Maricopa, Arizona Revocable Trust for Asset Protection is a legal mechanism that enables individuals to protect and secure their assets while maintaining control and flexibility over them. This trust is designed specifically for residents and investors in Maricopa, Arizona, ensuring that their assets are safeguarded according to state laws and regulations. A Maricopa, Arizona Revocable Trust for Asset Protection functions by transferring ownership of assets to the trust, thus separating them from personal ownership. This legal arrangement offers protection against potential creditors, lawsuits, or other legal issues, shielding the assets from potential risks. By creating this type of trust, individuals can ensure that their hard-earned assets are preserved and not jeopardized in uncertain circumstances. There are various types of Maricopa, Arizona Revocable Trusts for Asset Protection that cater to different needs and requirements. Some commonly known types include: 1. Maricopa, Arizona Revocable Living Trust: This type of trust is established during the granter's lifetime and can be modified or revoked as long as the granter is mentally competent. It provides asset protection and facilitates the seamless transfer of assets to beneficiaries upon the granter's death, avoiding probate. 2. Maricopa, Arizona Revocable Family Trust: This trust is designed specifically for families, enabling the granter to protect assets for the benefit of family members. It allows the granter to maintain control over the trust's assets while ensuring they are shielded from potential risks or legal disputes. 3. Maricopa, Arizona Revocable Charitable Trust: This trust is created with the intention of benefiting charitable organizations or causes. It provides asset protection while allowing the granter to contribute to their chosen charitable endeavors. 4. Maricopa, Arizona Revocable Irrevocable Trust: Although the term may sound contradictory, this trust provides a unique solution where the granter can enjoy some degree of flexibility. It combines elements of both revocable and irrevocable trusts, allowing for asset protection while maintaining certain modifications and revocations. 5. Maricopa, Arizona Revocable Special Needs Trust: This trust is specifically designed to protect and provide for individuals with special needs. It ensures that their inheritances or assets do not jeopardize their eligibility for certain government benefits or assistance programs. Overall, Maricopa, Arizona Revocable Trusts for Asset Protection offer a robust legal framework for individuals seeking to safeguard their wealth and investments. With several types available, individuals can select the trust that aligns with their specific asset protection goals and needs. Consulting with an experienced attorney knowledgeable in Arizona trust laws is highly recommended ensuring compliance and proper establishment of the trust for optimal asset protection.

