A Houston Texas Revocable Trust for Property is a legal document that allows an individual, known as the granter or trust maker, to transfer their assets, such as real estate and personal property, into a trust during their lifetime. The trust is managed by a trustee of the granter's choice, who oversees and distributes the assets according to the granter's instructions. The main purpose of a revocable trust is to avoid probate, which is the legal process of distributing a person's assets after their death. By transferring assets into the trust, the granter retains control over them during their lifetime, and upon their passing, the assets are distributed to the trust beneficiaries without the need for probate court involvement. This can save time, costs, and provide privacy for the granter's estate. There are several types of Houston Texas Revocable Trusts for Property, each designed to cater to the unique needs and circumstances of the granter. Some common types include: 1. Revocable Living Trust: This is the most common type of revocable trust, where the granter transfers their assets into the trust and can amend or revoke it at any time during their lifetime. It allows for seamless management of assets during incapacity or in the event of the granter's death. 2. Marital Trust: This type of trust is commonly used by married couples to provide for their surviving spouse after one spouse passes away. It allows the surviving spouse to access and use the trust assets while preserving their distribution to the ultimate beneficiaries, typically the couple's children. 3. Testamentary Trust: Unlike a revocable living trust, a testamentary trust is created within a will and only becomes effective upon the granter's death. It allows for specific instructions to be carried out, such as providing for minor children or individuals with special needs. 4. Charitable Remainder Trust: This trust is designed for individuals who wish to support charitable causes. The granter transfers assets into the trust, receives income from the trust for a specified period, and then the remaining assets are distributed to the designated charitable organizations. 5. Special Needs Trust: This trust is established for individuals with disabilities to ensure that they have access to assets without affecting their eligibility for government assistance programs. It allows for the trust assets to be used for the beneficiary's supplemental needs, such as medical expenses or education, while maintaining their eligibility for government benefits. In summary, a Houston Texas Revocable Trust for Property is a flexible estate planning tool that enables individuals to manage and distribute their assets according to their wishes. Whether it is a revocable living trust, marital trust, testamentary trust, charitable remainder trust, or special needs trust, each type serves specific purposes catered to the unique needs and goals of the granter.

