Suffolk New York Revocable Trust for Child A Suffolk New York Revocable Trust for Child is a legally binding arrangement that allows parents or guardians in Suffolk County, New York to protect and manage assets on behalf of their children. This trust provides the opportunity for parents to plan for their child's future financial well-being while maintaining flexibility and control over the assets within the trust. Keywords: Suffolk New York, Revocable Trust, Child, parents, guardians, assets, future financial well-being, flexibility, control. There are different types of Suffolk New York Revocable Trust for Child, namely: 1. Living Trust for Child: This type of revocable trust is created during the parent's lifetime and allows them to transfer assets to the trust to be managed for the benefit of their child. The parent can act as the trustee, maintaining control over the assets until a predetermined point in the child's life or until the revocable trust is terminated. 2. Testamentary Trust for Child: This type of revocable trust is established within a parent's will and only goes into effect upon their death. The trust assets are then managed by a designated trustee for the benefit of the child, following the instructions outlined in the will. 3. Education Trust for Child: This revocable trust focuses specifically on funding a child's education in Suffolk New York. Parents can set aside funds and assets to be used solely for educational purposes, ensuring that their child has the financial means to pursue higher education. 4. Minor's Trust: This type of revocable trust is designed to provide financial support and asset management for a child until they reach a specific age, typically 18 or 21, in Suffolk, New York. Parents can establish rules and guidelines for managing the assets within the trust, ensuring their child's financial security while gradually transferring control and ownership as they mature. Overall, a Suffolk New York Revocable Trust for Child offers parents and guardians the peace of mind that their child's financial future is protected and well-managed. By utilizing different types of revocable trusts, parents can tailor the trust to their specific needs and ensure that their child's best interests are served.

Suffolk New York Revocable Trust for Child

Description

How to fill out Suffolk New York Revocable Trust For Child?

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Suffolk Revocable Trust for Child, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business occasions. All the forms can be used many times: once you purchase a sample, it remains available in your profile for future use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Suffolk Revocable Trust for Child from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Suffolk Revocable Trust for Child:

