A Houston Texas Revocable Trust for Minors is a legal tool designed to manage and protect assets left to minors in the event of the granter's (person establishing the trust) incapacity or death. It enables parents or guardians to have control over how their assets are distributed to their children until they reach a certain age or maturity level. Revocable trusts are flexible and can be modified or terminated by the granter during their lifetime. There are different types of Houston Texas Revocable Trusts for Minors, each offering specific advantages depending on the needs and goals of the granter. Some common types include: 1. Education Trust: This trust focuses on providing financial assistance for the beneficiary's education expenses until they complete college or attain a specific degree. 2. Support Trust: A support trust ensures that beneficiaries receive monetary support for their essential needs such as healthcare, housing, education, and general welfare, until they reach a certain age or milestone. 3. Spendthrift Trust: This type of trust protects the beneficiary from wasting or squandering their inheritance by providing controlled distributions over a longer period. This is particularly useful if the granter believes the beneficiary may struggle with financial management. 4. Special Needs Trust: Designed for individuals with special needs or disabilities, this trust ensures they can receive financial assistance without jeopardizing their eligibility for government benefits. 5. Living Trust: Unlike testamentary trusts established through a will, a living trust takes effect during the granter's lifetime and allows them to manage and distribute assets to minors according to their wishes. 6. Life Insurance Trust: This trust is often established to manage life insurance policy proceeds, ensuring they are disbursed to minors in a controlled manner while reducing estate taxes. When establishing a Revocable Trust for Minors in Houston, Texas, it is advisable to consult with an experienced estate planning attorney to navigate the legal complexities and ensure all aspects comply with state laws. By setting up a trust, parents or guardians gain peace of mind knowing that their minor children's financial future is secure and managed according to their intentions.

Houston Texas Revocable Trust for Minors

Description

How to fill out Houston Texas Revocable Trust For Minors?

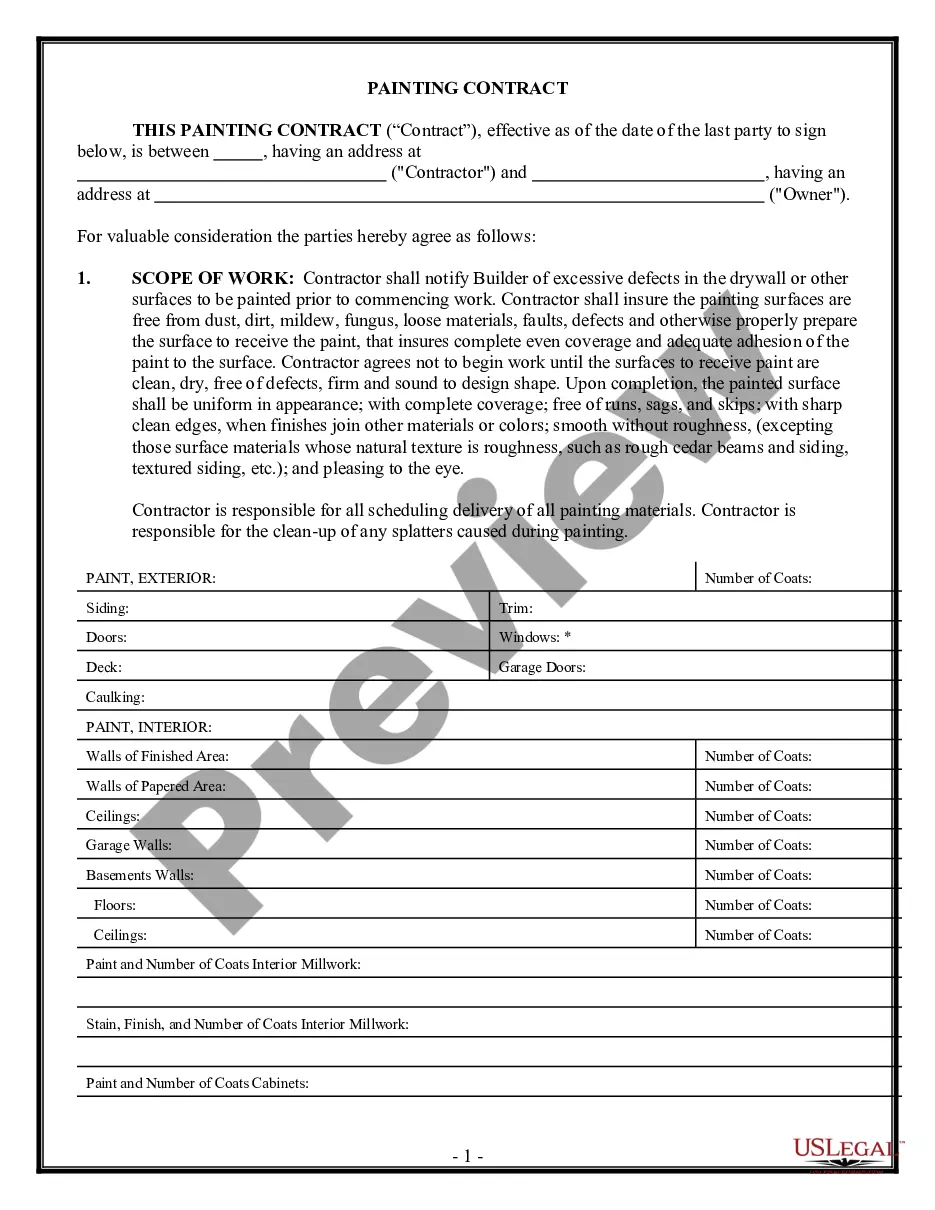

Draftwing documents, like Houston Revocable Trust for Minors, to take care of your legal matters is a difficult and time-consumming process. A lot of cases require an attorney’s participation, which also makes this task expensive. Nevertheless, you can acquire your legal affairs into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal documents created for a variety of cases and life circumstances. We ensure each document is compliant with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Houston Revocable Trust for Minors form. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your document? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly simple! Here’s what you need to do before downloading Houston Revocable Trust for Minors:

- Make sure that your template is specific to your state/county since the regulations for writing legal paperwork may vary from one state another.

- Find out more about the form by previewing it or going through a brief intro. If the Houston Revocable Trust for Minors isn’t something you were looking for, then use the header to find another one.

- Sign in or register an account to start using our website and get the document.

- Everything looks good on your end? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your template is ready to go. You can try and download it.

It’s easy to locate and buy the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other perks you can get with US Legal Forms!