A Hillsborough Florida Revocable Trust for Married Couples is a legal arrangement that allows spouses residing in Hillsborough County, Florida to protect and manage their assets during their lifetime and after their passing. It provides flexibility, control, and privacy, allowing individuals to avoid probate court proceedings and secure the uninterrupted transfer of their assets to heirs. A revocable trust, also known as a living trust, is a popular option for married couples looking to establish a comprehensive estate plan. It is revocable, meaning it can be modified or dissolved during the lifetime of the trust creators. The trust creators, who are usually the married couple, become the trustees and maintain control over the trust assets. In the event of their incapacitation or death, a successor trustee will take over the management and distribution of assets according to the stipulations set in the trust. Some common types of Hillsborough Florida Revocable Trusts for Married Couples include: 1. Joint Revocable Trust: This type of trust is a single entity created and managed jointly by both spouses. It allows for the seamless transfer of assets upon the death of one spouse to the surviving spouse while maintaining control over the remaining assets. 2. Separate Revocable Trust: Also known as individual trusts or "A-B trusts," this option allows each spouse to create and manage their own trust. It is particularly useful for couples with different asset ownership or those who want to maintain separate control over their share of assets. 3. Pour-over Will Trust: This trust is established alongside a pour-over will, which ensures that any assets not properly titled in the name of the trust during the creators' lifetime are transferred into the trust upon their death. This option acts as a safety net to ensure all assets are protected and distributed according to the trust's provisions. By utilizing a Hillsborough Florida Revocable Trust for Married Couples, individuals can have peace of mind knowing that their assets will be managed and distributed according to their wishes. It is important to consult with an experienced estate planning attorney to create a trust that aligns with your specific needs and goals, taking into consideration Hillsborough County's laws and regulations.

