A Franklin Ohio revocable trust for asset protection is a legal entity created to safeguard assets and provide flexibility in managing and distributing them. This type of trust, also referred to as a living trust or inter vivos trust, is established during the granter's lifetime and can be altered, modified, or revoked at any time. Asset protection is the primary goal of this trust, aiming to shield the granter's wealth from potential lawsuits, creditors, and excessive estate taxes. Here are the different types of Franklin Ohio revocable trusts for asset protection: 1. Franklin Ohio Revocable Living Trust: This is the most common type of revocable trust used for asset protection. It allows the granter to retain control over the assets while providing protection from creditors and potential litigation. 2. Franklin Ohio Revocable Granter Retained Annuity Trust: This type of trust suits individuals who want to minimize estate taxes by transferring assets to the trust while retaining an income stream from those assets for a specified period. 3. Franklin Ohio Revocable Dynasty Trust: Designed to preserve wealth for multiple generations, this trust allows assets to be transferred to beneficiaries while maintaining certain controls to protect against mismanagement, divorces, or creditors. 4. Franklin Ohio Revocable Qualified Personnel Residence Trust: This trust permits the granter to transfer the primary residence or vacation home into the trust while retaining the right to reside in it for a predetermined period. It helps reduce estate taxes while protecting the property from potential claims. 5. Franklin Ohio Revocable Charitable Remainder Trust: This type of trust allows the granter to donate assets to a charitable organization while retaining an income stream from those assets over a specified period. It offers tax benefits, asset protection, and the opportunity to support charitable causes. 6. Franklin Ohio Revocable Special Needs Trust: This trust is specifically designed to provide for the financial needs of individuals with disabilities without jeopardizing their eligibility for government benefits, such as Medicaid or Social Security. In conclusion, Franklin Ohio revocable trusts for asset protection serve as a powerful tool to safeguard wealth, minimize estate taxes, and control the distribution of assets. These trusts come in various forms, each catering to specific needs and objectives of the granter. Consultation with an experienced estate planning attorney is highly recommended determining the most suitable trust structure for individual circumstances.

Franklin Ohio Revocable Trust for Asset Protection

Description

How to fill out Franklin Ohio Revocable Trust For Asset Protection?

Preparing paperwork for the business or individual demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state laws and regulations of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to generate Franklin Revocable Trust for Asset Protection without expert assistance.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Franklin Revocable Trust for Asset Protection by yourself, using the US Legal Forms online library. It is the biggest online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed form.

If you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Franklin Revocable Trust for Asset Protection:

