A revocable trust for a married couple in Franklin, Ohio is a legal arrangement designed to protect the assets and interests of a couple during their lifetime, as well as ensure proper distribution of their estate upon their passing. This trust is established and managed according to Ohio state laws and regulations. The Franklin Ohio Revocable Trust for Married Couple allows couples to have control over their assets during their lifetime while offering flexibility and potential tax benefits. It is essential to consider various types of revocable trusts suited for different couples' needs: 1. Basic Revocable Trust: A straightforward trust that allows the married couple to retain control over their assets and make changes or revoke the trust at any time. 2. A-B Trust: Also known as a "bypass trust" or "credit shelter trust," this type of trust aims to minimize estate taxes upon the passing of the first spouse. It splits the trust into two parts: one part holds the assets of the deceased spouse, which are not subject to estate tax, while the surviving spouse retains access to the remaining assets, providing financial security. 3. TIP Trust: The Qualified Terminable Interest Property Trust ensures that the surviving spouse receives income generated from the trust assets during their lifetime, while ultimately dictating the distribution of the assets upon their passing. This type of trust is particularly useful for couples with children from previous marriages or situations where the surviving spouse needs financial support but is not the ultimate beneficiary. 4. Marital Property Trust: This type of trust is designed to preserve marital property rights while offering protection against creditors or claims from beneficiaries other than the surviving spouse. It ensures that each spouse's assets are recognized as his/her own and will be distributed according to their wishes. 5. Living Trust: Sometimes referred to as an "inter vivos trust," the living trust allows the married couple to transfer assets into the trust during their lifetime and retain control over them. It offers flexibility, the ability to avoid probate, and may provide other benefits based on specific provisions tailored to the couple's needs. In conclusion, the Franklin Ohio Revocable Trust for Married Couple offers couples the opportunity to protect their assets, provide for their loved ones, and preserve their estate's value. By utilizing different types of revocable trusts, couples can tailor their estate plans to suit their unique circumstances and goals. It is advisable to consult with an experienced estate planning attorney to determine the most suitable trust type and to ensure compliance with Ohio state laws.

Franklin Ohio Revocable Trust for Married Couple

Description

How to fill out Franklin Ohio Revocable Trust For Married Couple?

