The Franklin Ohio Revocable Trust for Property is a legal instrument that is commonly used for estate planning purposes. It allows individuals to transfer their assets, such as real estate, investments, and personal belongings, into a trust during their lifetime. This trust is established in accordance with the laws of the state of Ohio and is revocable, meaning it can be amended, modified, or terminated at any time by the granter. The main purpose of creating a Franklin Ohio Revocable Trust for Property is to ensure a smooth and efficient transfer of assets upon the granter's death, without the need for probate. Probate is a legal process that often involves considerable time, expenses, and public record disclosures. By establishing a revocable trust, individuals can avoid probate and provide their loved ones with a more private and seamless transfer of assets. There are several types of Franklin Ohio Revocable Trusts for Property that individuals can consider, depending on their specific objectives. Some common types include: 1. Individual Revocable Trust: This is a trust established by a single individual for the purpose of managing, preserving, and distributing their assets. 2. Joint Revocable Trust: This type of trust is established by a married couple or domestic partners. It allows both parties to fund the trust with their assets and designate how those assets will be distributed after their deaths. 3. Marital Revocable Trust: Often used by married couples, this type of trust provides for the surviving spouse while ensuring that the remaining assets are ultimately distributed to the intended beneficiaries upon the death of both spouses. 4. Irrevocable Life Insurance Trust: While not strictly revocable, this trust is worth mentioning as it is commonly used in conjunction with a revocable trust. It allows individuals to remove the value of an insurance policy from their taxable estate, potentially reducing estate taxes. In summary, the Franklin Ohio Revocable Trust for Property is a flexible estate planning tool that allows individuals to protect and manage their assets during their lifetime, and facilitate a smooth transfer of those assets upon death. By avoiding probate, individuals can maintain privacy, reduce costs, and ensure their wishes are carried out effectively.

Franklin Ohio Revocable Trust for Property

Description

How to fill out Franklin Ohio Revocable Trust For Property?

How much time does it typically take you to draft a legal document? Considering that every state has its laws and regulations for every life sphere, locating a Franklin Revocable Trust for Property meeting all local requirements can be exhausting, and ordering it from a professional attorney is often expensive. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, grouped by states and areas of use. Apart from the Franklin Revocable Trust for Property, here you can find any specific form to run your business or personal deeds, complying with your regional requirements. Experts check all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can retain the file in your profile anytime later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your Franklin Revocable Trust for Property:

