A San Jose California Revocable Trust for Asset Protection is a legal instrument that allows individuals or couples to protect their assets and plan for the distribution of their wealth upon death or incapacity. This trust is flexible and can be modified or revoked by the person(s) establishing it, known as the granter(s), at any time during their lifetime. The primary purpose of a revocable trust is to avoid the probate process, which can be time-consuming and costly. By transferring assets into the trust, individuals can ensure that their assets are managed and distributed according to their wishes, without the need for court intervention. In San Jose, California, there are a few types of revocable trusts commonly used for asset protection: 1. Revocable Living Trust: This is the most common type of trust, where the granter retains full control over the assets transferred into the trust during their lifetime. The granter can act as the trustee, managing the assets, and can also change or revoke the trust at any time. Upon the granter's death or incapacity, a successor trustee takes over and distributes the assets in accordance with the terms of the trust. 2. Joint Revocable Trust: This type of trust is created by a married couple, allowing both spouses to transfer their assets into the trust. Similar to a revocable living trust, the couple can act as trustees and have control over the assets during their joint lifetime. In the event of the death of one spouse, the surviving spouse continues to manage and distribute the trust assets, ensuring seamless asset protection and transfer. 3. Pour-Over Trust: This trust is usually created in conjunction with a will, making it a "pour-over" trust. It allows the granter to transfer any assets left outside the trust at the time of their death into the trust. This ensures that all assets are subject to the provisions and protections of the trust, providing asset protection and efficient distribution. 4. Irrevocable Living Trust: While not technically a revocable trust, it is worth mentioning the irrevocable living trust in the context of asset protection. This type of trust, once established, cannot be modified or revoked by the granter. Assets transferred into an irrevocable trust are no longer considered part of the granter's estate, offering significant protection from creditors and potential lawsuits. Irrevocable trusts are typically used for more advanced asset protection strategies. In conclusion, a San Jose California Revocable Trust for Asset Protection is a valuable tool for individuals and couples to safeguard their assets and provide for their loved ones upon death or incapacity. Whether it is a revocable living trust, joint revocable trust, pour-over trust, or an irrevocable living trust, each type has its own advantages and benefits depending on the specific needs and goals of the granter(s). Seek guidance from an experienced estate planning attorney to determine the most suitable trust to protect your assets and ensure your legacy.

