Wayne Michigan Revocable Trust for Estate Planning

Description

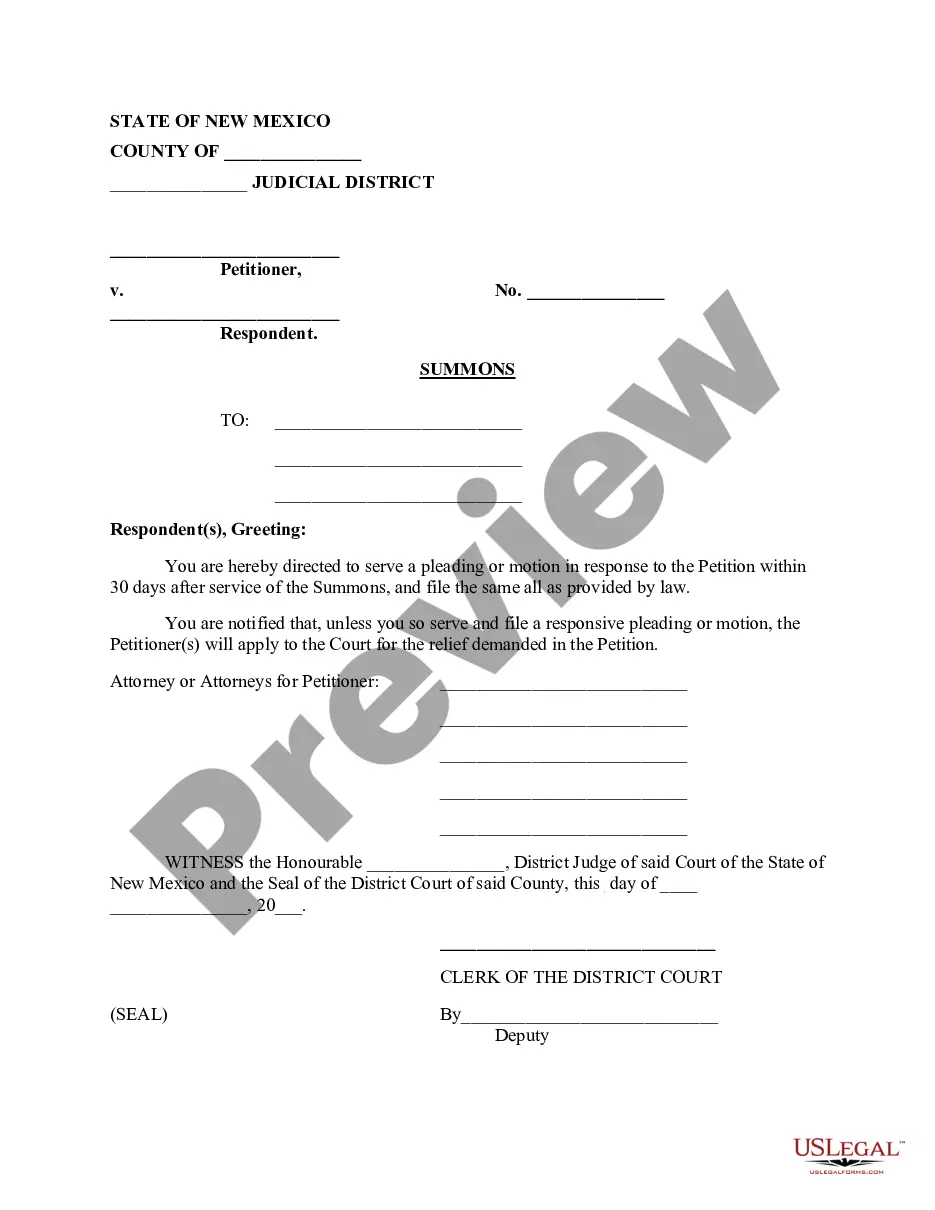

How to fill out Wayne Michigan Revocable Trust For Estate Planning?

Creating forms, like Wayne Revocable Trust for Estate Planning, to manage your legal affairs is a difficult and time-consumming task. A lot of cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can get your legal matters into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms crafted for different scenarios and life circumstances. We make sure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Wayne Revocable Trust for Estate Planning template. Simply log in to your account, download the template, and personalize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as straightforward! Here’s what you need to do before downloading Wayne Revocable Trust for Estate Planning:

- Make sure that your form is compliant with your state/county since the regulations for creating legal paperwork may differ from one state another.

- Find out more about the form by previewing it or reading a quick intro. If the Wayne Revocable Trust for Estate Planning isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to begin using our website and download the document.

- Everything looks good on your side? Click the Buy now button and choose the subscription option.

- Pick the payment gateway and enter your payment information.

- Your form is all set. You can try and download it.

It’s easy to locate and purchase the appropriate template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other perks you can get with US Legal Forms!

Form popularity

FAQ

Using a revocable living trust instead of a will means assets owned by your trust will bypass probate and flow to your heirs as you've outlined in the trust documents. A trust lets investors have control over their assets long after they pass away.

Everyone needs a living revocable trust, says Suze Orman. In response to several emails and tweets asking why a trust is so mandatory, Orman spells it out. "A living revocable trust serves as far more than just where assets are to go upon your death and it does that in an efficient way," she said.

The Inheritance Trust is the beneficiary of your revocable trust and/or any insurance policies you have. Upon your death if you are single, or upon the death of both you and your spouse if you are married, these assets will flow into your child's Inheritance Trust.

A Trust Fund is an effective tool that's often used in Estate Planning wherein a Grantor (you) sets up a plan that will ensure financial stability and security of a Beneficiary, often a child or grandchild. A Trust Fund can hold investments, cash, real estate and other assets to be distributed in the future.

A trust is traditionally used for minimizing estate taxes and can offer other benefits as part of a well-crafted estate plan. A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries.

We recommend living trusts to our clients because of the tremendous benefits they offer over wills, the more traditional estate planning tool. The biggest benefit of using a living trust instead of a will is that living trusts avoid probate. Probate is the court process by which wills are executed.

An irrevocable trust cannot be modified or terminated without permission of the beneficiary. Once the grantor transfers the assets into the irrevocable trust, he or she removes all rights of ownership to the trust and assets, Orman explained.

A trust can be used to determine how a person's money should be managed and distributed while that person is alive, or after their death. A trust helps avoid taxes and probate. It can protect assets from creditors, and it can dictate the terms of an inheritance for beneficiaries.

Assets That Can And Cannot Go Into Revocable Trusts Real estate.Financial accounts.Retirement accounts.Medical savings accounts.Life insurance.Questionable assets.