Maricopa Arizona Revocable Trust for Asset Protection

Description

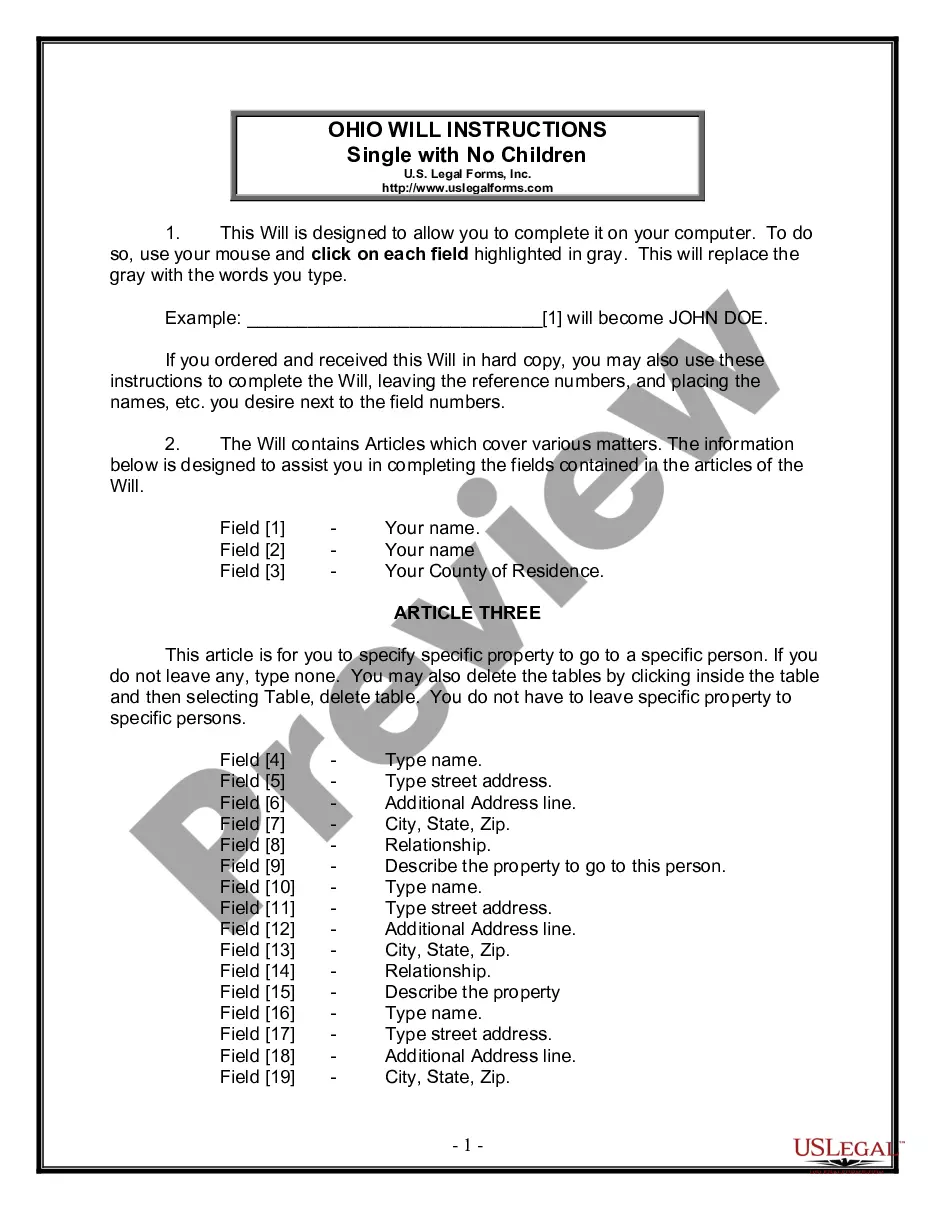

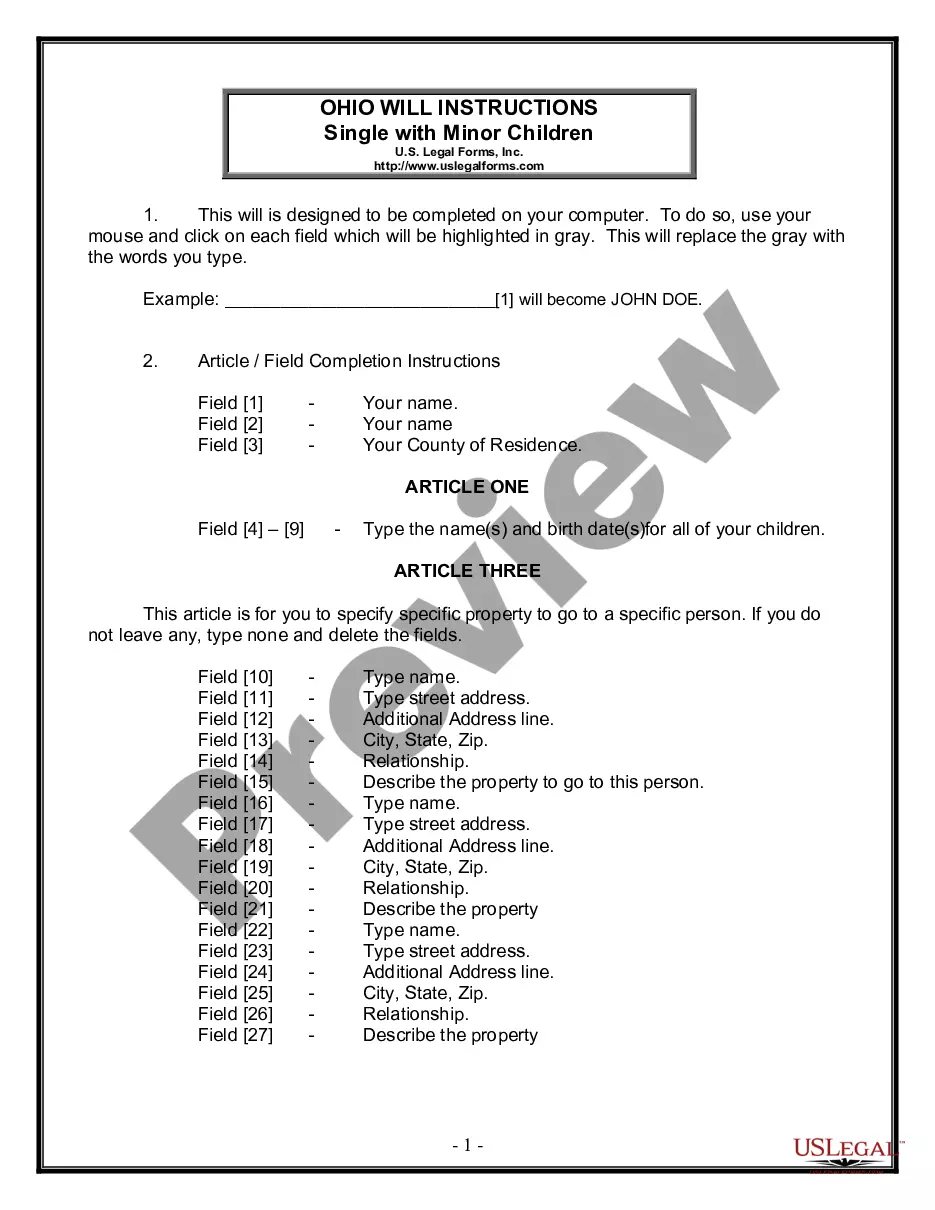

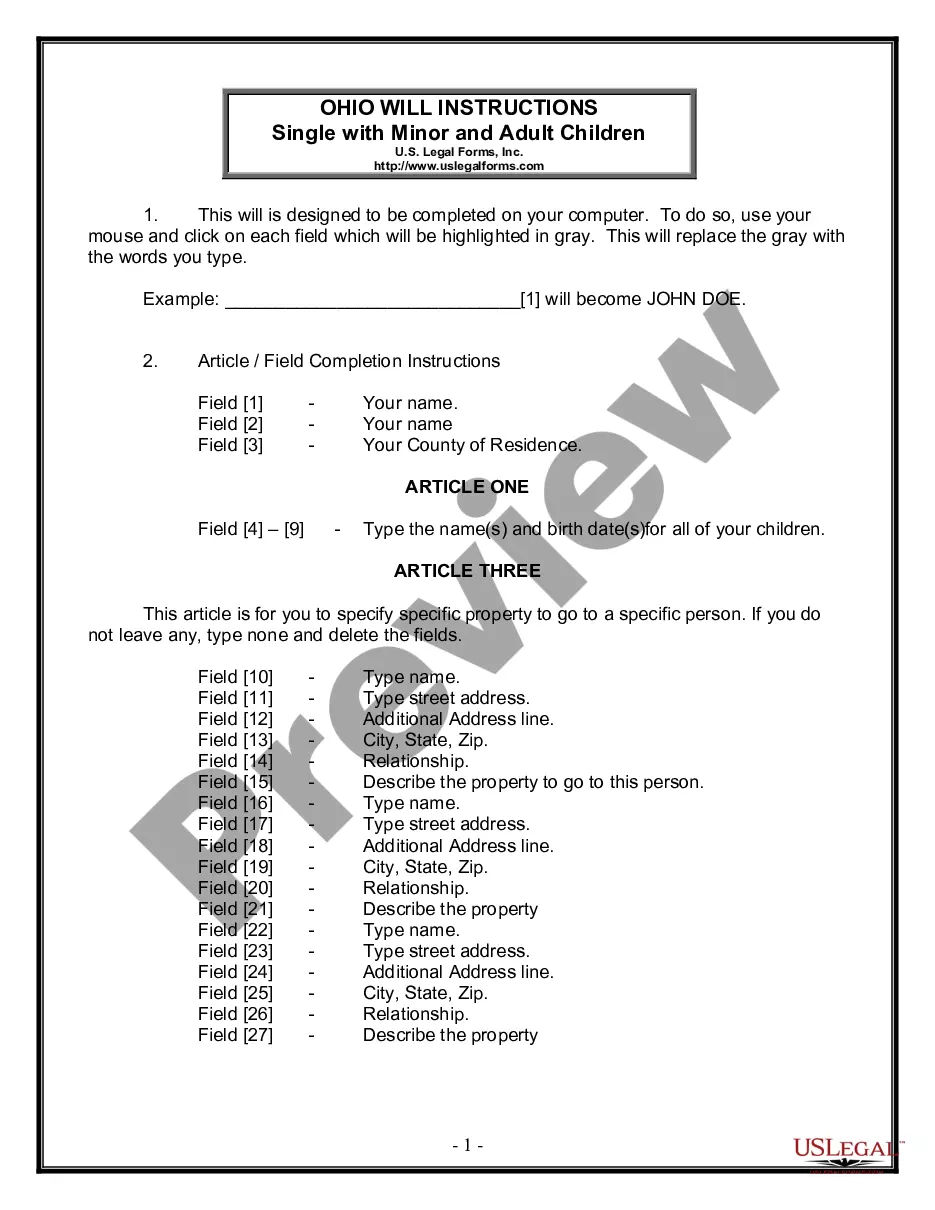

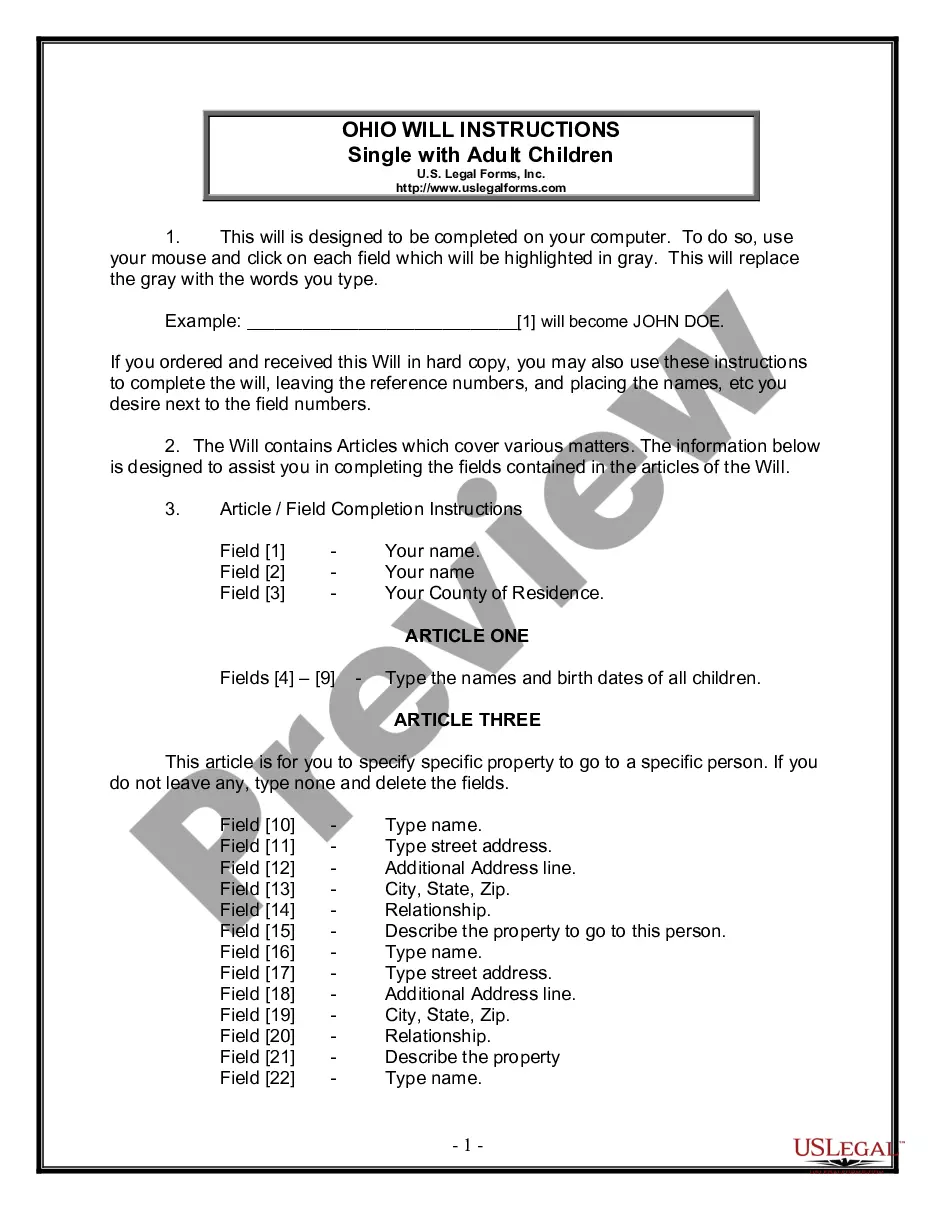

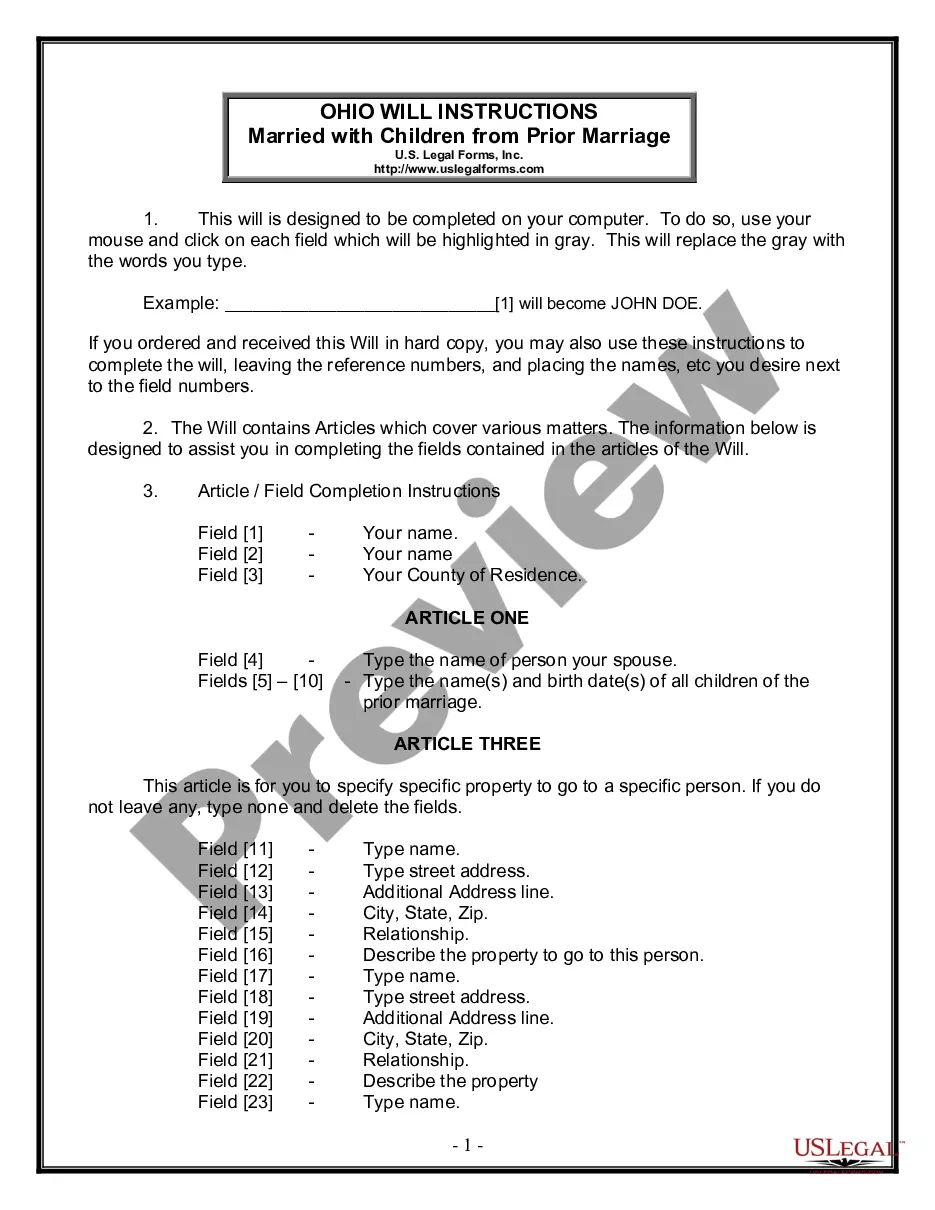

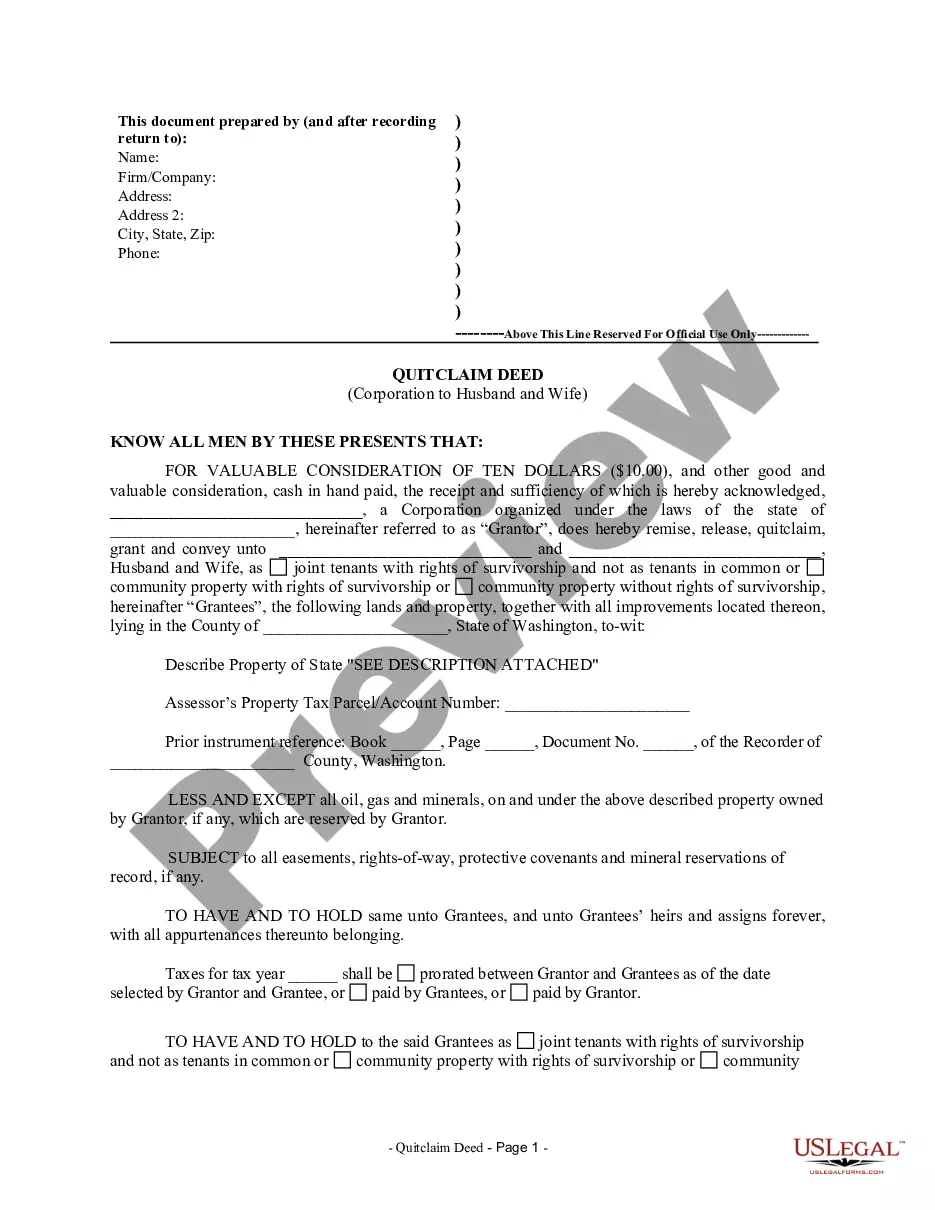

How to fill out Maricopa Arizona Revocable Trust For Asset Protection?

Are you looking to quickly draft a legally-binding Maricopa Revocable Trust for Asset Protection or probably any other document to take control of your own or corporate affairs? You can go with two options: hire a legal advisor to write a legal document for you or create it completely on your own. The good news is, there's an