Cuyahoga Ohio Revocable Trust for Lottery Winnings is a legally recognized trust arrangement specifically designed for individuals who have won a significant lottery prize in Cuyahoga County, Ohio. This specialized trust offers lottery winners several important benefits, including asset protection, tax efficiency, and control over the distribution of their winnings. The Cuyahoga Ohio Revocable Trust for Lottery Winnings provides a secure and reliable way for lottery winners to manage their newfound wealth. By placing their winnings into the trust, winners can protect their assets from potential creditors and lawsuits. This is particularly crucial for individuals who may face financial risks or are concerned about preserving their wealth for future generations. One of the primary advantages of this revocable trust is its tax efficiency. With careful planning and structuring, lottery winners can minimize their tax liability and maximize the amount of money they can keep. By working closely with legal and financial experts, winners can navigate complex tax laws and ensure their assets are protected and managed in a tax-optimal manner. Moreover, the Cuyahoga Ohio Revocable Trust for Lottery Winnings allows for control over the distribution of funds. Winners can determine how and when their winnings will be distributed, ensuring that beneficiaries or heirs receive the assets according to their wishes. This level of control ensures responsible financial management and can provide peace of mind to lottery winners who want to leave a lasting legacy. There are various types of Cuyahoga Ohio Revocable Trusts for Lottery Winnings that individuals can consider, depending on their specific needs and goals. Some potential types include: 1. Standard Revocable Trust: This is the most basic form of a revocable trust designed for lottery winners. It offers asset protection, tax benefits, and control over distribution, ensuring that the winnings are managed in the most efficient manner. 2. Charitable Remainder Trust: For lottery winners who are philanthropically inclined, this type of trust enables them to donate a portion of their winnings to charitable causes. By doing so, winners can benefit from tax deductions while supporting organizations close to their hearts. 3. Generation-Skipping Trust: This trust type allows lottery winners to transfer their winnings and assets directly to their grandchildren while minimizing estate taxes. This trust can be advantageous in preserving wealth for future generations and providing financial security for grandchildren. 4. Successor Trust: In the event of the original trust creator's incapacitation or passing, a successor trust ensures a smooth transition of managing and distributing the lottery winnings. This type of trust offers continuity and ensures the wishes of the original winner are honored. In conclusion, the Cuyahoga Ohio Revocable Trust for Lottery Winnings is a valuable tool available to protect, manage, and distribute winnings for lottery winners in Cuyahoga County, Ohio. By understanding the different types of revocable trusts available, individuals can tailor their estate plan to their specific needs and goals, ensuring the longevity and responsible management of their lottery winnings.

Cuyahoga Ohio Revocable Trust for Lottery Winnings

Description

How to fill out Cuyahoga Ohio Revocable Trust For Lottery Winnings?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring ownership, and lots of other life situations require you prepare formal paperwork that varies throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any personal or business objective utilized in your region, including the Cuyahoga Revocable Trust for Lottery Winnings.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Cuyahoga Revocable Trust for Lottery Winnings will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guideline to get the Cuyahoga Revocable Trust for Lottery Winnings:

- Ensure you have opened the proper page with your local form.

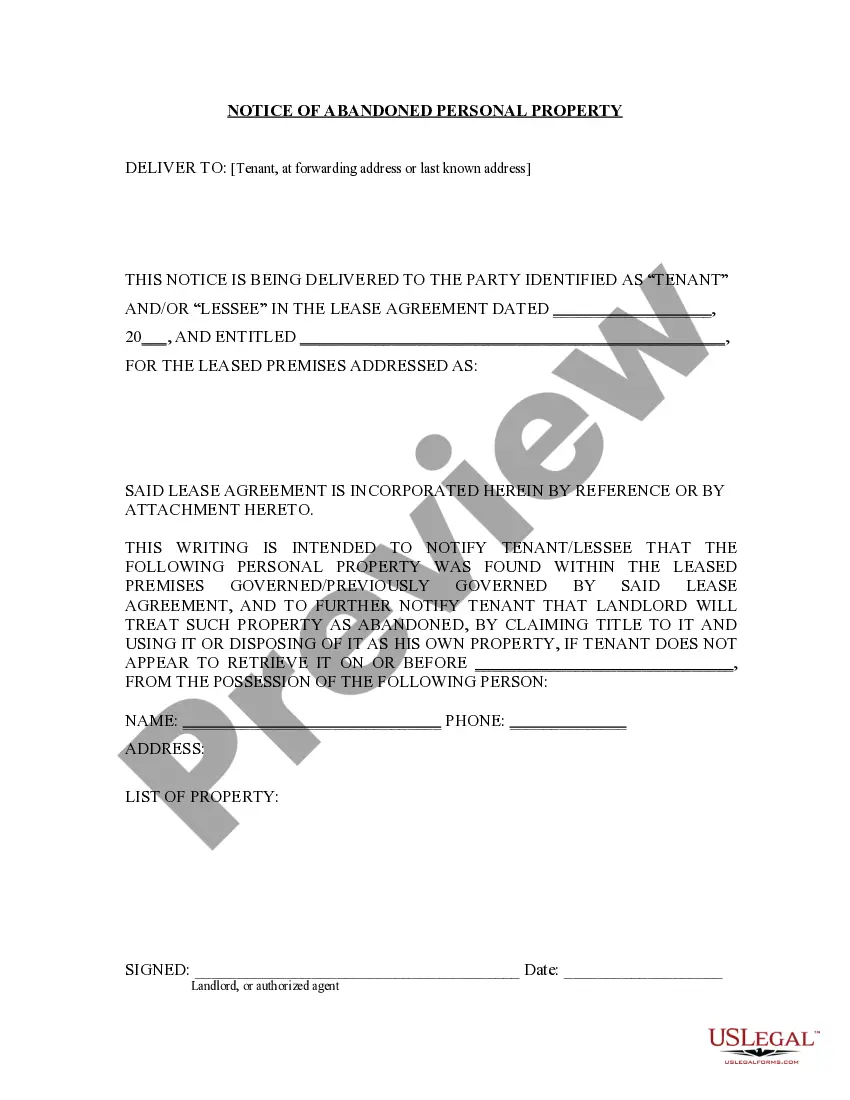

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template corresponds to your needs.

- Look for another document using the search option if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the suitable subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Cuyahoga Revocable Trust for Lottery Winnings on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!