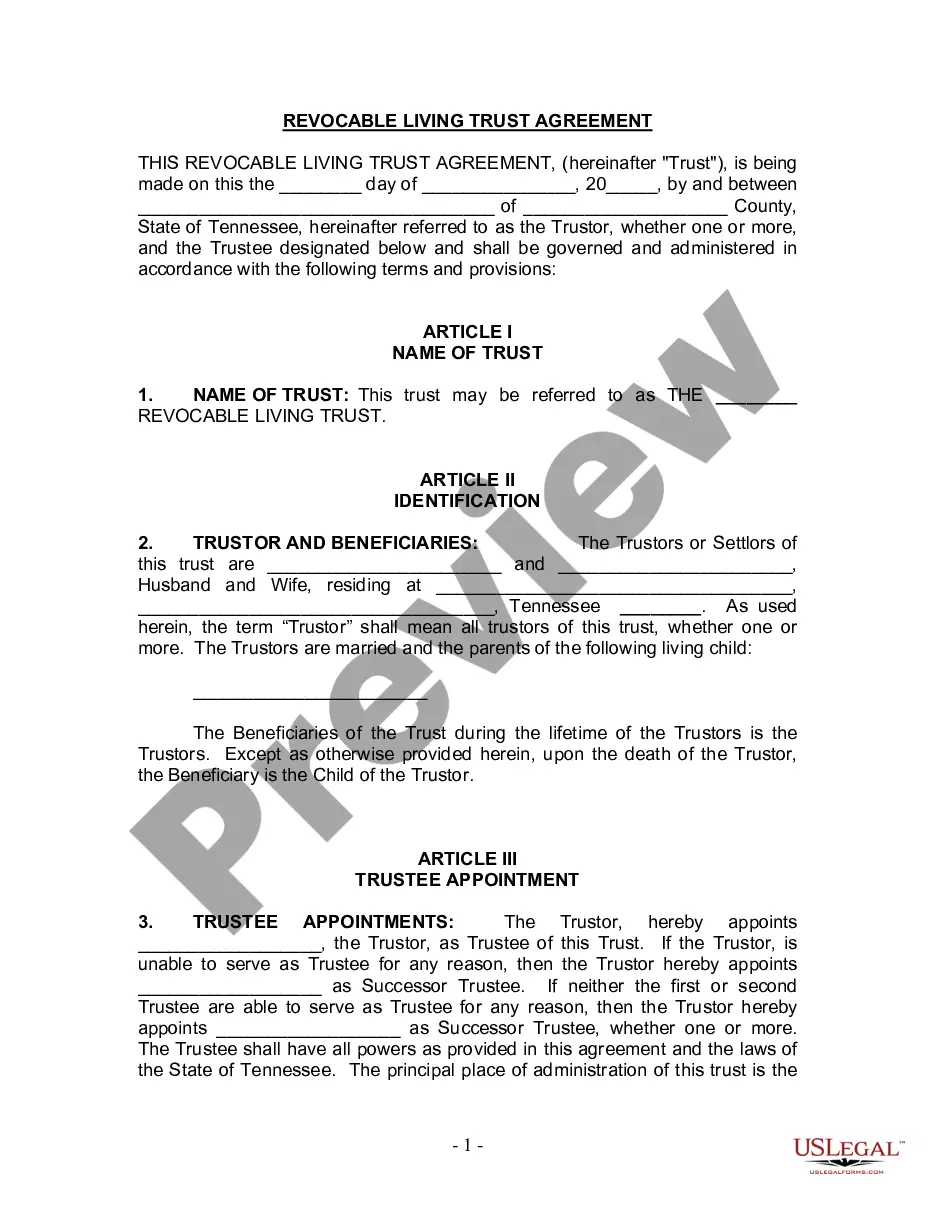

A Contra Costa California Revocable Trust for Estate Planning is a legal document that allows individuals in Contra Costa County, California, to transfer their assets to a trust during their lifetime and determine how they will be distributed after their death. This type of trust is revocable, meaning it can be modified or revoked by the trust creator at any time as long as they are mentally competent. The Contra Costa California Revocable Trust for Estate Planning is a popular choice for individuals who want to avoid the probate process, as assets placed in the trust are not subject to probate. Probate is a court-supervised process that validates a deceased person's will and ensures the proper distribution of assets. By establishing a revocable trust, individuals can bypass this potentially lengthy and costly process, allowing for a smoother transition of assets to beneficiaries. One key advantage of a revocable trust is the flexibility it offers. The trust creator, also known as the settler, has the ability to amend or revoke the trust during their lifetime, ensuring they can make changes as necessary. This flexibility allows for adapting to changing circumstances, such as acquiring or selling new assets, adding or removing beneficiaries, or changing distribution instructions. There are different types of Contra Costa California Revocable Trusts for Estate Planning, tailored to individual needs and goals, including: 1. Living Revocable Trust: This trust is established during the settler's lifetime and can be modified or revoked as per their wishes. It is commonly used to avoid probate and ensure proper asset management. 2. Irrevocable Life Insurance Trust (IIT): This trust is specifically designed to own life insurance policies, removing the policy's value from the settler's estate and potentially reducing estate taxes. Once established, it cannot be modified or revoked. 3. Qualified Personnel Residence Trust (PRT): This trust allows the settler to transfer their primary residence or vacation home to the trust while retaining the right to live in it for a specified period. It offers potential estate tax benefits by reducing the value of the residence in the settler's estate. 4. Charitable Remainder Trust (CRT): This trust allows individuals to donate assets to a charitable trust during their lifetime while retaining an income stream from those assets. It provides potential tax benefits and allows individuals to support charitable causes. 5. Generation-Skipping Trust: This trust is designed to pass assets to beneficiaries who are at least two generations below the settler, such as grandchildren. It can provide estate tax benefits by skipping the estate tax liability that would occur if the assets were distributed directly. In summary, the Contra Costa California Revocable Trust for Estate Planning is a flexible and customizable legal tool that allows individuals to preserve their assets, avoid probate, and ensure a smooth transfer of wealth to their chosen beneficiaries. With various types of trusts available, individuals can select the one that aligns with their specific estate planning goals and objectives.

