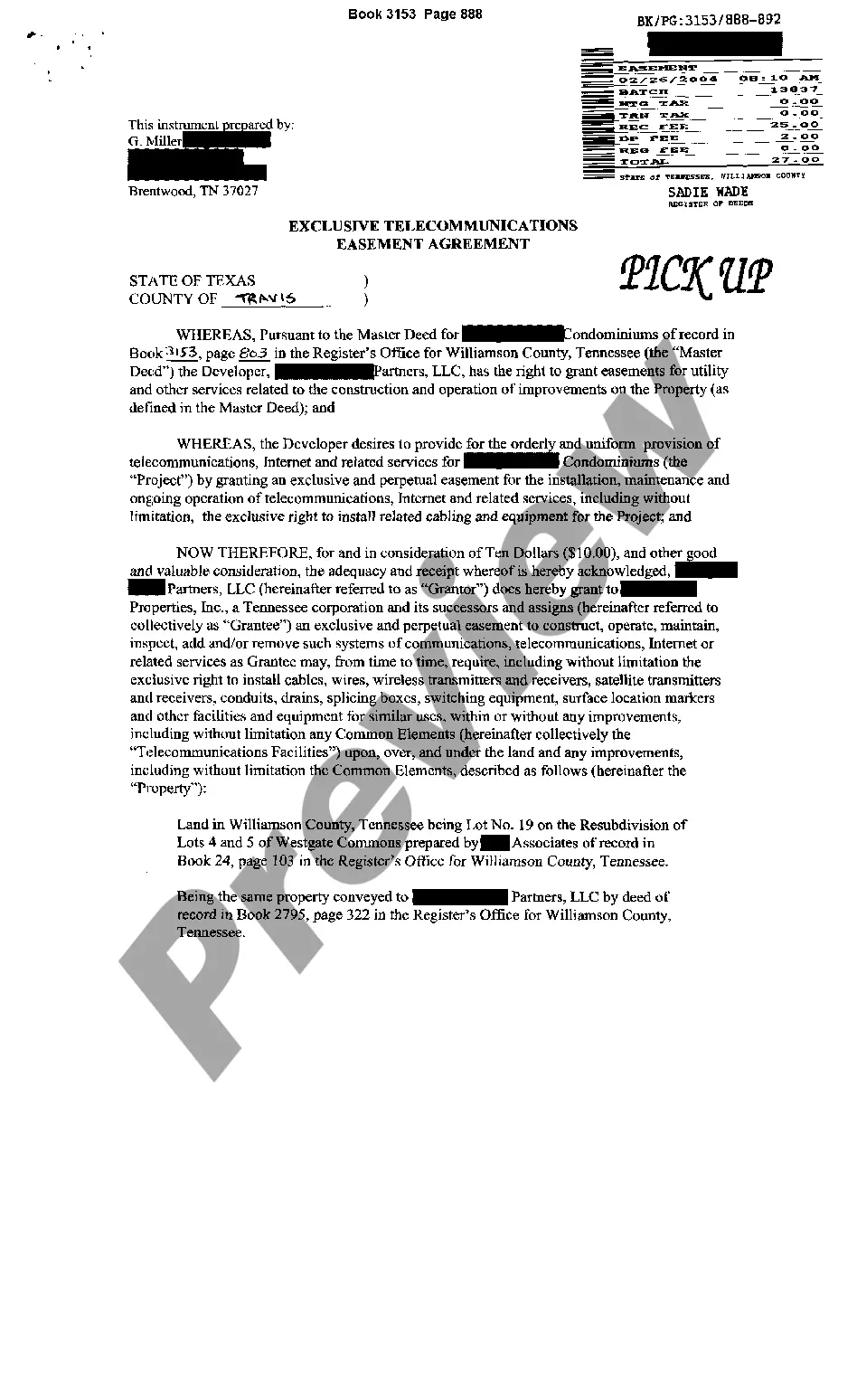

A Mecklenburg North Carolina Revocable Trust for Real Estate is a legal entity designed to hold, manage, and distribute real estate assets in Mecklenburg County, North Carolina. It is established by a granter who transfers ownership of their real property assets into the trust, which is then managed by a trustee. The uniqueness of this trust lies in its ability to be altered or revoked by the granter during their lifetime, offering flexibility and control over the assets held within. Some different types of Mecklenburg North Carolina Revocable Trusts for Real Estate may include: 1. Revocable Living Trust: A widely used type of trust that allows the granter to retain full control over the assets during their lifetime while designating beneficiaries who will receive the property after their passing. It can help avoid probate and provide privacy in asset distribution. 2. Family Trust: This type of trust extends beyond the granter's lifetime, providing a means for the seamless transfer of real estate assets to future generations. Typically, it allows for the continued management of properties for the benefit of family members while minimizing tax consequences. 3. Charitable Remainder Trust: A trust designed to benefit both the granter and a designated charity. Real estate assets are transferred into the trust, and the granter retains the right to receive income generated from the property during their lifetime. Upon their passing, the remaining assets are then donated to the chosen charity. 4. Special Needs Trust: This trust is specifically created to provide ongoing care and financial support for beneficiaries with special needs. Real estate assets held within the trust can be managed and utilized for the benefit of the individual while maintaining their eligibility for government assistance programs. 5. Testamentary Trust: Unlike revocable trusts, a testamentary trust is established through the granter's will and only comes into effect upon their passing. It allows for the distribution of real estate assets to specified beneficiaries according to the granter's wishes, potentially minimizing estate taxes and providing asset protection. With a Mecklenburg North Carolina Revocable Trust for Real Estate, individuals can maintain control over their real property assets, avoid the often costly and time-consuming probate process, and provide for seamless asset transfers to their loved ones or a designated charitable organization. It is imperative to consult with an experienced attorney specializing in estate planning and real estate law to create and tailor a trust that meets specific needs and objectives.

Mecklenburg North Carolina Revocable Trust for Real Estate

Description

How to fill out Mecklenburg North Carolina Revocable Trust For Real Estate?

If you need to get a trustworthy legal document supplier to obtain the Mecklenburg Revocable Trust for Real Estate, look no further than US Legal Forms. Whether you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate form.

- You can browse from more than 85,000 forms arranged by state/county and case.

- The self-explanatory interface, number of supporting resources, and dedicated support team make it simple to find and complete various papers.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

Simply select to search or browse Mecklenburg Revocable Trust for Real Estate, either by a keyword or by the state/county the document is created for. After locating needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the Mecklenburg Revocable Trust for Real Estate template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and click Buy now. Register an account and select a subscription plan. The template will be immediately ready for download as soon as the payment is completed. Now you can complete the form.

Taking care of your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes this experience less costly and more reasonably priced. Set up your first business, arrange your advance care planning, create a real estate agreement, or complete the Mecklenburg Revocable Trust for Real Estate - all from the convenience of your sofa.

Join US Legal Forms now!