Philadelphia Pennsylvania Revocable Trust for Asset Protection is a legal arrangement established in Philadelphia, Pennsylvania, that provides individuals with a powerful tool for protecting their assets. This type of trust allows individuals to retain control over their assets while still benefiting from the protection it offers. A revocable trust, also known as a living trust, is a flexible legal instrument that allows individuals to transfer ownership of their assets to the trust while still maintaining the ability to alter or revoke the trust during their lifetime. It is commonly used as a key component of a comprehensive asset protection strategy. The primary purpose of a Philadelphia Pennsylvania Revocable Trust for Asset Protection is to shield assets from potential creditors and legal action. By placing assets within the trust, individuals can minimize the risk of losing them in the event of litigation, bankruptcy, or other financial hardships. This trust structure serves as a safeguard to protect wealth for future generations or other designated beneficiaries. One notable advantage of a revocable trust is its ability to avoid probate. Unlike assets that pass through a will, assets held in a revocable trust can be distributed to beneficiaries without having to go through the probate process. This can help preserve privacy, save time, and reduce costs associated with probate. Different types of Philadelphia Pennsylvania Revocable Trusts for Asset Protection include: 1. Irrevocable Trusts: Though not technically revocable, these trusts can be categorized under the broader umbrella of asset protection trusts. They provide more robust protection against creditors but require irrevocable transfer of assets and relinquishing control over them. 2. Spendthrift Trusts: These trusts are designed to protect beneficiaries from poor financial choices or external influences. The trust acts as a barrier, restricting creditors' access to the trust's assets and controlling the distribution of funds to beneficiaries. 3. Dynasty Trusts: These trusts are commonly used to minimize estate taxes and protect assets for multiple generations. By preserving assets within the trust, beneficiaries can enjoy the benefits of the trust while minimizing tax liabilities. 4. Personal Residence Trusts: These trusts are specifically designed to protect a primary residence or a second home. By transferring ownership of the property to the trust, individuals can benefit from tax advantages and shelter the property from potential creditors. In summary, a Philadelphia Pennsylvania Revocable Trust for Asset Protection is a crucial legal tool for individuals seeking to safeguard their assets. It allows them to maintain control over their wealth while shielding it from potential creditors, minimizing estate taxes, and avoiding probate. Depending on individual needs and circumstances, various types of revocable trusts such as irrevocable trusts, spendthrift trusts, dynasty trusts, and personal residence trusts may be employed.

Philadelphia Pennsylvania Revocable Trust for Asset Protection

Description

How to fill out Philadelphia Pennsylvania Revocable Trust For Asset Protection?

Laws and regulations in every sphere vary around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Philadelphia Revocable Trust for Asset Protection, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for different life and business occasions. All the documents can be used multiple times: once you obtain a sample, it remains available in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Philadelphia Revocable Trust for Asset Protection from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Philadelphia Revocable Trust for Asset Protection:

