A Phoenix Arizona Revocable Trust for House is a legal document created to transfer ownership of a residential property in Phoenix, Arizona, into a trust. This type of trust allows individuals, also known as granters or trustees, to retain control over their property while ensuring a smooth and efficient transfer of assets upon their death or incapacity. The primary purpose of a Phoenix Arizona Revocable Trust for House is to avoid probate, a time-consuming and often costly legal process that occurs after an individual's death. By placing the ownership of a residential property into a trust, the granter retains the right to control and use the property during their lifetime. One key advantage of a Revocable Trust for House in Phoenix, Arizona, is that it allows for the seamless transfer of the property to designated beneficiaries upon the granter's death. This means that the intended heirs can avoid the delays and expenses associated with probate court proceedings. There are several types of Phoenix Arizona Revocable Trusts for House, each designed to meet specific needs and circumstances. Some common variations include: 1. Single Granter Revocable Trust: This is a trust created by a single individual who is the sole granter of the trust and retains complete control over the house during their lifetime. 2. Joint Revocable Trust: A trust created by two individuals, typically spouses, who jointly own the house and wish to establish a trust that will govern the property's transfer upon their deaths. 3. Testamentary Revocable Trust: This is a trust created within a will, becoming effective only upon the granter's death. It allows the granter to make changes to the trust during their lifetime, ensuring flexibility. 4. Living Revocable Trust: A trust established during the granter's lifetime, enabling them to retain control over the house while specifying instructions for its management and distribution after their death or incapacity. Phoenix Arizona Revocable Trusts for House offer numerous benefits such as privacy, as trust documents generally remain private and do not become part of the public record like probate proceedings. Additionally, this type of trust allows for the potential reduction of estate taxes and may provide protection against challenges to the distribution of assets. However, it is crucial to consult with a qualified estate planning attorney familiar with Arizona state laws when considering a Phoenix Arizona Revocable Trust for House. They can guide individuals through the entire trust creation process, ensuring it aligns with their specific needs and fulfills their objectives.

