San Diego California Revocable Trust for Lottery Winnings is a legal instrument that allows lottery winners in San Diego, California, to establish a trust to manage and protect their winnings. This type of trust provides flexibility and control over the distribution and management of lottery proceeds while ensuring the preservation of assets. One of the primary benefits of a San Diego California Revocable Trust for Lottery Winnings is its revocable nature. This means that the creator of the trust, known as the granter or settler, can modify or revoke the trust at any time during their lifetime. This flexibility allows lottery winners to adapt the trust to their changing circumstances or goals. Several types of San Diego California Revocable Trusts for Lottery Winnings may exist, such as: 1. Discretionary Trust: This type of trust gives the trustee full discretion to distribute lottery winnings and income to the beneficiaries according to their individual needs. The trustee can consider factors such as education, health, and welfare when making distribution decisions. It provides an added layer of protection against mismanagement of funds by beneficiaries. 2. Spendthrift Trust: A spendthrift trust protects lottery winnings from creditors, ensuring that beneficiaries cannot transfer or pledge their future interests in the trust for loans or attachments. The trust assets are shielded from the reach of creditors, providing an additional layer of security for the beneficiaries. 3. Special Needs Trust: This trust is specifically designed for lottery winners who have beneficiaries with special needs. It ensures that the winnings do not disqualify the beneficiaries from government benefits and programs they may be entitled to. The trust can be crafted to supplement public assistance, ensuring their quality of life is maintained without jeopardizing their eligibility. 4. Charitable Trust: For individuals looking to make philanthropic contributions from their lottery winnings, a charitable trust can be established. This type of trust allows the granter to support charitable causes while potentially providing tax benefits. The trust can be tailored to support specific charitable organizations or causes chosen by the granter. Regardless of the specific type of San Diego California Revocable Trust for Lottery Winnings chosen, it is crucial to consult with a qualified estate planning attorney to ensure compliance with California state laws and to properly draft the trust agreement. Professional guidance ensures that the trust meets the granter's specific goals, protects the beneficiary's interests, and addresses any potential tax implications. Overall, a San Diego California Revocable Trust for Lottery Winnings provides lottery winners with a versatile tool to safeguard and effectively manage their newfound wealth while allowing for customization based on the unique needs and objectives of the granter and beneficiaries.