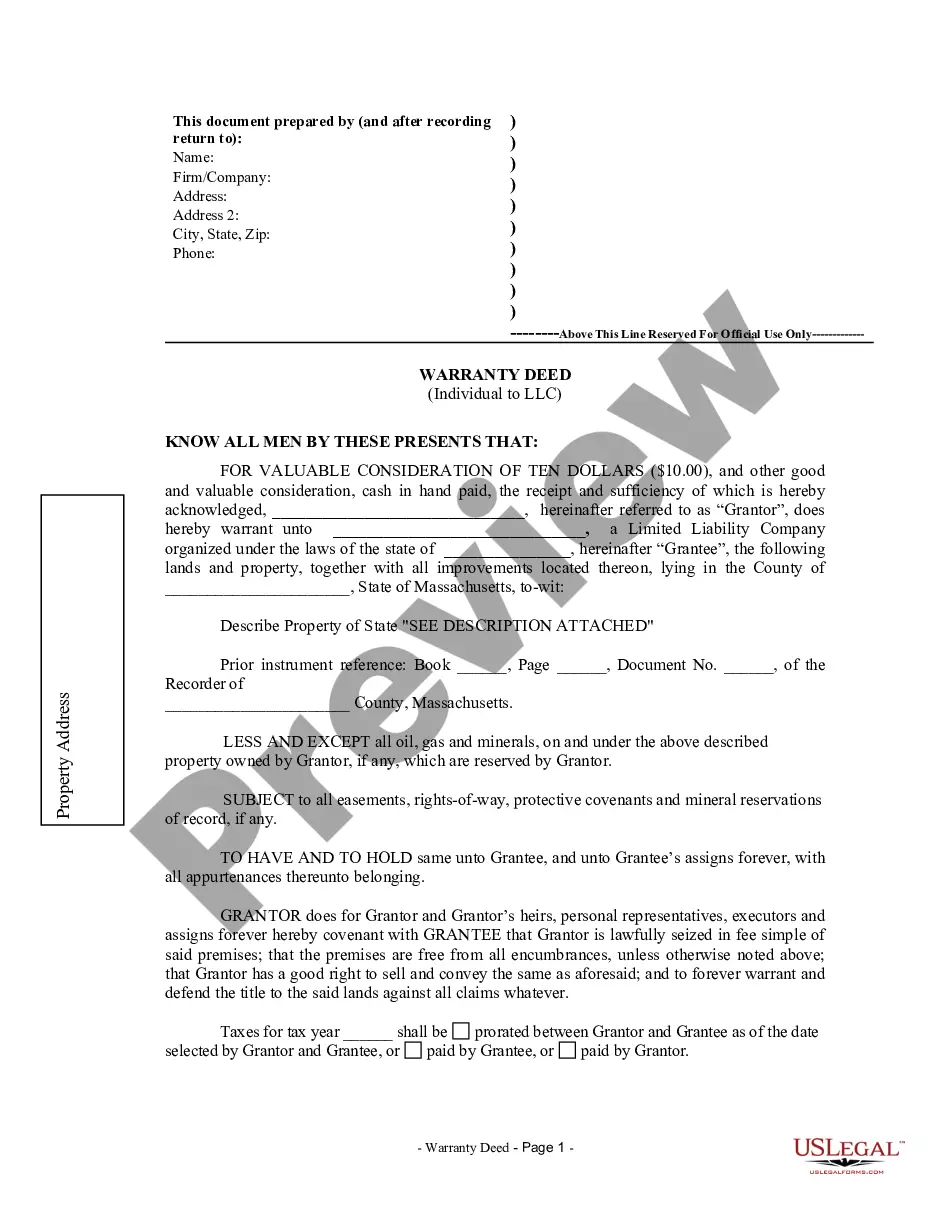

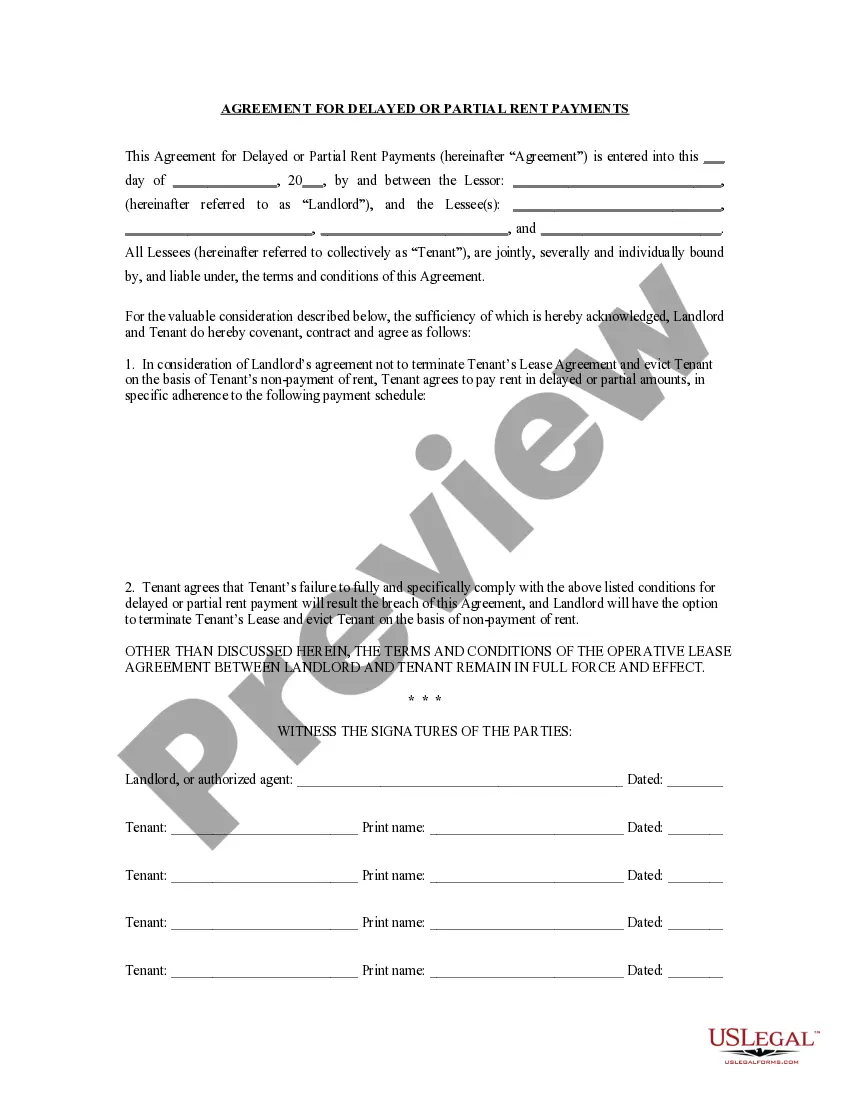

- Examine the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the template once you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

What Type of Assets Go into a Trust? Bonds and stock certificates. Shareholders stock from closely held corporations. Non-retirement brokerage and mutual fund accounts. Money market accounts, cash, checking and savings accounts. Annuities. Certificates of deposit (CD) Safe deposit boxes.

The Pros and Cons of Revocable Living Trusts Probate can be avoided.Ancillary probate in another state can also be avoided.Protection in case of incapacitation.No immediate tax benefits.No asset protection.It requires some administrative work.

Assets That Can And Cannot Go Into Revocable Trusts Real estate.Financial accounts.Retirement accounts.Medical savings accounts.Life insurance.Questionable assets.

Some of the Cons of a Revocable Trust Shifting assets into a revocable trust won't save income or estate taxes. No asset protection. Although assets held in an irrevocable trust are generally beyond the reach of creditors, that's not true with a revocable trust.

Everyone needs a living revocable trust, says Suze Orman. In response to several emails and tweets asking why a trust is so mandatory, Orman spells it out. "A living revocable trust serves as far more than just where assets are to go upon your death and it does that in an efficient way," she said.

The primary benefit of creating a revocable trust is that it provides a prearranged mechanism that will ensure the continued management and preservation of your assets, should you become disabled. It can also set forth all of the dispositive provisions of your estate plan.

If you created a revocable living trust to avoid probate and you think that your estate plan is done once you've signed your trust documents, it isn't....What Assets Should Go Into a Trust? Bank Accounts.Corporate Stocks.Bonds.Tangible Investment Assets.Partnership Assets.Real Estate.Life Insurance.

To make sure your Beneficiaries can easily access your accounts and receive their inheritance, protect your assets by putting them in a Trust. A Trust-Based Estate Plan is the most secure way to make your last wishes known while protecting your assets and loved ones.

A revocable living trust is a trust document created by an individual that can be changed over time. Revocable living trusts are used to avoid probate and to protect the privacy of the trust owner and beneficiaries of the trust as well as minimize estate taxes.