Philadelphia Pennsylvania Revocable Trust for Lottery Winnings

Description

How to fill out Philadelphia Pennsylvania Revocable Trust For Lottery Winnings?

Laws and regulations in every area differ throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Philadelphia Revocable Trust for Lottery Winnings, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you pick a sample, it remains available in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Philadelphia Revocable Trust for Lottery Winnings from the My Forms tab.

For new users, it's necessary to make several more steps to get the Philadelphia Revocable Trust for Lottery Winnings:

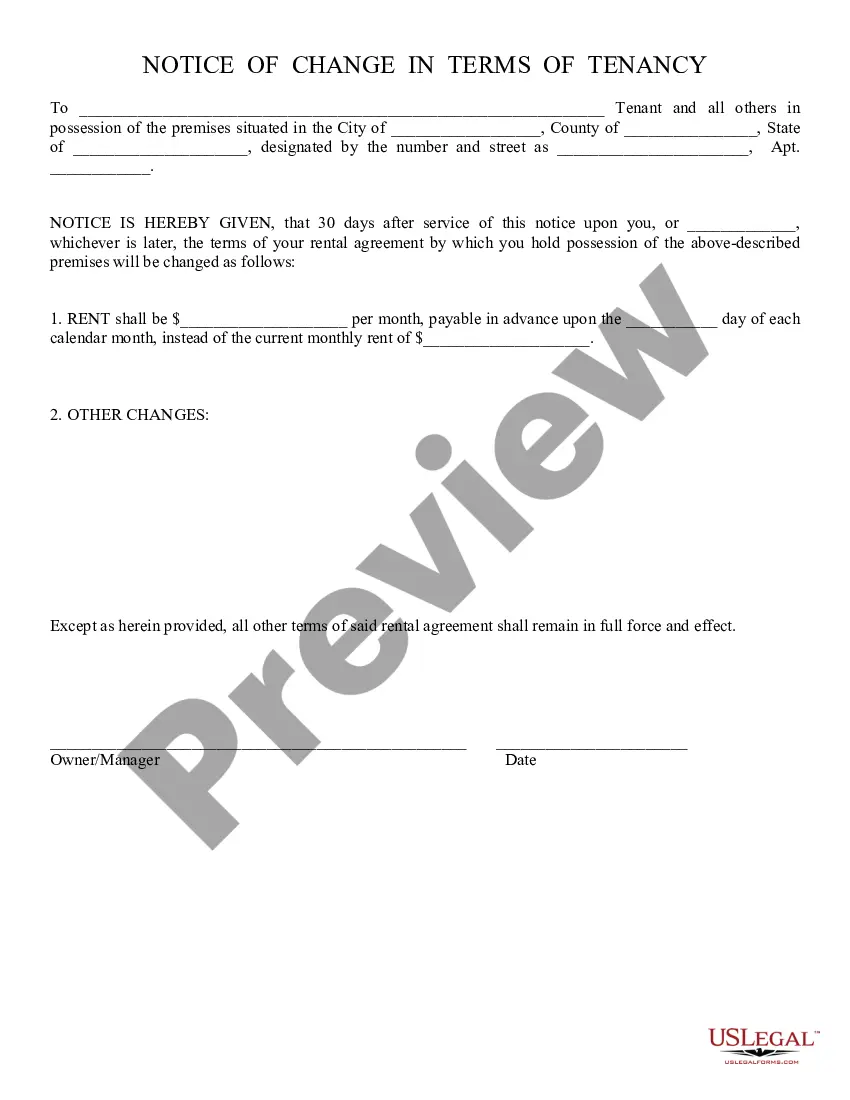

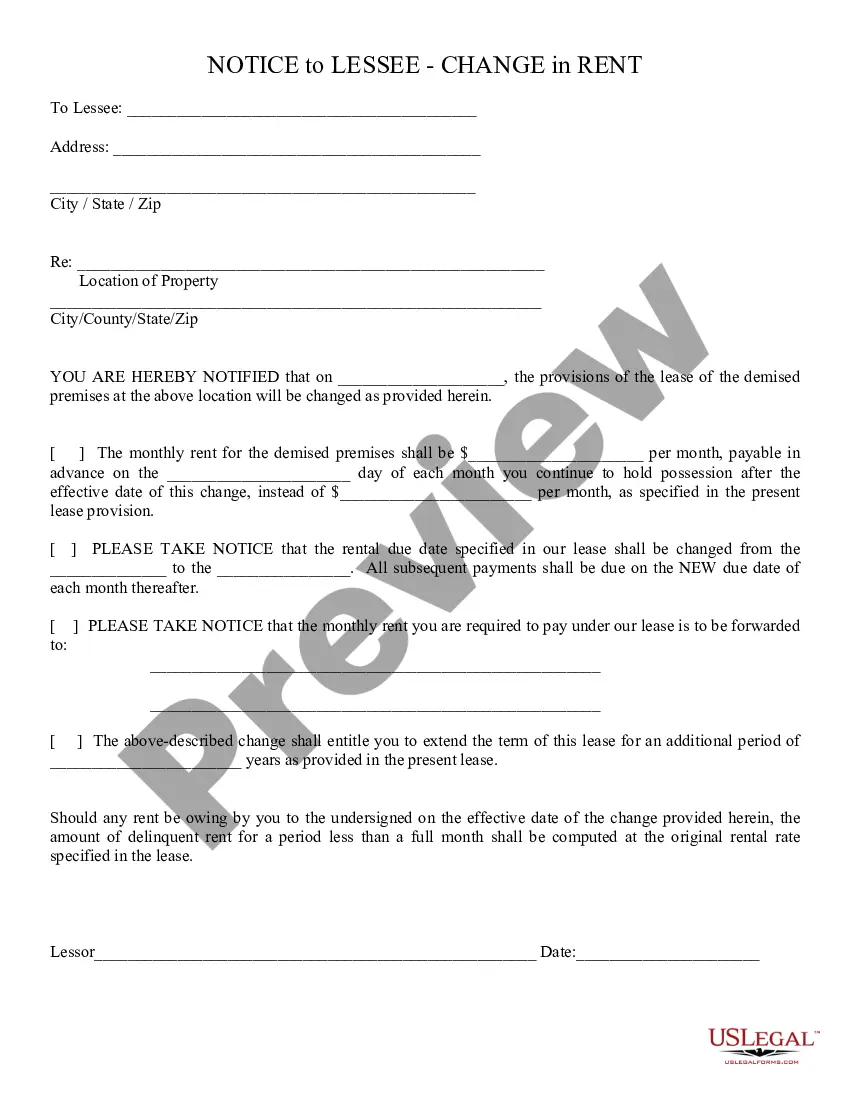

- Take a look at the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template once you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

State Laws About Trusts A few states, including Pennsylvania, prohibit blind trusts from claiming lottery winnings, but they permit other trusts to do so. This is good news because even if your state prohibits blind trusts, you can still use another form of trust to help manage your large windfall of cash.

What to Do Before Claiming Your Prize Protect Your Ticket.Don't Rush to Claim Your Prize.Don't Quit Your Job or Spread News of Your Good Fortune.Hire Professionals.Change Your Address & Go Unlisted.Taking the Lump-Sum Payout.Taking the Long-Term Payout.Consult With the Professionals You Hired.

While an annuity may offer more financial security over a longer period of time, you can invest a lump sum, which could offer you more money down the road. Take the time to weigh your options, and choose the one that's best for your financial situation.

Pennsylvania Lottery winners cannot remain anonymous. Only certain claimant information can be released. This assures the public that Lottery winners are real people and that the Lottery operates with integrity and transparency.

Irrevocable trusts protect lottery winnings because the assets legally do not belong to you. They also benefit your survivors as they are not subject to estate taxes. Blind trusts are also suitable as they protect your winnings from unscrupulous relatives and friends who want your property.

We talked to several professionals including lawyers and one of the world's top blackjack players to get their best tips. Buy your ticket in a state that doesn't require you to come forward.Don't tell anyone.Delete social media accounts (and change your phone number and address, too).Wear a disguise.

If the lottery administrators will distribute your winnings to you in lump sum and you don't trust yourself to manage them, you can set up the trust so that funds are distributed to you over time, and grant the trustee the authority to invest trust assets without your knowledge or consent.

They can collect their prize through this trust to keep their identity hidden. The state of California does not permit lottery winners to hide their identities. California winners are compelled by law to reveal their names and locations. This places them at higher risk. Many people hope to keep their win private.