San Diego California Revocable Trust for Lottery Winnings

Description

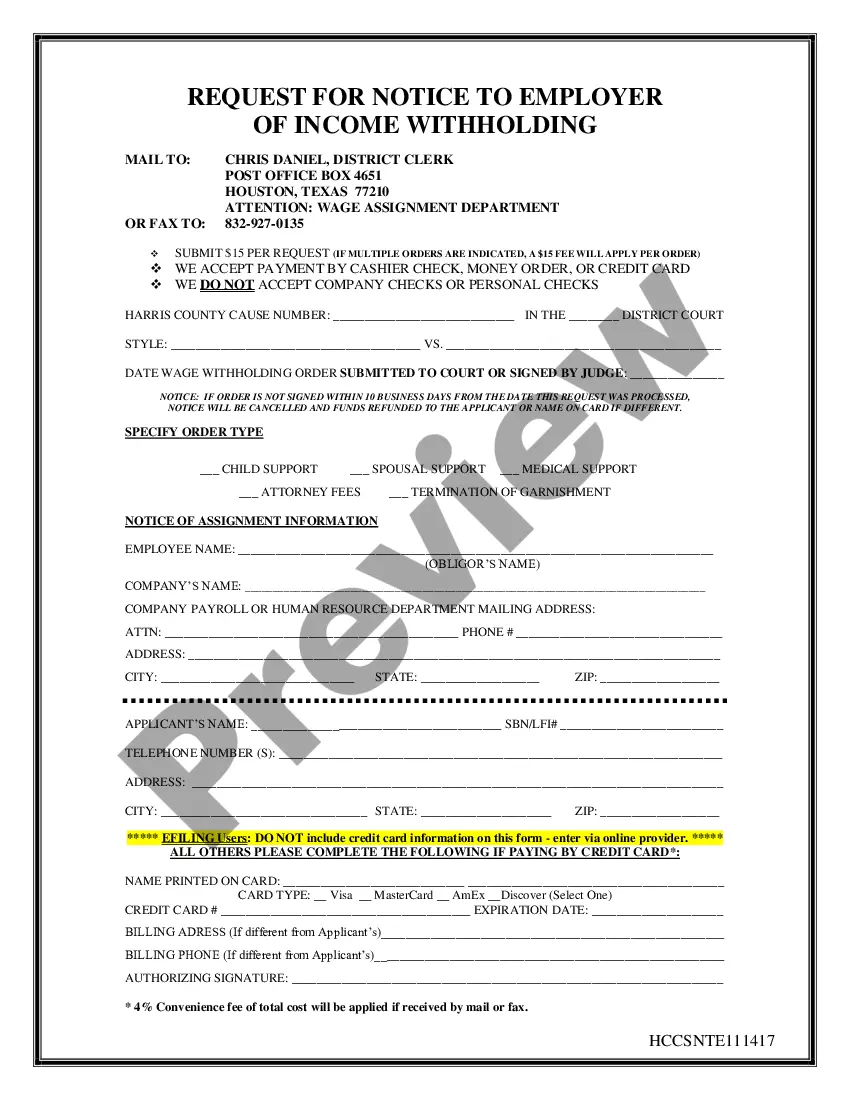

How to fill out San Diego California Revocable Trust For Lottery Winnings?

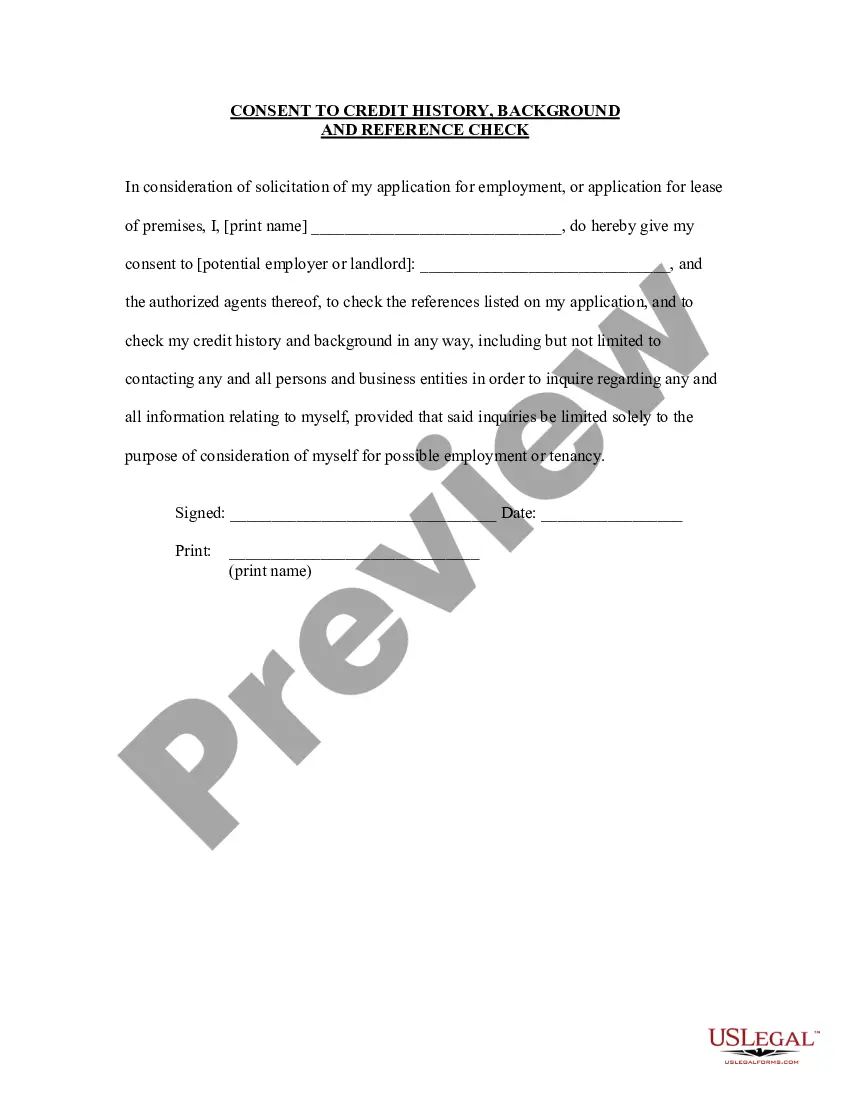

If you need to get a trustworthy legal paperwork supplier to obtain the San Diego Revocable Trust for Lottery Winnings, look no further than US Legal Forms. No matter if you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can browse from over 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of supporting materials, and dedicated support team make it easy to get and execute various paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply select to search or browse San Diego Revocable Trust for Lottery Winnings, either by a keyword or by the state/county the document is created for. After locating necessary template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to start! Simply find the San Diego Revocable Trust for Lottery Winnings template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Create an account and select a subscription plan. The template will be instantly available for download once the payment is processed. Now you can execute the form.

Handling your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes this experience less pricey and more affordable. Set up your first company, organize your advance care planning, draft a real estate contract, or execute the San Diego Revocable Trust for Lottery Winnings - all from the convenience of your home.

Sign up for US Legal Forms now!