Phoenix Arizona Revocable Trust for House

Description

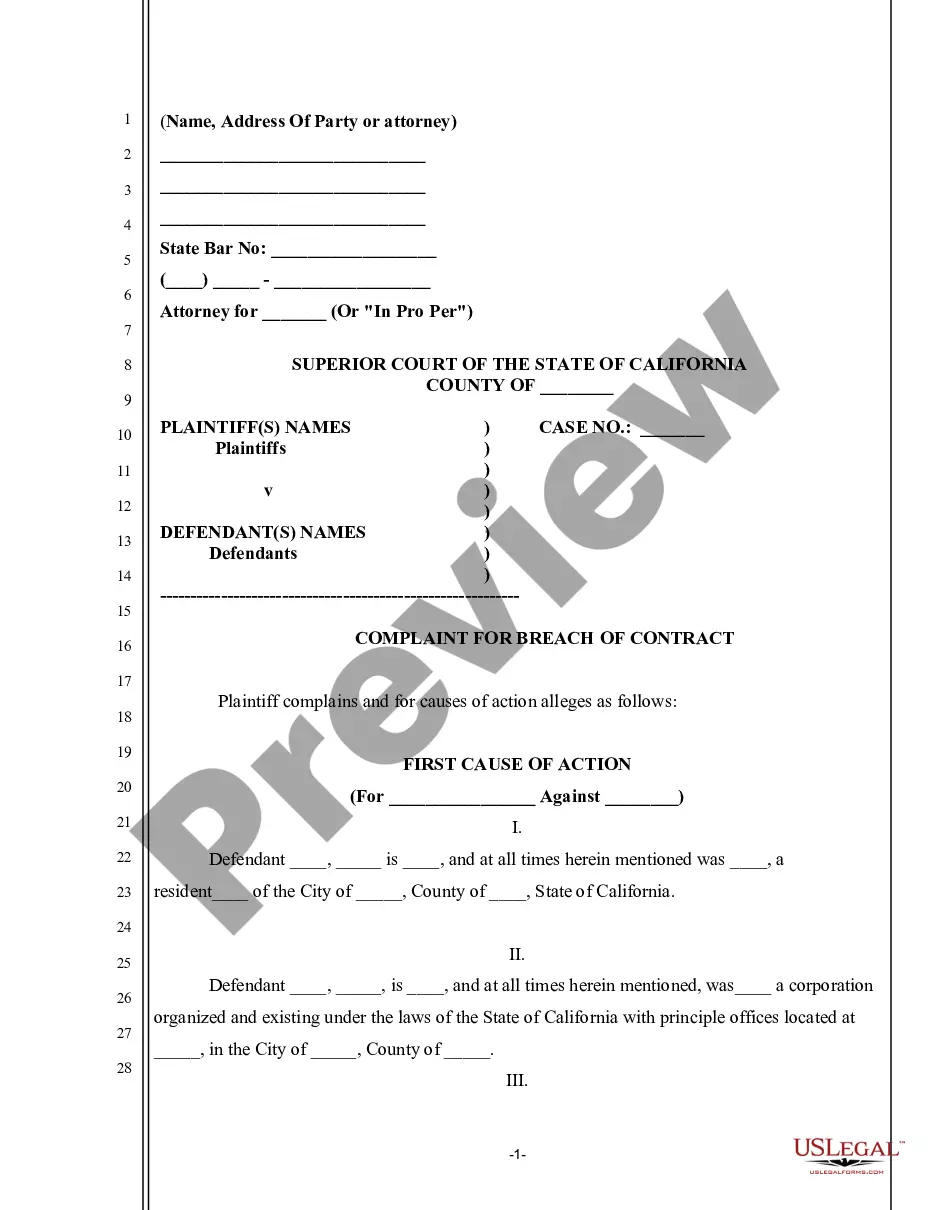

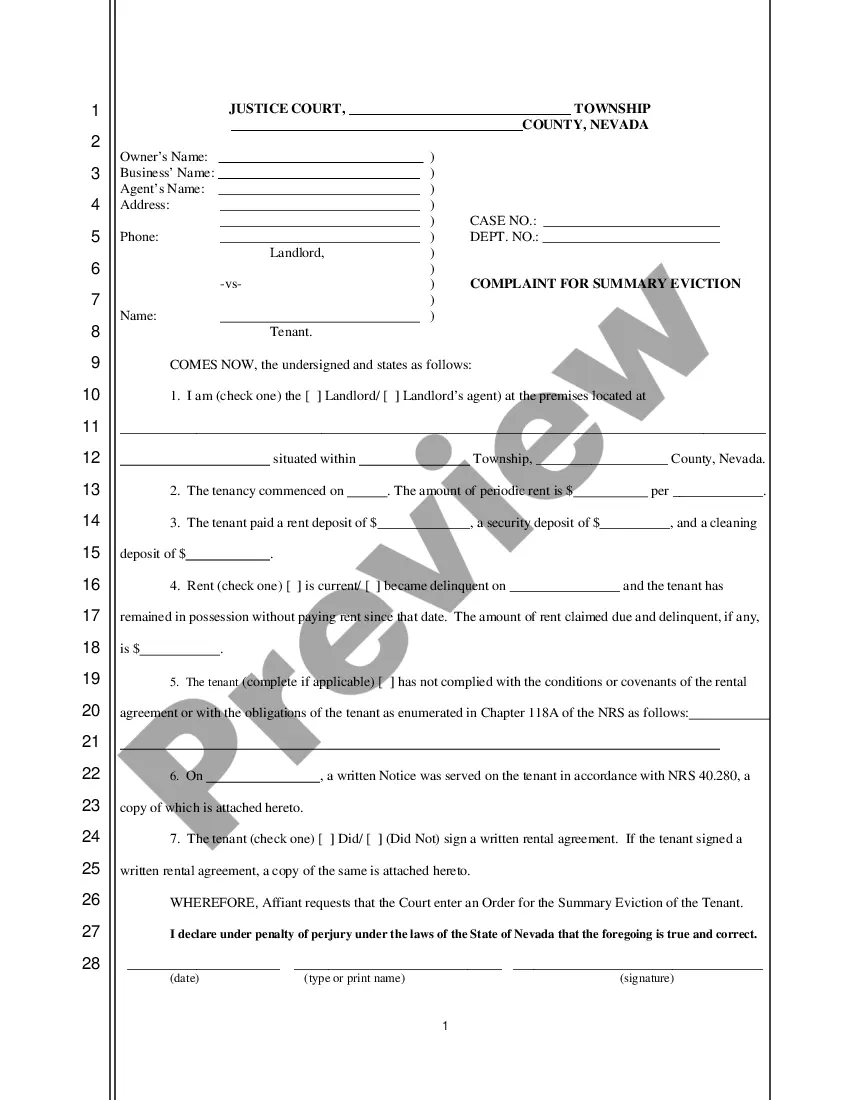

How to fill out Phoenix Arizona Revocable Trust For House?

Laws and regulations in every area differ around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Phoenix Revocable Trust for House, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you pick a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Phoenix Revocable Trust for House from the My Forms tab.

For new users, it's necessary to make some more steps to get the Phoenix Revocable Trust for House:

- Examine the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the document once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Living Trusts vs. We recommend living trusts to our clients because of the tremendous benefits they offer over wills, the more traditional estate planning tool. The biggest benefit of using a living trust instead of a will is that living trusts avoid probate.