Houston Texas Revocable Trust for Property

Description

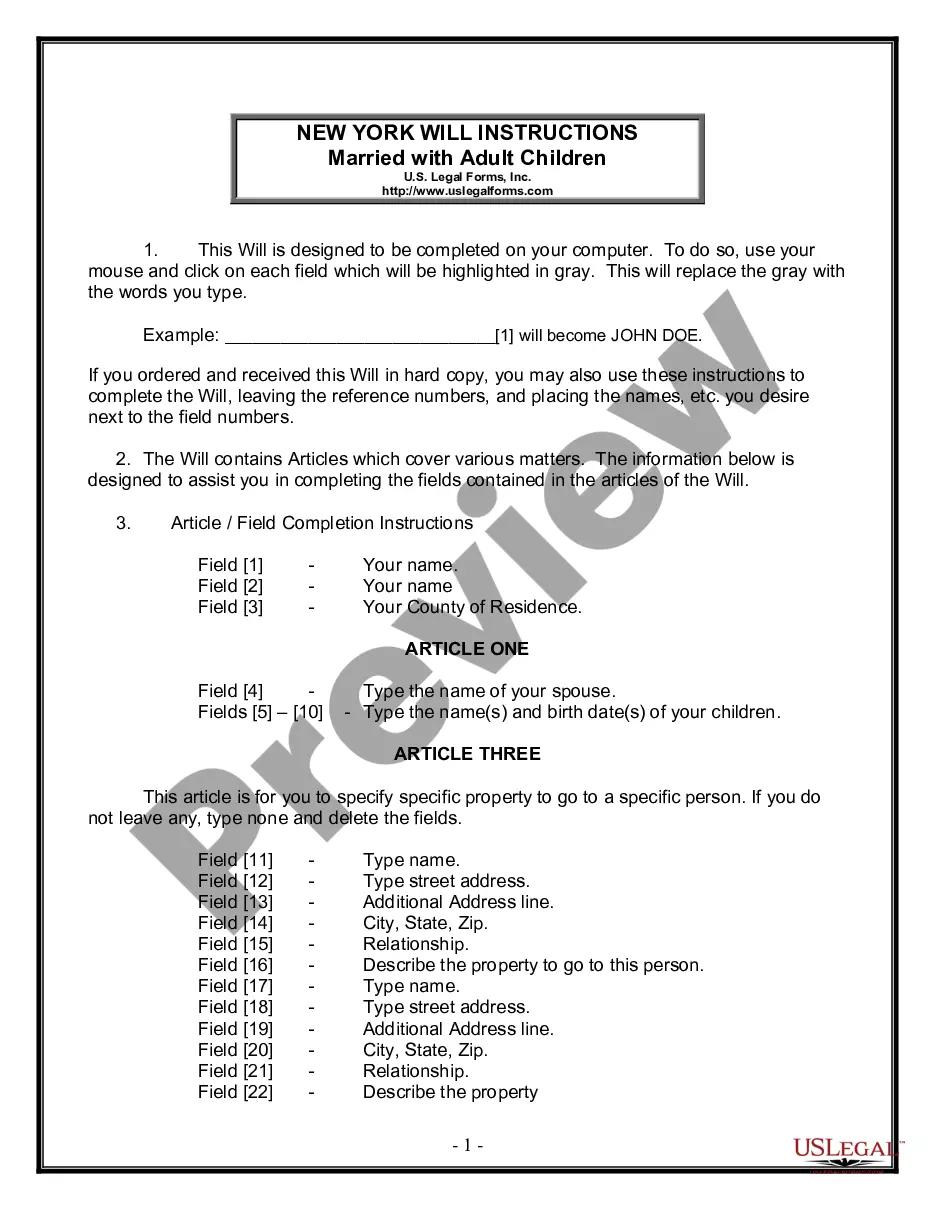

How to fill out Houston Texas Revocable Trust For Property?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and many other life situations require you prepare formal paperwork that varies throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and get a document for any individual or business objective utilized in your region, including the Houston Revocable Trust for Property.

Locating samples on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Houston Revocable Trust for Property will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guide to obtain the Houston Revocable Trust for Property:

- Ensure you have opened the proper page with your localised form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template corresponds to your needs.

- Search for another document using the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Select the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Houston Revocable Trust for Property on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

The Cost of a Revocable Living Trust If the Trust is created by an attorney, the cost ranges from $2,000 to as high as $8,000 for a couple and $1,500 to $5,000 for an individual.

With your property in trust, you typically continue to live in your home and pay the trustees a nominal rent, until your transfer to residential care when that time comes. Placing the property in trust may also be a way of helping your surviving beneficiaries avoid inheritance tax liabilities.

To make a living trust in Texas, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

A trust, more formally known as a revocable living trust, is a legal entity set up to control your assets. To create a trust, you first set it up, and then take all of your assets ? your house, your car, your property, your accounts ? and re-title them in the name of the trust.

If you die without either a will or a living trust, Texas controls the disposition of your property. And settling your estate likely will be more troublesome ? and more costly. The primary difference between a will and a living trust is that assets placed in your living trust avoid probate at your death.

The main benefit of putting a house in a trust in Texas is to bypass the probate process. Even if you have a will, all of your assets will go through probate when you die. For married couples, placing a house in trust ensures that the surviving spouse becomes the sole owner when the other spouse dies.

The Cons. While there are many benefits to putting your home in a trust, there are also a few disadvantages. For one, establishing a trust is time-consuming and can be expensive. The person establishing the trust must file additional legal paperwork and pay corresponding legal fees.

Drawbacks of a living trust The most significant disadvantages of trusts include costs of set and administration. Trusts have a complex structure and intricate formation and termination procedures. The trustor hands over control of their assets to trustees.

You could end up paying more than $1,000 to create a living trust. While these costs are a definite downside, you'll dodge the potential dangers of DIY estate planning by getting an expert's input.

Trusts are not legal entities that can own, manage or sell property. It is the trustee of the trust that can hold legal title to the property on behalf or for the benefit of the beneficiaries of the trust. What this means is that a trustee has the power to sell or lease the property.

Interesting Questions

More info

If you transfer assets to the Revocable Living Trust you are transferring ownership of that property to an independent group of people. To avoid problems with creditors, don't forget to put it in writing and be realistic in what you think you can live on. If you have any doubts at all, call and talk with your attorneys at Morris Fishman to confirm their advice when you take actions. REINDEER MESS (THE RETURN OF THE REINDEER.) You want to take the risk out of any financial situation by allowing a trustee to pay your debts. This person will review your financial situation and make a decision about what is best for you. When that happens you will receive your checks in the mail each month. REFUND OF TAXES REFUNDING the taxes that are rightfully due may be the single best decision you can ever make. For many years, people who have never paid these costs were stuck with bills from collection agencies.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.