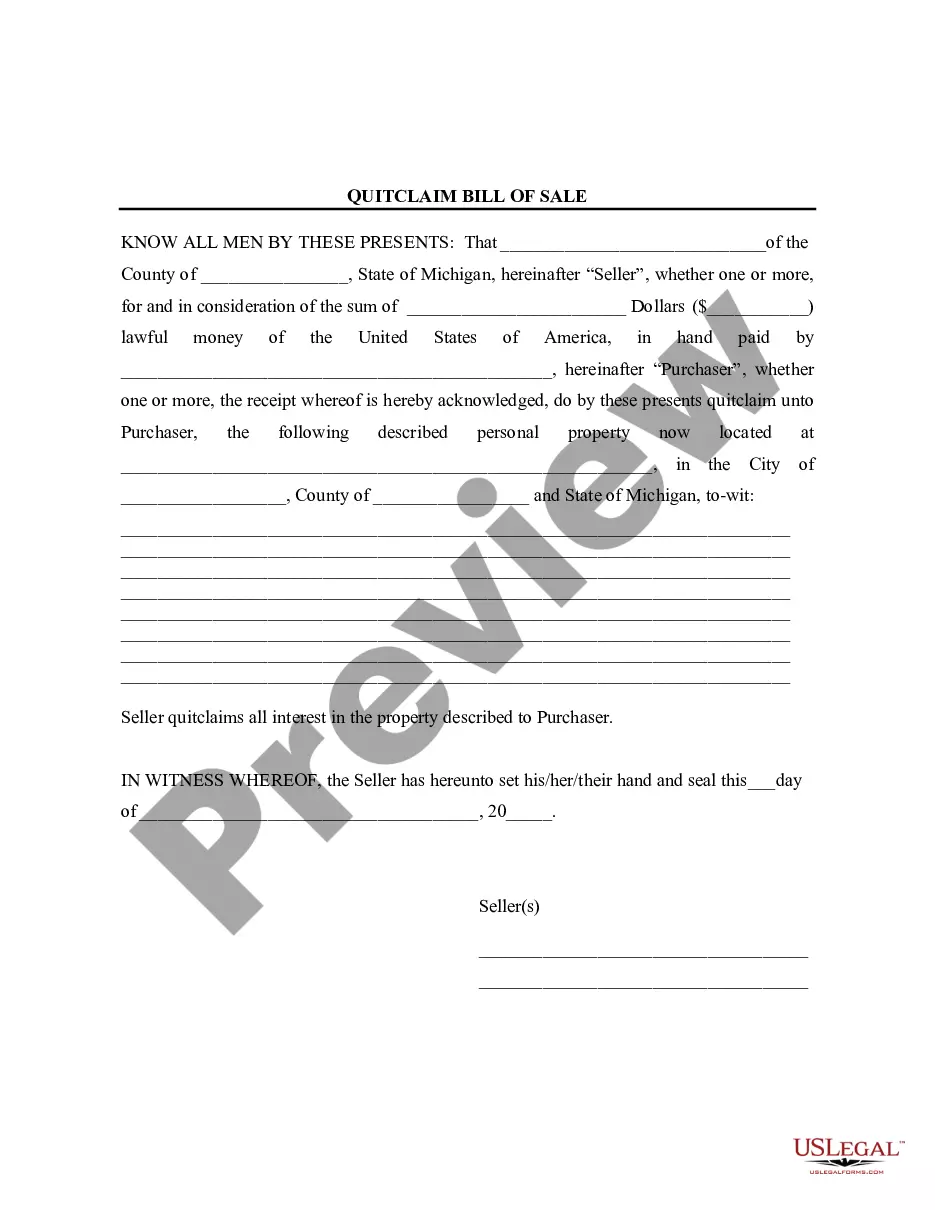

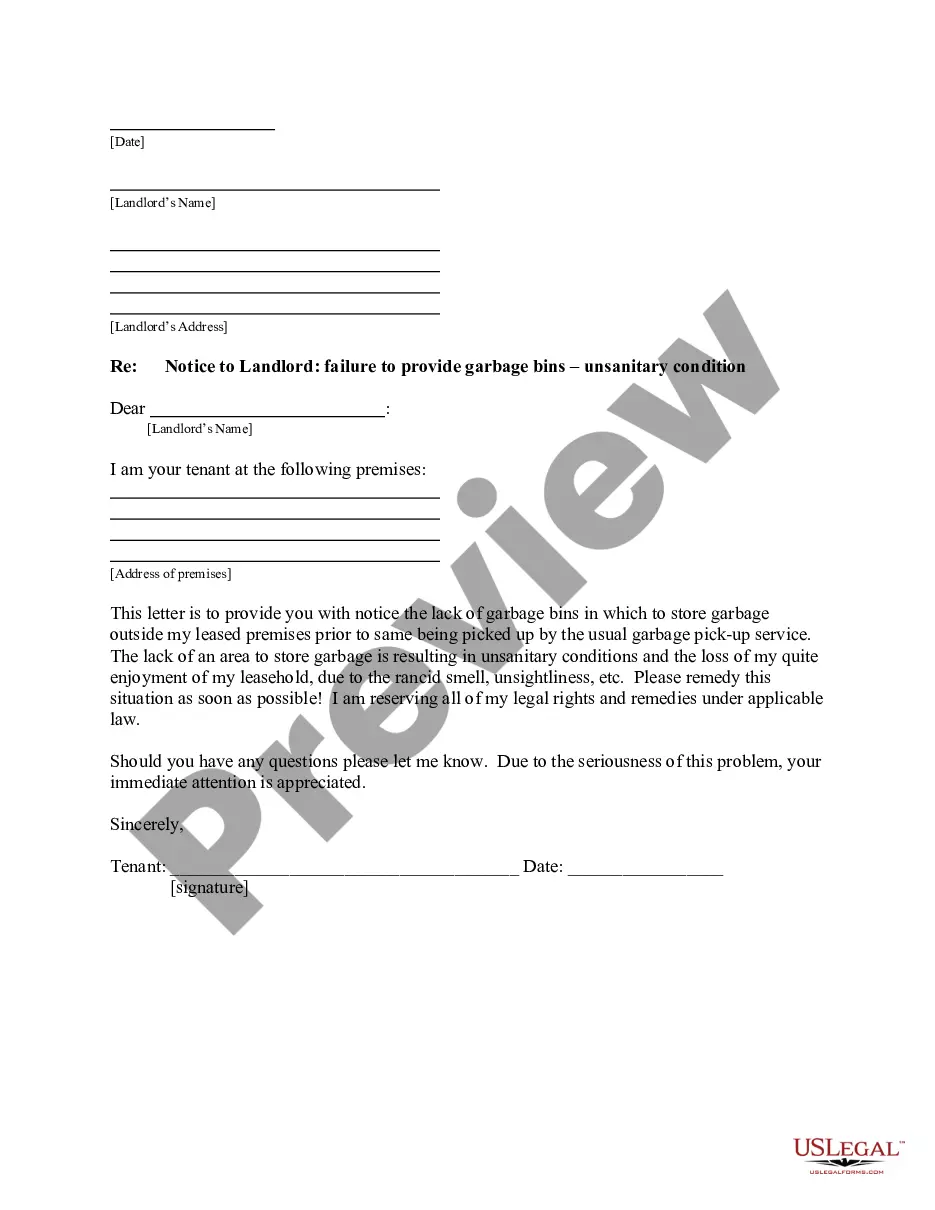

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Franklin Revocable Trust for Property.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!