Orange California Revocable Trust for Property is a legal arrangement created by an individual, known as the settler or granter, to transfer ownership of their property to a trustee, who manages the assets for the benefit of the named beneficiaries. This type of trust is established during the lifetime of the settler and can be modified or terminated at any time as per their discretion. The Orange California Revocable Trust for Property offers numerous benefits for individuals seeking to protect and manage their assets. Firstly, it allows the settler to avoid the lengthy and costly probate process, ensuring a faster and more efficient transfer of assets to the intended beneficiaries upon their passing. Additionally, since the trust is revocable, the settler maintains control and can make changes to the trust throughout their lifetime, reflecting any changed circumstances or preferences. There are several types of Orange California Revocable Trust for Property. The first is the Basic Revocable Trust, which is a straightforward arrangement allowing for the transfer of property to the trust. Another type is the Pour-Over Trust, which is created in conjunction with a will and ensures any assets not accounted for in the trust at the time of the settler's passing are "poured over" into the trust. This provision bolsters the comprehensive administration of the settler's estate and minimizes the need for probate. Additionally, the Orange California Revocable Trust for Property can be an Individual or Joint trust. An Individual Trust is established by a single person, while a Joint Trust is created by a married couple. Joint trusts offer the advantage of consolidation and ease of management, as assets owned jointly by the couple can be included. However, both types provide the benefit of probate avoidance and flexibility in managing assets. By creating an Orange California Revocable Trust for Property, individuals can ensure the efficient distribution of their property, maintain control over their assets during their lifetime, and minimize the legal complexities for their loved ones upon their passing. It is advisable to consult with a qualified estate planning attorney or financial advisor to determine the most suitable type of trust based on individual circumstances and goals.

Orange California Revocable Trust for Property

Description

How to fill out Orange California Revocable Trust For Property?

Preparing legal documentation can be cumbersome. In addition, if you decide to ask a lawyer to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Orange Revocable Trust for Property, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case collected all in one place. Consequently, if you need the latest version of the Orange Revocable Trust for Property, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Orange Revocable Trust for Property:

- Glance through the page and verify there is a sample for your region.