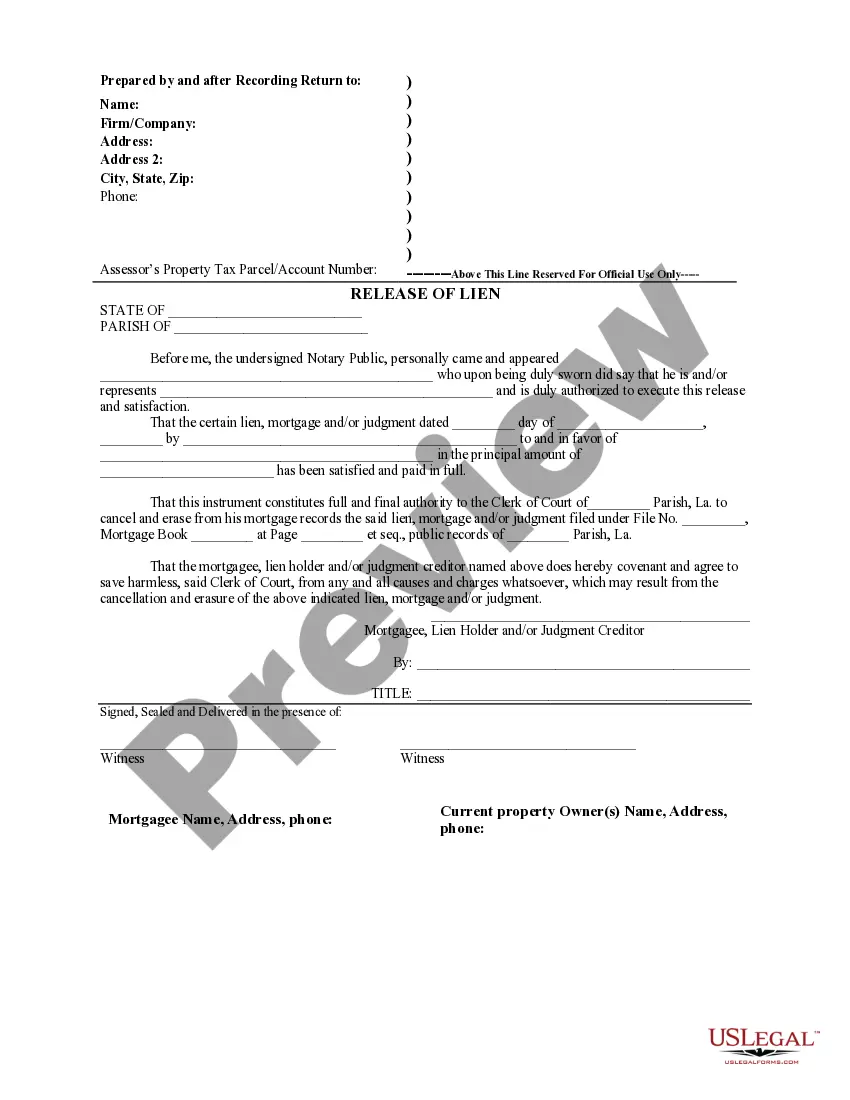

- Examine the page you've opened and check if it has the document you need.