alternative solution - US Legal Forms. It will help you get professionally written legal papers without paying sky-high prices for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-compliant document templates, including Maricopa Revocable Trust for Asset Protection and form packages. We offer documents for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been out there for over 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the necessary document without extra troubles.

- To start with, double-check if the Maricopa Revocable Trust for Asset Protection is tailored to your state's or county's laws.

- In case the document comes with a desciption, make sure to verify what it's suitable for.

- Start the search over if the template isn’t what you were hoping to find by utilizing the search box in the header.

- Select the subscription that best suits your needs and proceed to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Maricopa Revocable Trust for Asset Protection template, and download it. To re-download the form, just head to the My Forms tab.

It's effortless to find and download legal forms if you use our catalog. In addition, the documents we offer are reviewed by industry experts, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

With a revocable trust, your assets will not be protected from creditors looking to sue. That's because you maintain ownership of the trust while you're alive. Therefore if you lose a lawsuit and a judgment is awarded to the creditor, the trust may have to be closed and the money handed over.

Irrevocable trust Most trusts can be irrevocable. This type of trust can help protect your assets from creditors and lawsuits and reduce your estate taxes.

A revocable living trust, on the other hand, does not protect your assets from your creditors. This is because a revocable living trust can, by its terms, be changed or terminated at any time during your lifetime. As a result, the trust creator maintains ownership of the assets.

Nevada, South Dakota, Alaska, Ohio, and Delaware have excellent asset protection laws. Nevada likely has the strongest.

Assets That Can And Cannot Go Into Revocable Trusts Real estate.Financial accounts.Retirement accounts.Medical savings accounts.Life insurance.Questionable assets.

Which Trust Is Best For You: Top 4 Revocable Trusts. One of the two main types of trust is a revocable trust.Irrevocable Trusts. The other main type of trust is a irrevocable trust.Credit Shelter Trusts.Irrevocable Life Insurance Trust.

Revocable living trusts don't, however, protect your assets from people with legal claims against you. That's because although the trust is a legal entity, for legal purposes you're treated as the owner of the trust assets.

Some of the Cons of a Revocable Trust Shifting assets into a revocable trust won't save income or estate taxes. No asset protection. Although assets held in an irrevocable trust are generally beyond the reach of creditors, that's not true with a revocable trust.

The primary benefit of creating a revocable trust is that it provides a prearranged mechanism that will ensure the continued management and preservation of your assets, should you become disabled. It can also set forth all of the dispositive provisions of your estate plan.

Summary: Arizona does not permit self-settled asset protection trusts, but an alternative exists. An asset protection trust is created when a person called a trustor transfers ownership of an asset into an irrevocable trust, which is managed by a trustee for benefit of one or more beneficiaries.