Contra Costa California Revocable Trust for Estate Planning

Description

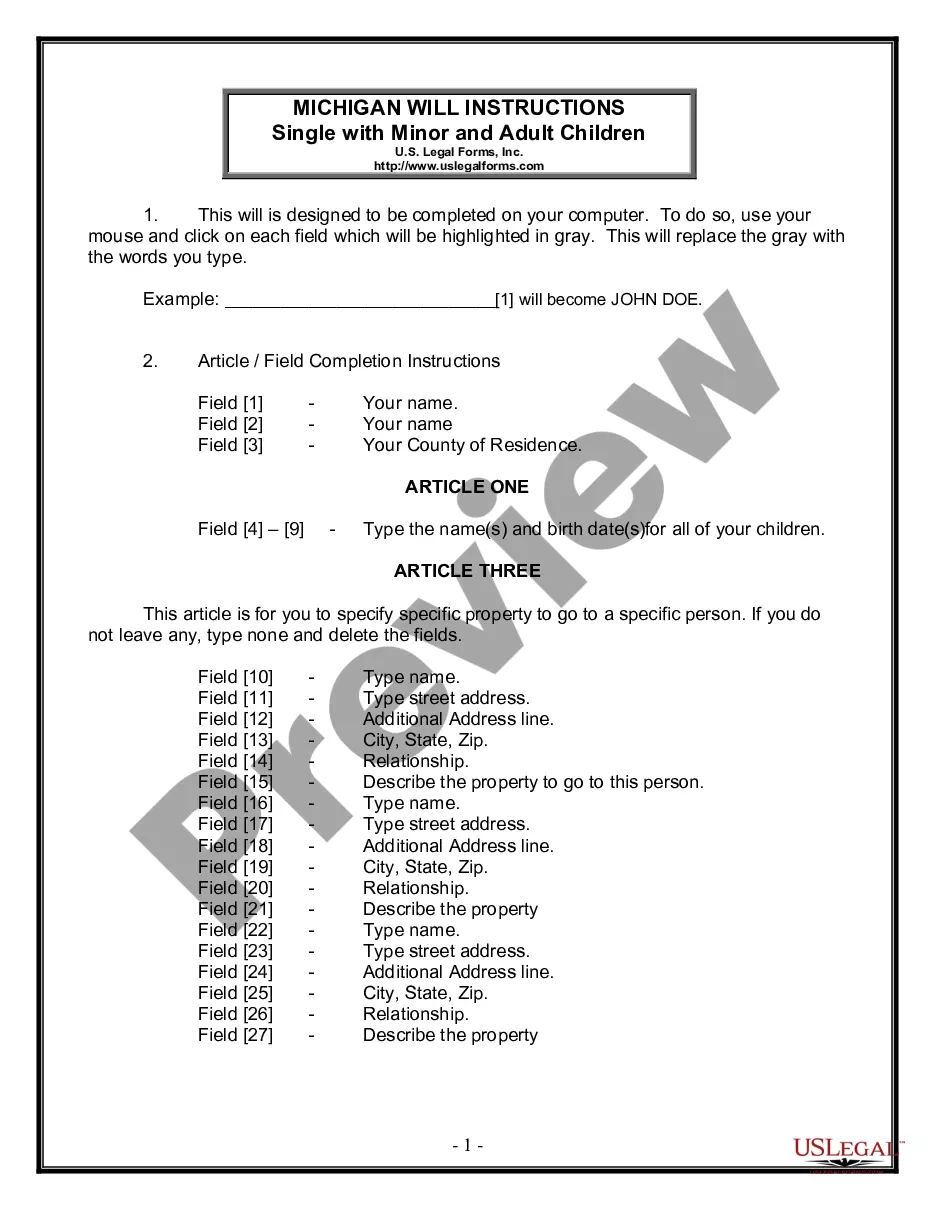

How to fill out Contra Costa California Revocable Trust For Estate Planning?

If you need to find a trustworthy legal document supplier to obtain the Contra Costa Revocable Trust for Estate Planning, look no further than US Legal Forms. Whether you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can browse from over 85,000 forms arranged by state/county and situation.

- The intuitive interface, number of supporting materials, and dedicated support team make it simple to locate and complete various paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

Simply select to search or browse Contra Costa Revocable Trust for Estate Planning, either by a keyword or by the state/county the form is intended for. After locating necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Contra Costa Revocable Trust for Estate Planning template and take a look at the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Create an account and select a subscription option. The template will be instantly ready for download once the payment is processed. Now you can complete the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes this experience less expensive and more reasonably priced. Set up your first business, organize your advance care planning, create a real estate agreement, or execute the Contra Costa Revocable Trust for Estate Planning - all from the convenience of your sofa.

Join US Legal Forms now!

Form popularity

FAQ

A Trust Fund is an effective tool that's often used in Estate Planning wherein a Grantor (you) sets up a plan that will ensure financial stability and security of a Beneficiary, often a child or grandchild. A Trust Fund can hold investments, cash, real estate and other assets to be distributed in the future.

Living Trust Cost in California Revocable Living Trust (Individual) For one individual$250Revocable Trust or Restatement of Revocable Trust (Couple) Trust or Trust Restatement only (you must have an existing trust)$375Special Needs Trust Designed for beneficiaries with physical or mental disabilities.$6005 more rows