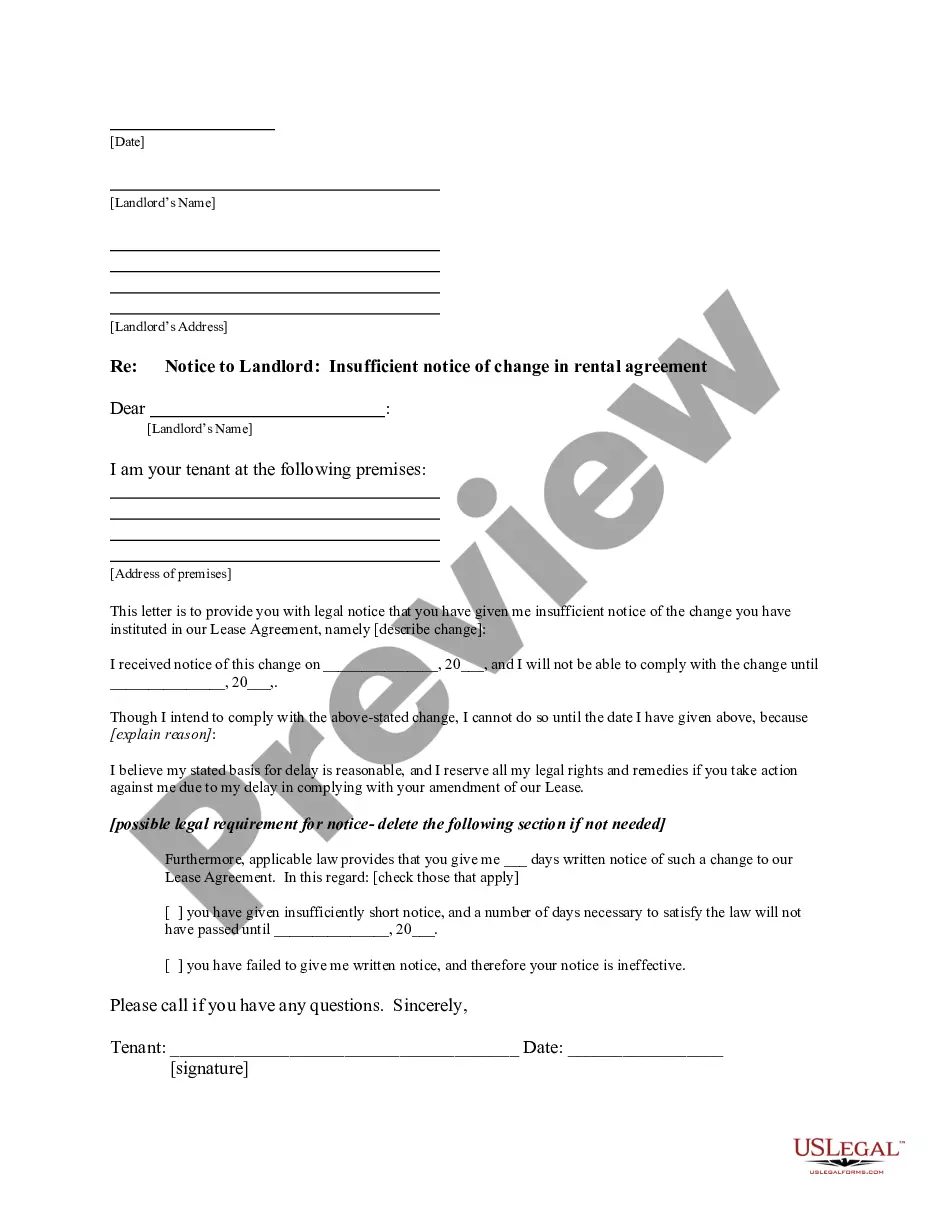

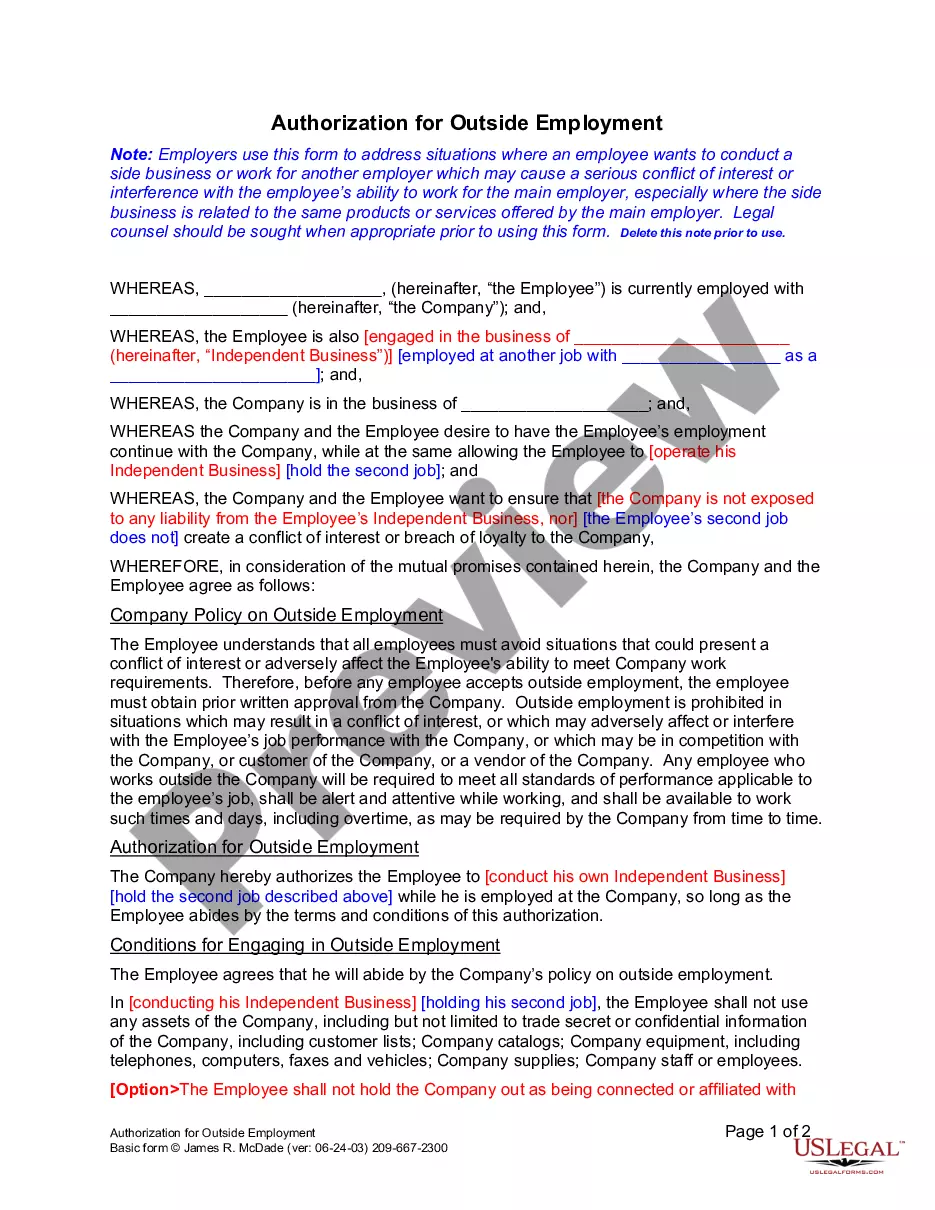

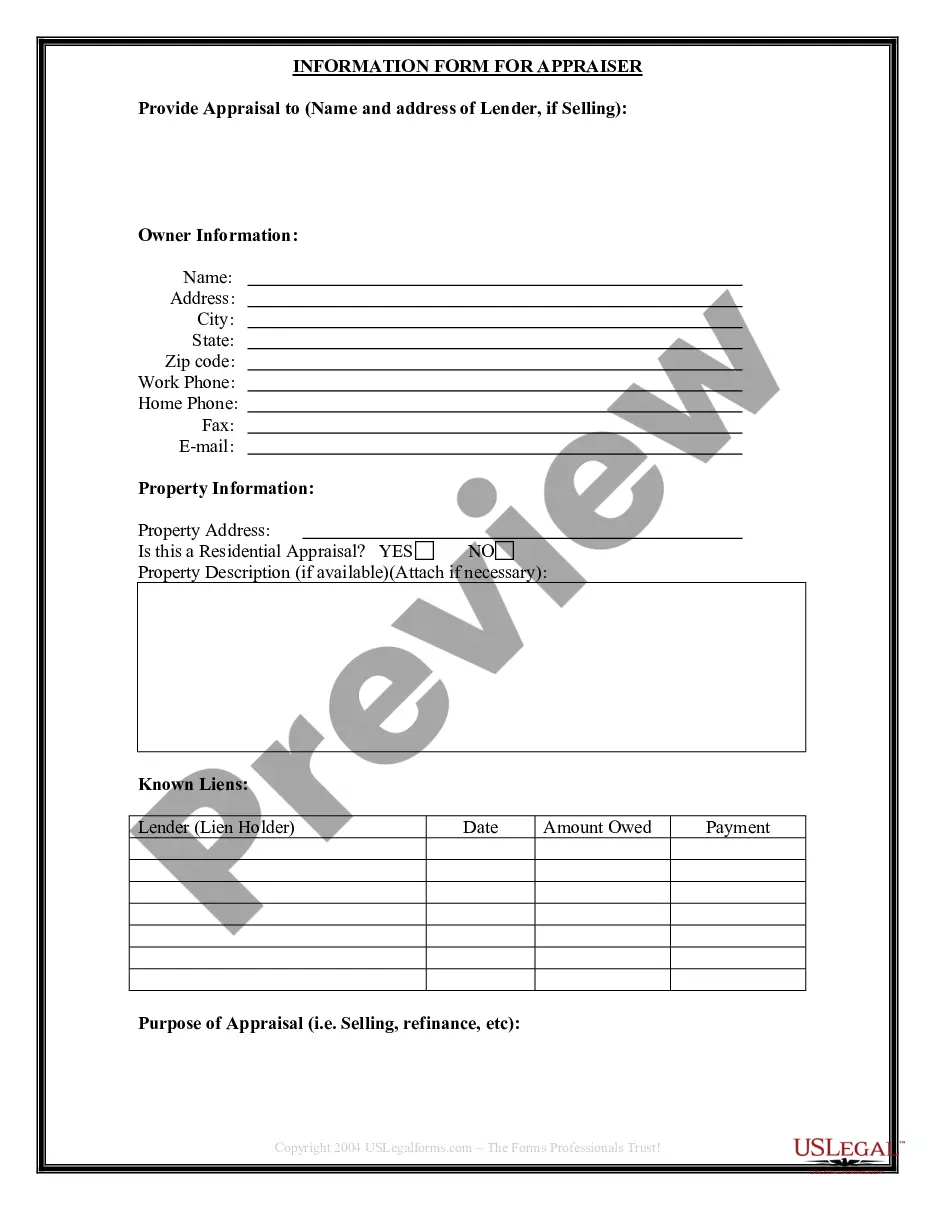

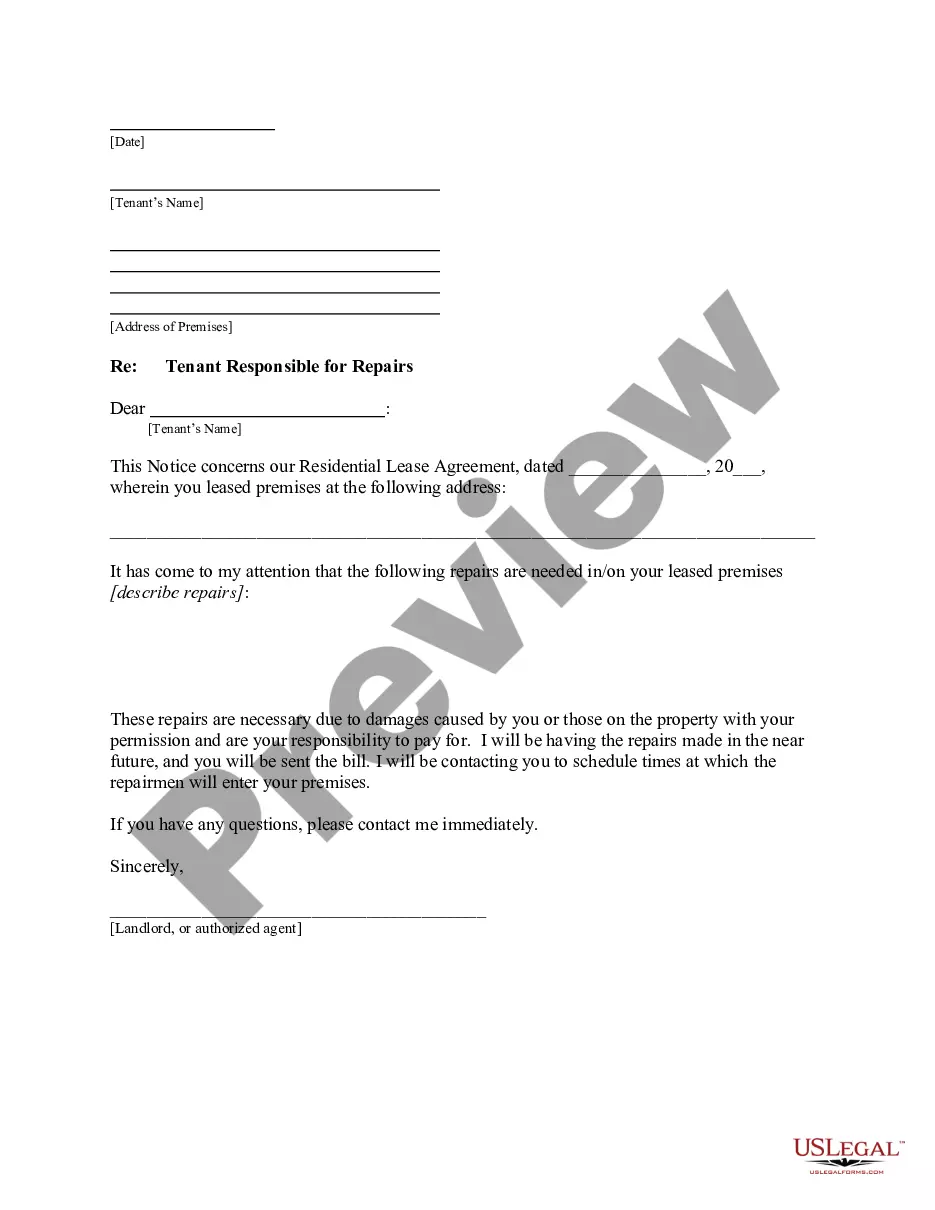

Dealing with legal forms is a must in today's world. However, you don't always need to look for qualified assistance to create some of them from scratch, including Franklin Revocable Trust for Married Couple, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in different types ranging from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching process less frustrating. You can also find information resources and guides on the website to make any tasks associated with paperwork execution straightforward.

Here's how you can locate and download Franklin Revocable Trust for Married Couple.

- Take a look at the document's preview and outline (if provided) to get a general idea of what you’ll get after downloading the document.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can affect the validity of some documents.

- Examine the similar document templates or start the search over to locate the appropriate document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment gateway, and buy Franklin Revocable Trust for Married Couple.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Franklin Revocable Trust for Married Couple, log in to your account, and download it. Of course, our website can’t replace a lawyer entirely. If you need to cope with an exceptionally difficult case, we recommend using the services of a lawyer to review your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of users. Become one of them today and get your state-specific documents effortlessly!