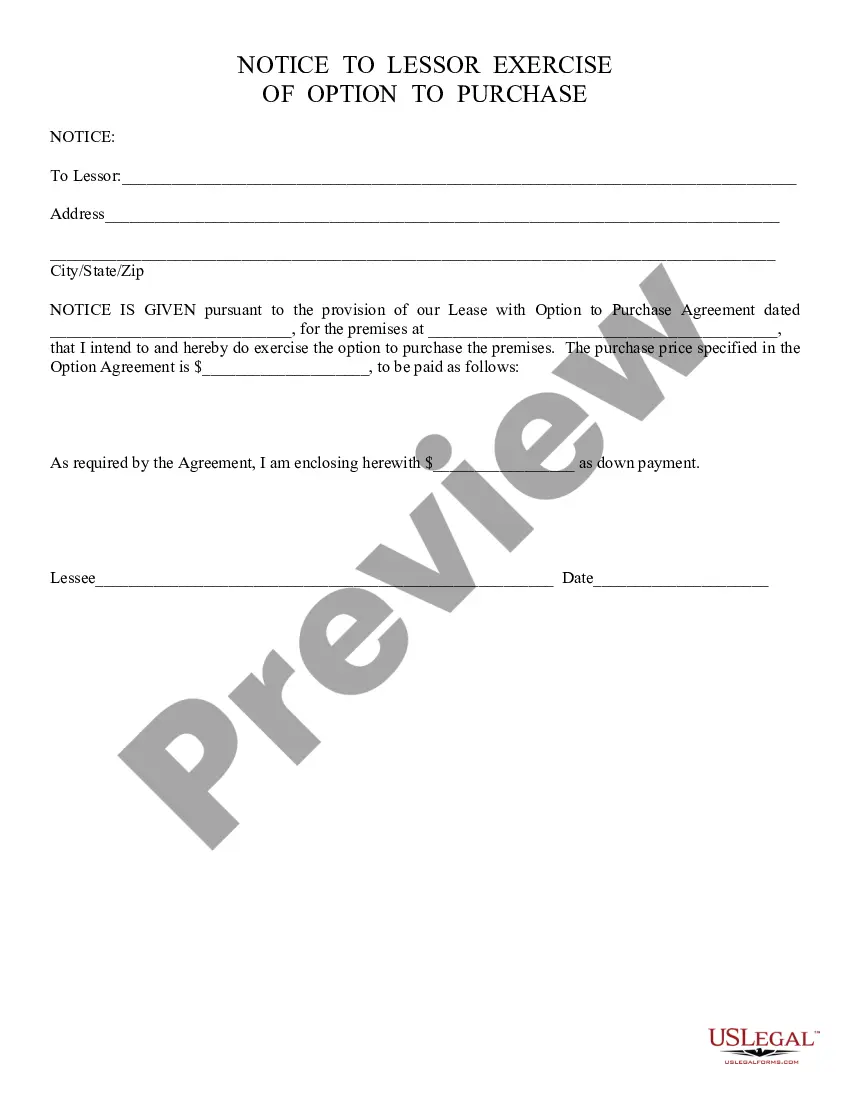

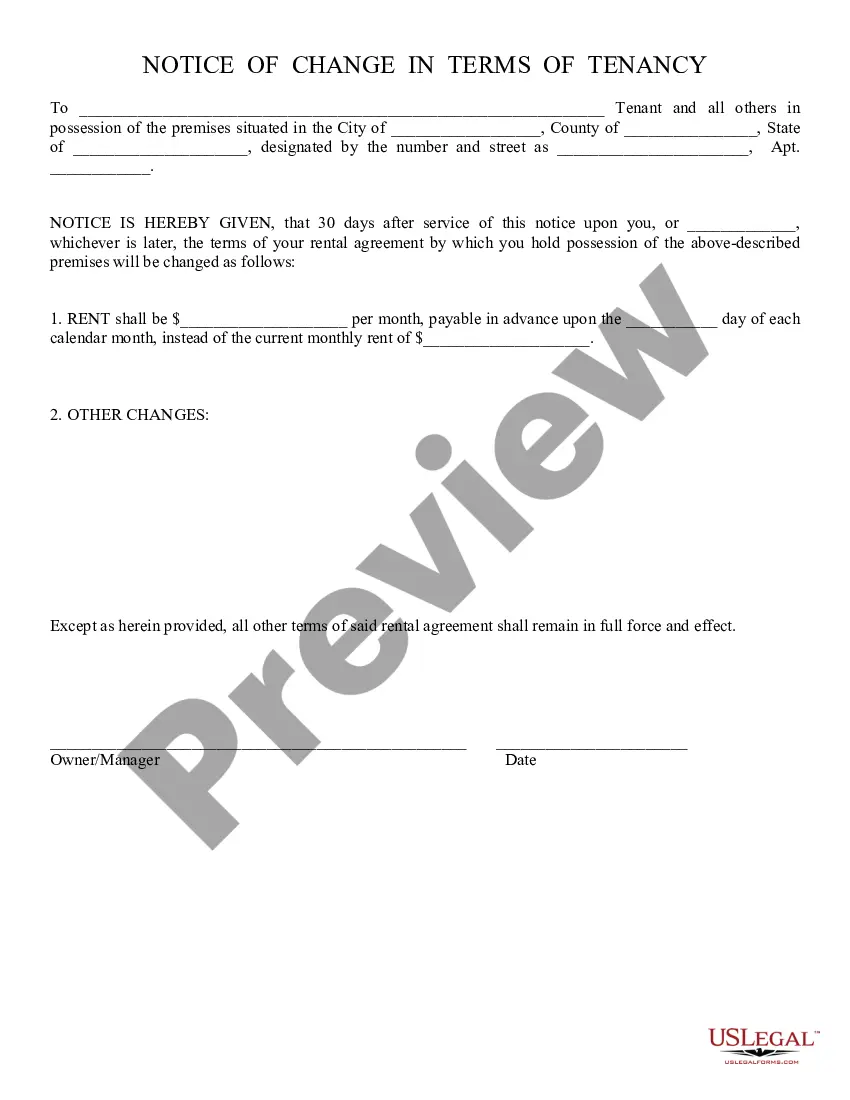

- Examine the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document when you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

An asset protection trust (APT) is a trust vehicle that holds an individual's assets with the purpose of shielding them from creditors. Asset protection trusts offer the strongest protection you can find from creditors, lawsuits, or any judgments against your estate.

Options for asset protection include: Domestic asset protection trusts. Limited liability companies, or LLCs. Insurance, such as an umbrella policy or a malpractice policy. Alternate dispute resolution. Prenuptial agreements. Retirement plans such as a 401(k) or IRA. Homestead exemptions. Offshore trusts.

One of the most effective asset protection strategies is the limited liability company. LLCs separate the owners' personal assets from those owned by the business, so if the company comes under fire, the owners' personal belongings are kept safe from seizure. At least, that's the ideal situation.

Irrevocable trust This type of trust can help protect your assets from creditors and lawsuits and reduce your estate taxes. If you file bankruptcy or default on a debt, assets in an irrevocable trust won't be included in bankruptcy or other court proceedings.

A revocable living trust, on the other hand, does not protect your assets from your creditors. This is because a revocable living trust can, by its terms, be changed or terminated at any time during your lifetime. As a result, the trust creator maintains ownership of the assets.

The assets in a revocable trust are still yours and you will pay taxes accordingly. That includes any income taxes, inheritance taxes or estate taxes. In fact, your revocable trust will have the same Social Security number as you. The effect is that any income from assets in the trust will go on your own income return.

Luber. A trust protector is a person who is not a trustee, but yet holds powers over an individual's trust.

An Irrevocable Living Trust is Best For: This trust is best for those who are looking for an extra layer of protection for their assets and want to minimize taxes associated with the estate.

Asset Protection for You as a Resident of Pennsylvania: Together your financial plan and estate plan will create your asset protection. In some cases, our Pennsylvania clients will use Qualified Personal Residence Trusts, GRATS, and asset protection trusts located in states such as Delaware and/or Nevada.

With a revocable trust, your assets will not be protected from creditors looking to sue. That's because you maintain ownership of the trust while you're alive. Therefore if you lose a lawsuit and a judgment is awarded to the creditor, the trust may have to be closed and the money handed over.