Hillsborough Florida Revocable Trust for Married Couple

Description

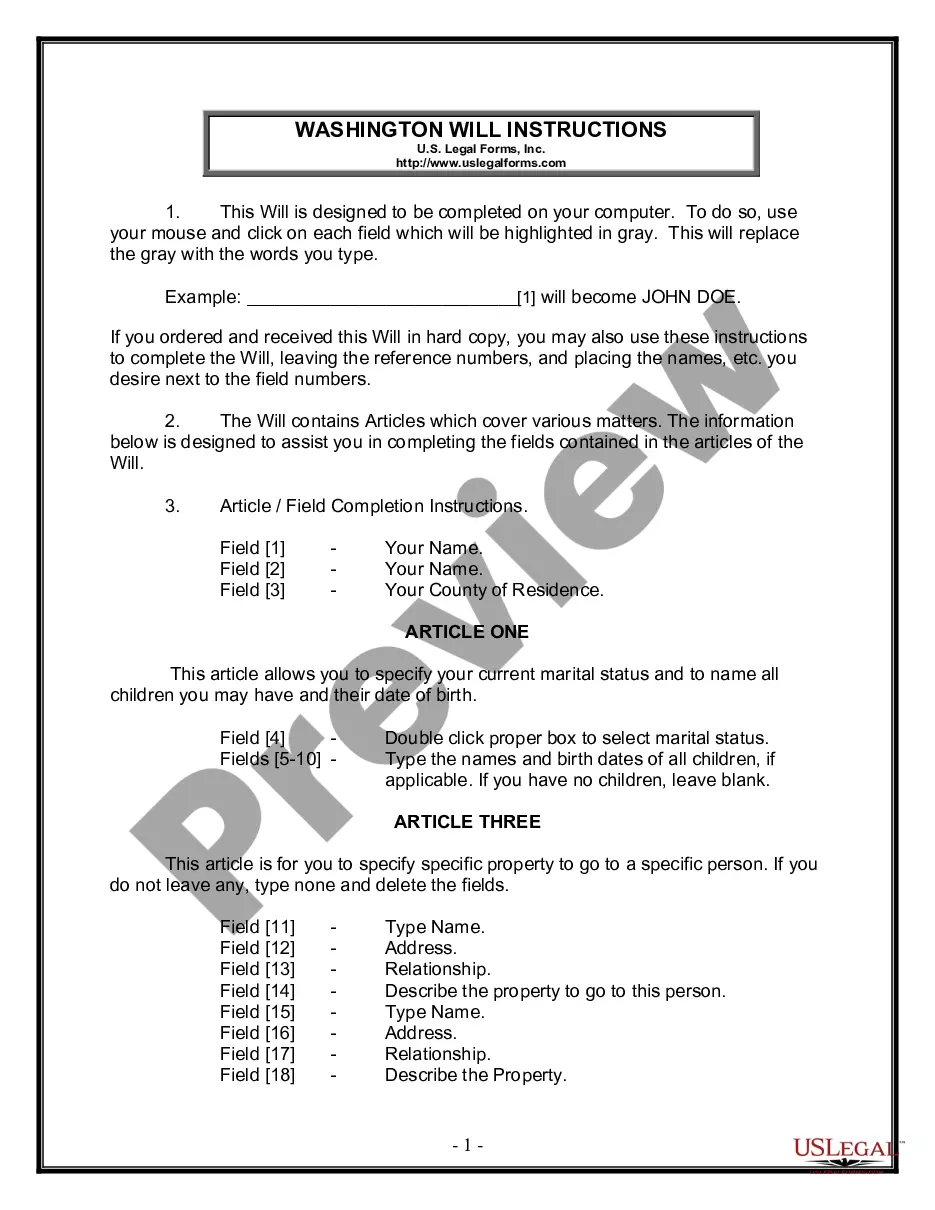

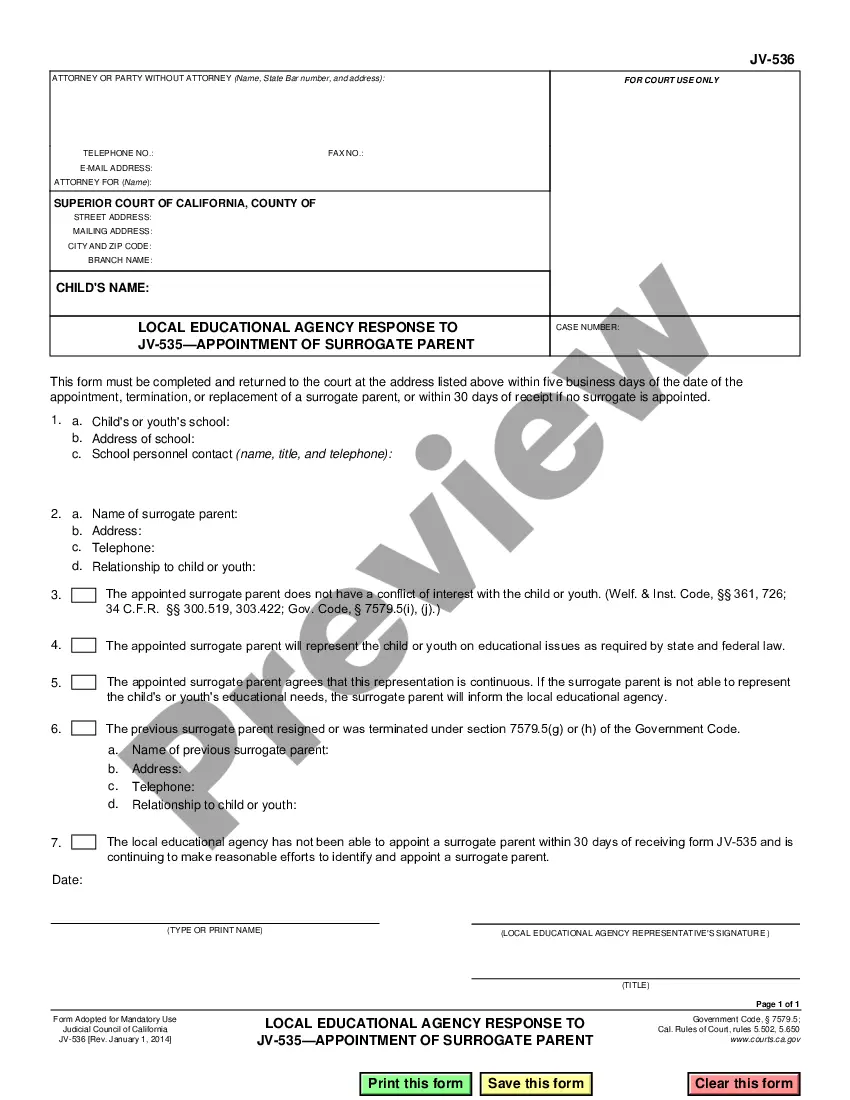

How to fill out Hillsborough Florida Revocable Trust For Married Couple?

Creating legal forms is a necessity in today's world. However, you don't always need to seek professional help to draft some of them from scratch, including Hillsborough Revocable Trust for Married Couple, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in various types varying from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching experience less frustrating. You can also find detailed materials and tutorials on the website to make any activities associated with paperwork completion straightforward.

Here's how to locate and download Hillsborough Revocable Trust for Married Couple.

- Go over the document's preview and description (if available) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state regulations can impact the validity of some documents.

- Examine the similar forms or start the search over to find the correct file.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the option, then a needed payment method, and purchase Hillsborough Revocable Trust for Married Couple.

- Choose to save the form template in any offered format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Hillsborough Revocable Trust for Married Couple, log in to your account, and download it. Needless to say, our website can’t replace a legal professional completely. If you need to cope with an extremely difficult situation, we advise getting an attorney to examine your document before signing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Become one of them today and purchase your state-compliant paperwork effortlessly!

Form popularity

FAQ

Trusts for Spouses California follows the law of community property, which means that each spouse owns a half interest in community property and a full interest in any separate property. Each spouse is allowed to decide who receives their half of the community property when they die.

Though not a silver bullet for every situation, in appropriate circumstances, a Joint Revocable Living Trust ("Joint Trust") can provide a married couple with significant benefits and simplify the administration of assets upon death or incapacity.

What happens in this type of trust is that the trust is a joint revocable trust when both spouses are alive. When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse.

In general, most experts agree that Separate Trusts can provide more asset protection. Joint Trust: Marital assets are all together in a single trust. This means there's less asset protection, because if there's ever a judgment over one of the spouses, all of the assets could end up being at risk.

In a simple living trust, a couple can share the control and benefits of the trust while they are living. Once one spouse dies, the other spouse will have total control over the trust. After one spouse's death, the survivor can alter the beneficiaries if they wish.

The use of a joint revocable living trust as the primary estate planning instrument can be appropriate for certain married couples whose assets are uncomplicated and whose combined estates are not subject to the estate tax.

No, a revocable living trust does not need to be recorded in Florida. A living trust document is a private and confidential agreement between the grantor (person setting up the trust) and the trustee (person with legal title to the trust assets).