An Overview Estate planning can be done by writing a will or setting up a trust. While a will is a document that expresses the creator's wishes regarding the distribution of their property, a trust is an arrangement that allows a third party to hold and direct the creator's assets in the trust fund.

The Inheritance Trust is the beneficiary of your revocable trust and/or any insurance policies you have. Upon your death if you are single, or upon the death of both you and your spouse if you are married, these assets will flow into your child's Inheritance Trust.

A trust can be used to determine how a person's money should be managed and distributed while that person is alive, or after their death. A trust helps avoid taxes and probate. It can protect assets from creditors, and it can dictate the terms of an inheritance for beneficiaries.

Using a revocable living trust instead of a will means assets owned by your trust will bypass probate and flow to your heirs as you've outlined in the trust documents. A trust lets investors have control over their assets long after they pass away.

Living Trust Cost in California Revocable Living Trust (Individual) For one individual$250Revocable Trust or Restatement of Revocable Trust (Couple) Trust or Trust Restatement only (you must have an existing trust)$375Special Needs Trust Designed for beneficiaries with physical or mental disabilities.$6005 more rows

A trust is traditionally used for minimizing estate taxes and can offer other benefits as part of a well-crafted estate plan. A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries.

If you do it yourself by buying a book or an online guide, it will likely cost less than $100. However, there are pitfalls to DIY estate planning. The downside of working with a professional, however, is the cost. If you choose to use an attorney to help you draft your trust documents, it could cost more than $1,000.

Assets That Can And Cannot Go Into Revocable Trusts Real estate.Financial accounts.Retirement accounts.Medical savings accounts.Life insurance.Questionable assets.