The courts have inherent power to restrain the sale of mortgaged premises in foreclosure proceedings, but are reluctant to exercise such power except where it is shown that particular circumstances, extrinsic to the instrument, would render its enforcement in this manner inequitable and work irreparable injury, and that complainant has no adequate remedy at law. Furthermore, a party must show a probable right of recovery in order to obtain a temporary injunction of a foreclosure action.

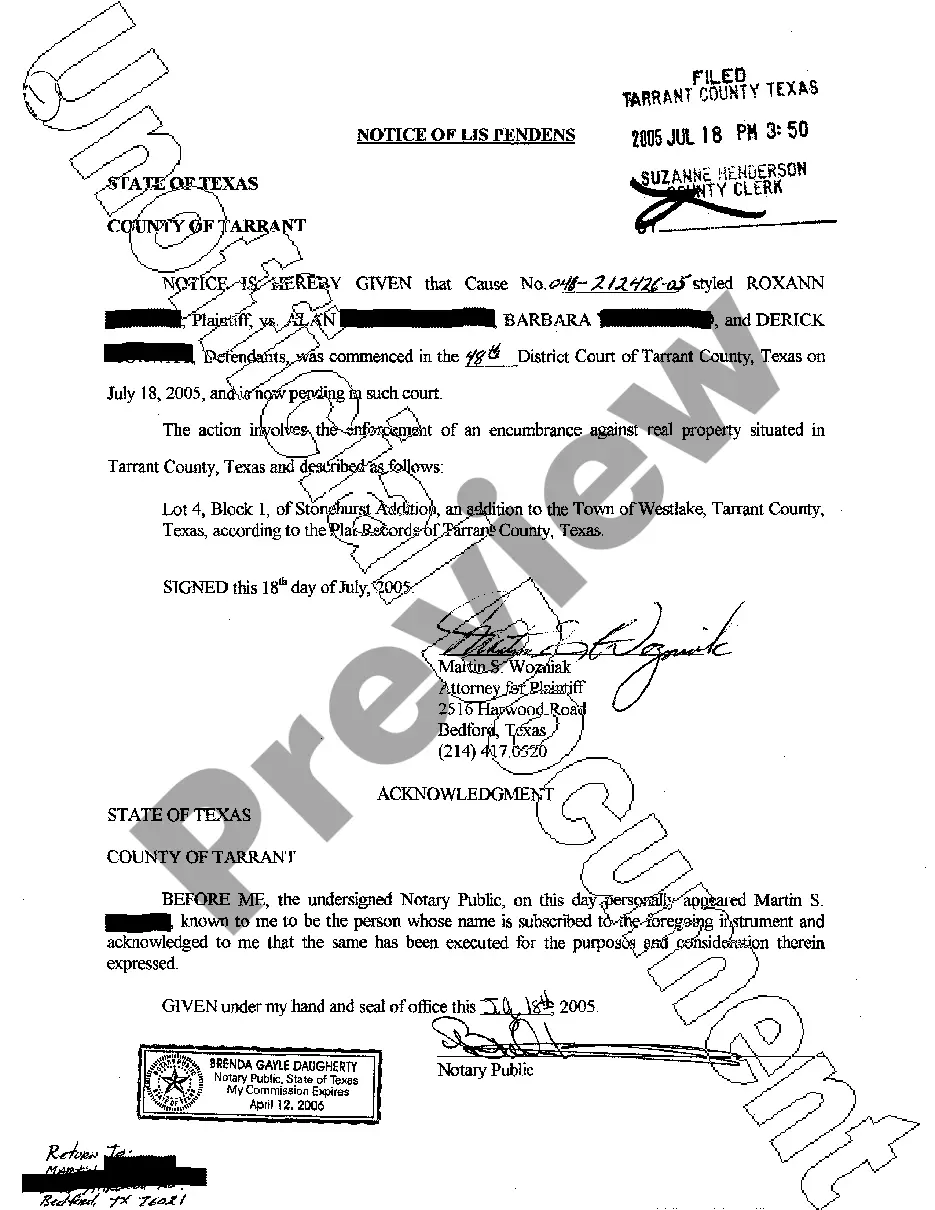

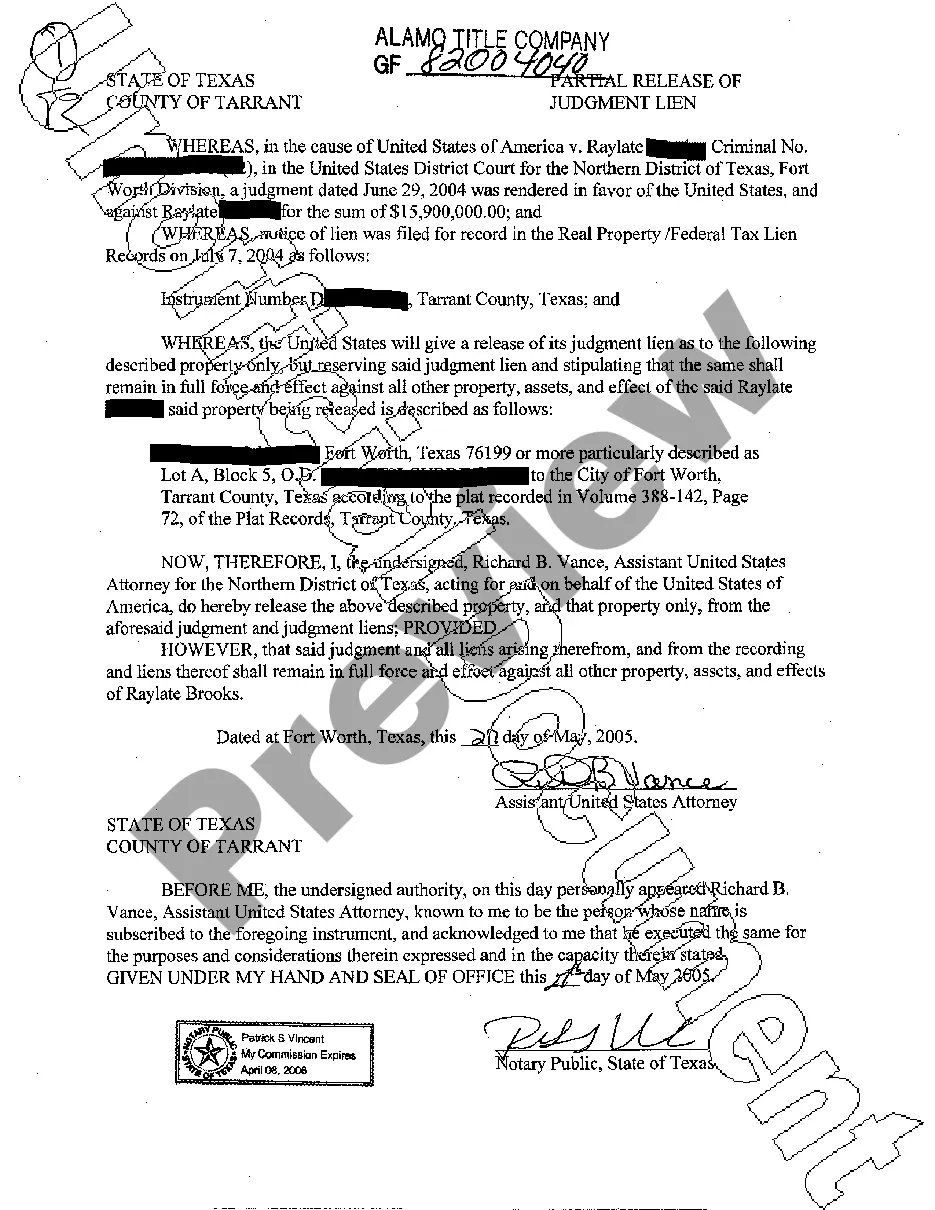

San Diego California Petition or Complaint to Enjoin Nonjudicial Foreclosure Sale and for Declaratory Relief is a legal document that individuals may file in the San Diego County court system to prevent the sale of their property through nonjudicial foreclosure and seek a declaration from the court regarding their rights and interests in the property. This petition or complaint can be filed when a property owner believes that the foreclosure process is being conducted improperly or there are legal issues surrounding the foreclosure sale. Keywords: San Diego California, petition, complaint, enjoin, nonjudicial foreclosure sale, declaratory relief, property owner, foreclosure process, legal issues, court system. There are different types of San Diego California Petition or Complaint to Enjoin Nonjudicial Foreclosure Sale and for Declaratory Relief, including: 1. Wrongful Foreclosure Petition: This type of petition is filed when the property owner believes that the lender or the party conducting the foreclosure sale has violated the law or failed to follow proper procedures during the foreclosure process. 2. Quiet Title Action Complaint: When there are disputes or uncertainties regarding the ownership or title of the property, property owners can file a Quiet Title Action Complaint to seek a court judgment that clears any competing claims and declares them as the rightful owner of the property. 3. Li's Pendent Petition: If a property owner wants to give notice to third parties that there is ongoing litigation related to the property, they may file a Li's Pendent Petition. This helps to preserve their rights and interests in the property while the foreclosure sale is being litigated. 4. Breach of Contract Complaint: If the property owner believes that the lender or the party conducting the foreclosure sale has breached the terms of their contractual agreement, they can file a Breach of Contract Complaint. This complaint can address issues such as improper loan modification or breach of a foreclosure prevention agreement. These are some different types of San Diego California Petition or Complaint to Enjoin Nonjudicial Foreclosure Sale and for Declaratory Relief that property owners may consider filing based on their specific circumstances and legal grounds. It is important to consult with an attorney familiar with foreclosure and property law to determine the most appropriate legal action to take.