With your property in trust, you typically continue to live in your home and pay the trustees a nominal rent, until your transfer to residential care when that time comes. Placing the property in trust may also be a way of helping your surviving beneficiaries avoid inheritance tax liabilities.

Your total costs could be less than $100, or it could be a $300, depending on the online program you select. If you choose to hire an attorney to help you create the trust, the attorney's fees will determine your total costs. You could end up paying more than $1,000.

In Arizona, the average cost for a living trust is around $1,500. However, this price may vary depending on the location and size of the trust. For example, trusts in major metropolitan areas may be more expensive than those in rural areas. Smaller trusts may also cost less than larger ones.

Drawbacks of a living trust The most significant disadvantages of trusts include costs of set and administration. Trusts have a complex structure and intricate formation and termination procedures. The trustor hands over control of their assets to trustees.

With your property in trust, you typically continue to live in your home and pay the trustees a nominal rent, until your transfer to residential care when that time comes. Placing the property in trust may also be a way of helping your surviving beneficiaries avoid inheritance tax liabilities.

5 Reasons a Trust is Better Than a Will in Arizona A will cannot provide creditor protection for the inheritance you will leave to your children as a trust can. A will cannot protect government benefits for people with disabilities but a trust can. A will can't reduce estate taxes as a trust can.

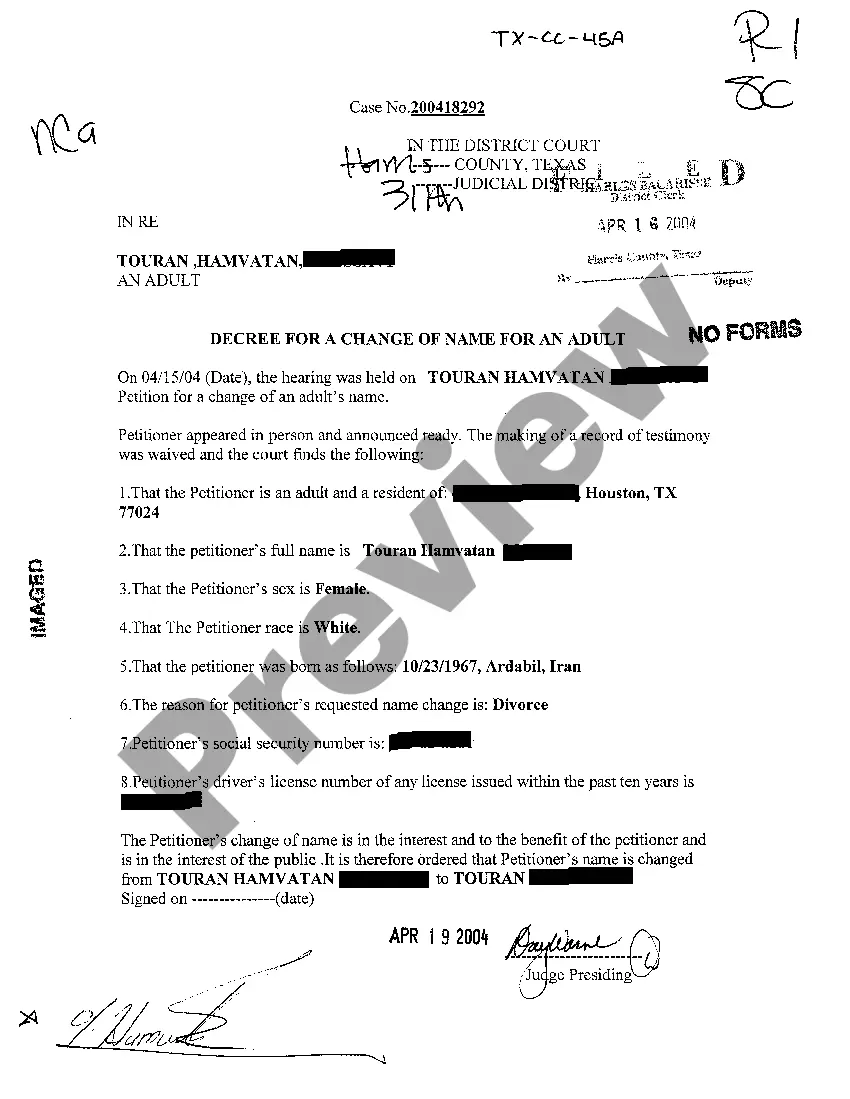

To create a living trust in Arizona you need to create a trust document that lays out all the details of your trust and names the trustee and beneficiaries. You will sign the document in front of a notary. To complete the process, you fund the trust by transferring the ownership of assets to the trust entity.

Real Estate ? Real estate which is to be transferred into a trust must be conveyed in an Arizona Deed. The document must be signed by all parties in front of a Notary Public and filed with the County Recorder's Office.