The Bexar Texas Revocable Trust for Estate Planning is a legal tool that allows individuals in Bexar County, Texas, to efficiently manage their assets and plan for the future. This type of revocable trust, often referred to as a living trust or inter vivos trust, is a versatile estate planning solution that provides flexibility, privacy, and potential tax benefits. By creating a Bexar Texas Revocable Trust, individuals can transfer their assets into the trust, effectively becoming the trust's owner and retaining full control over their property during their lifetime. This trust is revocable, meaning that the creator can modify or terminate it at any time, as long as they have the legal capacity to do so. One of the key advantages of the Bexar Texas Revocable Trust is its ability to bypass probate, the legal process of administering an individual's estate after their passing. This grants beneficiaries quick access to the assets held in the trust, without the delays, costs, and public scrutiny associated with probate. As a result, this trust type offers privacy and reduces the administrative burden on loved ones during an already challenging time. Furthermore, the Bexar Texas Revocable Trust can facilitate seamless asset management in the event of the creator's incapacity. By appointing a successor trustee, the trust can ensure a smooth transition of control, allowing for the uninterrupted management and distribution of assets. This aspect can provide peace of mind knowing that financial affairs will be handled according to the individual's wishes, even if they become unable to manage them themselves. There are several variations of the Bexar Texas Revocable Trust for Estate Planning, tailored to meet different needs and goals: 1. Simple Revocable Trust: This trust is a basic form of estate planning that allows individuals to transfer their assets and designate beneficiaries. It commonly includes provisions for the management and distribution of assets upon the creator's death or incapacity. 2. Marital Revocable Trust: Specifically designed for married couples, this trust provides for the seamless transfer of assets between spouses while maximizing potential tax benefits. It is aimed at protecting the surviving spouse's financial well-being and ensuring the efficient management and distribution of assets. 3. Irrevocable Life Insurance Trust (IIT): Although technically not a revocable trust, it is worth mentioning an alternative. An IIT is created to exclude life insurance proceeds from the creator's estate, potentially reducing estate taxes. It allows the insured person to maintain control over the policy while designating the trust as the beneficiary, thereby protecting the life insurance proceeds for beneficiaries. In summary, the Bexar Texas Revocable Trust for Estate Planning is a versatile and customizable tool for individuals living in Bexar County, Texas, to effectively manage and plan for the future distribution of their assets. By establishing this trust, individuals can benefit from privacy, asset management during incapacity, avoidance of probate, and potentially reduce estate taxes. Whether it is a simple revocable trust, marital revocable trust, or an irrevocable life insurance trust, it is essential to consult with an experienced estate planning attorney to ensure the trust aligns with specific objectives and legal requirements.

Bexar Texas Revocable Trust for Estate Planning

Description

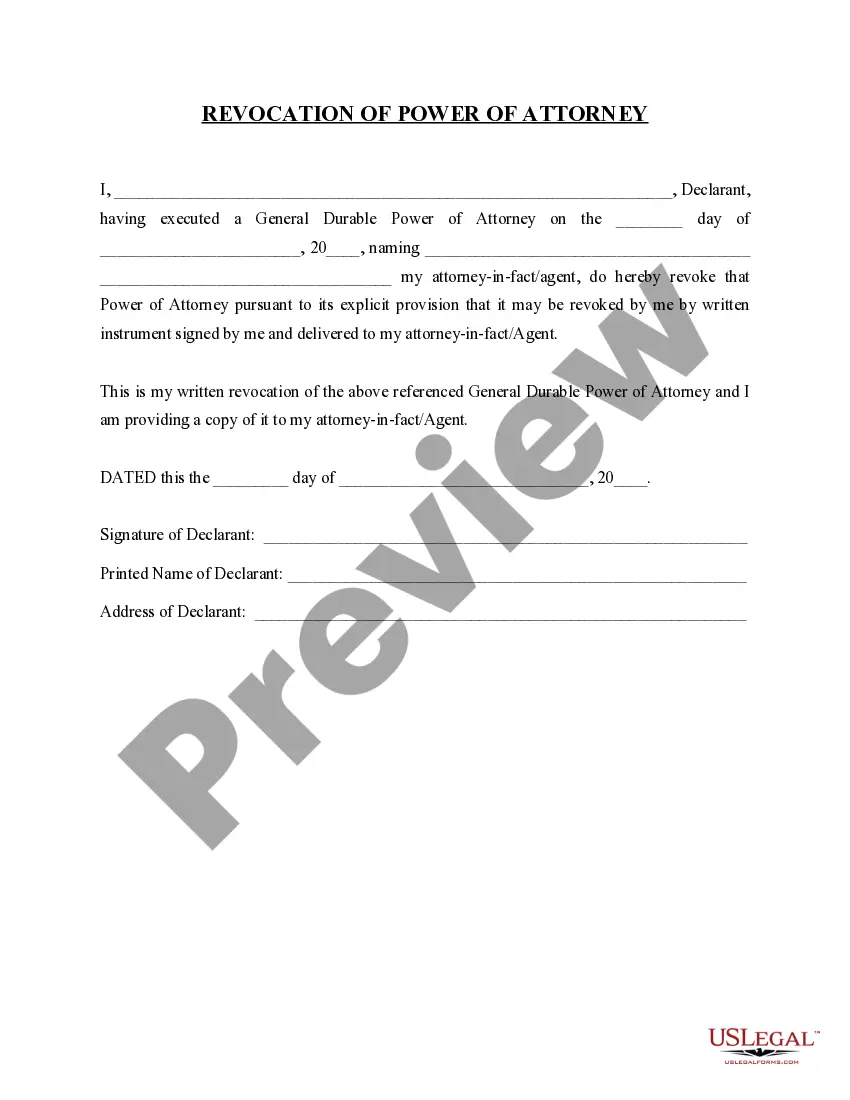

How to fill out Bexar Texas Revocable Trust For Estate Planning?

Creating forms, like Bexar Revocable Trust for Estate Planning, to manage your legal affairs is a tough and time-consumming process. A lot of circumstances require an attorney’s involvement, which also makes this task expensive. However, you can take your legal matters into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal forms created for various scenarios and life circumstances. We ensure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Bexar Revocable Trust for Estate Planning form. Go ahead and log in to your account, download the form, and personalize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as simple! Here’s what you need to do before downloading Bexar Revocable Trust for Estate Planning:

- Make sure that your document is specific to your state/county since the regulations for writing legal documents may vary from one state another.

- Discover more information about the form by previewing it or going through a brief description. If the Bexar Revocable Trust for Estate Planning isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to start using our service and download the form.

- Everything looks good on your side? Click the Buy now button and select the subscription option.

- Pick the payment gateway and type in your payment details.

- Your template is all set. You can try and download it.

It’s easy to locate and purchase the needed document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!