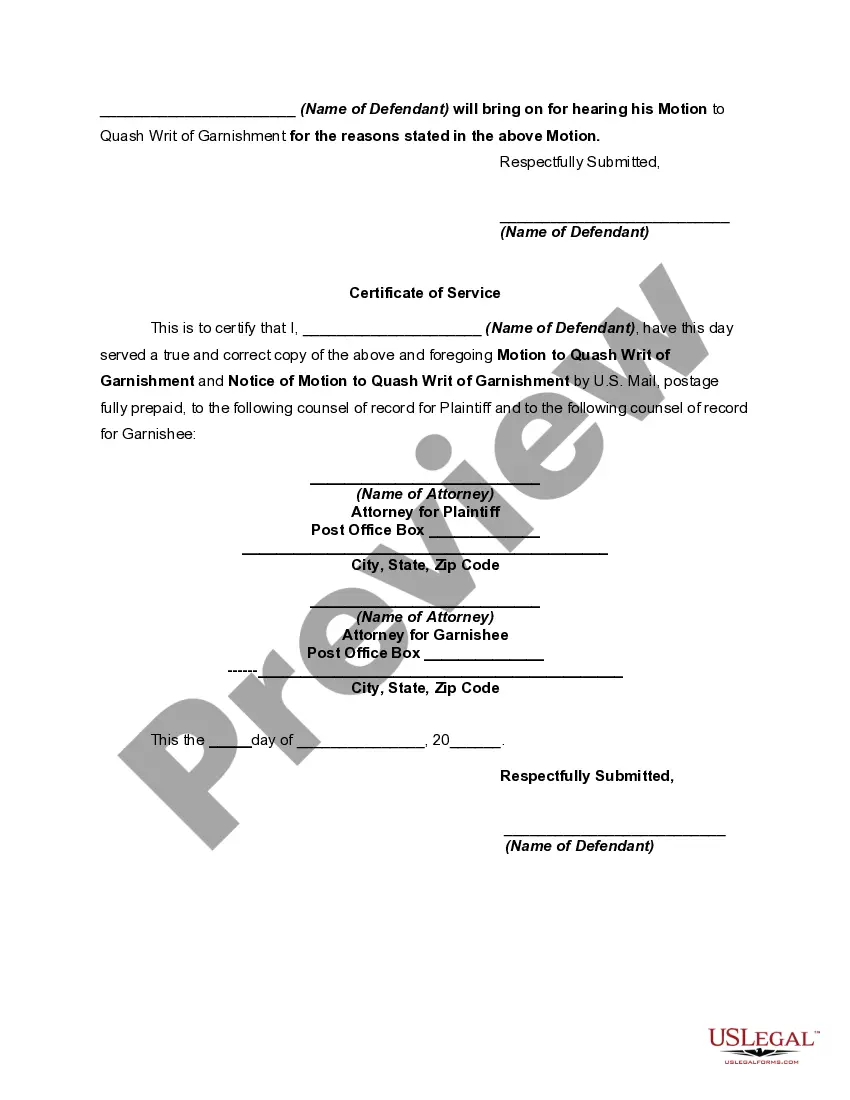

San Jose, California, is a vibrant city located in the heart of Silicon Valley. Known for its high-tech industry and innovative spirit, San Jose offers a diverse and thriving community with a wealth of attractions and opportunities. When it comes to legal matters, one important aspect is the motion of the defendant to discharge or quash a writ of garnishment. This motion allows the defendant to challenge the validity or procedures of a garnishment order. In San Jose, California, this motion can be used to protect certain funds that are exempt from garnishment under the law. There are several types of San Jose, California, motions that defendants can file to discharge or quash a writ of garnishment, and among them are: 1. Motion to Discharge: This motion argues that the underlying judgment that led to the garnishment order is invalid or needs to be reconsidered. It may focus on issues such as improper service, lack of jurisdiction, or other legal deficiencies. 2. Motion to Quash: This motion challenges the procedural aspects of the garnishment order, claiming that it was issued without proper notice or that the defendant's rights were violated during the process. 3. Motion to Exempt Funds from Garnishment: This motion specifically addresses the exemption of certain funds by law from garnishment. It asserts that the funds being targeted for garnishment are protected under applicable exemption laws and should be exempt from collection. 4. Notice of Motion: This document informs the court and involved parties about the defendant's intention to file a motion to discharge or quash the garnishment order. It provides details about the upcoming motion, including the grounds for the challenge and the requested relief. It's crucial for defendants in San Jose, California, to stand up for their rights in matters related to writs of garnishment. By filing a motion to discharge or quash, and potentially utilizing the exemption of funds by law from garnishment, defendants can protect their assets and ensure a fair legal process.San Jose, California, is a vibrant city located in the heart of Silicon Valley. Known for its high-tech industry and innovative spirit, San Jose offers a diverse and thriving community with a wealth of attractions and opportunities. When it comes to legal matters, one important aspect is the motion of the defendant to discharge or quash a writ of garnishment. This motion allows the defendant to challenge the validity or procedures of a garnishment order. In San Jose, California, this motion can be used to protect certain funds that are exempt from garnishment under the law. There are several types of San Jose, California, motions that defendants can file to discharge or quash a writ of garnishment, and among them are: 1. Motion to Discharge: This motion argues that the underlying judgment that led to the garnishment order is invalid or needs to be reconsidered. It may focus on issues such as improper service, lack of jurisdiction, or other legal deficiencies. 2. Motion to Quash: This motion challenges the procedural aspects of the garnishment order, claiming that it was issued without proper notice or that the defendant's rights were violated during the process. 3. Motion to Exempt Funds from Garnishment: This motion specifically addresses the exemption of certain funds by law from garnishment. It asserts that the funds being targeted for garnishment are protected under applicable exemption laws and should be exempt from collection. 4. Notice of Motion: This document informs the court and involved parties about the defendant's intention to file a motion to discharge or quash the garnishment order. It provides details about the upcoming motion, including the grounds for the challenge and the requested relief. It's crucial for defendants in San Jose, California, to stand up for their rights in matters related to writs of garnishment. By filing a motion to discharge or quash, and potentially utilizing the exemption of funds by law from garnishment, defendants can protect their assets and ensure a fair legal process.