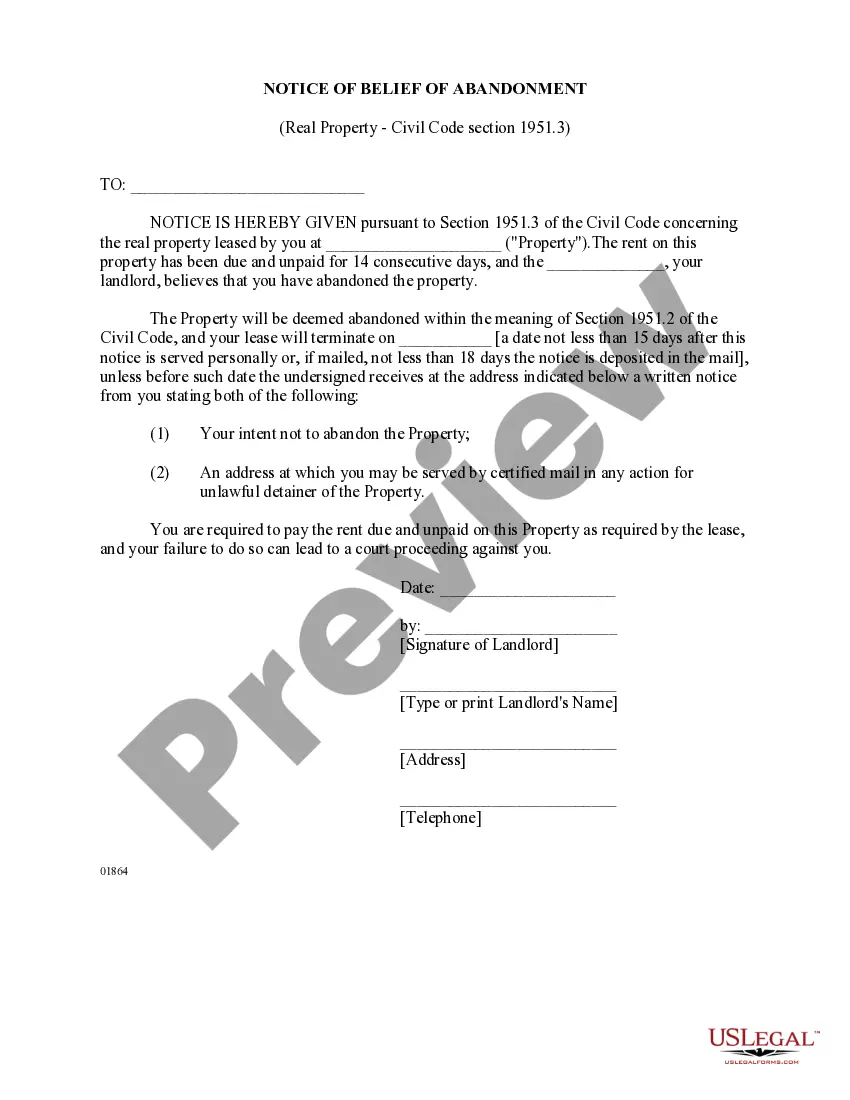

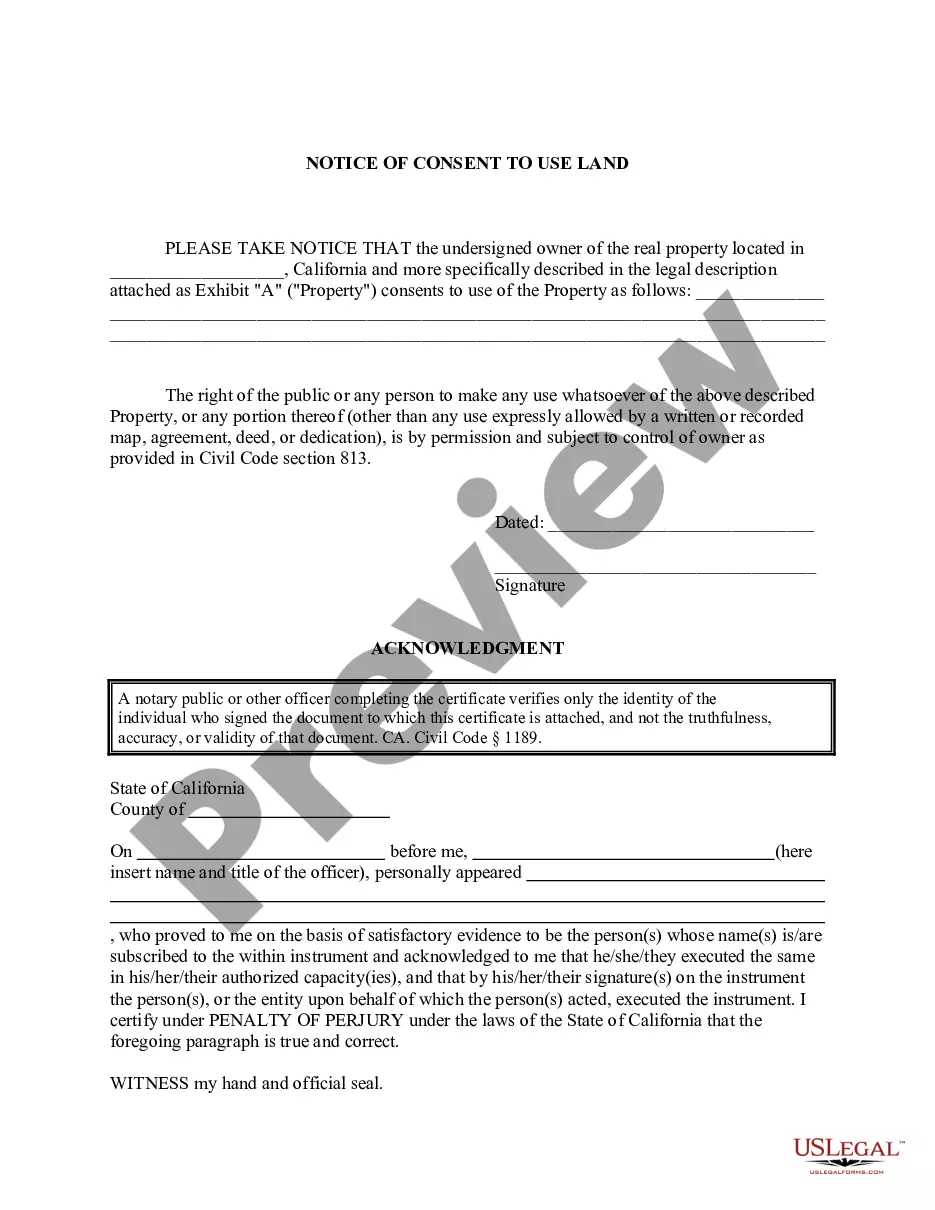

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Orange Revocable Trust for Property and download it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!