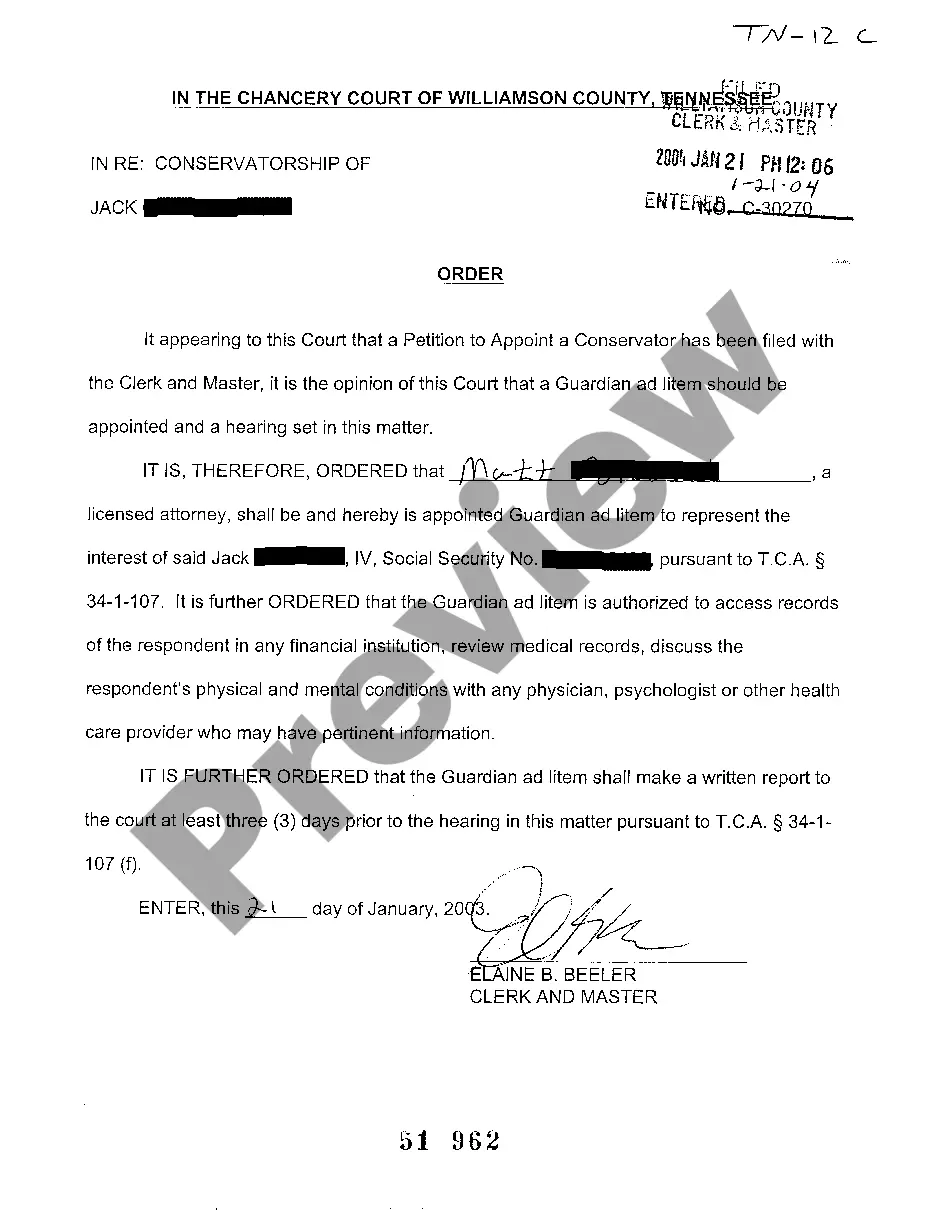

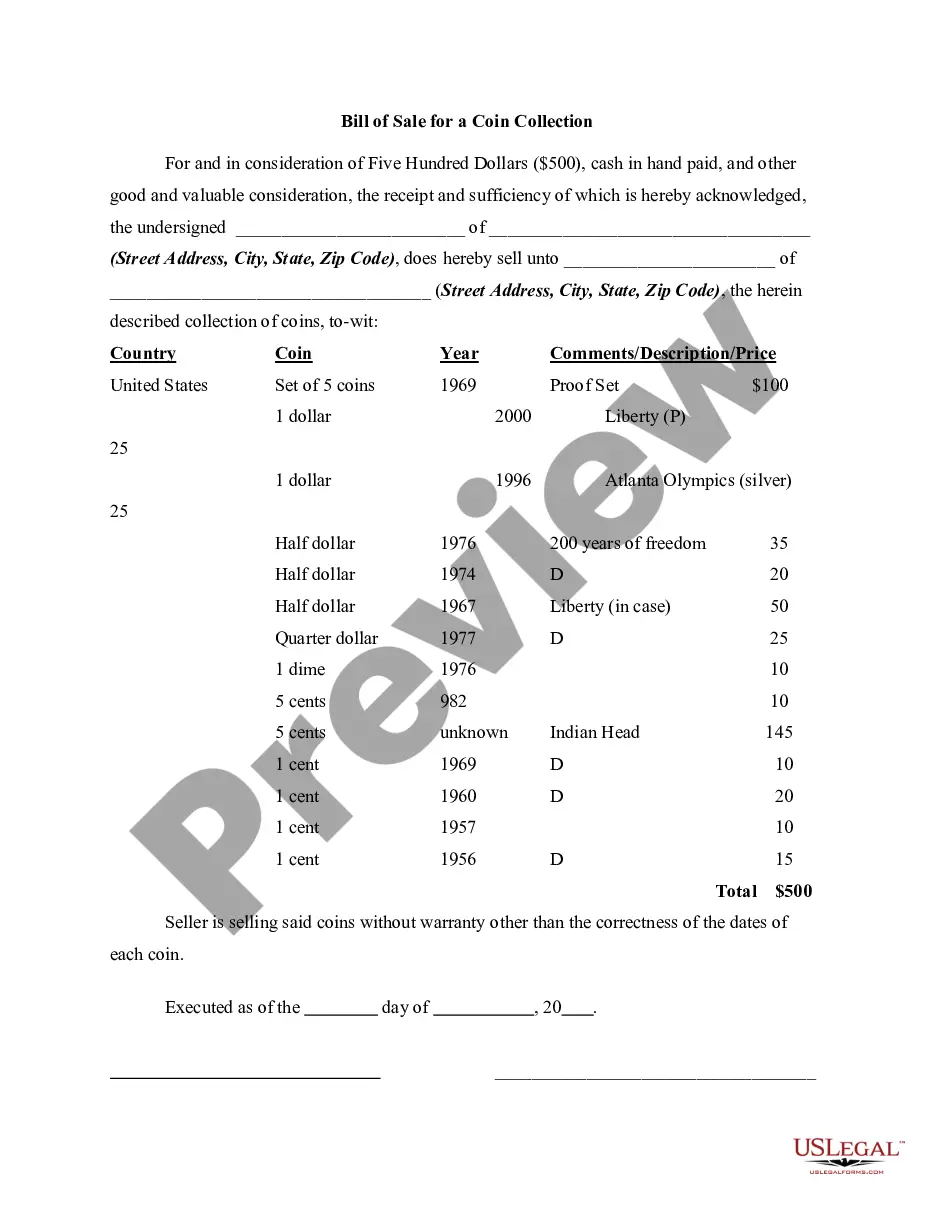

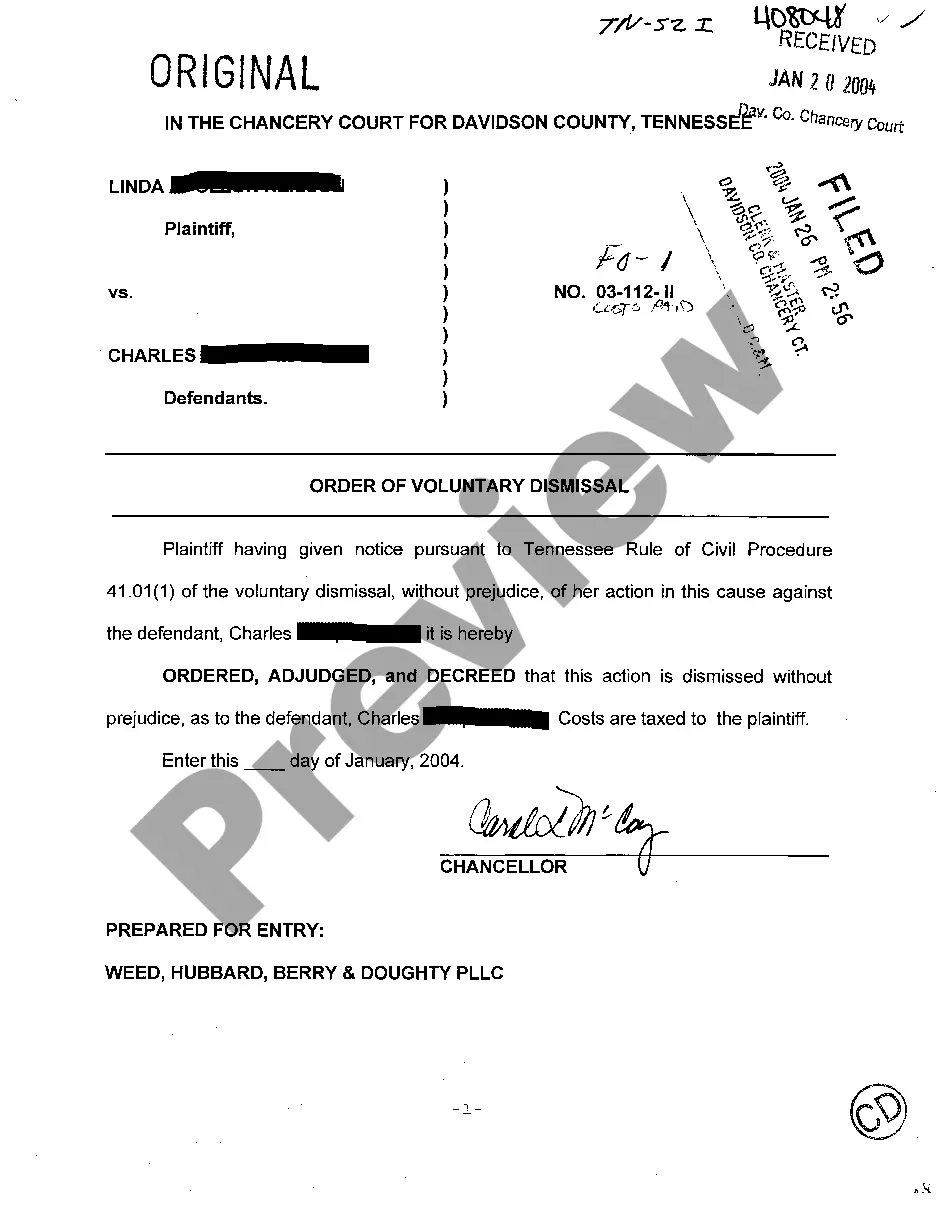