San Jose California Revocable Trust for Asset Protection

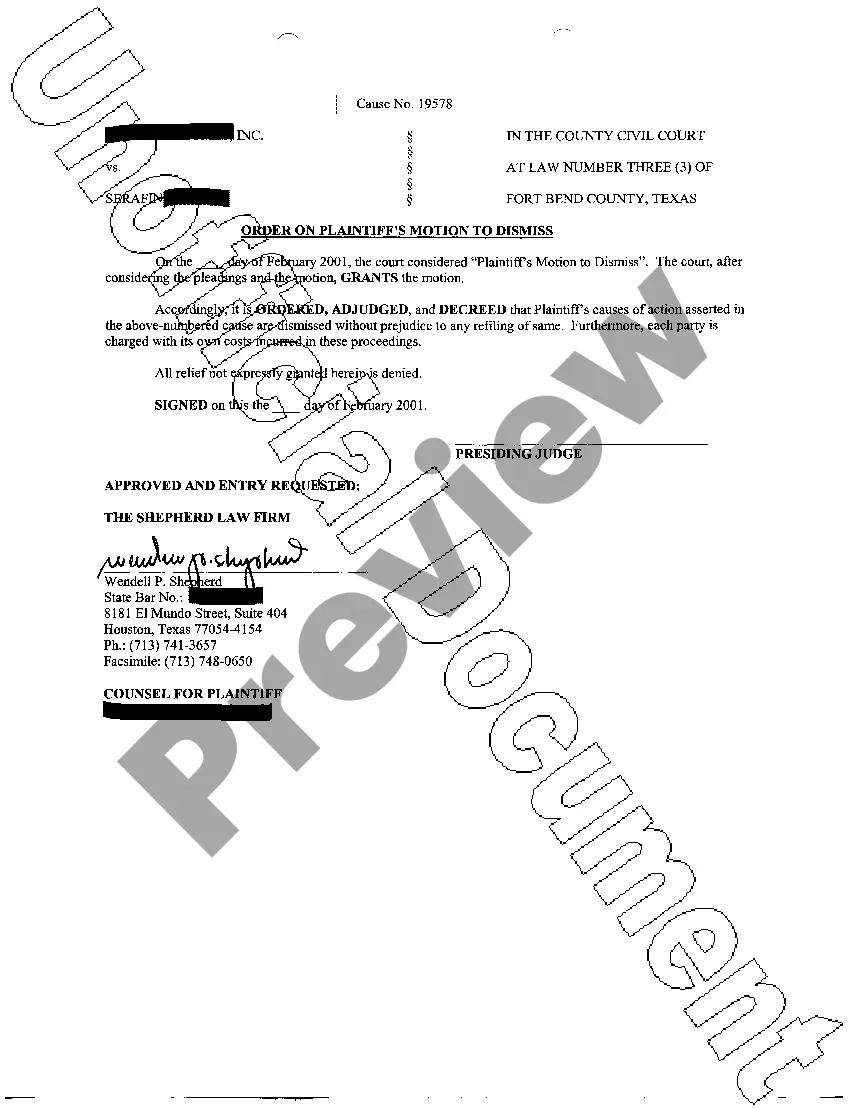

Description

How to fill out San Jose California Revocable Trust For Asset Protection?

Preparing documents for the business or individual demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to consider all federal and state laws of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to create San Jose Revocable Trust for Asset Protection without professional assistance.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid San Jose Revocable Trust for Asset Protection on your own, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal templates that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required document.

In case you still don't have a subscription, adhere to the step-by-step guide below to obtain the San Jose Revocable Trust for Asset Protection:

- Examine the page you've opened and check if it has the sample you require.

- To do so, use the form description and preview if these options are presented.

- To locate the one that meets your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any scenario with just a couple of clicks!

Form popularity

FAQ

How Much Does an Asset Protection Trust Cost? Asset Protection Trusts in Estate Plans are generally not cheap. For a simple domestic plan that's not complex, legal fees could range anywhere from $2000 to about $4000. More complicated Trusts could run up towards the $5000 range.

The property protection trust disadvantages can include the cost, unexpected tax consequences, and the possibility of the trust not working as you intended.

Everyone needs a living revocable trust, says Suze Orman. In response to several emails and tweets asking why a trust is so mandatory, Orman spells it out. "A living revocable trust serves as far more than just where assets are to go upon your death and it does that in an efficient way," she said.

Nevada, South Dakota, Alaska, Ohio, and Delaware have excellent asset protection laws. Nevada likely has the strongest.

There are a number of pros to using this type of trust: Important in estate planning to preserve family wealth. You will have to give less to the local authority and there may be less inheritance tax implications. In terms of preserving the value of your estate, money in trust will be risky than gifts to children.

Revocable trusts are a good choice for those concerned with keeping records and information about assets private after your death. The probate process that wills are subjected to can make your estate an open book since documents entered into it become public record, available for anyone to access.

Irrevocable trust Most trusts can be irrevocable. This type of trust can help protect your assets from creditors and lawsuits and reduce your estate taxes.

A revocable living trust, on the other hand, does not protect your assets from your creditors. This is because a revocable living trust can, by its terms, be changed or terminated at any time during your lifetime. As a result, the trust creator maintains ownership of the assets.

Anyone who is single and has assets titled in their sole name should consider a revocable living trust. The two main reasons are to keep you and your assets out of a court-supervised guardianship, and to allow your beneficiaries to avoid the costs and hassles of probate.

Although California limits asset protection trusts to the benefit of third parties, California does allow for other asset protection strategies for that can protect a person's own assets.