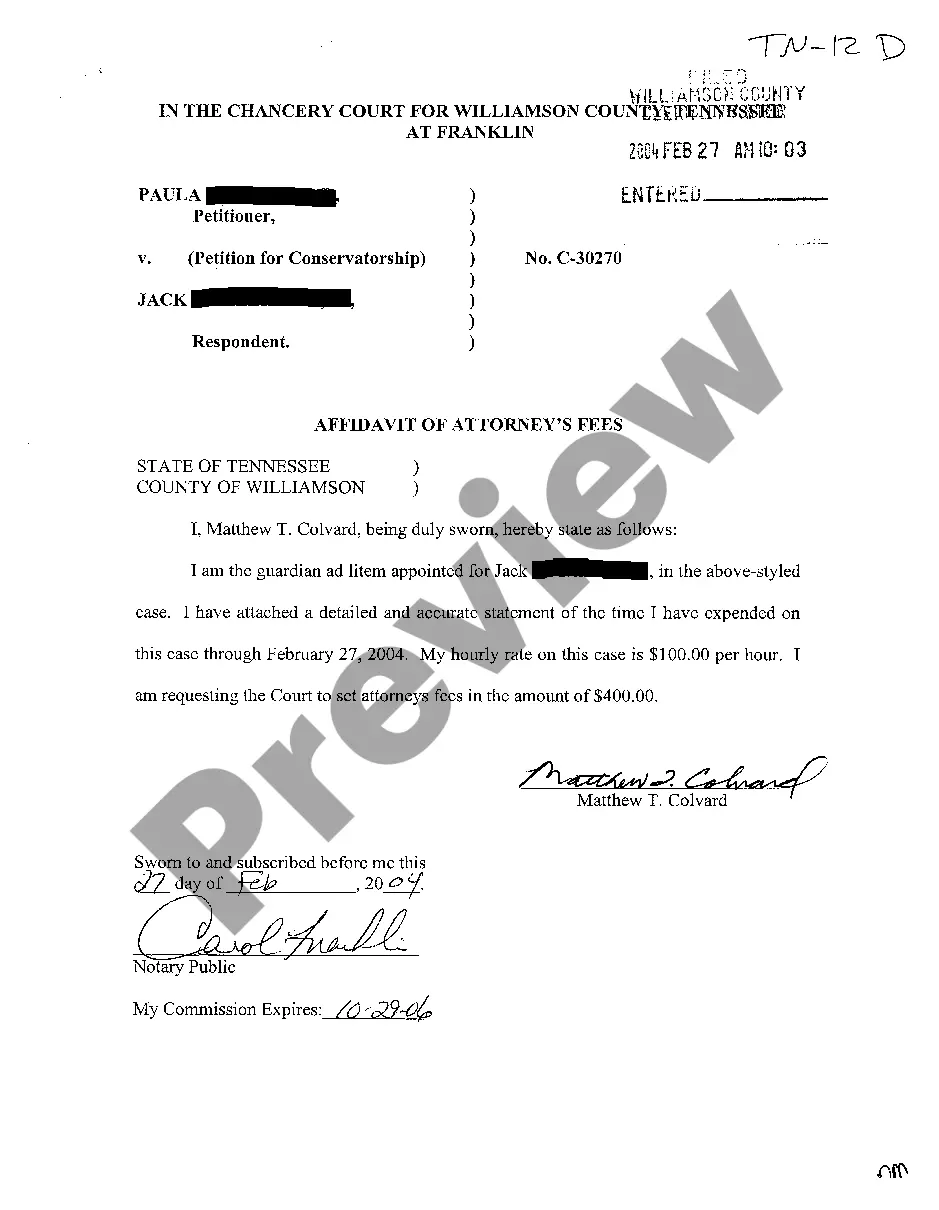

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that suits your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any use case with just a couple of clicks!